This really simple slide from Marvell& #39;s investor day really keeps coming back to me over and over

Being first matters a lot more in semiconductors than in other markets, and for a single reason, YIELDS!!!!! Lets discuss

Being first matters a lot more in semiconductors than in other markets, and for a single reason, YIELDS!!!!! Lets discuss

as many of you know - semiconductor manufacturing is an INSANELY fixed cost biz w/ very low marginal costs, and insane upfront costs. The hardest part is "ramping"

As a new product comes out - they are cooking new batches with less defects everyday. The first....

As a new product comes out - they are cooking new batches with less defects everyday. The first....

batch might have 50% defects! Anywhere else this is kind of a huge failure. Think of 6 sigma stuff and then think of a thousand-dollar wafer w/ 50% of the dies having defects

But as you make more batches - you get better. So let& #39;s say you lower defects to 90% yields

But as you make more batches - you get better. So let& #39;s say you lower defects to 90% yields

One of the most virtuous cycles i& #39;m aware of really starts to kick off around there

At a 90% yield - you& #39;re making $$$$ in gross profit, and you can lower your prices while making more money than someone entering your subsegment

This is a "trench" (its not a moat)

At a 90% yield - you& #39;re making $$$$ in gross profit, and you can lower your prices while making more money than someone entering your subsegment

This is a "trench" (its not a moat)

But if you do it enough times it gets pretty moaty. TXN is not some magic moaty company - it& #39;s a company with a million embedded wins in ordinary devices with mature yields

your risk to move to someone else is really high + often the incumbent can lower price and still make $$$

your risk to move to someone else is really high + often the incumbent can lower price and still make $$$

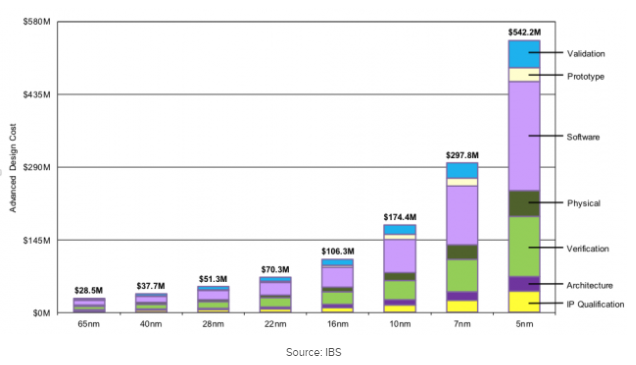

So let& #39;s say you want to enter your competitor& #39;s market. They got there 6-12 months before you did - shipping a big volume product climbing a yield curve. That is a freaking wide trench - and as we know - the barrier at the leading node is getting higher

Are you willing to put down 300million in costs to become number 2/3 in a 1-3 billion dollar market?

That is a hard decision imo. Assuming graciously you make 70% GM - 30% share in a 2 billion market - thats a ~420 in GP and that& #39;s not thinking about op costs / time value

That is a hard decision imo. Assuming graciously you make 70% GM - 30% share in a 2 billion market - thats a ~420 in GP and that& #39;s not thinking about op costs / time value

Read on Twitter

Read on Twitter