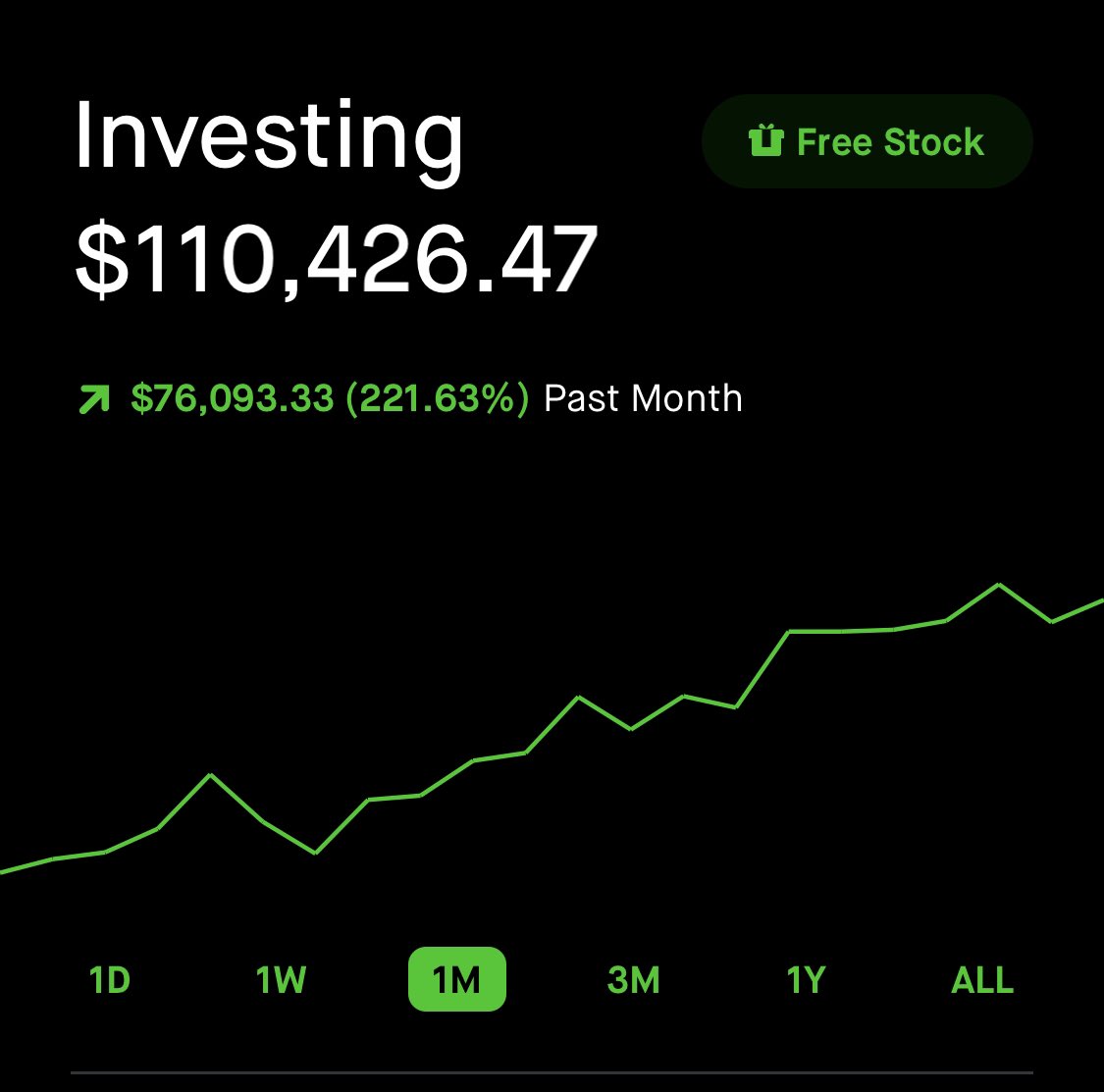

My last 30-days of trading has been absolutely awesome.

I started trading more seriously and working harder in May, but hit a rough patch from mid-August until mid-September.

I had to take a step back, recalibrate, and reevaluate my strategy. Here are some things I learned.

I started trading more seriously and working harder in May, but hit a rough patch from mid-August until mid-September.

I had to take a step back, recalibrate, and reevaluate my strategy. Here are some things I learned.

First, my trading is heavily options focused. It’s been that way since May. But I noticed that I’m great at identifying solid setups but not great at honing in on when exactly they’ll breakout.

Until a month ago I was still trying to trade weekly (or the next) expirations.

Until a month ago I was still trying to trade weekly (or the next) expirations.

Most of my trades were also slightly out of the money contracts.

My wins were strong enough to balance out my mediocre hit rate. That wasn’t really the problem.

It was when the market went against me. My losses would mount quickly and I couldn’t afford to wait out turbulence.

My wins were strong enough to balance out my mediocre hit rate. That wasn’t really the problem.

It was when the market went against me. My losses would mount quickly and I couldn’t afford to wait out turbulence.

So I adjusted. I now focus on expirations 3-4 weeks out and buy at-the-money or slightly in-the-money contracts.

This has helped MASSIVELY because it reduces my drawdown through corrections, obviously, but it also allows me a luxury I didn’t previously have - patience.

This has helped MASSIVELY because it reduces my drawdown through corrections, obviously, but it also allows me a luxury I didn’t previously have - patience.

Patience has been my other game changer.

I have to credit @traderstewie and @AOTtrades for driving this into my brain literally every day. I joined early September and the “no panicking allowed” mantra has been invaluable.

Far more valuable than the trade alerts.

I have to credit @traderstewie and @AOTtrades for driving this into my brain literally every day. I joined early September and the “no panicking allowed” mantra has been invaluable.

Far more valuable than the trade alerts.

In fact, I rarely take the trade alerts.

Not because they aren’t good, but because I’m already in too many of my own trades (usually) to justify it.

But I’ll happily stay subscribed because it helps my mental game stay on track.

Not because they aren’t good, but because I’m already in too many of my own trades (usually) to justify it.

But I’ll happily stay subscribed because it helps my mental game stay on track.

Find something or someone that can do that for you.

I also started keeping track of EVERY trade I make in a spreadsheet. I started that on September 15th alongside a daily journal.

Coincidence? Doubtful.

I also started keeping track of EVERY trade I make in a spreadsheet. I started that on September 15th alongside a daily journal.

Coincidence? Doubtful.

My win rate is 72% and my wins are 2x my losses. It’s great to know those stats and it builds my confidence.

In my daily journal I quickly summarize what happened, went well, poorly, etc.

It takes me 5 min but it’s amazing to read back on it.

In my daily journal I quickly summarize what happened, went well, poorly, etc.

It takes me 5 min but it’s amazing to read back on it.

I have a ton to still work on. My style is still very risky and vulnerable to a prolonged or very aggressive correction.

I’m aware of that.

I plan to de-risk my trading style more and more soon. But the things I’ve mentioned above have made big strides for me.

Hope it helps

I’m aware of that.

I plan to de-risk my trading style more and more soon. But the things I’ve mentioned above have made big strides for me.

Hope it helps

Read on Twitter

Read on Twitter