Today’s labour market statistics saw the crisis start to show up in the headline labour market statistics, with unemployment up and redundancies rising sharply at the end of the summer. Here are our charts from this morning’s data (THREAD)

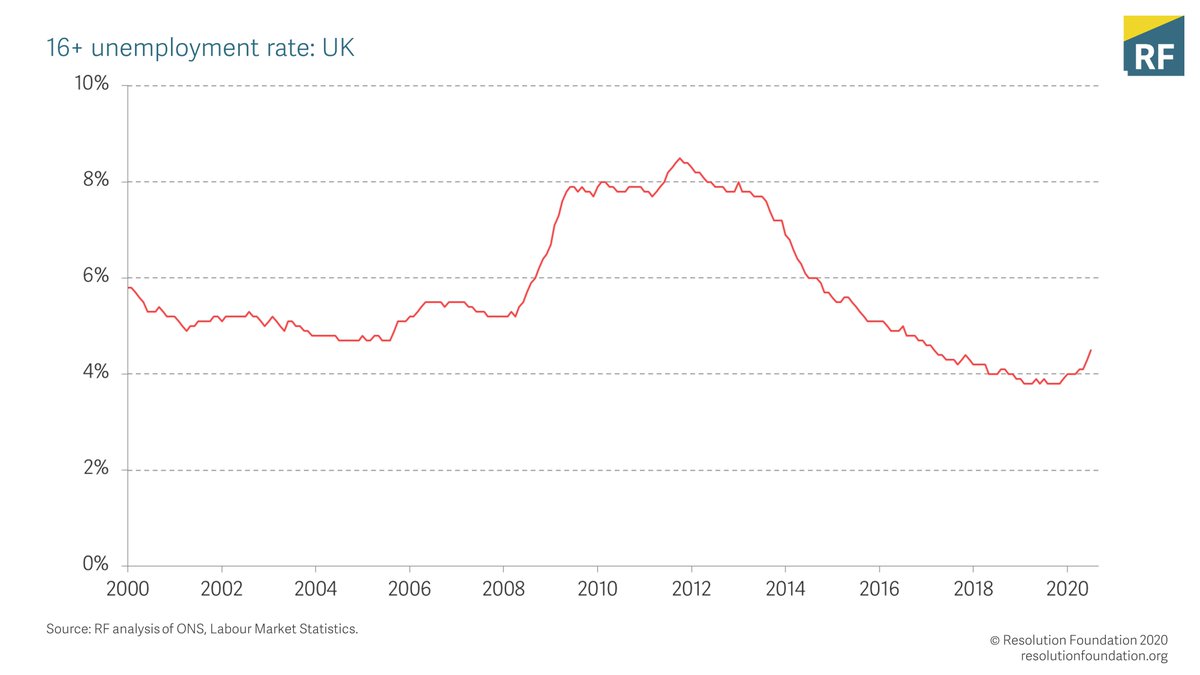

In the three months to August, the 16+ unemployment rate rose to 4.5%, up from 4.3% and 4.1% in the two months before that. This was a rise of 138k on the previous quarter, the largest rise since 2009.

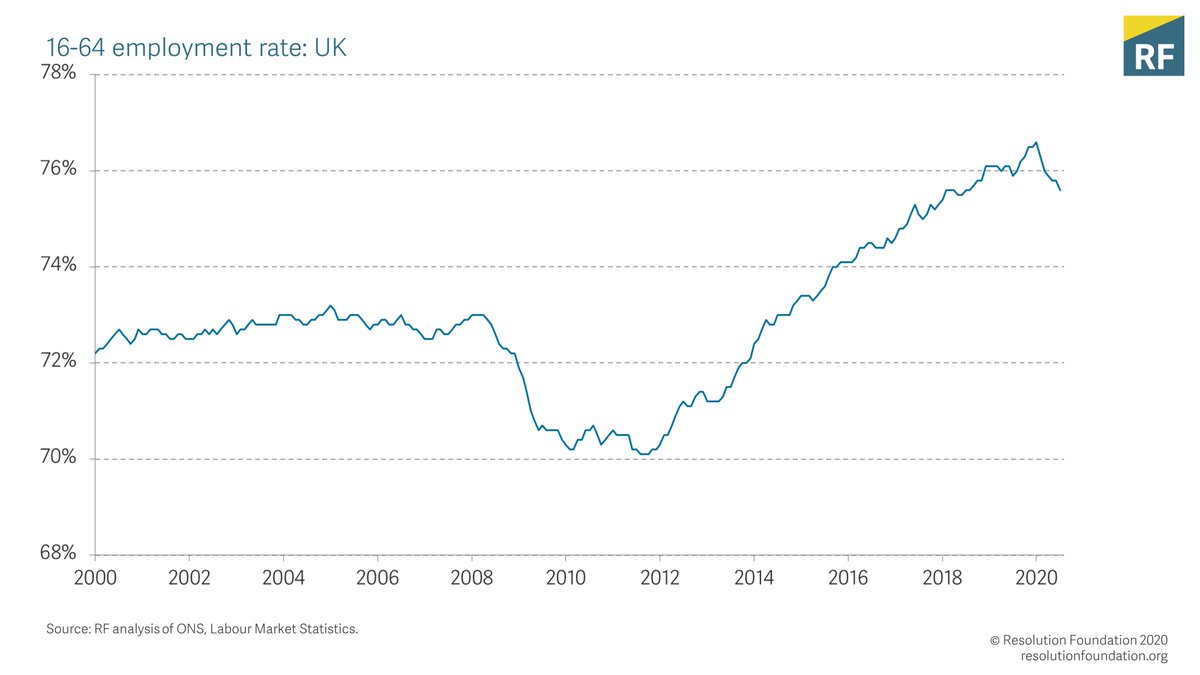

Similarly, employment in the LFS fell by 153k in the three months to September on the previous quarter. This was mainly driven by falling self-employment (down 366k on the start of the year).

(As an aside, it’s worth noting that today’s data have been revised following the ONS’s decision to reweight their LFS data to take account of under-sampling of renters during the crisis. This also means we don’t have single-month data this month.)

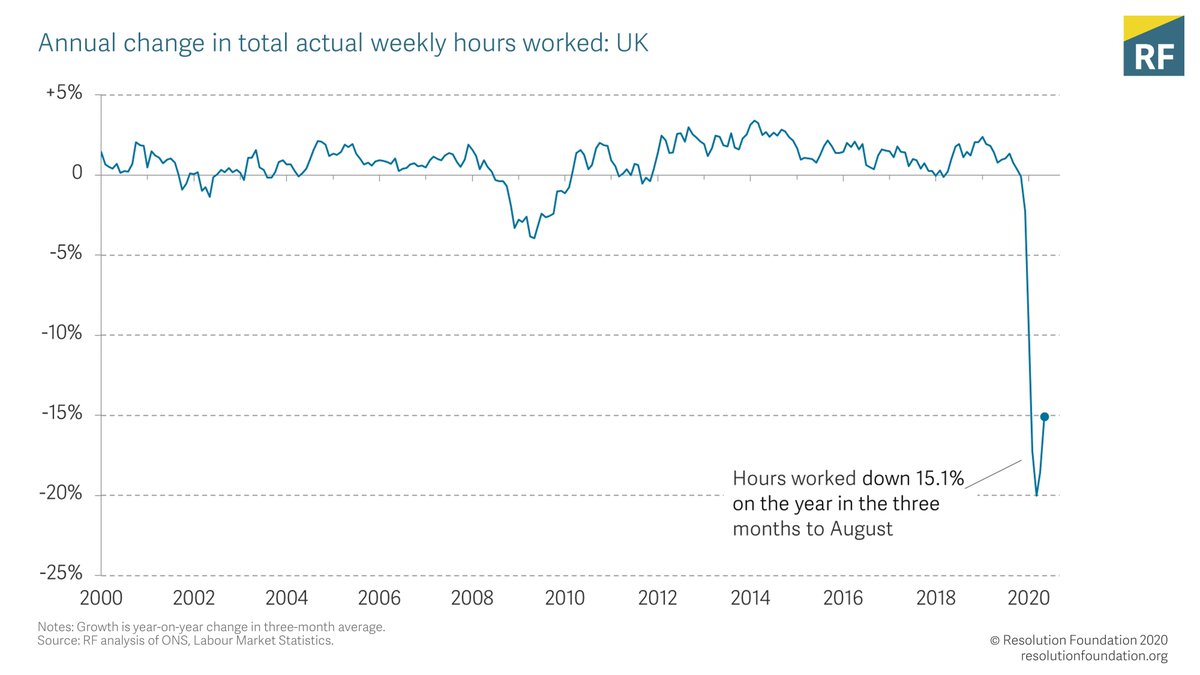

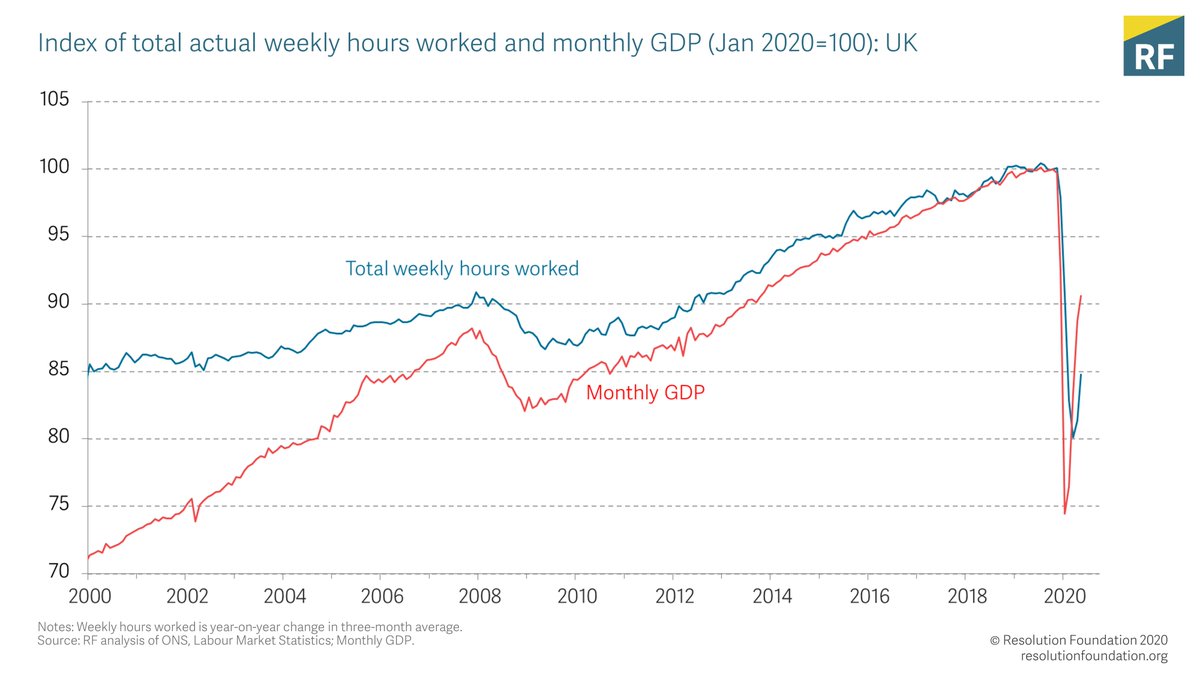

So far, the crisis has mostly shown up in falls in hours worked, rather than employment. Hours recovered slightly in the three months to August - rising by 2.3% compared to the three months to May - but remained 15% down compared to a year earlier.

The recovery in hours worked has been slower than the recovery in GDP, which might be due to many workers in lower-productivity sectors remaining on furlough.

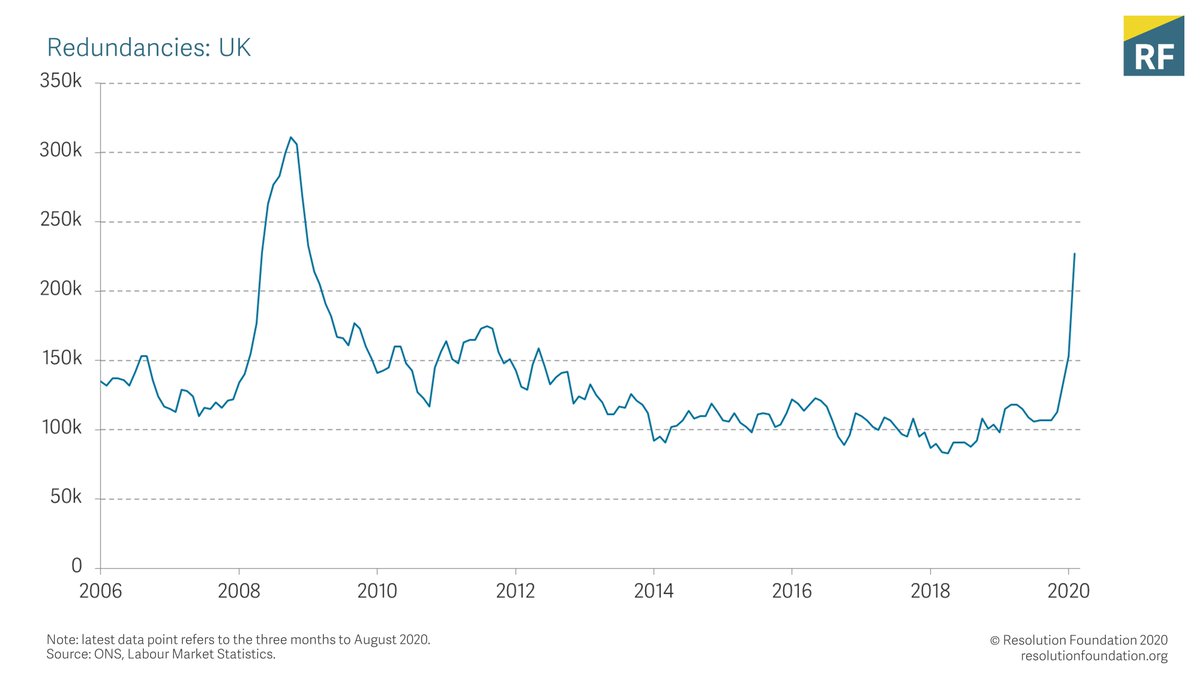

The most alarming data is on redundancies, which rose to 227k in the three months to August, heading towards the levels seen in the financial crisis. This chimes with previous data on employers’ plans for redundancies over the summer.

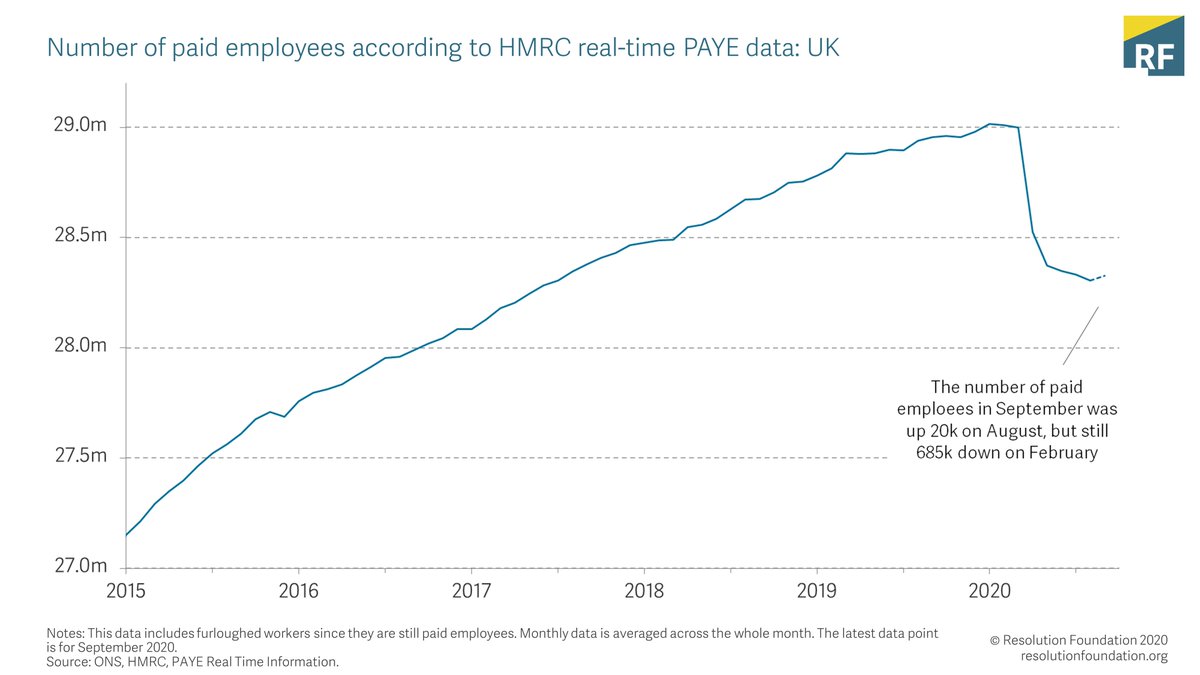

In contrast to the worsening LFS headline data, the HMRC’s more timely measure of paid employees showed a slight rise in September, of 20k. This is encouraging and may reflect increasing activity. This small rise still leaves the count 685k down on February.

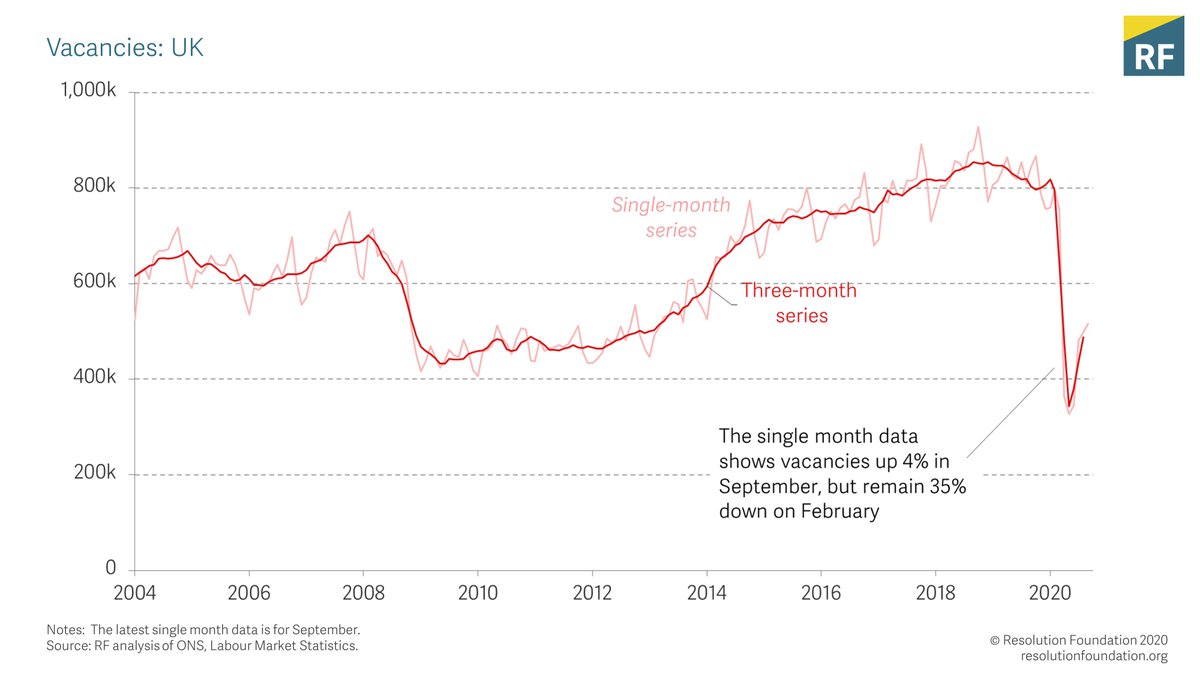

There was also some encouragement to be taken from the vacancies data, which rose 4 per cent in September. This is a fairly muted rise, though, and leaves the total around a third below pre-pandemic levels.

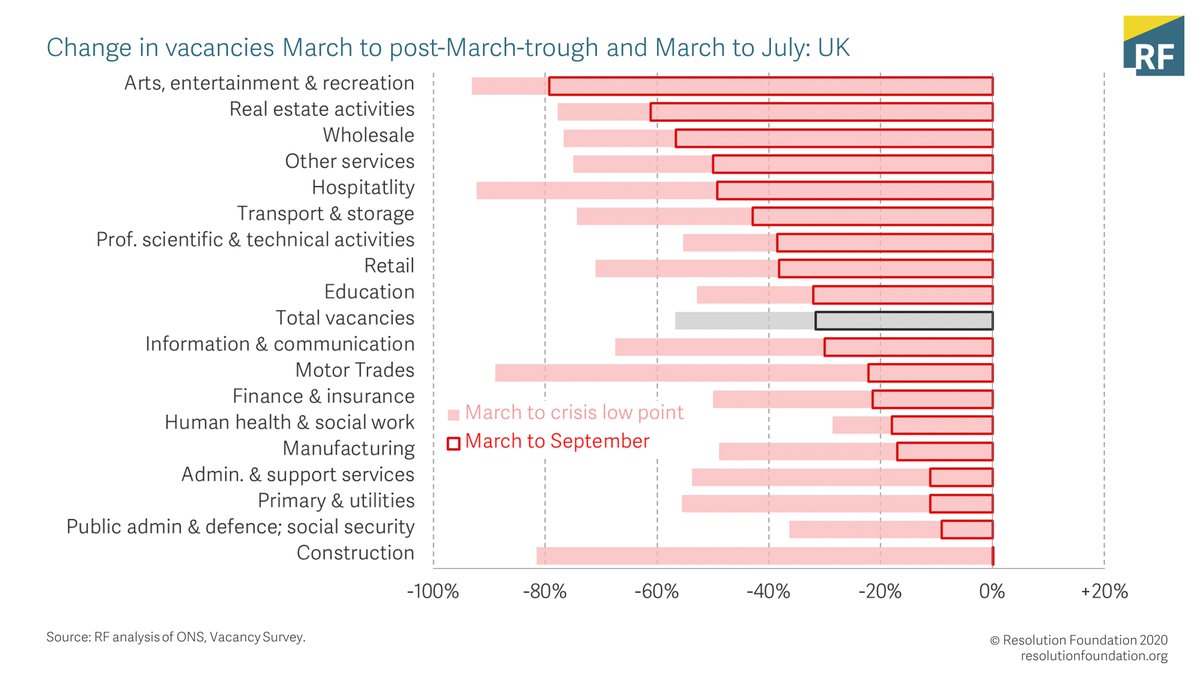

On sectors, the story is much the same as in recent months, with big sectoral variation, and very low postings in leisure and some other hard-hit sectors. Construction, by contrast, is posting vacancies at the same level as pre-pandemic.

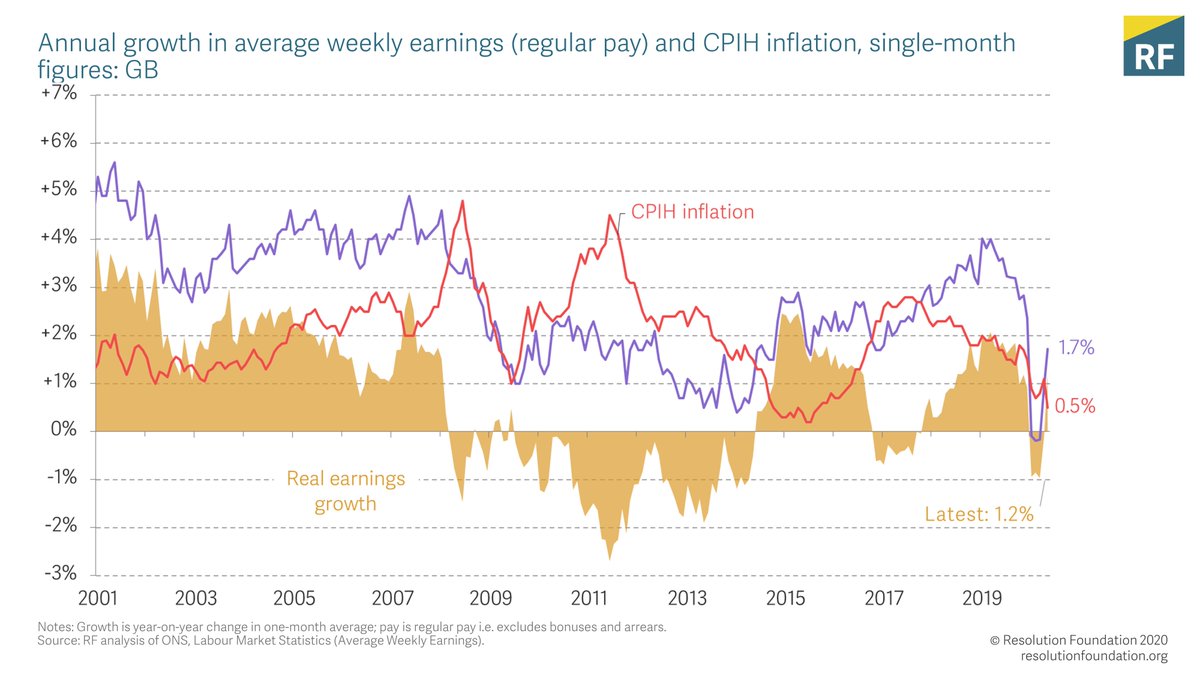

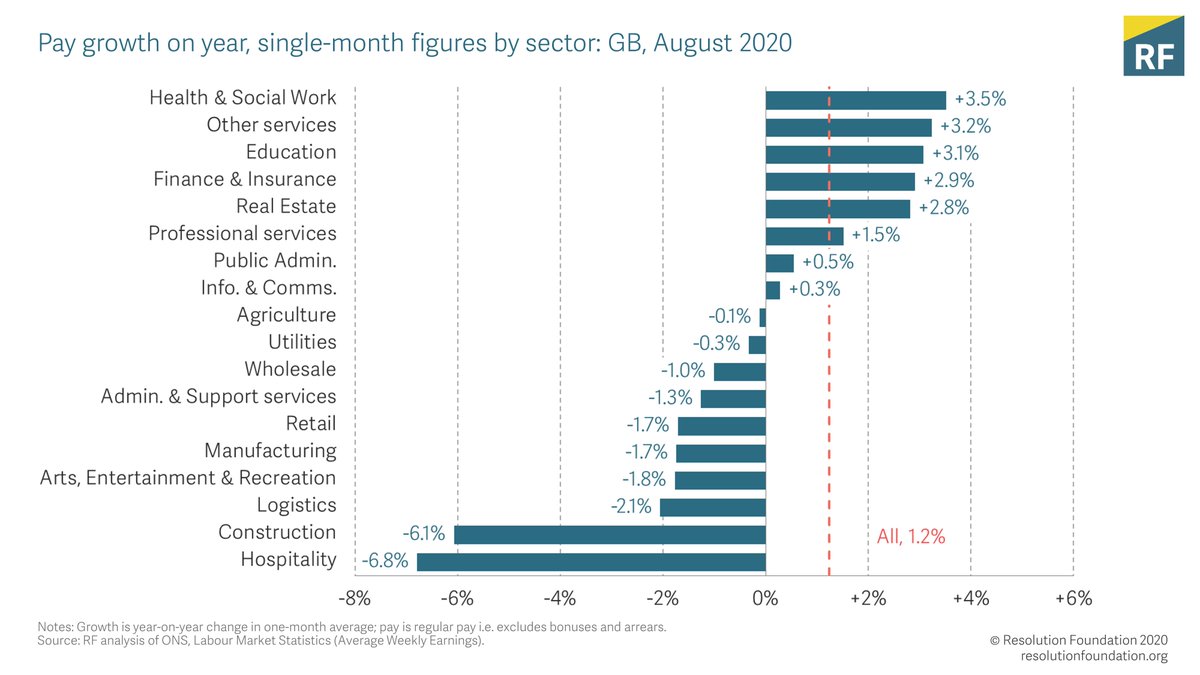

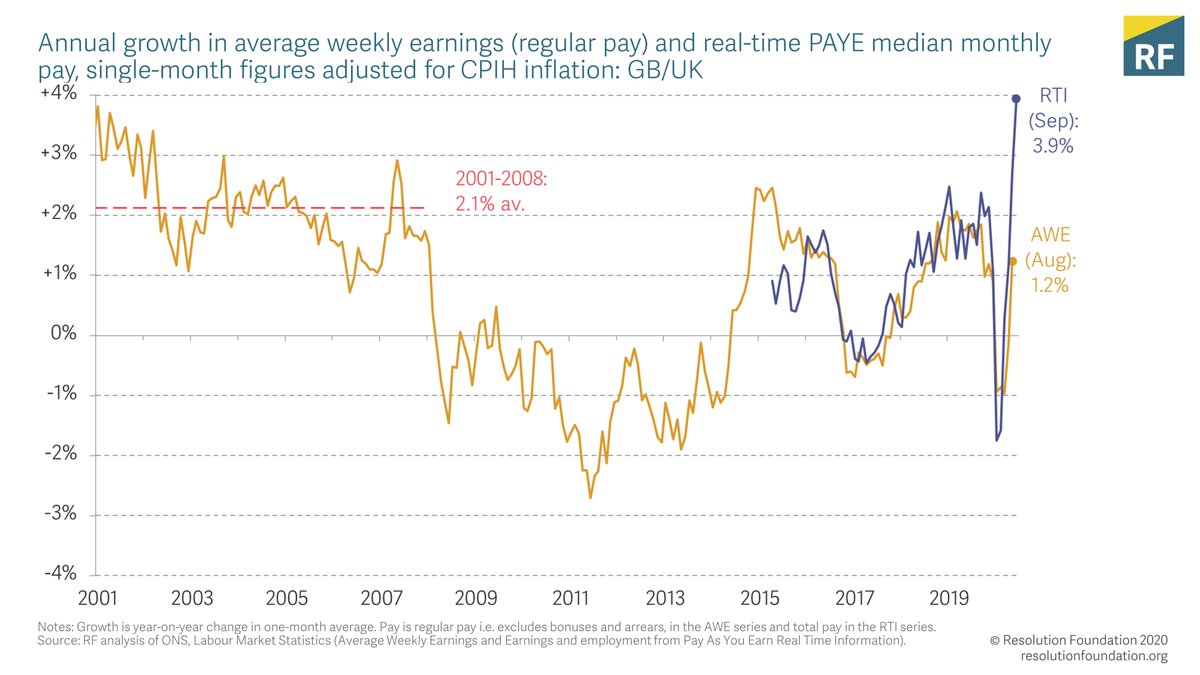

On pay, we’ve seen a return to growth: earnings grew by 1.2% in the year to August after adjusting for inflation.

But not all sectors have seen pay growth. Pay in the hospitality sector has fallen by 6.8%, as many workers remained on the 80% of pay covered by the Job Retention Scheme in August.

Read on Twitter

Read on Twitter