Brian Moynihan talked about this today on $BAC call.. Customer inventories are gonna hit lean levels (already are) & are building to meet sales growth vs just generating cash.. working capital need = C&I loan growth.. same with Consumer with 14% Savings Rate..once they draw that https://twitter.com/gamesblazer06/status/1310963620168171520">https://twitter.com/gamesblaz...

...down further.. they start taking down Consumer loans.. right now flush with cash so less demand.. Loan growth starting to improve but a 2021 event.. some improvement but the flip side is Fees are very strong in Trading & I Banking as Real Rates are used to get 2 Peak Reserves.

Real Rates bottomed in August at -1.08% coz Fed flooded the system with Cash...Now that’s draining into Consumer Spending & GDP growth as Rate Sensitive Sectors lead...we are now at the Point where the Training Wheels are coming off.. & $XLF NII is hitting a trough in late 2020.

In a Deep Recession... the 1st thing you need to Cure are Credit Issues.. that’s done with Liquidity... NII takes a back seat for the time being.

... then the natural inventory re-leveraging gets EBITDA & Earnings up in V form.. within the context of backward looking jobs and defaults. All usually happens simultaneously.

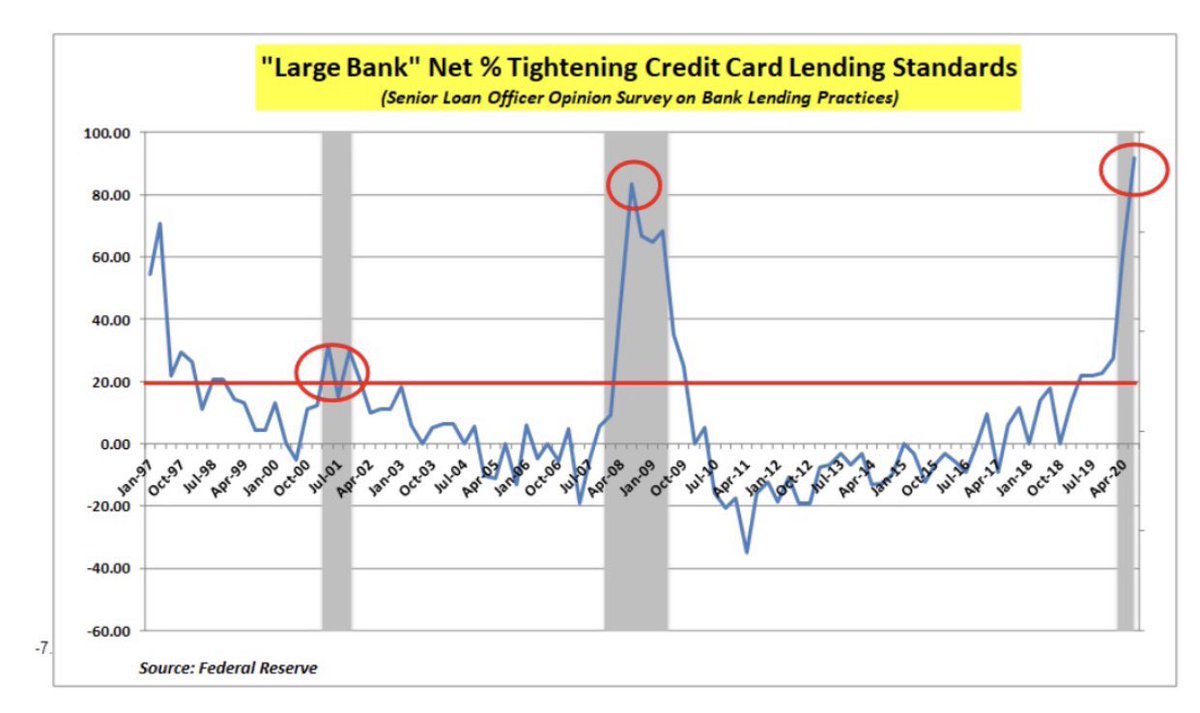

Peak Corp Leverage (Net Debt/EBITDA) & Peak Tightening of Lending Standards are one of most Bullish charts one can find that ratifies value - within context of a Recovery - after or within a Recession. Jobs and Defaults are always backward looking. Peak Loan Loss Reserves Ratify.

Can u find me one alleged “Bubble” with Peak Bank Loan Loss Reserves well over 2% in the last 100 years?

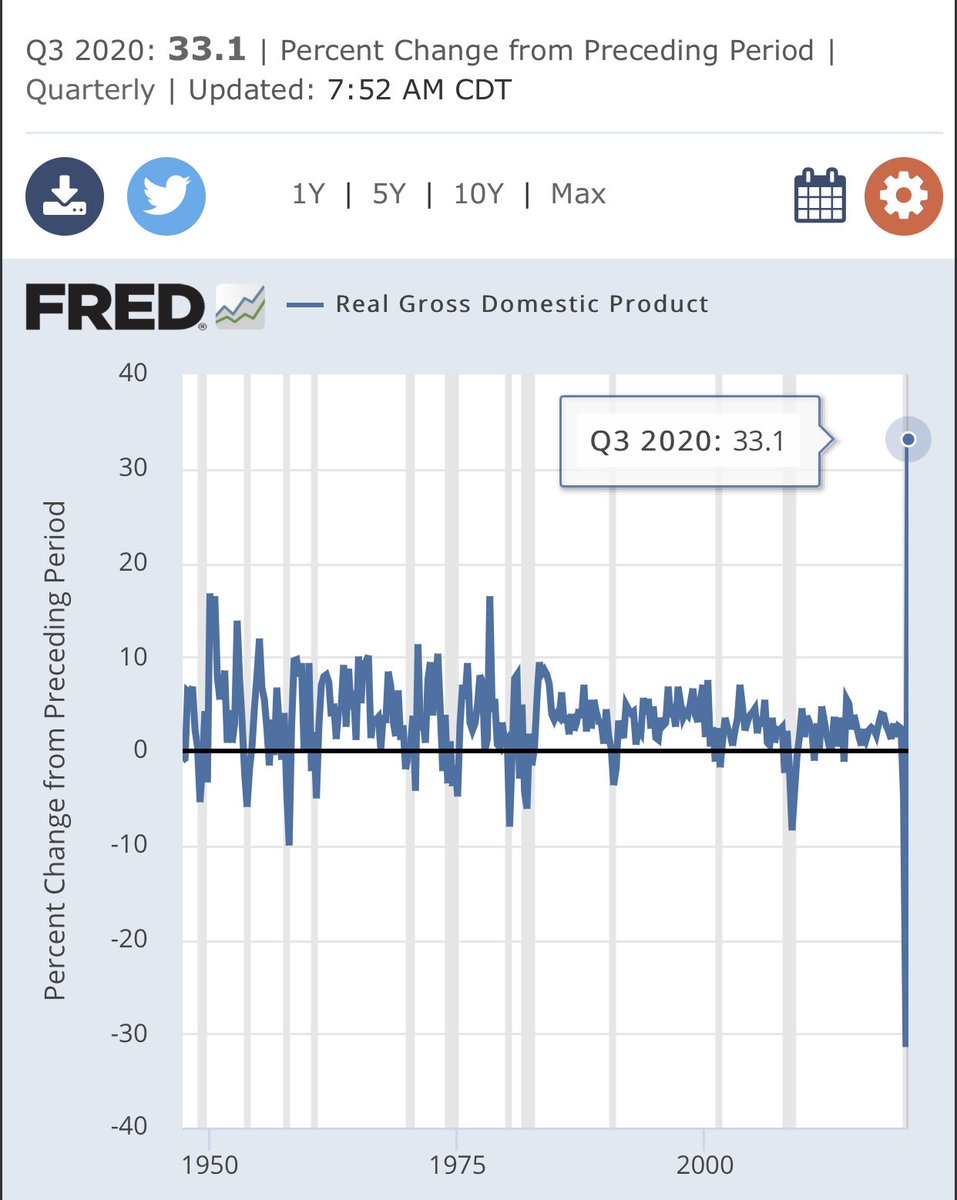

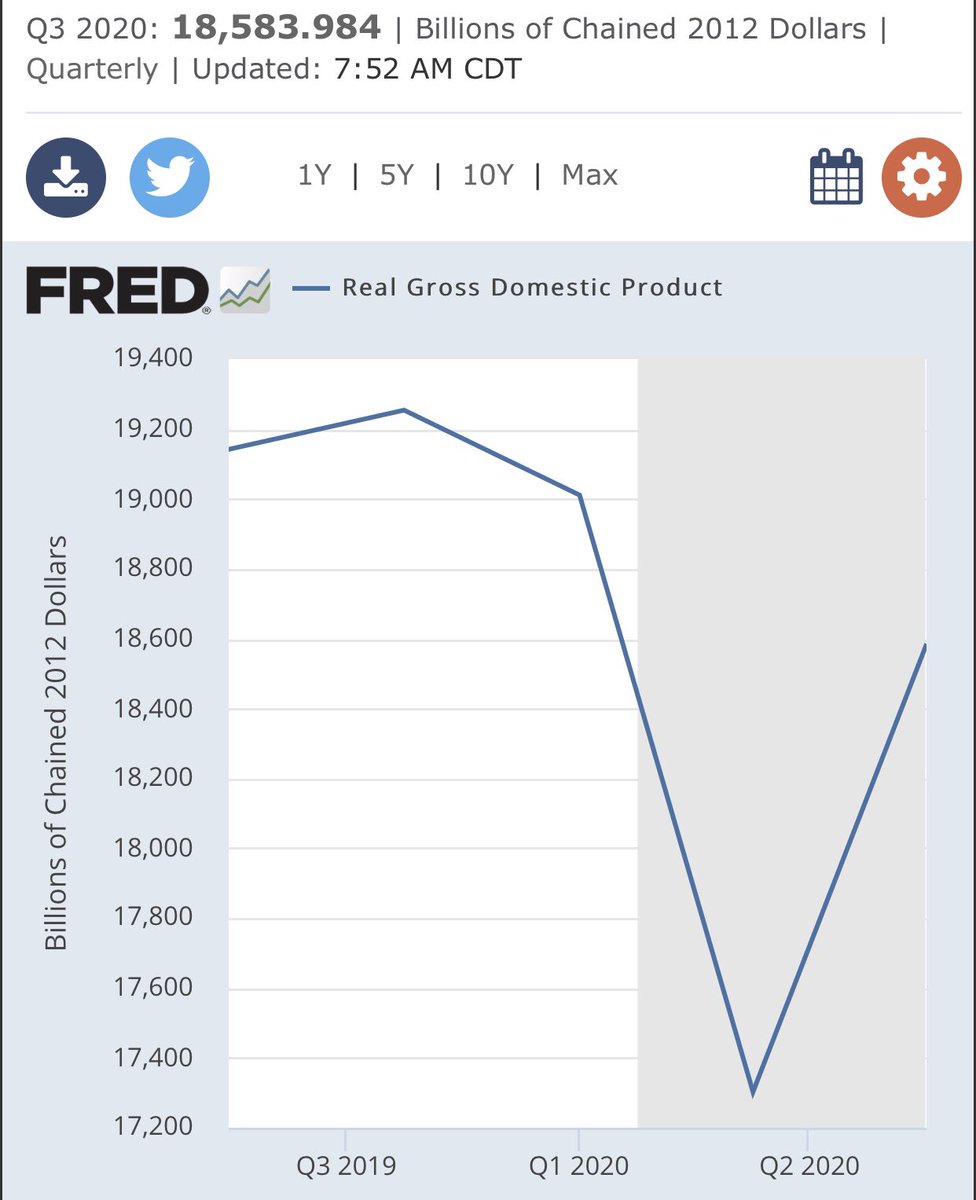

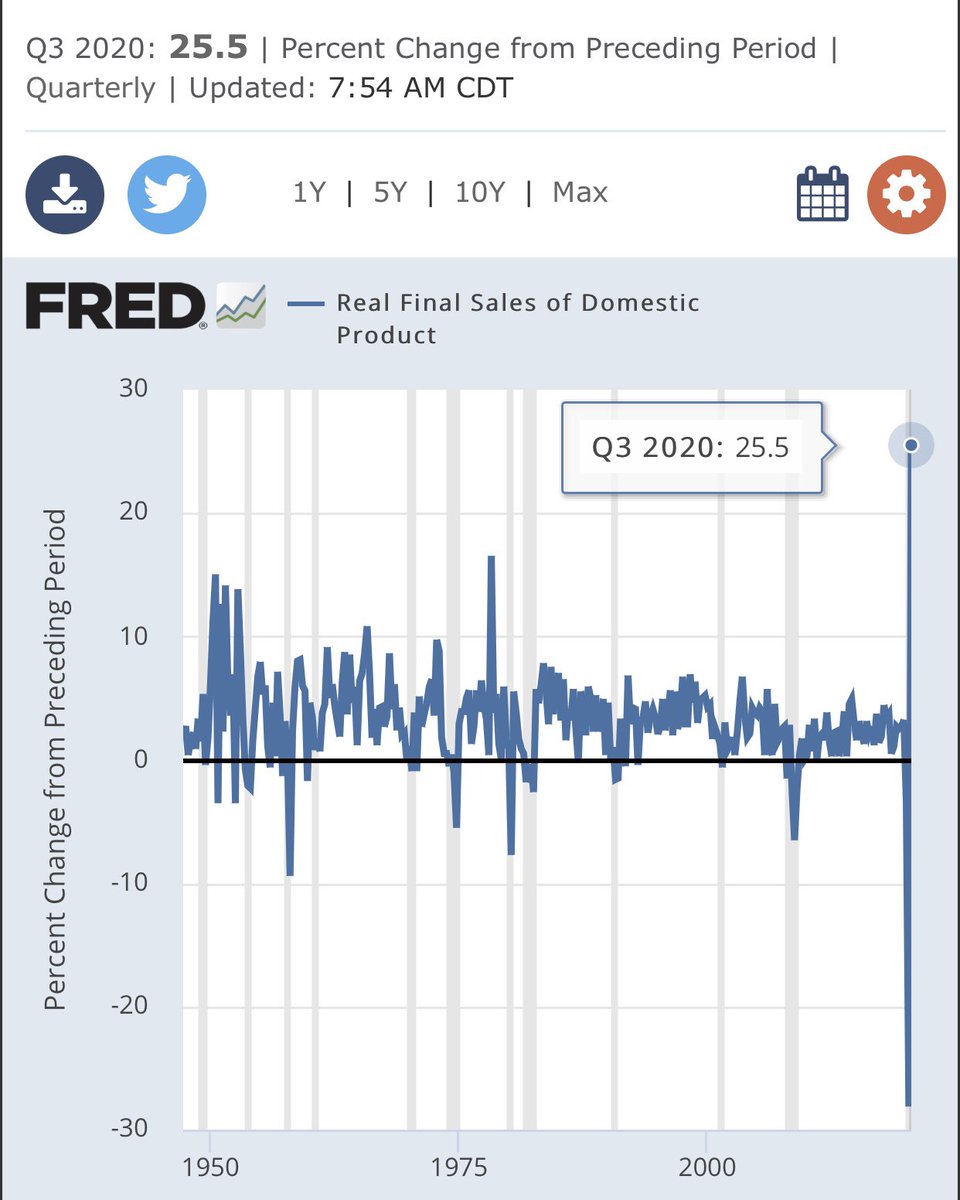

We r at the point where economy has grown like a weed (35% 3Q20 GDP) with still 2 low inventory (so should grow more in 2021 with loans)..Asset Prices Up with ~Peak Reserve Build, Inflation expectations rising with Real Rates as well...Rates at ZIRP on front end. NII 3/4Q bottom.

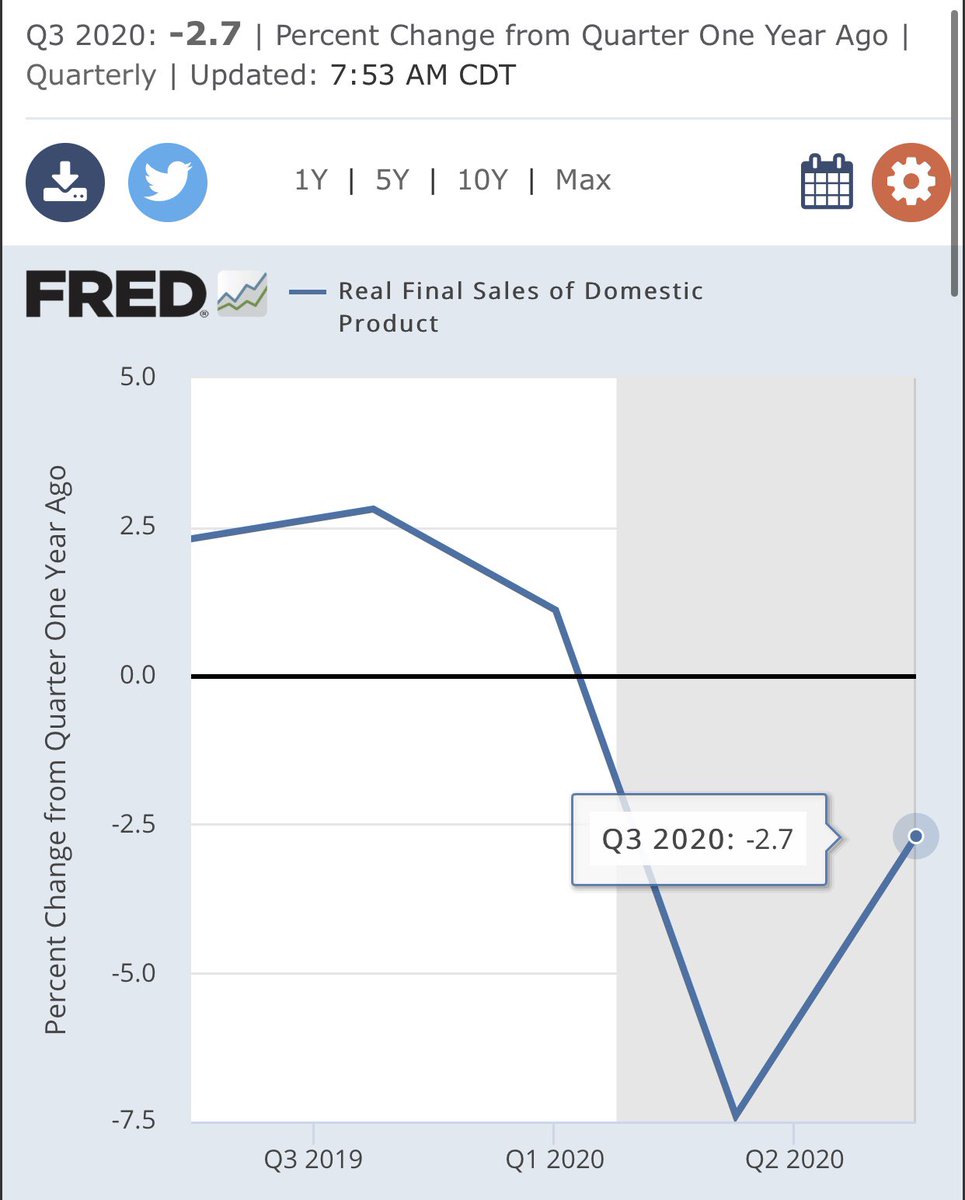

3Q20 Real GDP +33% QoQ... Bouncing back from -32% QoQ in 2Q20. -2.9% YoY.. Remember..the dismal scientists who were all hiding under their desks in April, May & June proclaiming world was ending buy $TLT $ZROZ..now lecturing on Rate of Change Math.. Fade em, not +33% the Print.

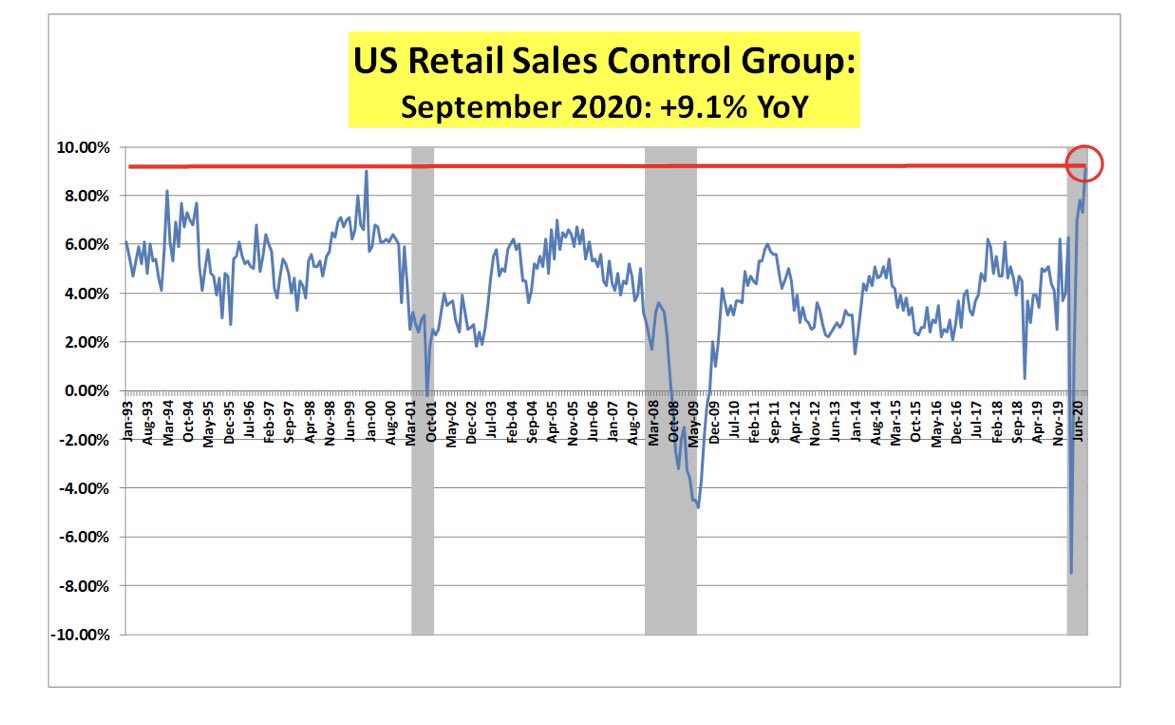

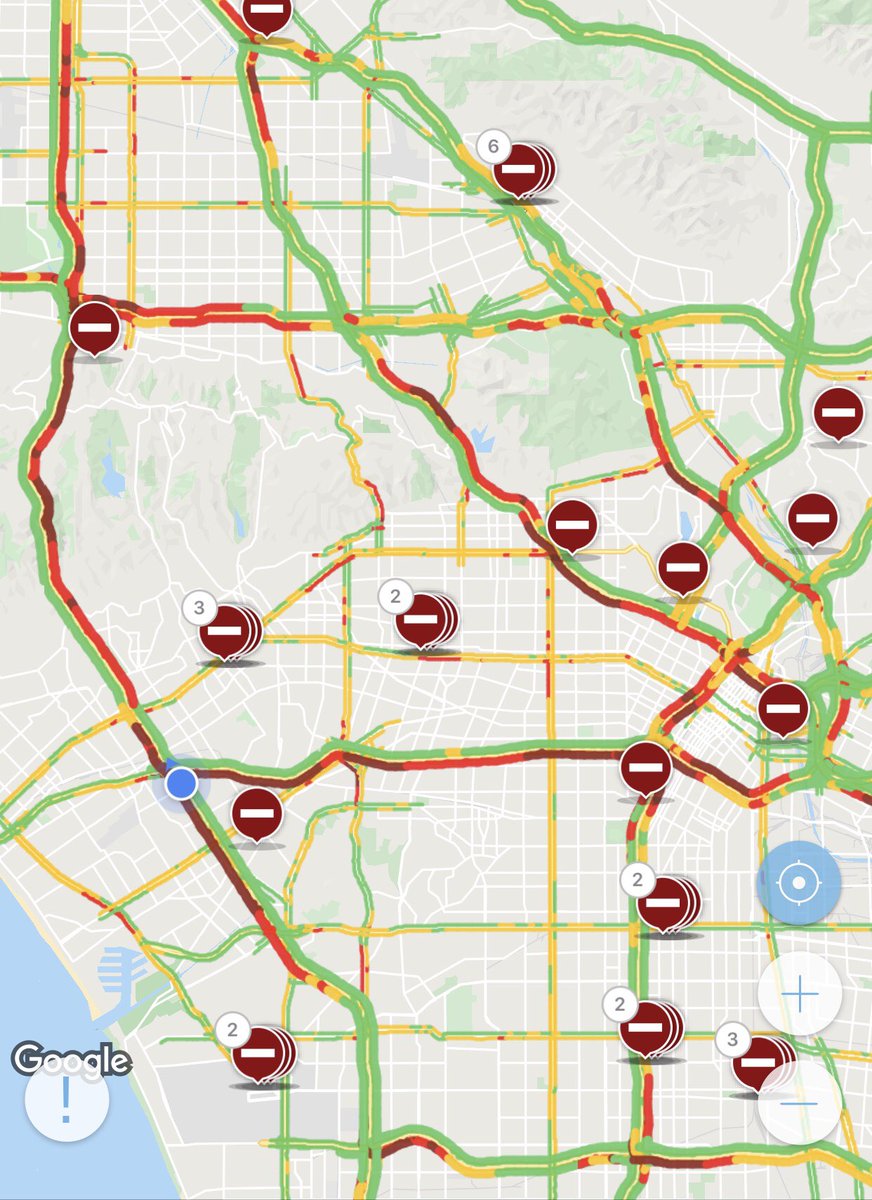

Don’t fade 3Q20... Real Final Sales were +25.5% QoQ & -2.7% YoY... Inventory Change only -$1Billion. Consumer was & is En Fuego  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">... Inventory lean.. will have to be built back up as Solid Capex Order growth continues at +4.5% YoY. Most importantly LA traffic continues 2 suck.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">... Inventory lean.. will have to be built back up as Solid Capex Order growth continues at +4.5% YoY. Most importantly LA traffic continues 2 suck.

Elevated Stimulus expired on July 31...Consumer barely flinched.. with a 14.1% Savings Rate their Buffer is at a 50+ year high... & Banks (little loan growth now) are willing to lend in ‘21 as lending standards peaking with Reserve Build - Especially at the Consumer level. $XLF

Read on Twitter

Read on Twitter

... Inventory lean.. will have to be built back up as Solid Capex Order growth continues at +4.5% YoY. Most importantly LA traffic continues 2 suck." title="Don’t fade 3Q20... Real Final Sales were +25.5% QoQ & -2.7% YoY... Inventory Change only -$1Billion. Consumer was & is En Fuego https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">... Inventory lean.. will have to be built back up as Solid Capex Order growth continues at +4.5% YoY. Most importantly LA traffic continues 2 suck.">

... Inventory lean.. will have to be built back up as Solid Capex Order growth continues at +4.5% YoY. Most importantly LA traffic continues 2 suck." title="Don’t fade 3Q20... Real Final Sales were +25.5% QoQ & -2.7% YoY... Inventory Change only -$1Billion. Consumer was & is En Fuego https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">... Inventory lean.. will have to be built back up as Solid Capex Order growth continues at +4.5% YoY. Most importantly LA traffic continues 2 suck.">

... Inventory lean.. will have to be built back up as Solid Capex Order growth continues at +4.5% YoY. Most importantly LA traffic continues 2 suck." title="Don’t fade 3Q20... Real Final Sales were +25.5% QoQ & -2.7% YoY... Inventory Change only -$1Billion. Consumer was & is En Fuego https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">... Inventory lean.. will have to be built back up as Solid Capex Order growth continues at +4.5% YoY. Most importantly LA traffic continues 2 suck.">

... Inventory lean.. will have to be built back up as Solid Capex Order growth continues at +4.5% YoY. Most importantly LA traffic continues 2 suck." title="Don’t fade 3Q20... Real Final Sales were +25.5% QoQ & -2.7% YoY... Inventory Change only -$1Billion. Consumer was & is En Fuego https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">... Inventory lean.. will have to be built back up as Solid Capex Order growth continues at +4.5% YoY. Most importantly LA traffic continues 2 suck.">

... Inventory lean.. will have to be built back up as Solid Capex Order growth continues at +4.5% YoY. Most importantly LA traffic continues 2 suck." title="Don’t fade 3Q20... Real Final Sales were +25.5% QoQ & -2.7% YoY... Inventory Change only -$1Billion. Consumer was & is En Fuego https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">... Inventory lean.. will have to be built back up as Solid Capex Order growth continues at +4.5% YoY. Most importantly LA traffic continues 2 suck.">

... Inventory lean.. will have to be built back up as Solid Capex Order growth continues at +4.5% YoY. Most importantly LA traffic continues 2 suck." title="Don’t fade 3Q20... Real Final Sales were +25.5% QoQ & -2.7% YoY... Inventory Change only -$1Billion. Consumer was & is En Fuego https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">... Inventory lean.. will have to be built back up as Solid Capex Order growth continues at +4.5% YoY. Most importantly LA traffic continues 2 suck.">

... Inventory lean.. will have to be built back up as Solid Capex Order growth continues at +4.5% YoY. Most importantly LA traffic continues 2 suck." title="Don’t fade 3Q20... Real Final Sales were +25.5% QoQ & -2.7% YoY... Inventory Change only -$1Billion. Consumer was & is En Fuego https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">... Inventory lean.. will have to be built back up as Solid Capex Order growth continues at +4.5% YoY. Most importantly LA traffic continues 2 suck.">

... Inventory lean.. will have to be built back up as Solid Capex Order growth continues at +4.5% YoY. Most importantly LA traffic continues 2 suck." title="Don’t fade 3Q20... Real Final Sales were +25.5% QoQ & -2.7% YoY... Inventory Change only -$1Billion. Consumer was & is En Fuego https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">... Inventory lean.. will have to be built back up as Solid Capex Order growth continues at +4.5% YoY. Most importantly LA traffic continues 2 suck.">