1/

So what actually moves the prices of cryptocurrencies? We spent over a month parsing through data to answer that question for you https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

Special thanks to @eToroUS for partnering with us on this research

A thread:

So what actually moves the prices of cryptocurrencies? We spent over a month parsing through data to answer that question for you

Special thanks to @eToroUS for partnering with us on this research

A thread:

2/

Leveraging The TIE’s Crypto SigDev™ feed we set out to identify whether news moved the crypto market and what, if any, impact sentiment had following key announcements.

SigDevs are news on token updates or major events (like M&A and Listings).

Leveraging The TIE’s Crypto SigDev™ feed we set out to identify whether news moved the crypto market and what, if any, impact sentiment had following key announcements.

SigDevs are news on token updates or major events (like M&A and Listings).

3/

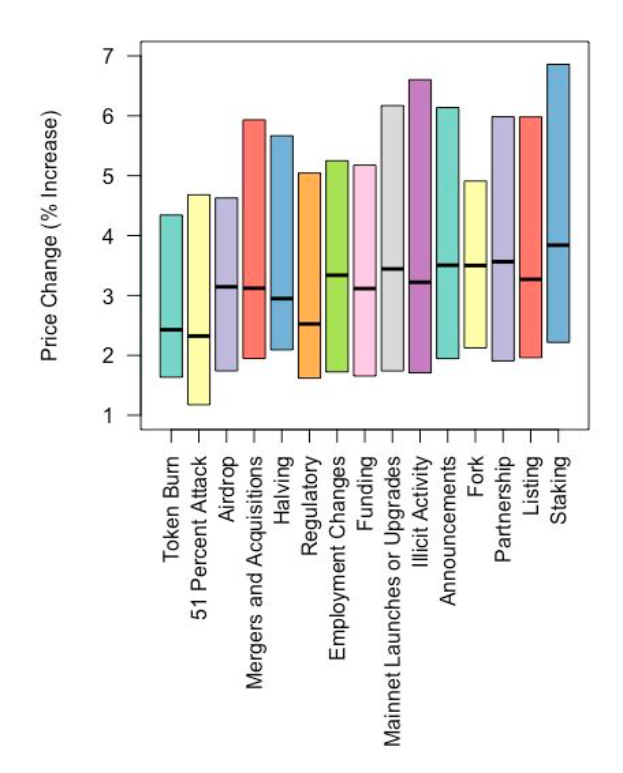

Looking at maximum price increases within 24 hours after different SigDev announcements, we see that certain announcements tend to procure more responses than others. These are ordered from left to right in order of increasing average positive effect on price.

Looking at maximum price increases within 24 hours after different SigDev announcements, we see that certain announcements tend to procure more responses than others. These are ordered from left to right in order of increasing average positive effect on price.

4/

These initial results are intuitive: one would expect 51% attacks — a negative assault on a blockchain — to not typically have a positive effect on price, while getting listed on a new exchange (“Listing”) increases demand for a cryptocurrency and thus should increase value

These initial results are intuitive: one would expect 51% attacks — a negative assault on a blockchain — to not typically have a positive effect on price, while getting listed on a new exchange (“Listing”) increases demand for a cryptocurrency and thus should increase value

5/

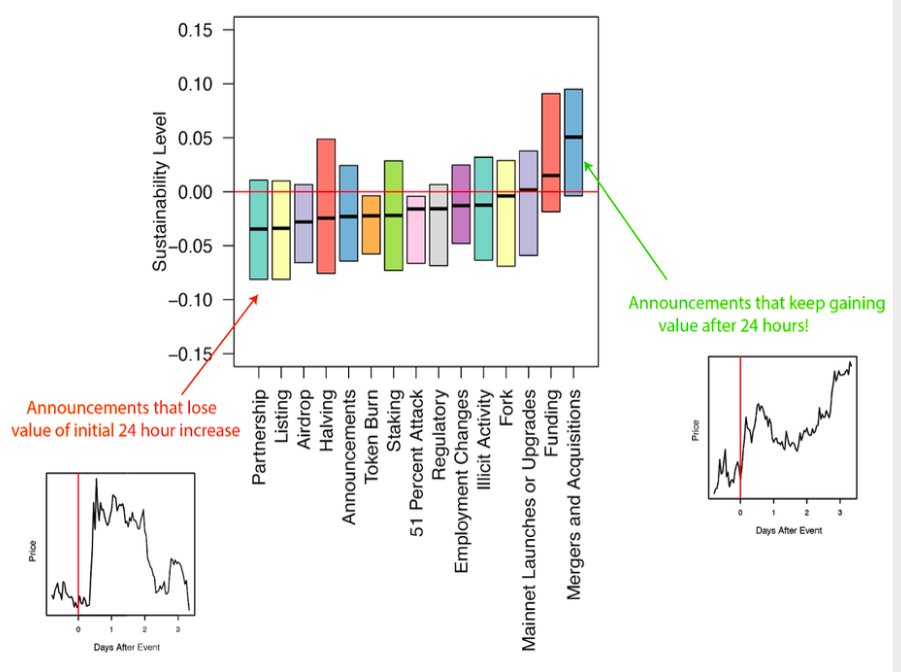

Although Listings and Partnerships have an immediate large influence on price, it does not mean the increase is sustained.

We looked at how sustainable each SigDev was. Specifically, the max price 24 hours after each SigDev compared to the following week& #39;s average price

Although Listings and Partnerships have an immediate large influence on price, it does not mean the increase is sustained.

We looked at how sustainable each SigDev was. Specifically, the max price 24 hours after each SigDev compared to the following week& #39;s average price

6/

The data shows that the hype of a Listing or Partnership announcement tends to wear off within a week; however, Funding announcements and announcements about Mergers and Acquisitions have positive effects that often extend well beyond a week

The data shows that the hype of a Listing or Partnership announcement tends to wear off within a week; however, Funding announcements and announcements about Mergers and Acquisitions have positive effects that often extend well beyond a week

7/

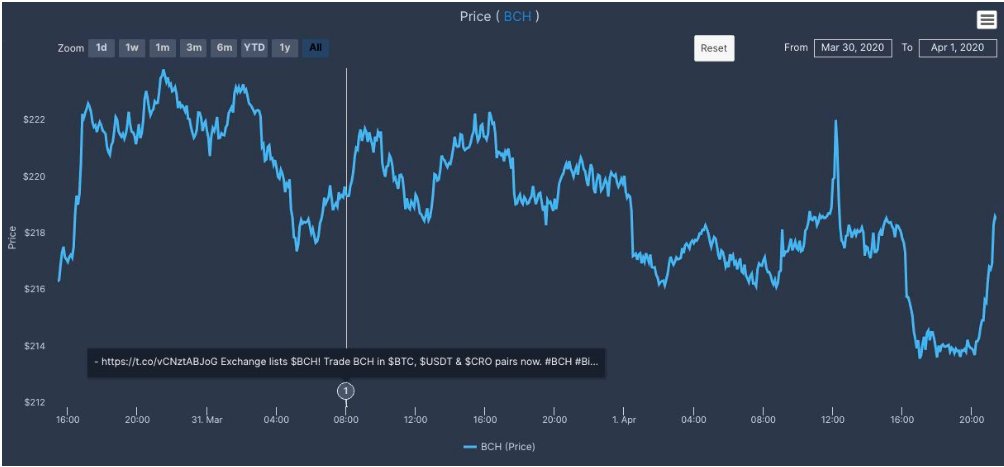

Listings can have large impacts on price, but why is there such variance in the data?

Some cryptos already trade on hundreds of exchanges, so an additional listing would likely have negligible impact on the price of the asset.

Ex. BCH on Crypto(dot)com

Listings can have large impacts on price, but why is there such variance in the data?

Some cryptos already trade on hundreds of exchanges, so an additional listing would likely have negligible impact on the price of the asset.

Ex. BCH on Crypto(dot)com

8/

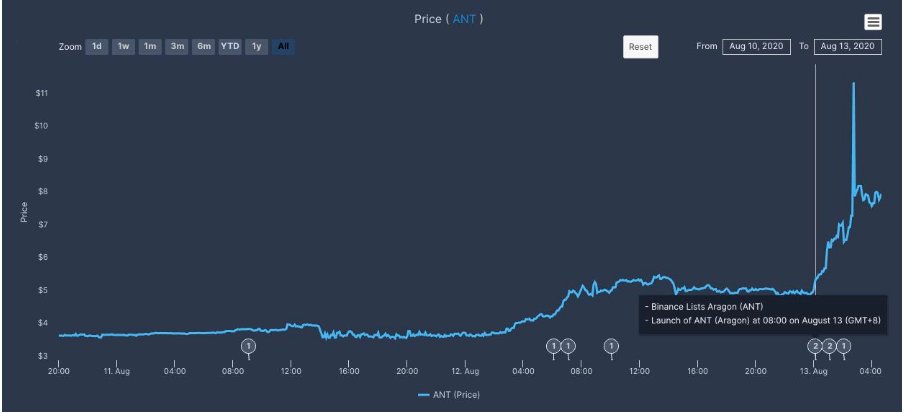

However, when a newer asset that was previously listed on more illiquid markets gets placed on a large trading venue like Coinbase or Binance — when markets previously didn’t exist for that coin on any of the larger exchanges. the potential impact is the greatest.

However, when a newer asset that was previously listed on more illiquid markets gets placed on a large trading venue like Coinbase or Binance — when markets previously didn’t exist for that coin on any of the larger exchanges. the potential impact is the greatest.

9/

Consider Aragon. On Aug 12th ANT was first listed on OKEx when it rose from $4.34 to $5.38 in just under two hours, a gain of 24%. Less than 24 hours later, the token was listed on Huobi and Binance concurrently, and the price of Aragon soared to a high of $11.45, a 164% gain

Consider Aragon. On Aug 12th ANT was first listed on OKEx when it rose from $4.34 to $5.38 in just under two hours, a gain of 24%. Less than 24 hours later, the token was listed on Huobi and Binance concurrently, and the price of Aragon soared to a high of $11.45, a 164% gain

10/

In the short-term increased exposure via listings is a positive for the price of cryptocurrencies.

However, as mentioned, listings are among the least sustainable events in the mid-term. In under three months the price of ANT dropped to below the pre-listing value.

In the short-term increased exposure via listings is a positive for the price of cryptocurrencies.

However, as mentioned, listings are among the least sustainable events in the mid-term. In under three months the price of ANT dropped to below the pre-listing value.

11/

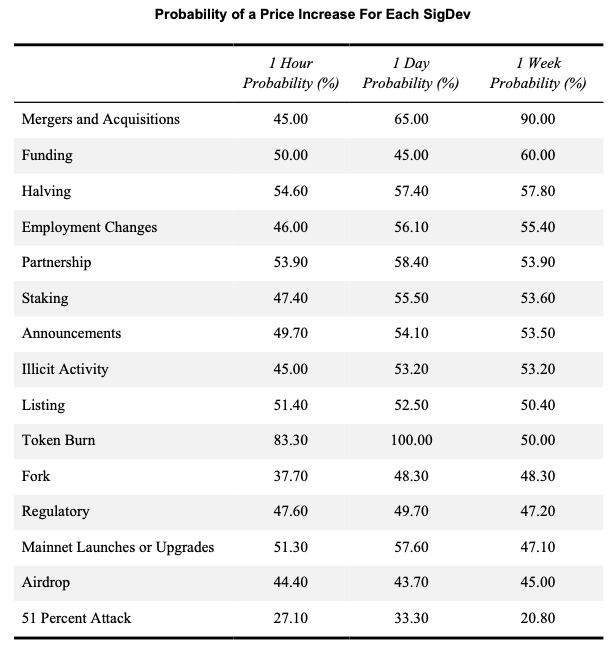

Analyzing over 10,000 unique SigDevs we then asked the question, what is the probability that a particular event will correlate with an increase in price?

See table below for the probability that each SigDev will result in a positive change after 1hr/24hr/7d

Analyzing over 10,000 unique SigDevs we then asked the question, what is the probability that a particular event will correlate with an increase in price?

See table below for the probability that each SigDev will result in a positive change after 1hr/24hr/7d

12/

Mergers and Acquisitions are remarkable, showing a 90% chance of a positive return after a week, averaging 8.23% in returns. This outsized return is likely due to the fact that most token-related M&A news are tightly held secrets.

Mergers and Acquisitions are remarkable, showing a 90% chance of a positive return after a week, averaging 8.23% in returns. This outsized return is likely due to the fact that most token-related M&A news are tightly held secrets.

13/

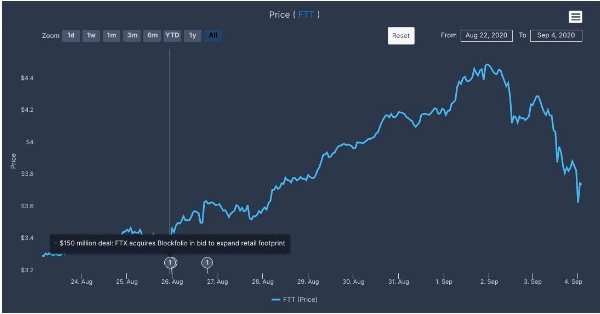

Further, M&A news in the context of tokens are typically done to add further value to an ecosystem. Ex. FTX’s acquisition of Blockfolio brought a significant number of additional users into the FTX ecosystem. In just over a week following the acquisition, FTT surged by 33%.

Further, M&A news in the context of tokens are typically done to add further value to an ecosystem. Ex. FTX’s acquisition of Blockfolio brought a significant number of additional users into the FTX ecosystem. In just over a week following the acquisition, FTT surged by 33%.

14/

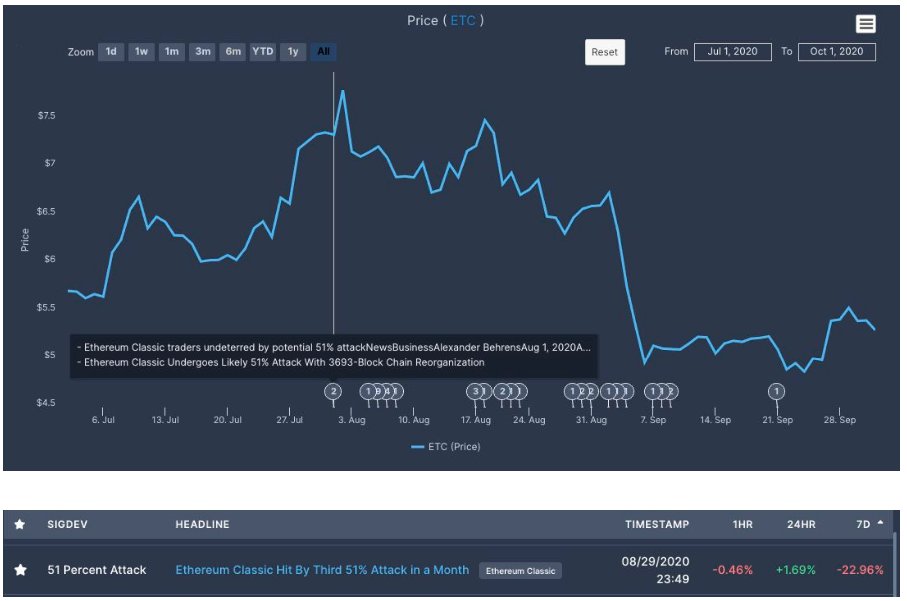

Conversely, and unsurprisingly, 51 % Attacks show the lowest probabilities of positive returns. 51% attacks show an average loss of 3.32% after one week. 79.2% of the time, tokens lose value after 7 days.

Conversely, and unsurprisingly, 51 % Attacks show the lowest probabilities of positive returns. 51% attacks show an average loss of 3.32% after one week. 79.2% of the time, tokens lose value after 7 days.

16/

A Mainnet Launch or Upgrade results in a positive price increase for the coin only 47% of the time. A mainnet launch means that a token is moving from a testing to a live environment. Negative price movement is likely due to a “buy the rumor and sell the news” mentality.

A Mainnet Launch or Upgrade results in a positive price increase for the coin only 47% of the time. A mainnet launch means that a token is moving from a testing to a live environment. Negative price movement is likely due to a “buy the rumor and sell the news” mentality.

17/

Token burns result in the decreasing of the supply of a token, so intuitively one would think that the deflationary pressure would be a positive in the longer-term, but early research on this subject has not offered any conclusive proof.

Token burns result in the decreasing of the supply of a token, so intuitively one would think that the deflationary pressure would be a positive in the longer-term, but early research on this subject has not offered any conclusive proof.

18/

As this industry develops over time we believe that it is more likely that gains for token burns will be more sustainable, all else equal.

As this industry develops over time we believe that it is more likely that gains for token burns will be more sustainable, all else equal.

19/

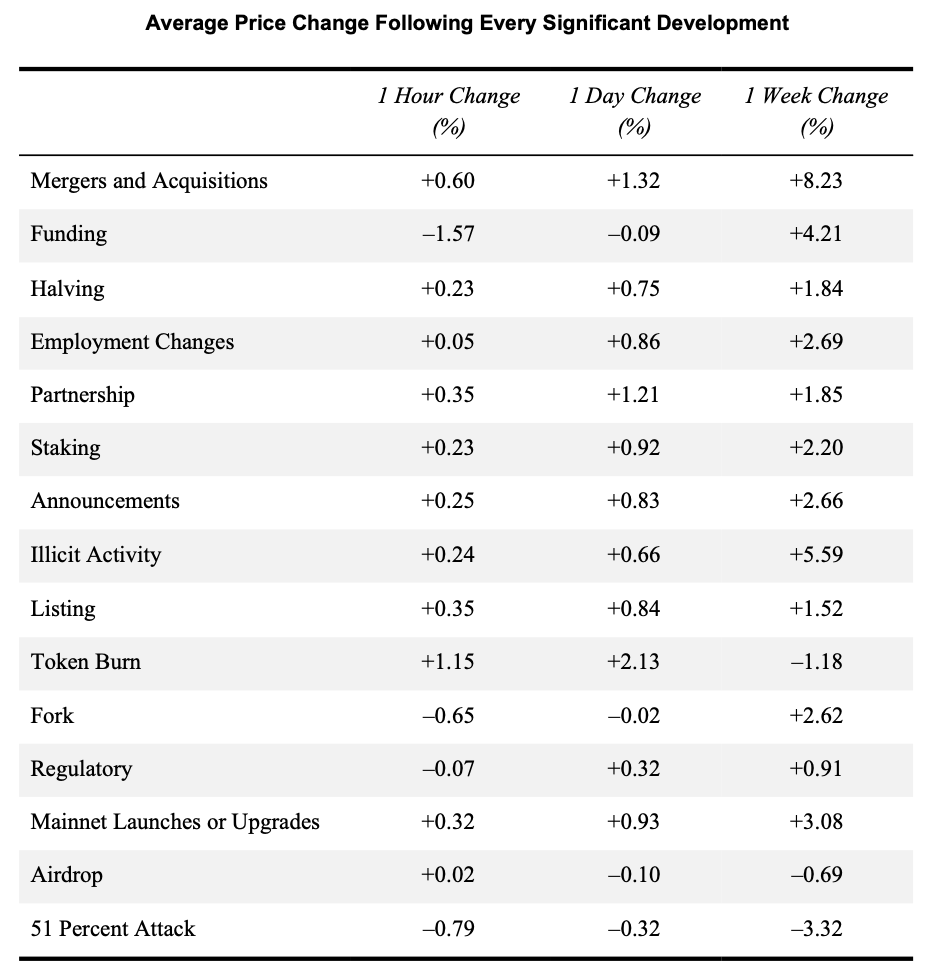

Here is an additional chart showing the average price change following each significant development:

Here is an additional chart showing the average price change following each significant development:

20/

Let’s be honest — as much as people like to say they get their news from real news outlets, many of us rely on Twitter. But does news from news outlets affect price more than tweeted information? It depends.

Let’s be honest — as much as people like to say they get their news from real news outlets, many of us rely on Twitter. But does news from news outlets affect price more than tweeted information? It depends.

21/

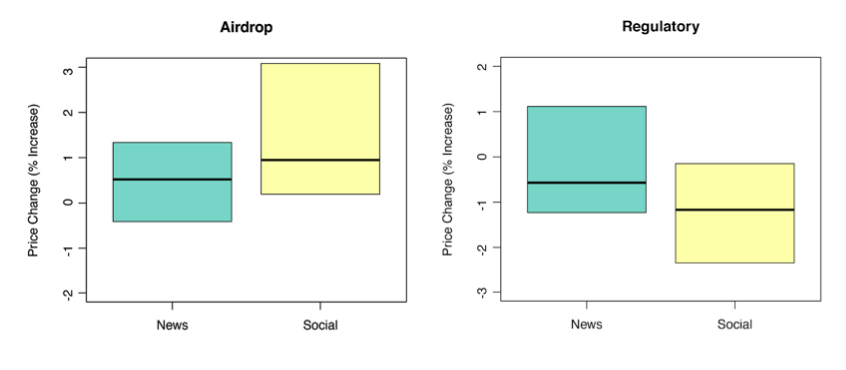

Generally, we find no significant difference in price action after announcements, whether they come from tweets or news. However, Regulatory announcements tend to have a larger effect from news while Airdrop announcements are more supported by Twitter activity.

Generally, we find no significant difference in price action after announcements, whether they come from tweets or news. However, Regulatory announcements tend to have a larger effect from news while Airdrop announcements are more supported by Twitter activity.

22/

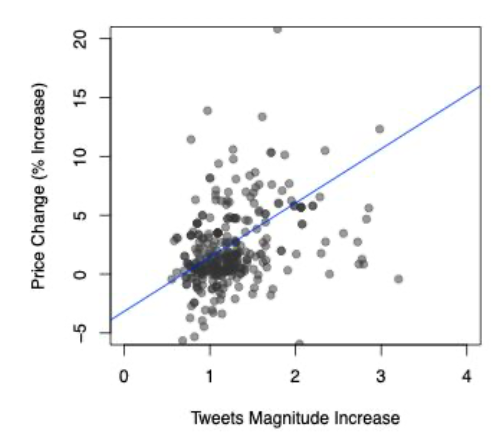

The next question we set out to ask is does Twitter activity matter? Does it matter how positive or negative investors are about a coin following a significant development and how big the size of the community discussing a particular asset is.

The next question we set out to ask is does Twitter activity matter? Does it matter how positive or negative investors are about a coin following a significant development and how big the size of the community discussing a particular asset is.

23/

We can& #39;t give everything away in a thread

Read the Q3 Quarterly Report that we put together with @eToroUS to learn more about what impact Twitter has on prices following SigDevs and dive deeper into what actually moves the prices of cryptocurrencies https://www.etoro.com/en-us/crypto/quarterly-report/">https://www.etoro.com/en-us/cry...

We can& #39;t give everything away in a thread

Read the Q3 Quarterly Report that we put together with @eToroUS to learn more about what impact Twitter has on prices following SigDevs and dive deeper into what actually moves the prices of cryptocurrencies https://www.etoro.com/en-us/crypto/quarterly-report/">https://www.etoro.com/en-us/cry...

Read on Twitter

Read on Twitter