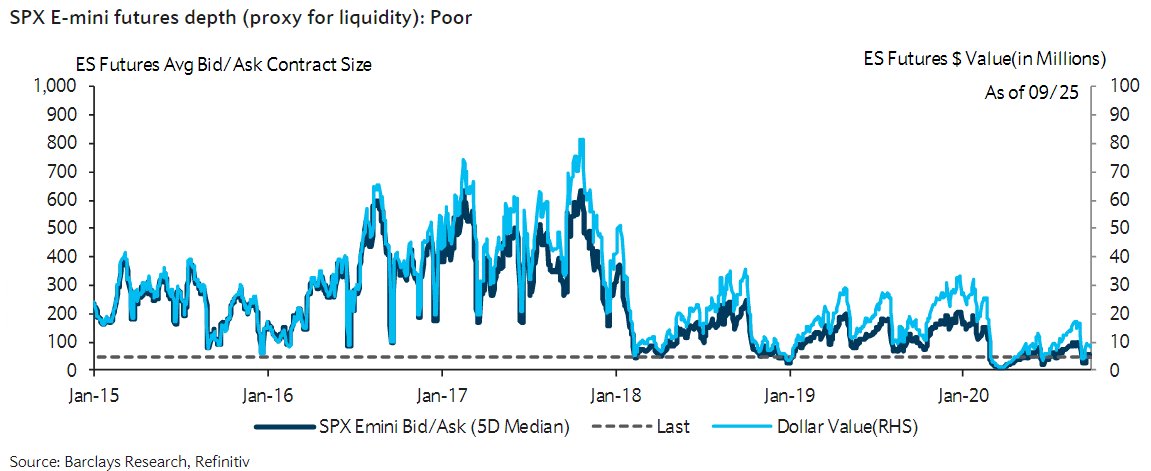

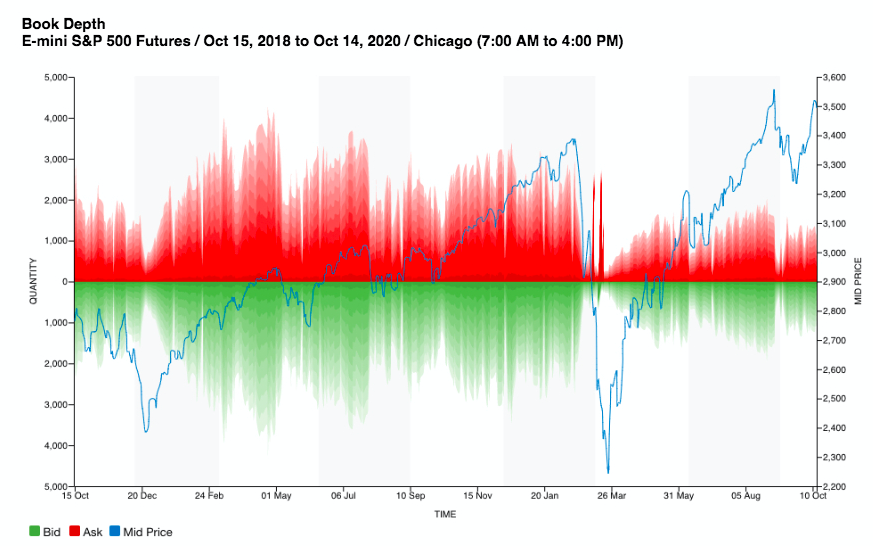

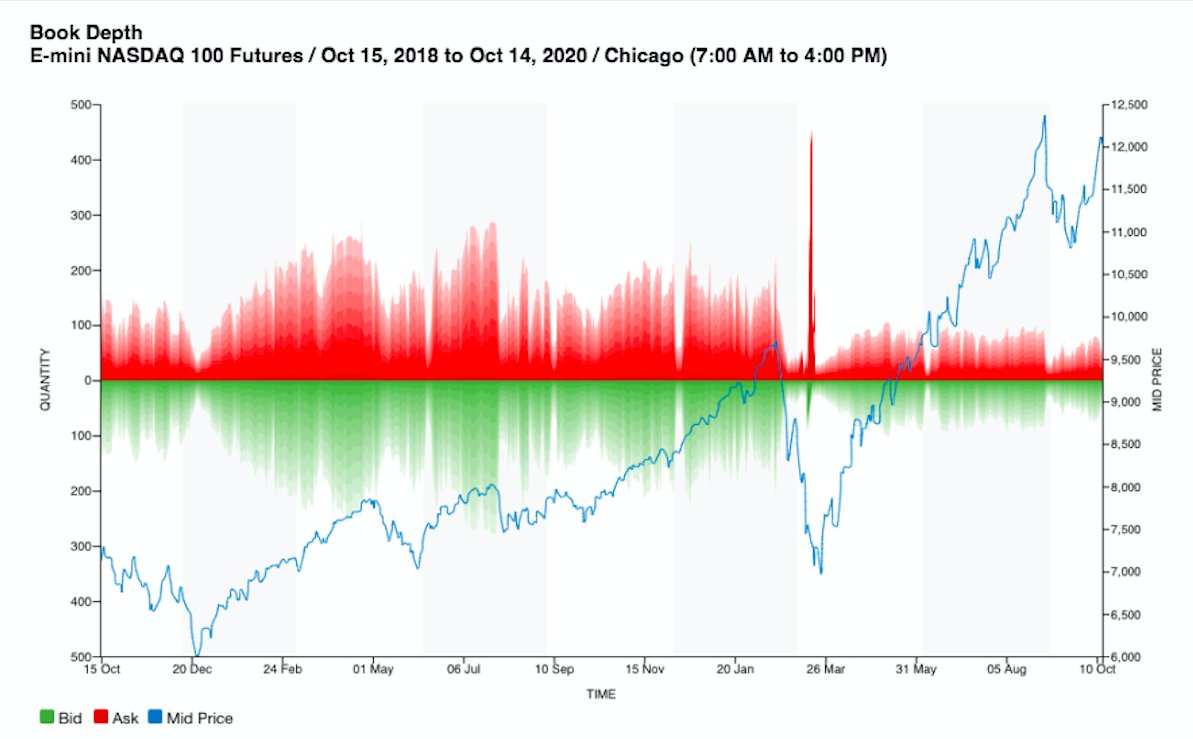

#ES_F futures depth. Charts like this have been circling around for a while, but I think this is one of the most critical pieces of data that can& #39;t be ignored. Highlights the shift that occurred in the markets, and the vulnerabilities that loom from the current lack of liquidity.

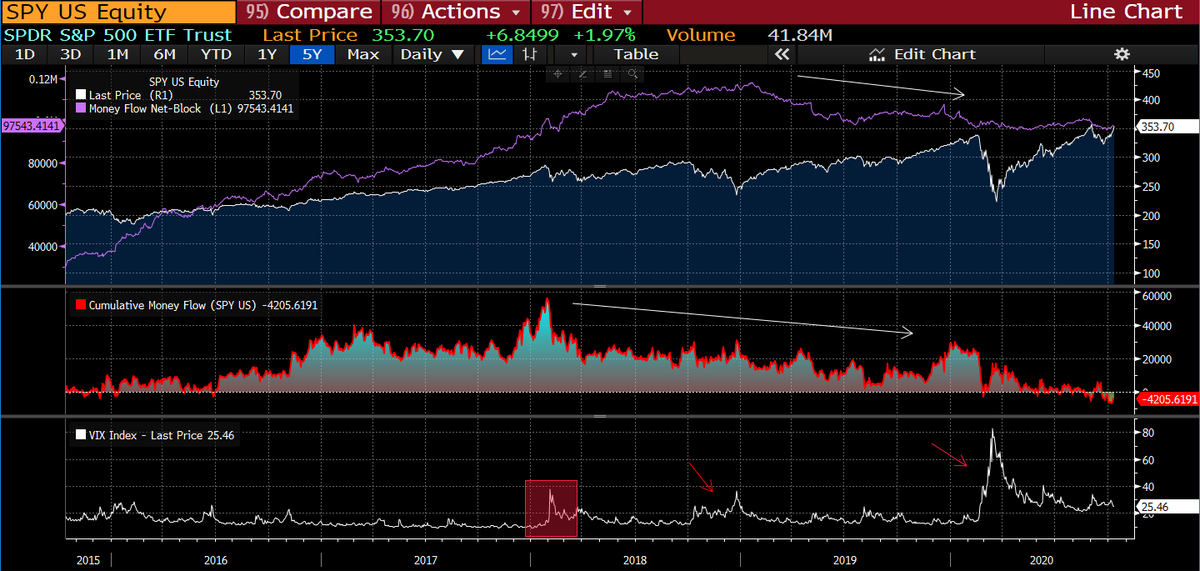

It& #39;s no coincidence that the $VIX spike in Feb 2018, Volmageddon, coincided with this shift in declining liquidity and triggered money flowing out of equities. Volmageddon marked a regime change in volatility, and hence declining liquidity that creates more fragile equity markets

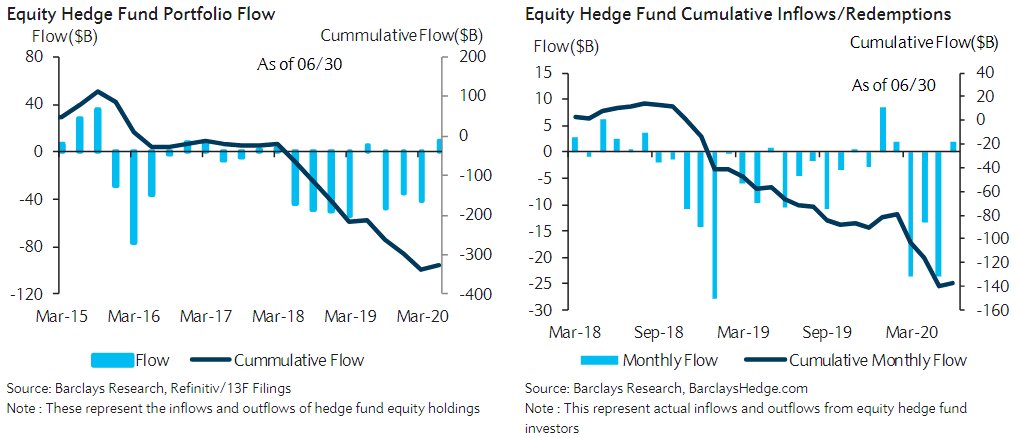

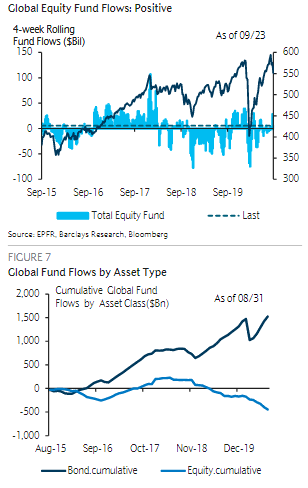

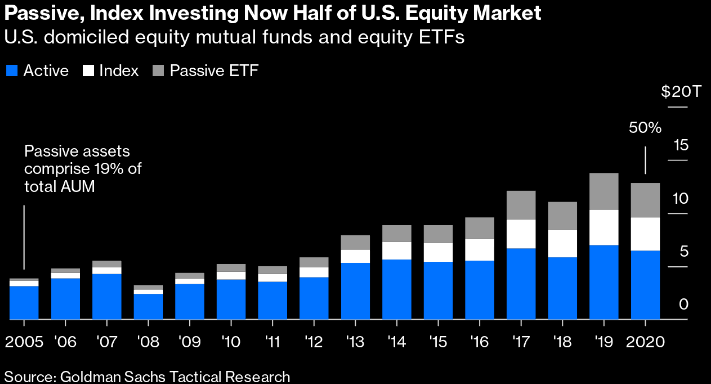

Passive & index funds are taking up an increasing share of equity markets. This growing concentration is killing diversification &creating a dangerous reflexivity of high correlations & volatility. This capital flow poses a huge risk to a fragile market with diminishing liquidity

This emerging bifurcation in equity markets in the post-QE era is tied to central banks& #39; control & can be observed through it& #39;s impact on volatility, as it creates a dynamic with fatter tails of higher vol. Periods of vol suppression last longer, but rises in $VIX are more rapid.

Essentially, this regime change that Volmageddon marked was highlighting the artificial stability that central banks tried to manifest through liquidity injections in the post-crisis era beginning to have diminishing marginal effects & starting to backfire https://twitter.com/FadingRallies/status/1316887707109515267?s=20">https://twitter.com/FadingRal...

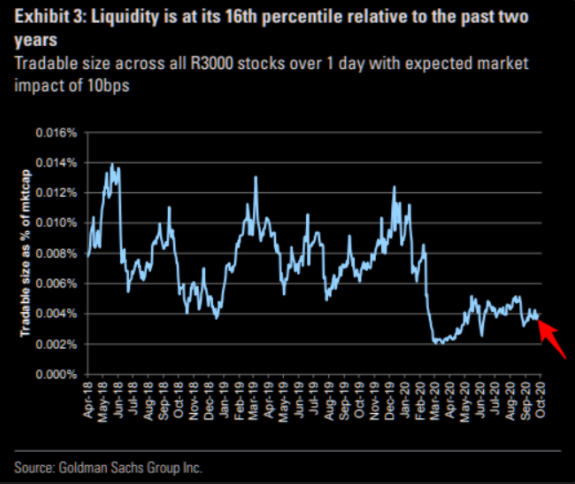

Came across this; tradable size across all R3000 stocks with an expected impact of 0.1%. This is consistent with the decline in #ES_F liquidity, further highlighting increasing divergences underneath the surface & the fragility that has emerged in the market.

Read on Twitter

Read on Twitter