Thoughts on $PTON. I just bought a position after owning a the device for a month. Thread on why the stock still looks to offer great value here to me for a long term investor.

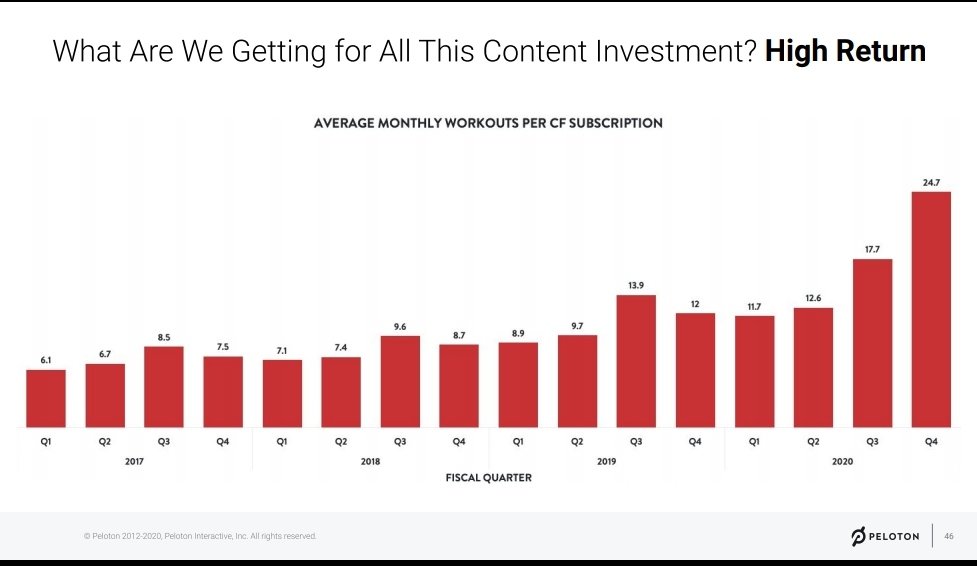

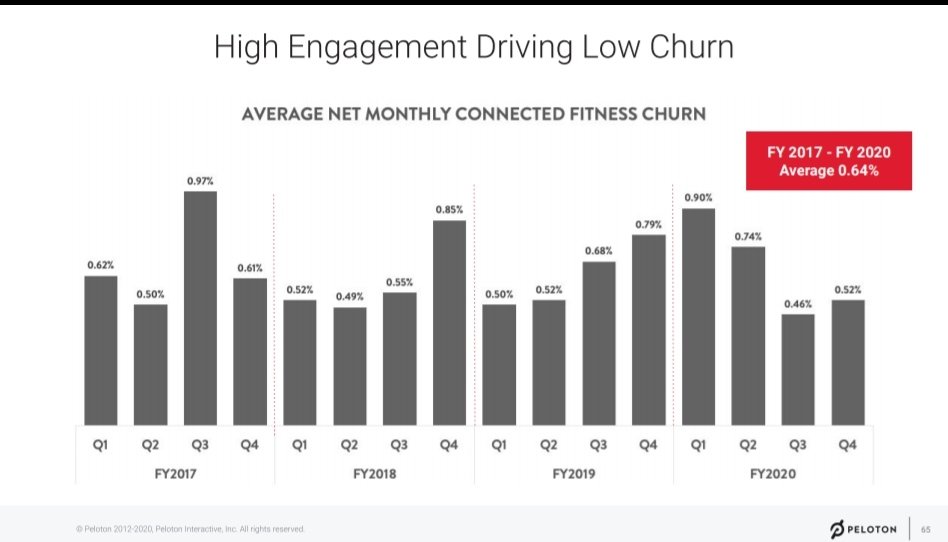

1) The device is awesome and is better than going to the gym. No travelling = convienice and encourages more workouts. This increases customer engagement and creates a powerful flywheel effect and builds a strong moat.

2) Huge TAM. Given $PTON beats going to a gym, we ought to look at gym numbers to size the opportunity.

There were 64.2 US million gym members in 2019, up 2.7% from 62..5 million in 2018 [IHRSA 2019].

There were 64.2 US million gym members in 2019, up 2.7% from 62..5 million in 2018 [IHRSA 2019].

Not all of these will become $PTON customers, but there is a huge runway still.

$PTON currently has 1.09m members, but not all are US. Let& #39;s assume 95% giving 1.03m or a 1.6% gym market share.

$PTON currently has 1.09m members, but not all are US. Let& #39;s assume 95% giving 1.03m or a 1.6% gym market share.

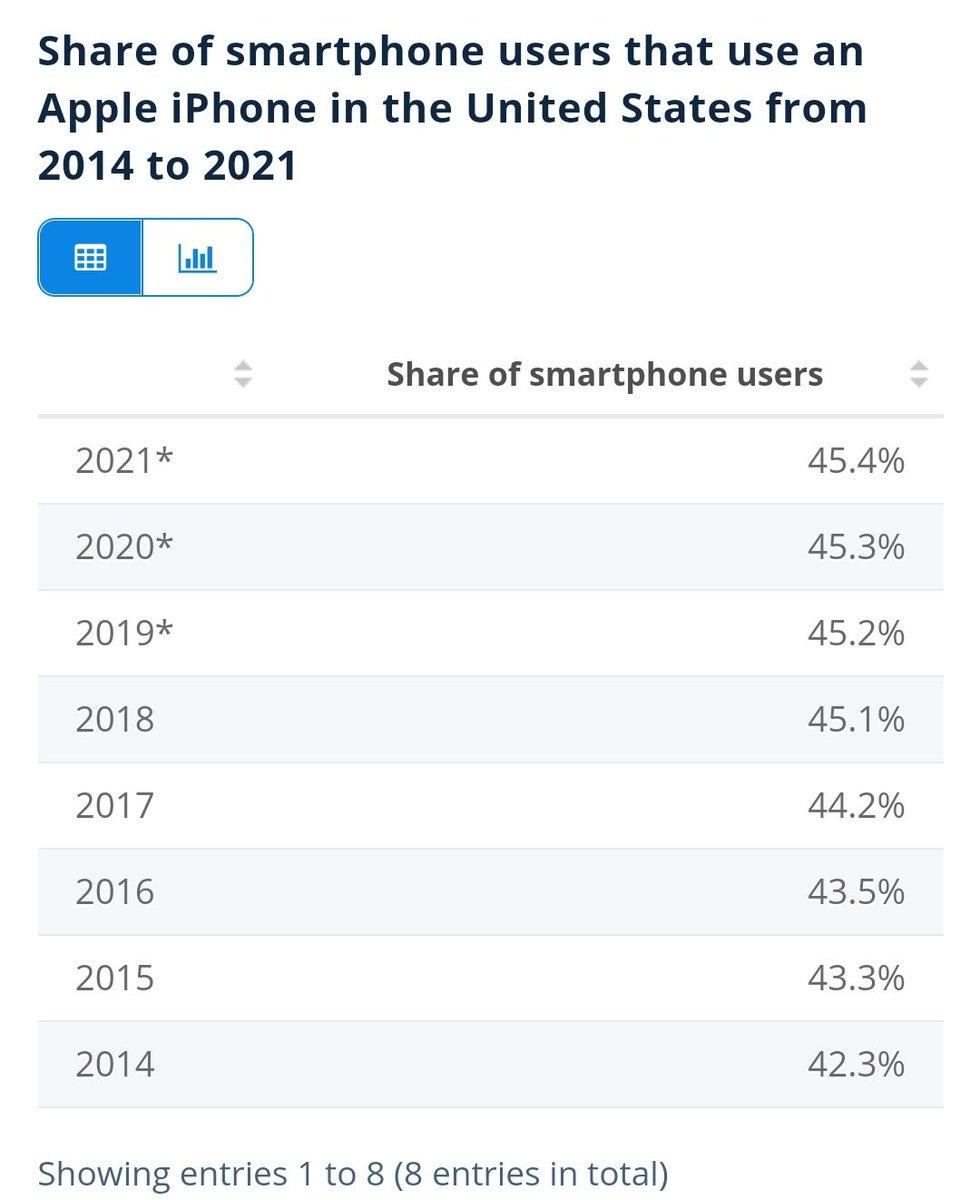

I see $PTON as the iPhone of fitness and the iPhone has a 45% market share of smart phones in the US.

While Peloton won& #39;t get there overnight, 64.2m gym members * 45% = a 29m TAM. Tasty. Some might argue that a Peloton is expensive but so are iPhones and finance is available.

While Peloton won& #39;t get there overnight, 64.2m gym members * 45% = a 29m TAM. Tasty. Some might argue that a Peloton is expensive but so are iPhones and finance is available.

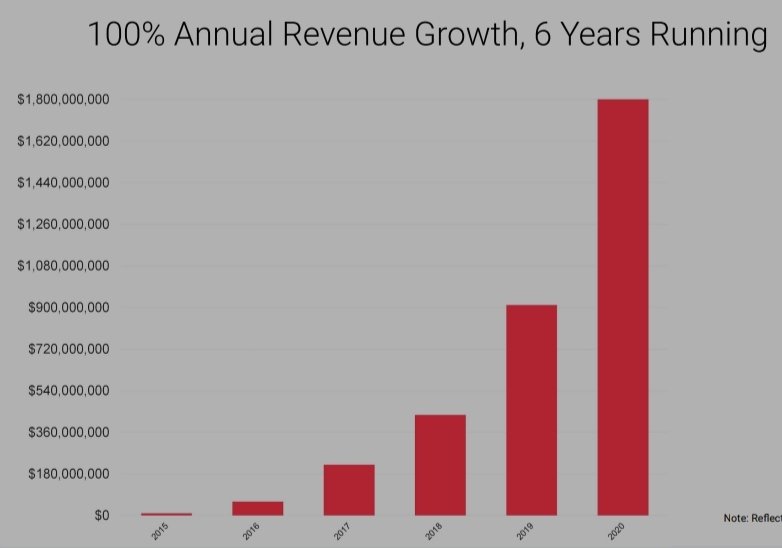

What is the revenue opportunity? Well let& #39;s ignore the bike/tread/hardware. That is a common mistake e.g. seeing $TSLA as just a car company.

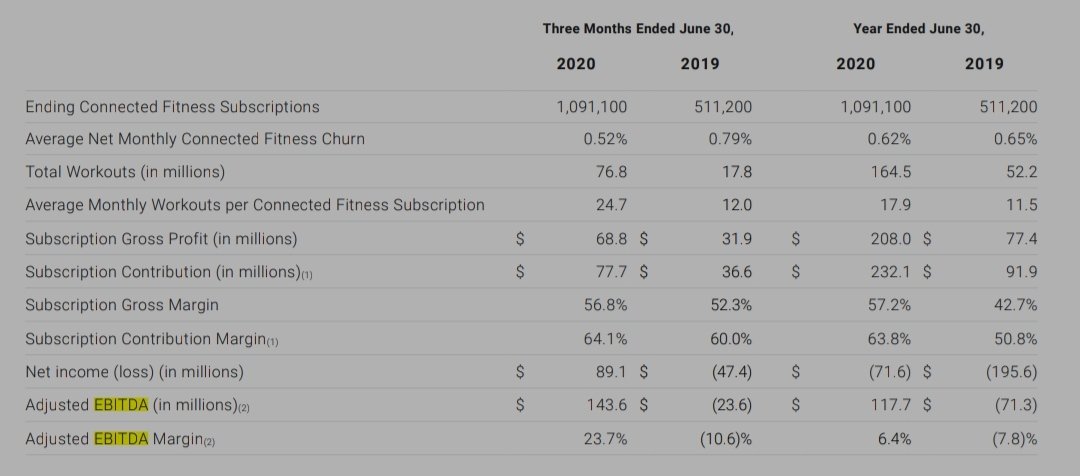

Peloton charge $39 a month as a subscription with super high retention. $39 * 12 * 29m subscribers = $13.6bn revenue opportunity.

Peloton charge $39 a month as a subscription with super high retention. $39 * 12 * 29m subscribers = $13.6bn revenue opportunity.

The beauty of $PTON beyond the huge TAM is the scalability of the model. There are big upfront costs in hiring instructors, filming, music etc. but these are fixed giving an incredibly high profit margin on each new customer.

EBITDA margins have already gone from -11% to +24%!

EBITDA margins have already gone from -11% to +24%!

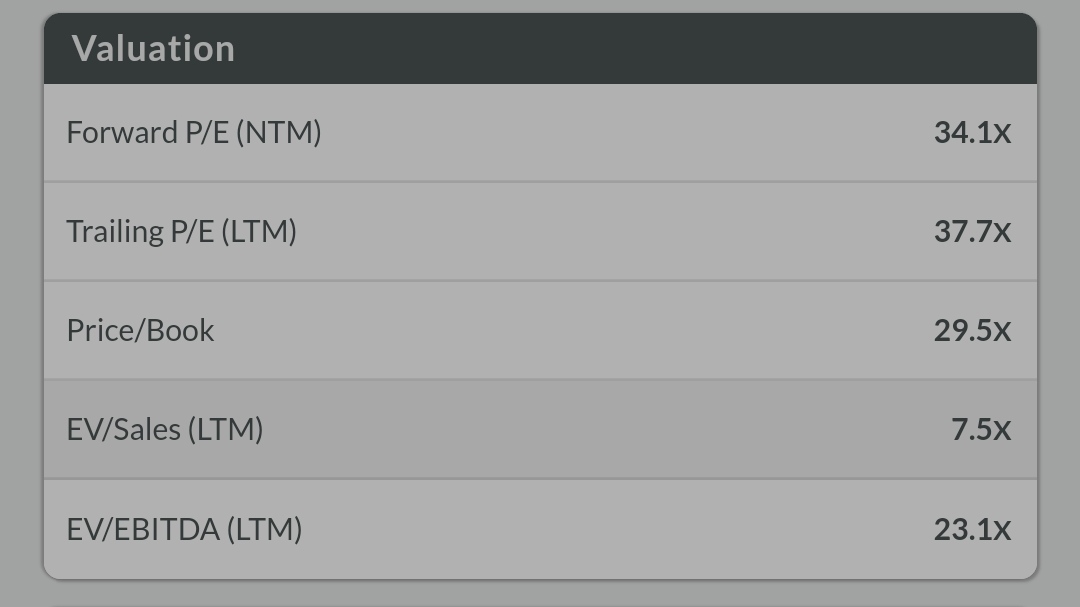

What is this worth? Some say $PTON is expensive.

I see $AAPL as the best comp: like Peloton, Apple offers a powerful combination of attractive hardware and recurring subscription revenues.

$AAPL trades on 7.5x sales and 23x EBITDA.

I see $AAPL as the best comp: like Peloton, Apple offers a powerful combination of attractive hardware and recurring subscription revenues.

$AAPL trades on 7.5x sales and 23x EBITDA.

Applying the 7.5x sales multiple that $AAPP trades on to my $13.6bn sales estimate earlier, implies a potential $102bn valuation.

This compares to $34bn today, implying the stock could 3x from here!

This compares to $34bn today, implying the stock could 3x from here!

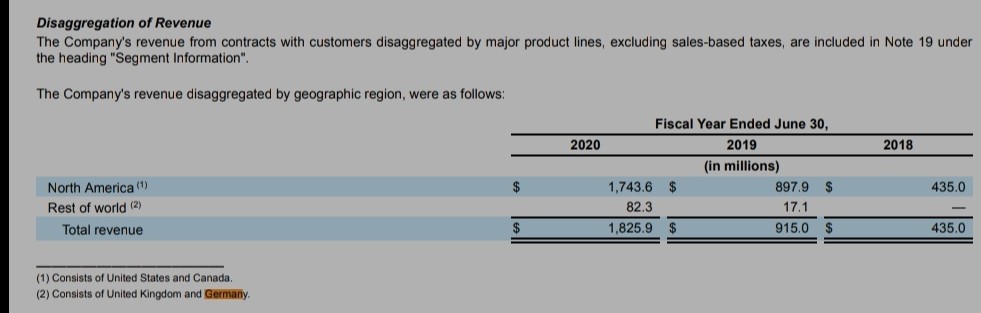

While this won& #39;t come through immediately in terms of gym member penetration, one gets a huge margin of safety here from the fact we haven& #39;t even yet considered Peloton& #39;s international opportunity!

My analysis of the 10k suggests this is growing at 82.3/17.1-1 = 381% in 2020!

My analysis of the 10k suggests this is growing at 82.3/17.1-1 = 381% in 2020!

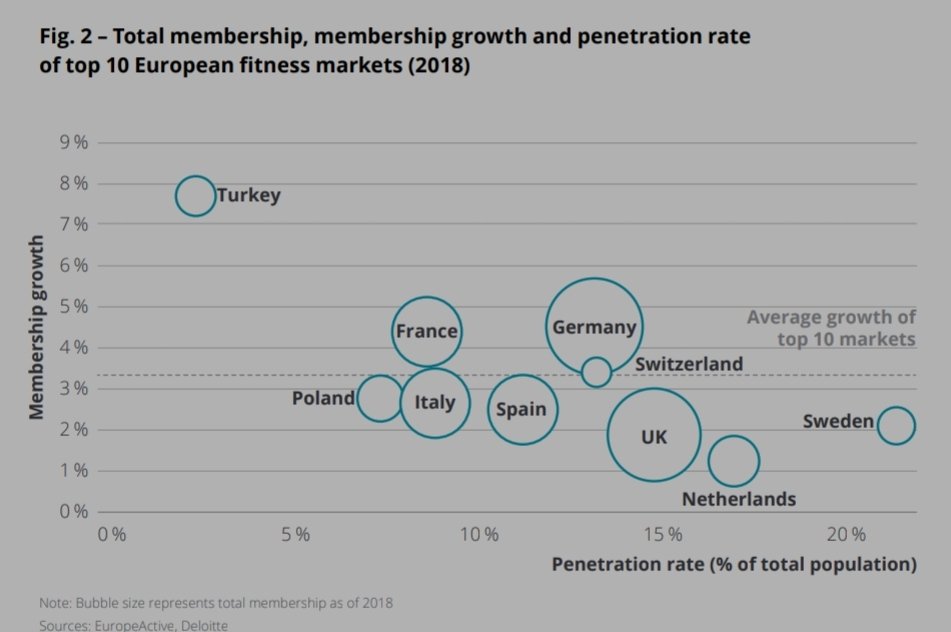

This is also only from two markets. The UK and Germany. While parts of the world of course aren& #39;t addressable today (e.g. Africa), there are plenty of other wealthy international countries with a large middle class that would love $PTON products.

Just a few examples include:

* Scandinavia

* France (6m gym members)

* Switzerland (can use the German content already there)

* Australia

* Longer-term China (in 2016 2.8m people participated in marathons across the country. This figure was 14x the level 5 years prior)

* Scandinavia

* France (6m gym members)

* Switzerland (can use the German content already there)

* Australia

* Longer-term China (in 2016 2.8m people participated in marathons across the country. This figure was 14x the level 5 years prior)

Given there is a $102bn value opportunity with just the US market alone, the opportunity including international could easily be double or triple higher. This could mean more than 10x the upside to the stock longer term!

Read on Twitter

Read on Twitter