5 Habits which make Solara Active, Mr. Dependable Stock! No 4 will shock you!!

A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://wealthsutra.wordpress.com/2020/10/13/5-habits-which-make-solara-active-mr-dependable-stock-no-4-will-shock-you/">https://wealthsutra.wordpress.com/2020/10/1...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://wealthsutra.wordpress.com/2020/10/13/5-habits-which-make-solara-active-mr-dependable-stock-no-4-will-shock-you/">https://wealthsutra.wordpress.com/2020/10/1...

A thread

Whether it is Cricket or Stock market, winners are made up of their habits. Between Cricket & Investment - Easy thing first. Let me put forth 5 traits/habits of Mr Rahul Dravid which make him & #39;Mr Dependable& #39; of the Cricketing world.

- Focus

- Long Term Thinking

- Consistency

- Adaptability

- Robust technical skills (The Wall /Moat)

Let us now get under the skin of a Pharma API company which has all these 5 qualities in one form or the another . I am talking about- Solara Active Pharma Sciences (SAPS)

- Long Term Thinking

- Consistency

- Adaptability

- Robust technical skills (The Wall /Moat)

Let us now get under the skin of a Pharma API company which has all these 5 qualities in one form or the another . I am talking about- Solara Active Pharma Sciences (SAPS)

Background

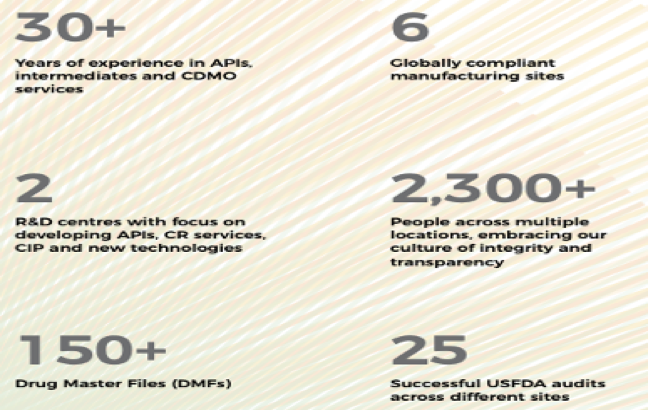

SAPS was formed in the year 2018 by carving out the Active Pharmaceutical Ingredients (API) business of Strides Pharma and Sequent http://Scientific.It"> http://Scientific.It carries a legacy of over three decades with API expertise of Strides Shasun Ltd.

and the technical know-how of human API business from Sequent Scientific Ltd

In a nutshell, Solara can be seen like this:

In a nutshell, Solara can be seen like this:

Business Model

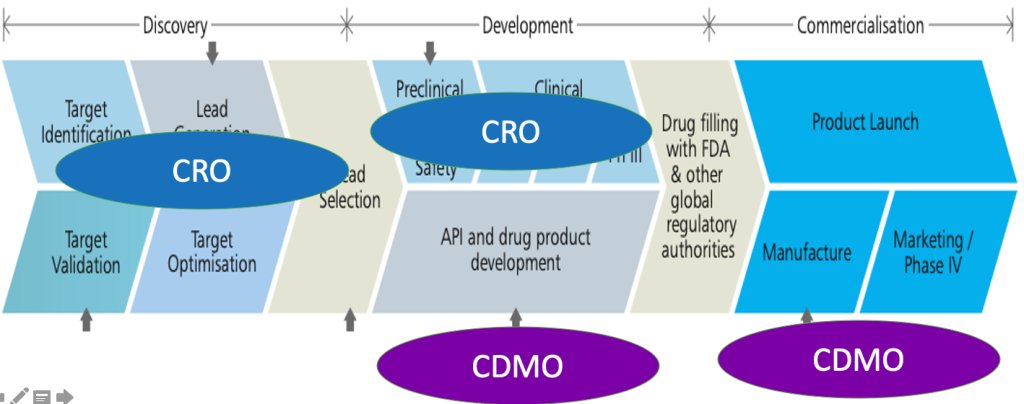

It is a CDMO (Contract Development Manufacturing Organization) which focuses on the manufacturing of Active Pharmaceutical Ingredients (API) for Formulation Companies. What CDMO does can be understand from the below pic where the whole value chain of drug is crisply captured:

You may learn more about CDMO here ( ):

Solara">https://youtu.be/qQ-EaQ5yC... is one of the top 3 API manufacturers in the country. The Company boasts of 100+ APIs and 84 active DMF filed with USFDA. Let us check out Solara& #39;s prowess against its peers below:

Solara">https://youtu.be/qQ-EaQ5yC... is one of the top 3 API manufacturers in the country. The Company boasts of 100+ APIs and 84 active DMF filed with USFDA. Let us check out Solara& #39;s prowess against its peers below:

So let us understand more about DMFs!!

Sadhan Simplify DMF

Sadhan Simplify DMF

While not required by law, a Drug Master File (DMF) is submitted to the Food and Drug Administration (FDA) to provide detailed information about facilities, processes and materials used in the manufacturing, processing and packaging of human drugs.

It’s a prerequisite to securing approval and commercialization and ensures confidentiality of proprietary information related to the API

Completing a DMF submission generally takes several months to develop, involving thousands of pages of documentation

Completing a DMF submission generally takes several months to develop, involving thousands of pages of documentation

High no of DMF vis a vis API indicates that the CDMO is very Transparent and focussed towards Quality, which is the most likable aspect of any Contract Manufacturers (Ask any Big Pharma )

Revenue Mix :Solara

Revenue Mix :Solara

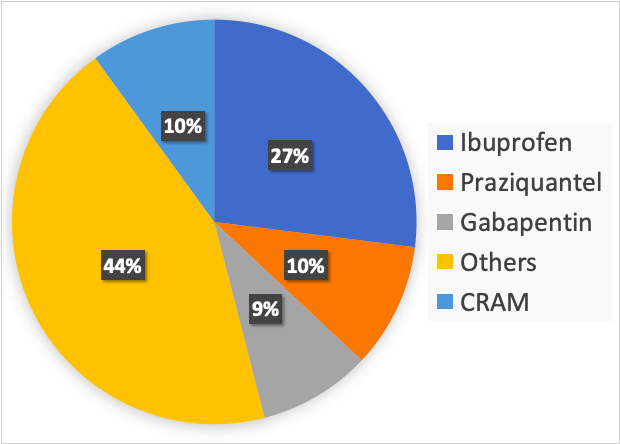

The company makes most of its bucks from selling ibuprofen API , whose prices have been growing since last 2 years.

IOL Chemical & Pharmaceuticals which is the Market Leader with 30% global market share in this API, has been precisely covered here ( https://www.youtube.com/watch?v=MD3S8UrN6yU)">https://www.youtube.com/watch...

IOL Chemical & Pharmaceuticals which is the Market Leader with 30% global market share in this API, has been precisely covered here ( https://www.youtube.com/watch?v=MD3S8UrN6yU)">https://www.youtube.com/watch...

5 Traits which make it Mr Dependable like Dravid

1.Focus: A Pure Play API Story

We learnt that filing DMFs is not a cake walk and not required by law also, but let us analyse how well placed Solara is in terms of DMFs filling vis a vis its peers:

1.Focus: A Pure Play API Story

We learnt that filing DMFs is not a cake walk and not required by law also, but let us analyse how well placed Solara is in terms of DMFs filling vis a vis its peers:

Solara is very well placed to capitalise on the huge opportunity for Indian API companies owing to its strong 30+ year track record, robust customer relationships with a long- term focus, cost-efficiencies, healthy DMF filings as well as a largely unblemished regulatory track…

…record

2. Long term Thinking

Like Dravid , SAPS is placed for long haul as evidenced from the followings:

•Strategic focus: Higher penetration for existing molecules

•Long-term contracts: 50-60% of its contracts are long-term (3-5 years)

2. Long term Thinking

Like Dravid , SAPS is placed for long haul as evidenced from the followings:

•Strategic focus: Higher penetration for existing molecules

•Long-term contracts: 50-60% of its contracts are long-term (3-5 years)

•Strong presence in developed markets:2/3 Sales from North America + Europe

•Strong relationship with Big pharma: ~40% of sales to big pharma companies and ~60% are to generic companies

•Strong relationship with Big pharma: ~40% of sales to big pharma companies and ~60% are to generic companies

•Stable Culture of compliance: 25 Successful FDA Audits; Except an negative observation due to global issue with Ranitidine as a product

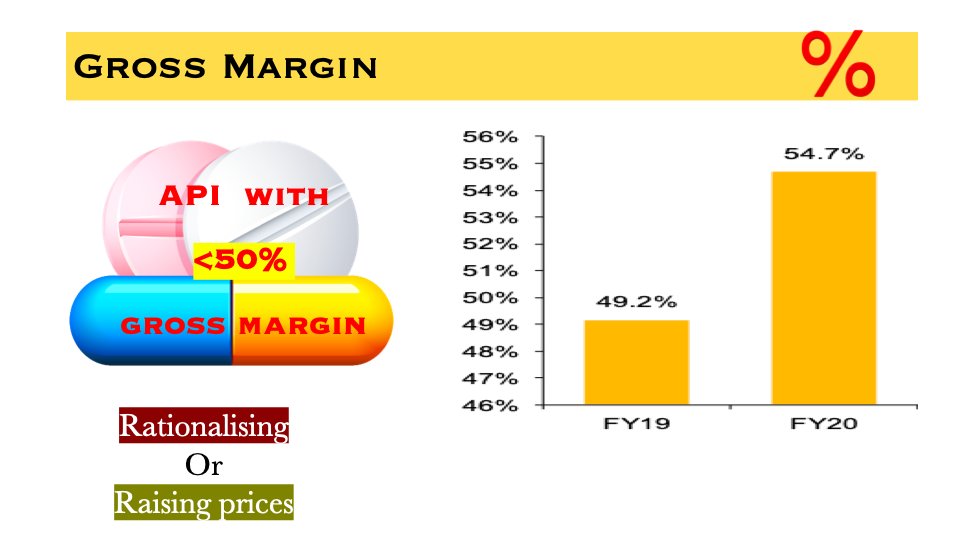

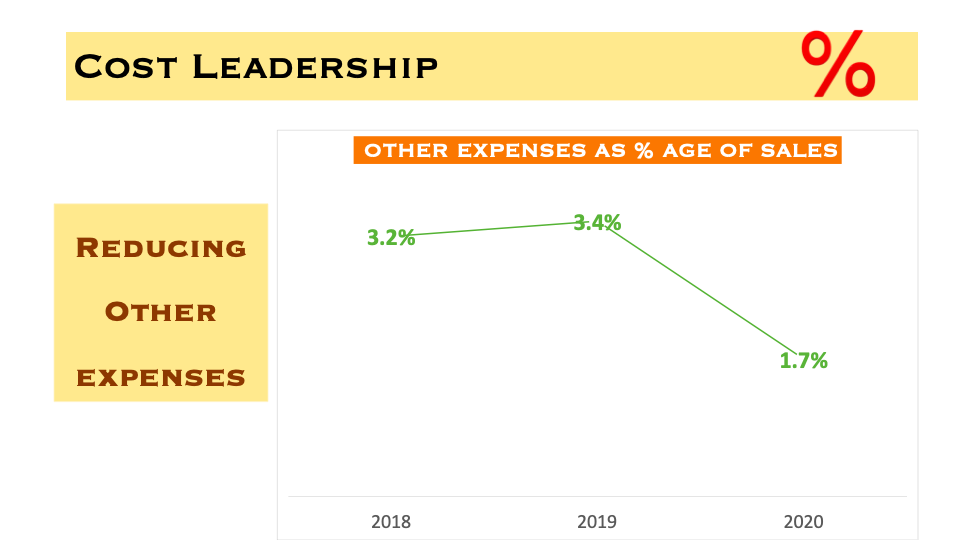

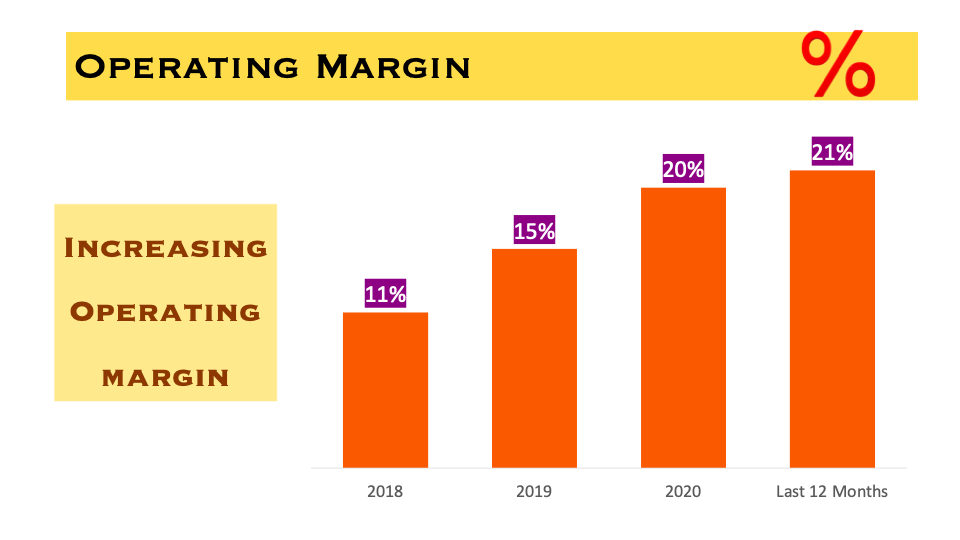

3. Consistency

3. Consistency

Rahul Dravid is the only Indian batsman to score four consecutive Hundreds/Centuries in Test cricket which signify the importance of consistency in earning a title of Mr Wall.

Likewise when the prices of its key API i.e.

Ibuprofen risen from US$11/kg to a peak US$20/kg (currently at US$17/kg) in export markets, many CDMOs have gone upto the hilt with maximising sales by maximising realization, however Solara has refrained from being opportunistic and taking aggressive price hikes and has been…

…supplying Ibuprofen API to its long-term customers at a much lower rate of US$12-14/kg.

Like all good qualities Consistency has a compounding effect , so we can be mindful of that.

4. Adaptability: Positioned with next growth Engine (CRAM)

Like all good qualities Consistency has a compounding effect , so we can be mindful of that.

4. Adaptability: Positioned with next growth Engine (CRAM)

When Indian team needed a batsman who can keep wickets then only one batsman (Rahul dravid) came out and that made the difference. he came out because he knew that people who can not adapt can not survive.

Similarly, in the ever evolving field of pharma, being open to different ideas/business models makes the difference. Contract Research And manufacturing (CRAM) is a growing & lucrative high margin business ( You may check out Syngene Story here ( https://youtu.be/qQ-EaQ5yCr4 ))">https://youtu.be/qQ-EaQ5yC...

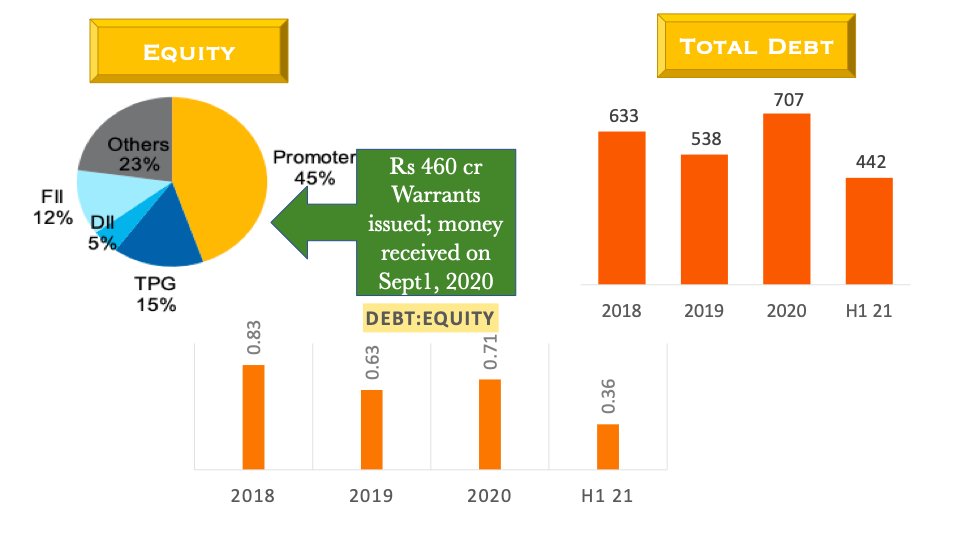

Current Contribution of CRAM is 10% of sales which Solara targets to increase to 30% of Sales by FY25.Solara intends to grow in CRAMS both organically and inorganically (recent Rs4.6bn equity infusion by promoters and TPG provides growth capital).

They are looking out for acquisition in Europe & USA.

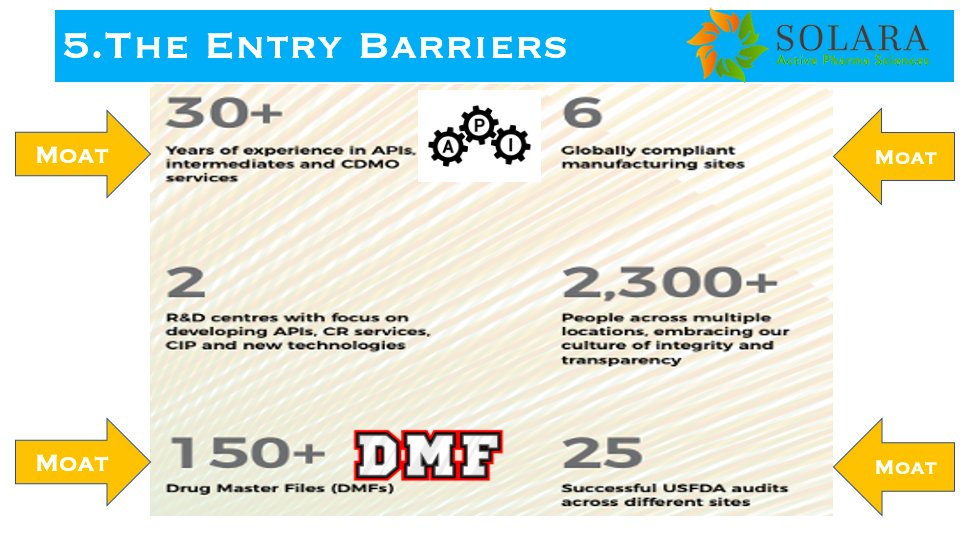

5. Creating High barriers to Entry

5. Creating High barriers to Entry

Interestingly when cricket fans named him "the Wall" which is not literally very far from "The Moat".

The Wall had the Moat of the craftsmanship in shots due to his hard work and seeking perfection attitude.That makes him is one of the most technically superior batsman our generation has seen.

So for a stock to be called dependable like Dravid have to have few moats. To my mind following are the moats of Solara:

Key Investment Risks

1.Regulatory Risk: Compliance of USFDA Audits

1.Regulatory Risk: Compliance of USFDA Audits

Example:Ranitidine is a “Time- and temperature-sensitive pharmaceutical product (TTSPP)”, which develops a known Carcinogen (Cancer Causing) called N-Nitrosodimethylamine (NDMA) when exposed to heat. So FDA banned it in April 2020. It’s contribution to Solara Top line was 7%

2. Ibuprofen Price Risk

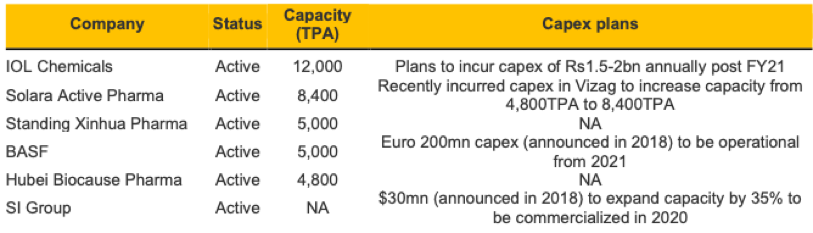

Ibuprofen market is interestingly placed, with key player investing in capex . The risk to watch out is Ibuprofen prices falling after 1-1.5 years due to the ongoing capacity additions by key players like BASF and SI group

Ibuprofen market is interestingly placed, with key player investing in capex . The risk to watch out is Ibuprofen prices falling after 1-1.5 years due to the ongoing capacity additions by key players like BASF and SI group

3. Approval delay risk at Vizag greenfield plant

Spread across 17 acres, Vizag is Solara’s multi-product, multi-purpose greenfield facility. Having incurred a capex of Rs2.5bn in Phase 1, the Phase 1 of Vizag has gone onstream with additional 3,600 tons of Ibuprofen API capacity.

While the facility is largely aimed at catering to the regulated markets, Solara has just commenced sales to semi-regulated markets (where facility inspection is not required) from the Vizag facility.

Solara is guiding for this facility to run at full capacity in the next 12-15 months when all regulatory audits and customer audits are completed.

Currently, the facility is undergoing customary regulatory processes and partner approvals for qualification. The facility inspection by both US FDA as well as the EU regulators is pending. The company is expecting approval from the European authorities earlier than US FDA.

However, due to the current travel restrictions, there is a risk of regulatory inspections getting delayed even as the company is trying for a virtual inspection.

4.Promoter Share Pledge risk: 51% of Promoters stakes are pledged with lenders

Valuation

4.Promoter Share Pledge risk: 51% of Promoters stakes are pledged with lenders

Valuation

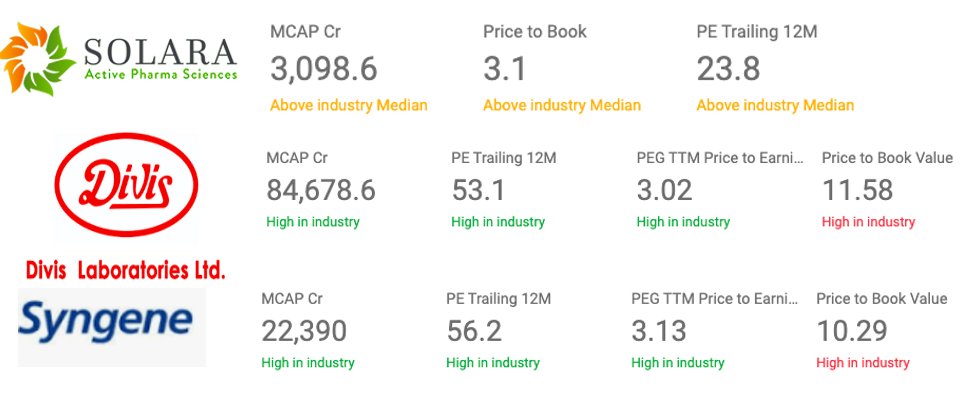

Huge room in existing market cap of Solara to expand considering its product prowess (Watchout Rs 85k cr market cap of Divi& #39;s) and aiming to strengthen CRAMs like Syngene ( Watchout Rs 22k cr market cap of Syngene)

You can watch the video for detailed analysis:

You can watch the video for detailed analysis:

https://www.youtube.com/watch?v=Ly-zL2JZcic&t=1s">https://www.youtube.com/watch...

Conclusion

•A growing business with high barrier to entry and conducive environment e.g. & #39;China Plus one’ & Production Linked Incentive by Govt of India

•A growing business with high barrier to entry and conducive environment e.g. & #39;China Plus one’ & Production Linked Incentive by Govt of India

•Great potential : Over the medium term, we expect Solara’s topline growth to accelerate by commissioning of the Vizag facility, formation of the CRAMS business, expansion of APIs to new markets/new customers and ramp-up of new product filings.

•Stock is little undervalued hence shall be watch out and 3-5 %allocation can be done for next 1 year.

This thread can be read here: https://wealthsutra.wordpress.com/2020/10/13/5-habits-which-make-solara-active-mr-dependable-stock-no-4-will-shock-you/">https://wealthsutra.wordpress.com/2020/10/1...

Read on Twitter

Read on Twitter https://wealthsutra.wordpress.com/2020/10/1..." title="5 Habits which make Solara Active, Mr. Dependable Stock! No 4 will shock you!!A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://wealthsutra.wordpress.com/2020/10/1..." class="img-responsive" style="max-width:100%;"/>

https://wealthsutra.wordpress.com/2020/10/1..." title="5 Habits which make Solara Active, Mr. Dependable Stock! No 4 will shock you!!A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://wealthsutra.wordpress.com/2020/10/1..." class="img-responsive" style="max-width:100%;"/>