Excited about first research outputs from @AshokaUniv Center for Economic Policy (ACEP) on India& #39;s Exports and Growth

Research paper: https://ashoka.edu.in/static/doc_uploads/file_1602585132.pdf

Policy">https://ashoka.edu.in/static/do... paper: https://ashoka.edu.in/static/doc_uploads/file_1602585593.pdf

w/">https://ashoka.edu.in/static/do... @shoumitro_c

1/

Research paper: https://ashoka.edu.in/static/doc_uploads/file_1602585132.pdf

Policy">https://ashoka.edu.in/static/do... paper: https://ashoka.edu.in/static/doc_uploads/file_1602585593.pdf

w/">https://ashoka.edu.in/static/do... @shoumitro_c

1/

Focus here is on policy paper.

India& #39;s inward turn ("atmanirbharta"):

-favoring domestic demand over exports (macro)

-imposing barriers favoring domestic production (trade)

...is consequential

3 questions

1. Is inward turn strong?

2. Is it warranted?

3. Will it work?

2/

India& #39;s inward turn ("atmanirbharta"):

-favoring domestic demand over exports (macro)

-imposing barriers favoring domestic production (trade)

...is consequential

3 questions

1. Is inward turn strong?

2. Is it warranted?

3. Will it work?

2/

Our @IndianExpress piece today (another tomorrow) covers questions 1 and 2: https://indianexpress.com/article/opinion/columns/india-trade-economy-coronavirus-impact-covid-6723899/

Is">https://indianexpress.com/article/o... Inward turn strong?

Yes: on trade, tariffs up, standstill on trade agreements, and slew of incentives/subsidies for domestic manufacturing.

3/

Is">https://indianexpress.com/article/o... Inward turn strong?

Yes: on trade, tariffs up, standstill on trade agreements, and slew of incentives/subsidies for domestic manufacturing.

3/

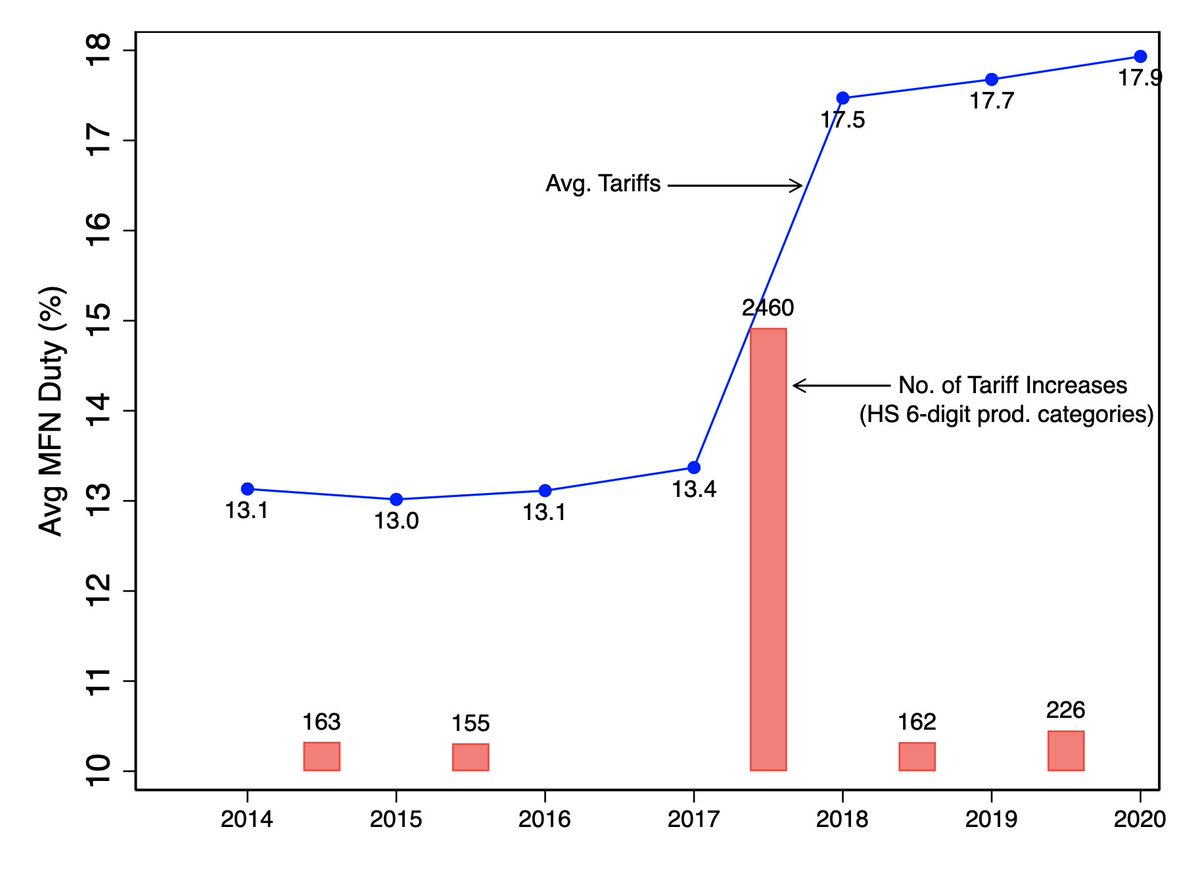

Tariff picture striking

Average up from 13% to 18% between 2014 and 2020

Tariff increases affect 3200 import categories (70%) or about $300 billion

Increases greatest (10-20 % pts) on low-skill manufactures (clothing, footwear etc.)

4/

Average up from 13% to 18% between 2014 and 2020

Tariff increases affect 3200 import categories (70%) or about $300 billion

Increases greatest (10-20 % pts) on low-skill manufactures (clothing, footwear etc.)

4/

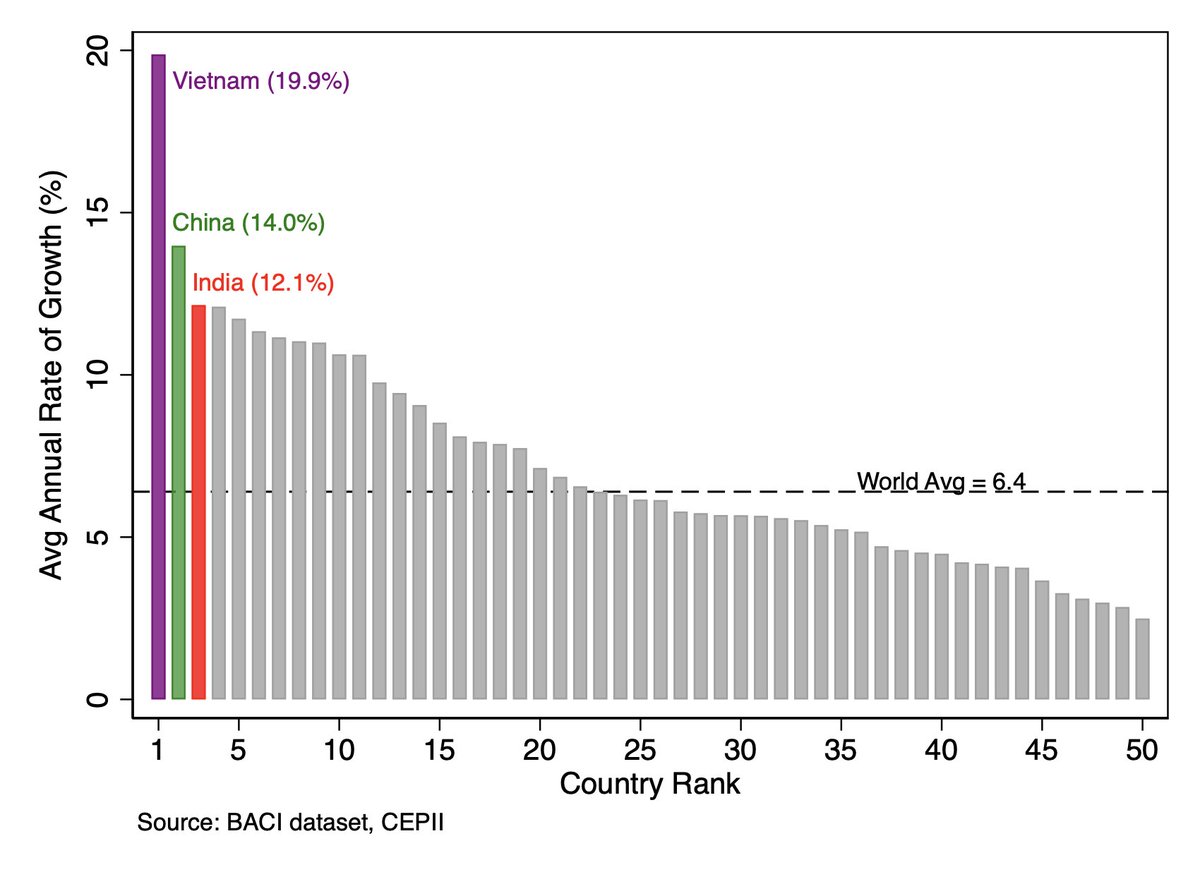

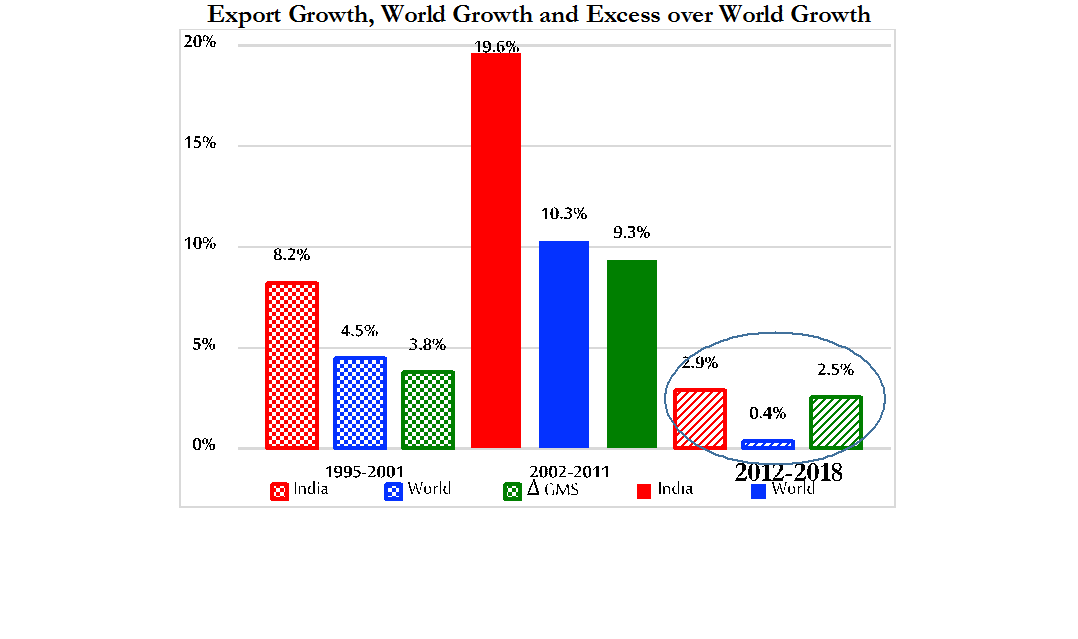

3 "myths" behind inward turn

1: India& #39;s growth based on domestic market not exports. NO, India was East Asian TIGER

India& #39;s exports b/w 1995-2018 stellar, not just services but manufacturing. Critical to overall growth

Mfg exp. growth (12%), 3rd fastest in world: WOW

5/

1: India& #39;s growth based on domestic market not exports. NO, India was East Asian TIGER

India& #39;s exports b/w 1995-2018 stellar, not just services but manufacturing. Critical to overall growth

Mfg exp. growth (12%), 3rd fastest in world: WOW

5/

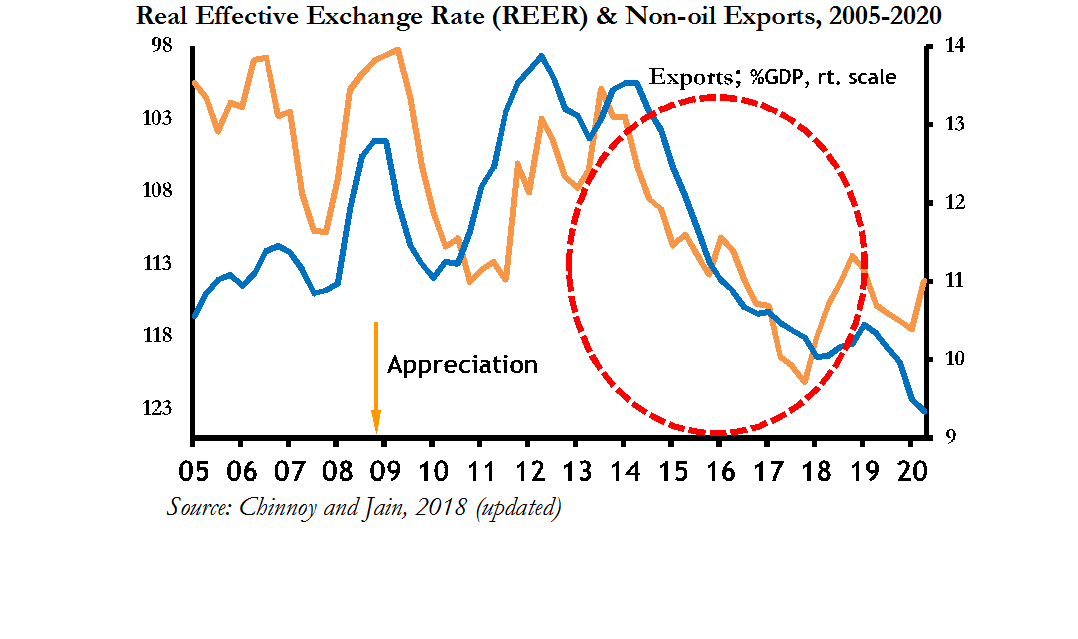

Even in post-2012 export growth slowdown:

India outpaced world

and Indian slowdown partly self-inflicted, e.g. by rupee appreciation and other policies

6/

India outpaced world

and Indian slowdown partly self-inflicted, e.g. by rupee appreciation and other policies

6/

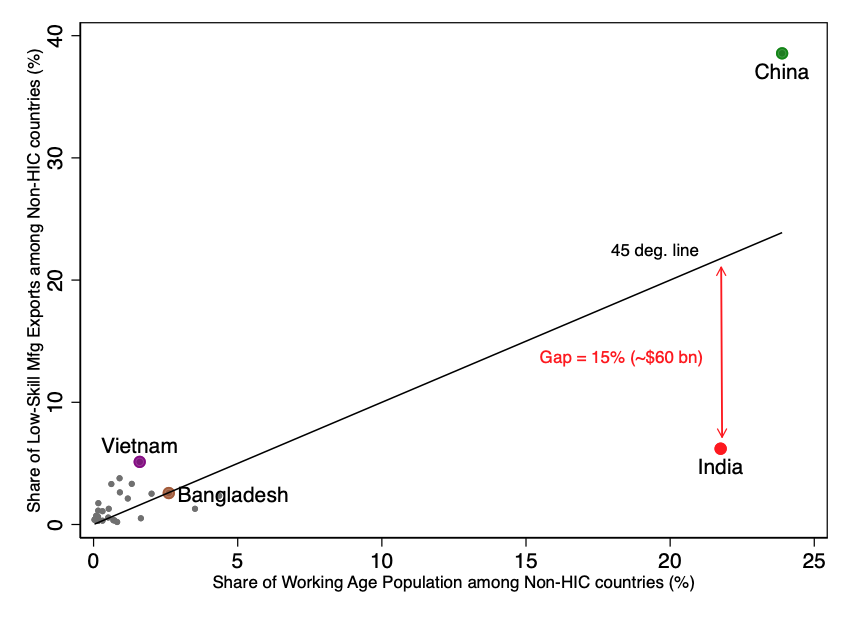

"Myth" 2: Export prospects dim. NOT REALLY

India& #39;s mfg. exp. global share small:1.7% < Vietnam. Scope for gaining market share even w/ deglobalization

Opportunity in low-skill exports. India under-performs relative to labor endowment ("missing" exp./output= $60-$140 bn.)

7/

India& #39;s mfg. exp. global share small:1.7% < Vietnam. Scope for gaining market share even w/ deglobalization

Opportunity in low-skill exports. India under-performs relative to labor endowment ("missing" exp./output= $60-$140 bn.)

7/

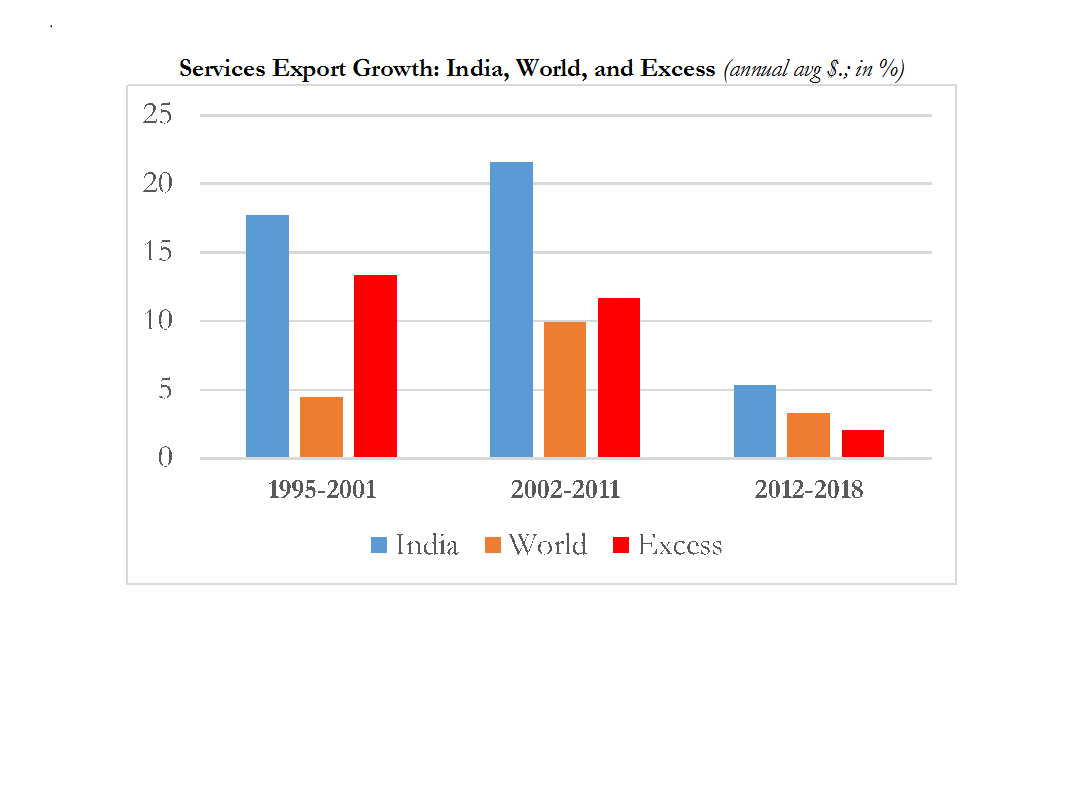

… moreover, even though world is deglobalizing in goods, it continues to globalize in services.

Also, Covid by favouring activity-at-a-distance could accelerate services globalization

India stands to benefit because it is still competitive in services

8/

Also, Covid by favouring activity-at-a-distance could accelerate services globalization

India stands to benefit because it is still competitive in services

8/

"Myth" 3: India has a BIG market, so export neglect not costly. NOT REALLY

GDP of $2.9 trillion (2019), world’s 5th largest

But "middle class" market w/ purchasing power much less than GDP

Why? Large popn. of rel. poor & lots of income w/ those who save a lot (~40%)

9/

GDP of $2.9 trillion (2019), world’s 5th largest

But "middle class" market w/ purchasing power much less than GDP

Why? Large popn. of rel. poor & lots of income w/ those who save a lot (~40%)

9/

Will prescriptions work?

1. Domestic demand over exports

History

Pre-1991, export growth=4.5%; real GDP=3.5%

Post-1991, 11% and ~6.5%

Why abandon success?

Today

ALL balance sheets propping domestic demand bleeding: firms & banks (pvt. invt), h/hold (consmpn) & govt.

10/

1. Domestic demand over exports

History

Pre-1991, export growth=4.5%; real GDP=3.5%

Post-1991, 11% and ~6.5%

Why abandon success?

Today

ALL balance sheets propping domestic demand bleeding: firms & banks (pvt. invt), h/hold (consmpn) & govt.

10/

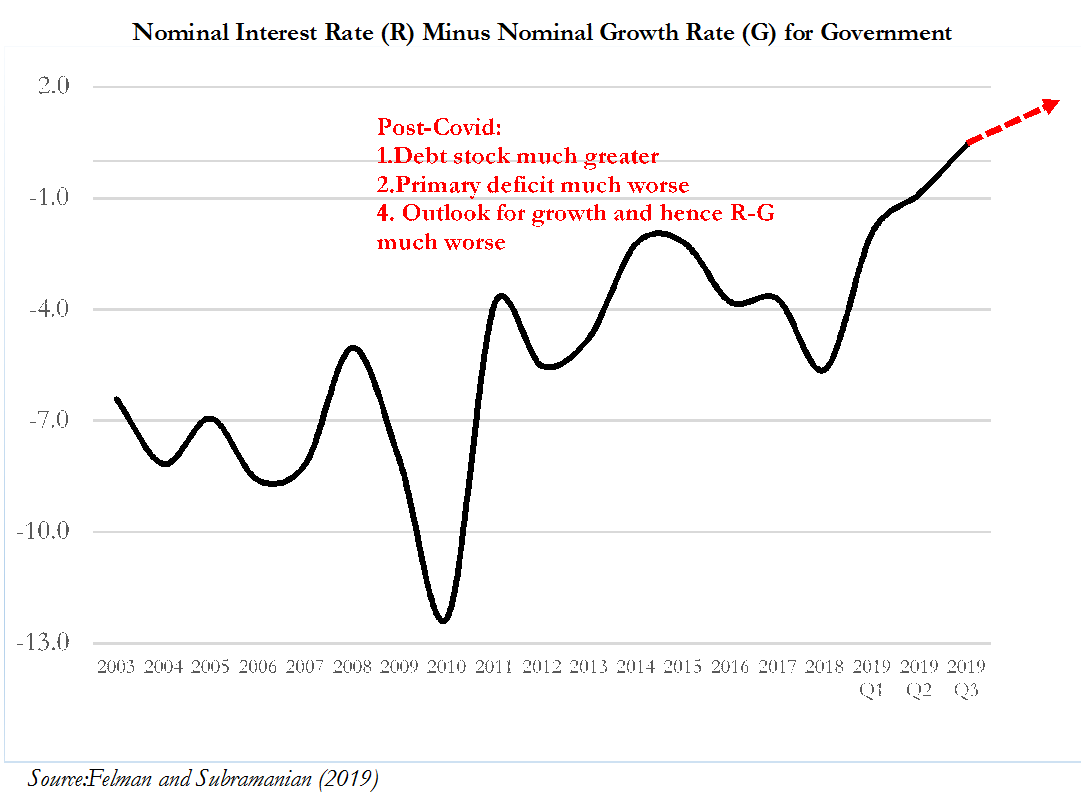

Take government, most important demand source

Pre-Covid: Public debt & interest-growth trajectory worsening

Post-Covid,3 knocks: higher debt/GDP (10-15 ppts), larger primary deficit & R-G differential from weaker growth

Fisc. Can/must prop recovery but long-run growth?

11/

Pre-Covid: Public debt & interest-growth trajectory worsening

Post-Covid,3 knocks: higher debt/GDP (10-15 ppts), larger primary deficit & R-G differential from weaker growth

Fisc. Can/must prop recovery but long-run growth?

11/

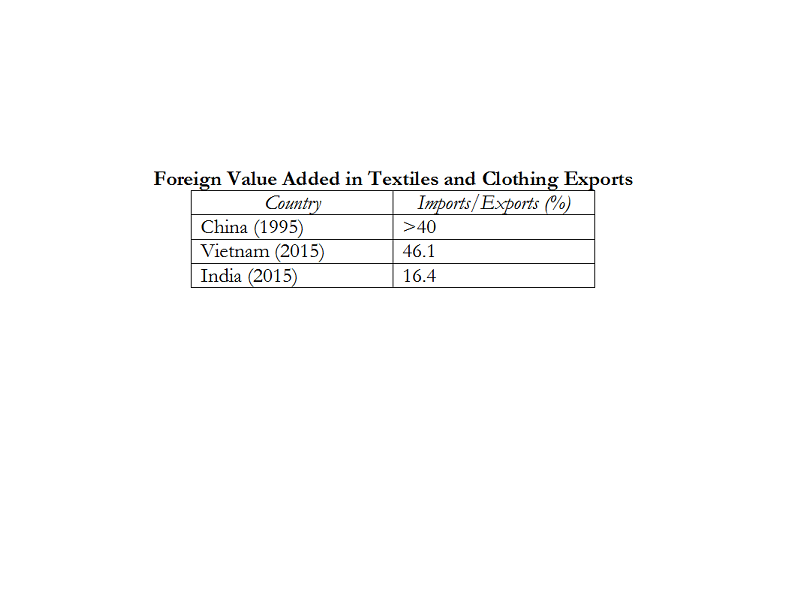

2.Can protectionism boost exports?

China vacating export space as wages rise & investors hedge bets, so India& #39;s big opportunity is low-skill exports

But this requires more not less openness, e.g. FTA with EU

Take clothing: needed import content much higher than India& #39;s

12/

China vacating export space as wages rise & investors hedge bets, so India& #39;s big opportunity is low-skill exports

But this requires more not less openness, e.g. FTA with EU

Take clothing: needed import content much higher than India& #39;s

12/

In sum, abandoning export orientation seems like:

-killing the goose that lays golden eggs

-Indeed, with balance sheets bleeding, killing the only goose than can lay eggs

India must double down on export orientation to save economy from a trajectory of mediocrity

13/

-killing the goose that lays golden eggs

-Indeed, with balance sheets bleeding, killing the only goose than can lay eggs

India must double down on export orientation to save economy from a trajectory of mediocrity

13/

Our policy and research papers build on our contribution to important @PIIE volume on US-India economic relations, featuring terrific contributions from colleagues: https://www.piie.com/publications/piie-briefings/wary-partnership-future-us-india-economic-relations

n/">https://www.piie.com/publicati...

n/">https://www.piie.com/publicati...

Read on Twitter

Read on Twitter