Building on the thread below, I& #39;ve got a new piece out today on the interplay between Brexit & Covid-19, in particular in terms of practical impacts for business. A real challenge in many sectors, here& #39;s a thread setting out key points 1/ https://www2.deloitte.com/uk/en/pages/global-markets/articles/tackling-brexit-and-covid-19-together.html">https://www2.deloitte.com/uk/en/pag... https://twitter.com/RaoulRuparel/status/1273571796336467969">https://twitter.com/RaoulRupa...

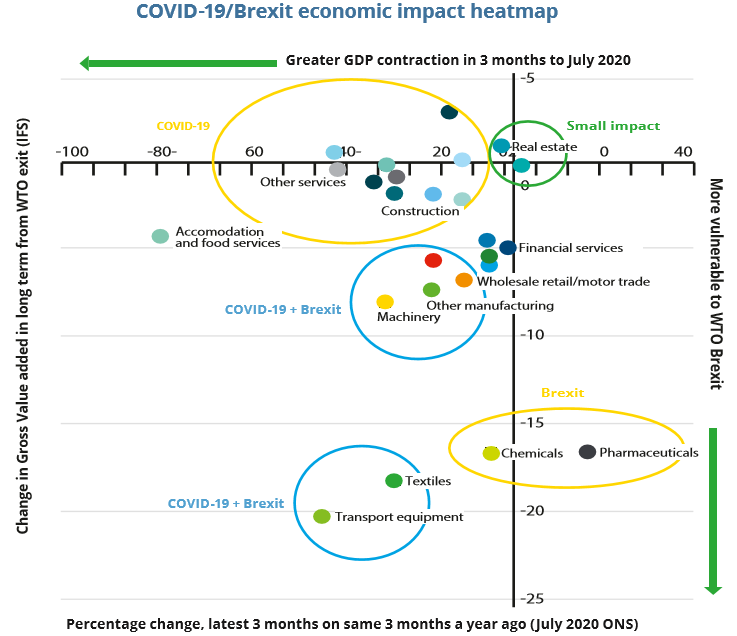

As the chart below highlights, in many cases the two shocks will hit different sectors, spreading the breadth of economic challenges at the end of this year. But there are some sectors (mostly those with complex manufacturing supply chains) which will face a double hit 2/

We identify three themes where there are likely to be particular interplays between Brexit & Covid-19 for business - supply chains, people & finance/resources. 3/

Supply Chains - business is seeing permanent increase in costs within supply chains from Brexit due to admin requirements (customs declarations etc) & potential delays. Meanwhile, Covid-19 has also increased costs in some supply chains by increasing uncertainty. 4/

Often these effects will compound rather than offset each other. Meaning higher costs within supply chains - auto sector is a prime example of this. Silver lining in that the lower level of trade may mean day 1 disruption from Brexit is somewhat lower than it might have been 5/

People - free movement with EU will end, causing challenges in sourcing labour from EU. Covid-19 has also made it hard to move people around due to various restrictions. 6/

But equally the labour market will be entirely reshaped by Covid-19 meaning it is very different to what was expected in most Brexit plans. Seeing some specific challenges arise around planned Brexit moves ahead of end of the year, which may now not be possible due to Covid-19 7/

Finance/resources - broadly business is more stretched than it has ever been. Often people/expertise being deployed on Covid-19 or Brexit are the same meaning the two compete for scare resources within firms. 8/

Seeing particular interplay where firms want to keep cash reserves on their balance sheet due to Covid-19 but should stockpile ahead of Brexit. The combination of these means in some cases firms are less prepared for Brexit now than they might have been previously. 9/

What does all this mean? Businesses are struggling to manage the dual shocks of Covid-19 & Brexit. Important that firms reassess Brexit prep in light of new economic context. Otherwise real risk that previous plans cannot be delivered or do not fit with new reality 10/ ENDS

Read on Twitter

Read on Twitter