1/ This whole thing was great, but the last few minutes grabbed me.

@maratikus_quant discusses his new research that suggests the financialization of commodities in the early 2000s created a term premium in commodity futures. https://twitter.com/InvestReSolve/status/1316398155890659329">https://twitter.com/InvestReS...

@maratikus_quant discusses his new research that suggests the financialization of commodities in the early 2000s created a term premium in commodity futures. https://twitter.com/InvestReSolve/status/1316398155890659329">https://twitter.com/InvestReS...

2/ The core idea is that as investors adopted commodities as an asset class, they did so through "passive" indices that purchased front-month contracts, driving the prices up and creating a term premium.

3/ The "financialization" of assets, and the reflexive impact upon the asset itself, is a rapidly growing area of interest and research for me.

Consider some of these examples...

Consider some of these examples...

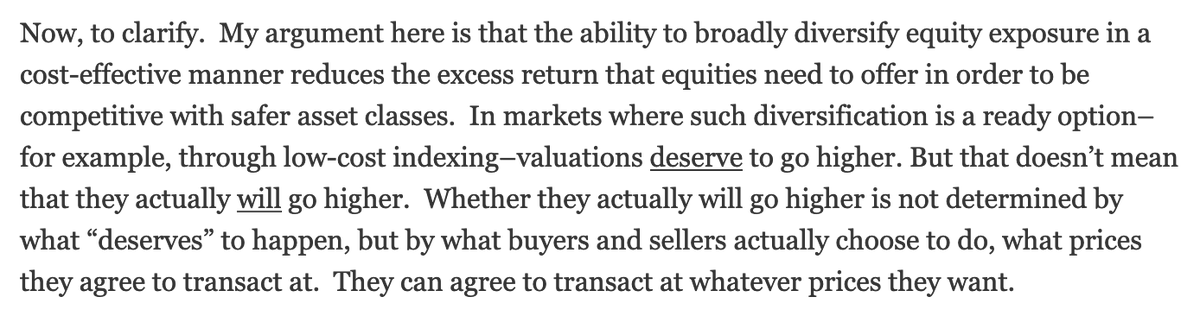

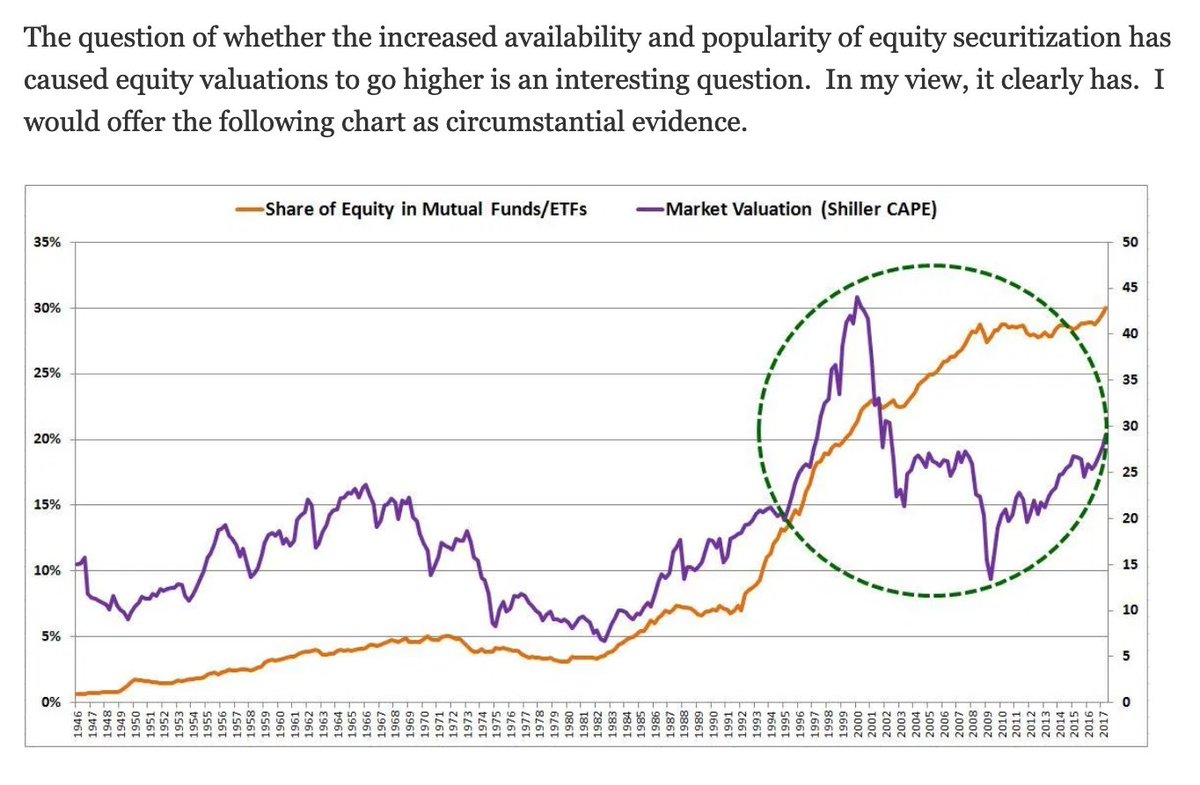

4/ In 2017, @Jesse_Livermore suggested that the financialization of markets themselves may justify a permanently higher plateau of valuations.

http://www.philosophicaleconomics.com/2017/04/diversification-adaptation-and-stock-market-valuation/">https://www.philosophicaleconomics.com/2017/04/d...

http://www.philosophicaleconomics.com/2017/04/diversification-adaptation-and-stock-market-valuation/">https://www.philosophicaleconomics.com/2017/04/d...

5/ The financialization of VIX futures in ETPs (e.g VXX and XIV) clearly became the tail that wagged the dog in 2018. https://www.bloombergquint.com/markets/the-day-the-vix-doubled-tales-of-volmageddon">https://www.bloombergquint.com/markets/t...

6/ A recent paper from @abnormalreturns and @camharvey suggests that the price of Gold may have less to do with real yield and more to due with supply/demand due to financialization (via ETPs)

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3667789">https://papers.ssrn.com/sol3/pape...

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3667789">https://papers.ssrn.com/sol3/pape...

7/ Financialization can allow new players to provide capital to a market in "safe" way, which should have impacts upon risk premia.

But when does financialization go too far?

But when does financialization go too far?

8/ I& #39;m reminded of a quote from @bennpeifert from our first podcast together, where he said he saw his job as "providing balance to the force."

How does financialization disturb the natural force of markets?

When does financialization overwhelm markets?

How does financialization disturb the natural force of markets?

When does financialization overwhelm markets?

9/ I suspect the answers lie within the ratio of "stock of capital" versus "flow of capital" and the size of "financialized" participants versus those trying to provide balance.

10/ I don& #39;t have any real answers here, but I think these are very interesting avenues for future research.

FIN.

FIN.

11/ Hey @GestaltU, give me your take on the financialization of factor strategies, will ya?

Read on Twitter

Read on Twitter