Should you invest in Sovereign Gold Bond

A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://wealthsutra.wordpress.com/2020/10/14/should-you-invest-in-sovereign-gold-bond/">https://wealthsutra.wordpress.com/2020/10/1...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://wealthsutra.wordpress.com/2020/10/14/should-you-invest-in-sovereign-gold-bond/">https://wealthsutra.wordpress.com/2020/10/1...

A thread

In April 2020, the RBI had announced that it will issue the sovereign gold bonds in 6 tranches for this financial year. The 7th tranche has opened for subscription on 12th October 2020 and will close on 16th OCtober 2020.

The issue price for this tranche has been fixed at Rs. 5051 per gram of gold. For those applying online, this issue price will be Rs. 5001 per gram.

What are Sovereign Gold Bond?

What are Sovereign Gold Bond?

Sovereign Gold Bonds (SGBs) are government securities mandated by the RBI and denominated in grams of gold. Sovereign Gold Bonds were introduced by the RBI in November 2015 as a substitute for holding physical gold.

Key Features

Key Features

•Investor can Invest online or through filling application form through Banks, SHCIL offices

•Demat is optional, but recommended for redemption

•Minimum investment: 1 gm of Gold (Rs 5000 currently)

•Investment into 24 k Gold

•Demat is optional, but recommended for redemption

•Minimum investment: 1 gm of Gold (Rs 5000 currently)

•Investment into 24 k Gold

Investor give money and receives a certificate of Holding which is tradable after 5 year lock in period.

But Why RBI is interested in Gold?

But Why RBI is interested in Gold?

RBI is the treasury of the country and hence has to keep its surplus in foreign currencies and in a form of Gold . Currently RBI Reserve is ~560 Tonnes on Gold. As gold is a great store of value.

So What happens after investment?

So What happens after investment?

4 Key Benefits of SGB

- Capital Appreciation From Gold Price

- A tax efficient debt product with no capital gain tax

- Elimination of Risk of impure Gold as Gold Impurity risk lies with RBI ,as Investor shall get paid worth of 99.99% purity of gold

- Cost Effective manner of Investing in gold :

- A tax efficient debt product with no capital gain tax

- Elimination of Risk of impure Gold as Gold Impurity risk lies with RBI ,as Investor shall get paid worth of 99.99% purity of gold

- Cost Effective manner of Investing in gold :

•No storage Cost

•No Security Cost

•No Making Charges

•Low transaction charge (1% total)

•No Hidden Expenses

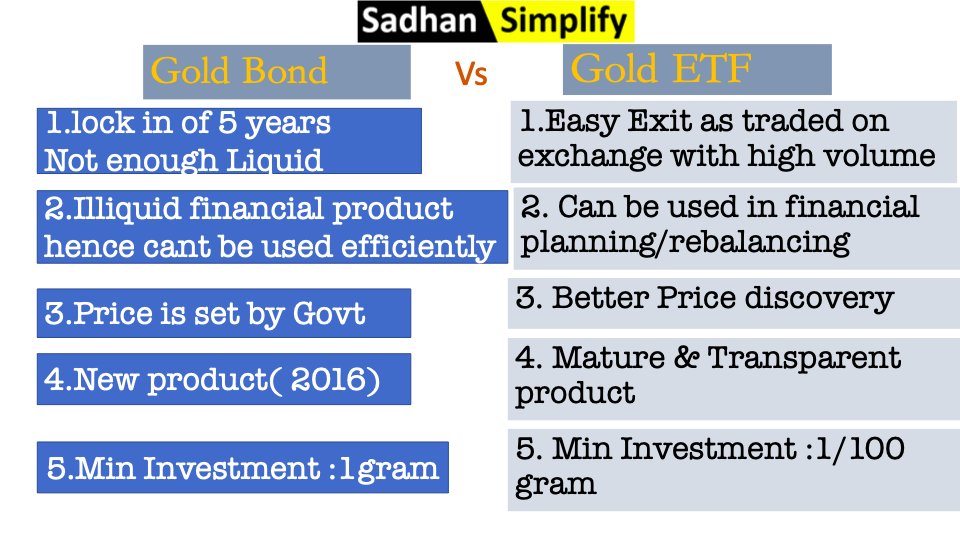

Comparison with Gold ETF

•No Security Cost

•No Making Charges

•Low transaction charge (1% total)

•No Hidden Expenses

Comparison with Gold ETF

A must watch video for investors: https://www.youtube.com/watch?v=f950SQOv9Yg">https://www.youtube.com/watch...

Serious about Investing in Gold??

We have a playlist containing 3 more videos on Gold investment explaining

We have a playlist containing 3 more videos on Gold investment explaining

- Rise of Gold and Should you buy? ( https://youtu.be/SnsakglyRBk )

-">https://youtu.be/SnsakglyR... How to Select Best Gold MF ( https://www.youtube.com/watch?v=SqdHIB4i1Z0)

-">https://www.youtube.com/watch... How to invest in Gold ETF? ( https://www.youtube.com/watch?v=SqdHIB4i1Z0)">https://www.youtube.com/watch...

-">https://youtu.be/SnsakglyR... How to Select Best Gold MF ( https://www.youtube.com/watch?v=SqdHIB4i1Z0)

-">https://www.youtube.com/watch... How to invest in Gold ETF? ( https://www.youtube.com/watch?v=SqdHIB4i1Z0)">https://www.youtube.com/watch...

This thread can be read here: https://wealthsutra.wordpress.com/2020/10/14/should-you-invest-in-sovereign-gold-bond/">https://wealthsutra.wordpress.com/2020/10/1...

Read on Twitter

Read on Twitter