1/21

Despite the ETH2.0 lockup contract being weeks away, I& #39;ve not been able to confirm any major project (other than @Rocket_Pool) that has confirmed they are ready to roll out a tokenized staked $ETH.

That& #39;s HUGE.

Why does this matter?

Despite the ETH2.0 lockup contract being weeks away, I& #39;ve not been able to confirm any major project (other than @Rocket_Pool) that has confirmed they are ready to roll out a tokenized staked $ETH.

That& #39;s HUGE.

Why does this matter?

2/21

Back in April I outlined how ETH2.0 will be a major economic value event for ETH:

https://twitter.com/AdamScochran/status/1250938829449674752

Due">https://twitter.com/AdamScoch... to changes in liquidity & accessibility.

The best possible outcome for this seems to be taking place. Let me explain!

Back in April I outlined how ETH2.0 will be a major economic value event for ETH:

https://twitter.com/AdamScochran/status/1250938829449674752

Due">https://twitter.com/AdamScoch... to changes in liquidity & accessibility.

The best possible outcome for this seems to be taking place. Let me explain!

3/21

Right now, it looks like we will only have 1 (or a small # of) tokenized ETH deposit solutions, the main one of which is @Rocket_Pool ($RPL)

However at the start Rocket Pool will be custodial.

Right now, it looks like we will only have 1 (or a small # of) tokenized ETH deposit solutions, the main one of which is @Rocket_Pool ($RPL)

However at the start Rocket Pool will be custodial.

4/21

Now all of this sounds bad for ETH philosophically, but, while I hope this changes long-term, it& #39;s actually REALLY bullish for ETH short-term.

Now all of this sounds bad for ETH philosophically, but, while I hope this changes long-term, it& #39;s actually REALLY bullish for ETH short-term.

5/21

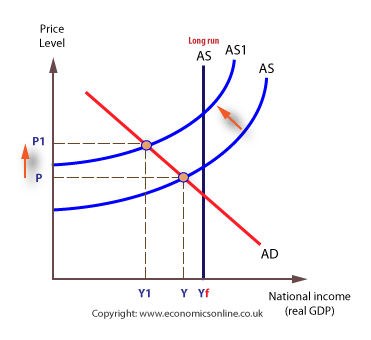

You see, if you have 0 tokenized deposit options then very few people will be eager to lock-up their ETH short term.

Resulting in overly aggressive rewards for those who do.

You see, if you have 0 tokenized deposit options then very few people will be eager to lock-up their ETH short term.

Resulting in overly aggressive rewards for those who do.

6/21

If you have too many options (many of which would be centralized) then ETH being locked into ETH2.0 doesn& #39;t have a strong price correlation because that liquidity will come back to exchanges anyway.

If you have too many options (many of which would be centralized) then ETH being locked into ETH2.0 doesn& #39;t have a strong price correlation because that liquidity will come back to exchanges anyway.

7/21

If you had on-chain solutions that lock-up ETH trustlessly, then every educated ETH user would do it and arbitrage to dump on retail investors (who wouldn& #39;t have access)

If you had on-chain solutions that lock-up ETH trustlessly, then every educated ETH user would do it and arbitrage to dump on retail investors (who wouldn& #39;t have access)

8/21

By having something that is on-chain and thus too complex for most of retail, and yet still custodial so that many hardknocks (fairly) won& #39;t want to use it, you actually create a perfect storm.

By having something that is on-chain and thus too complex for most of retail, and yet still custodial so that many hardknocks (fairly) won& #39;t want to use it, you actually create a perfect storm.

9/21

A large amount of retail staking providers like Coinbase, Kraken, Gemini and Staked will offer retail the ability to stake for rewards but no tokenized asset. This will drastically remove the amount of ETH in liquid circulation creating a supply shock.

A large amount of retail staking providers like Coinbase, Kraken, Gemini and Staked will offer retail the ability to stake for rewards but no tokenized asset. This will drastically remove the amount of ETH in liquid circulation creating a supply shock.

10/21

But progressive exchanges (i.e. not the Coinbase& #39;s of the world) will likely list the tokenized Rocket Pool rETH for trading providing liquidity for these assets on the locked chains.

But progressive exchanges (i.e. not the Coinbase& #39;s of the world) will likely list the tokenized Rocket Pool rETH for trading providing liquidity for these assets on the locked chains.

11/21

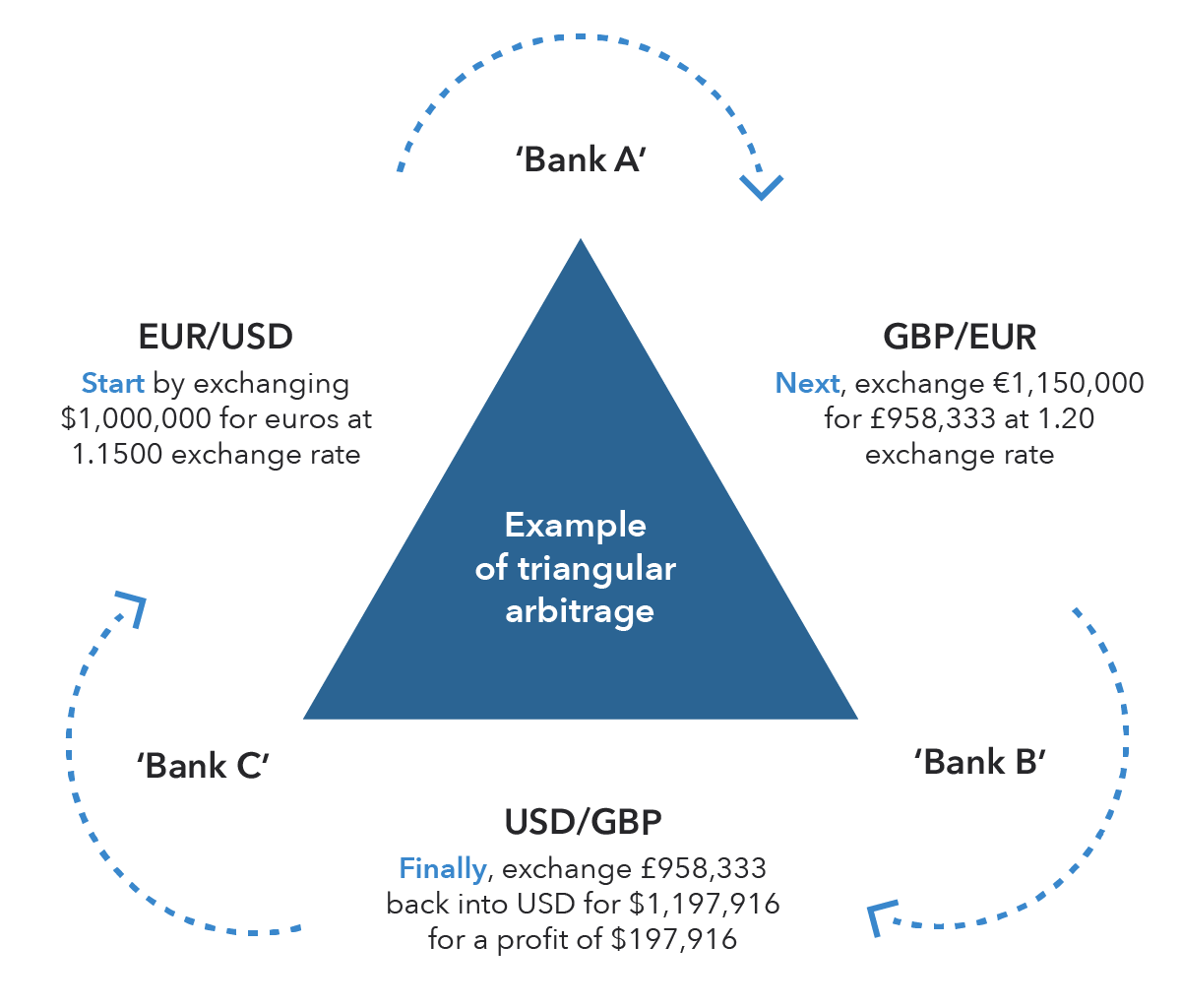

That means there is going to be a huge set of arbitrage opportunities for those willing to take on the risk, trading against ETH/rETH pairs accounting for risk and ETH2.0 chain block rewards.

That means there is going to be a huge set of arbitrage opportunities for those willing to take on the risk, trading against ETH/rETH pairs accounting for risk and ETH2.0 chain block rewards.

12/21

That arbitrage between the pairs is going to provide the kind of liquidity needed to make rETH a useable asset.

The arbitrage liquidity wouldn& #39;t exist if too much of the ETH2.0 Phase 0 ETH was tokenized by multiple services.

That arbitrage between the pairs is going to provide the kind of liquidity needed to make rETH a useable asset.

The arbitrage liquidity wouldn& #39;t exist if too much of the ETH2.0 Phase 0 ETH was tokenized by multiple services.

13/21

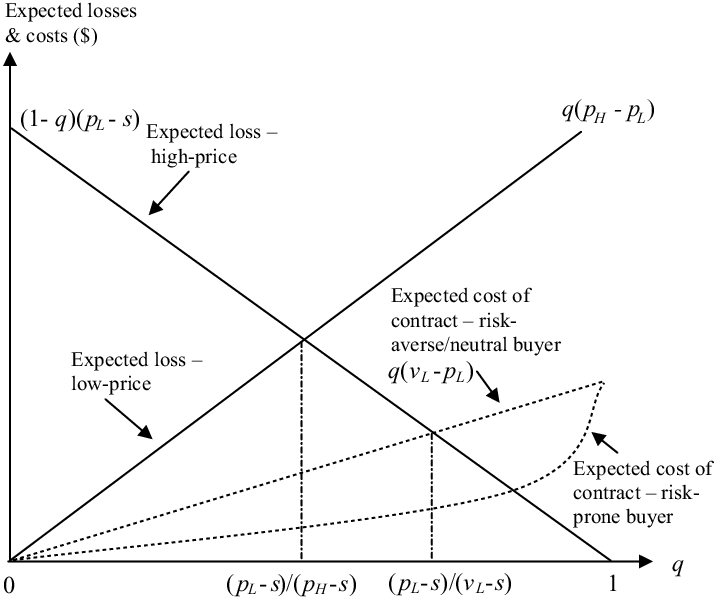

Nor would it be there if $RPL was already trustless, non-custodial, battle tested & risk free.

This arbitrage liquidity requires people to have a range of risk tolerances on these assets, and the asset to represent a smaller pool of ETH

Price is a function of risk reward

Nor would it be there if $RPL was already trustless, non-custodial, battle tested & risk free.

This arbitrage liquidity requires people to have a range of risk tolerances on these assets, and the asset to represent a smaller pool of ETH

Price is a function of risk reward

14/21

My hunch, is that while multiple services *want* to offer tokenized ETH2.0 stakes, there is regulatory ambiguity in doing so (especially in the US), and that will exist at least until the end of Phase 2 when these services can be offered in a non-custodial way.

My hunch, is that while multiple services *want* to offer tokenized ETH2.0 stakes, there is regulatory ambiguity in doing so (especially in the US), and that will exist at least until the end of Phase 2 when these services can be offered in a non-custodial way.

15/21

Given this, its not likely we& #39;ll see an US compliant exchanges or services take a stab at offering a tokenized ETH2.0 deposit during Phase 0.

Given this, its not likely we& #39;ll see an US compliant exchanges or services take a stab at offering a tokenized ETH2.0 deposit during Phase 0.

16/21

While they may offer the staking itself, I think at most we& #39;d see contracts representing deposits trade on their own exchanges but not as a fully withdrawable token.

While they may offer the staking itself, I think at most we& #39;d see contracts representing deposits trade on their own exchanges but not as a fully withdrawable token.

17/21

That means that on-chain quasi-custodial options like Rocket Pool& #39;s $rETH will have years of a head start in getting exchanges to list them on pairs, to become the bulk of ETH2.0/ETH liquidity.

That means that on-chain quasi-custodial options like Rocket Pool& #39;s $rETH will have years of a head start in getting exchanges to list them on pairs, to become the bulk of ETH2.0/ETH liquidity.

18/21

We may see tokenized deposits spring up from exchanges and services in Asia, which many Western investors (especially decentralization advocates in the ETH community) will be hesitant to use.

This will create another arbitrage opportunity between rETH and these tokens.

We may see tokenized deposits spring up from exchanges and services in Asia, which many Western investors (especially decentralization advocates in the ETH community) will be hesitant to use.

This will create another arbitrage opportunity between rETH and these tokens.

19/21

All in, this is super bullish for:

1. The price of $ETH

2. The price of $RPL

3. Exchanges who list Rocket Pools $rETH/$nETH and other tokenized ETH pairs.

4. Liquidity providers in @UniswapProtocol and @BalancerLabs pools for ETH/$rETH and other tokenized ETH2.0 pairs.

All in, this is super bullish for:

1. The price of $ETH

2. The price of $RPL

3. Exchanges who list Rocket Pools $rETH/$nETH and other tokenized ETH pairs.

4. Liquidity providers in @UniswapProtocol and @BalancerLabs pools for ETH/$rETH and other tokenized ETH2.0 pairs.

20/21

Even if we see centralized exchanges offering more services here, we& #39;re still well within what I think will be that perfect storm range.

Even if we see centralized exchanges offering more services here, we& #39;re still well within what I think will be that perfect storm range.

21/21

[PS - not investment advice, DYOR, crypto and services may not be legal in your area, and remember finance is personal, what is right for someone else may not fit your needs]

[PS - not investment advice, DYOR, crypto and services may not be legal in your area, and remember finance is personal, what is right for someone else may not fit your needs]

@Consensys @cz_binance @HuobiGlobal @cryptocom @staked_us @krakenfx @P2Pvalidator @SBF_Alameda @FTX_Official -

Are any of you planning to offer tokenized ETH2.0 staking deposits (like rocket pools $rETH) during phase 0 staking? Or are you working with any teams doing so?

Are any of you planning to offer tokenized ETH2.0 staking deposits (like rocket pools $rETH) during phase 0 staking? Or are you working with any teams doing so?

If you know of other projects (that have a live and existing codebase ready to go for ETH2.0 deposit tokenization) tag them here!

Read on Twitter

Read on Twitter