Is the World Bank’s COVID Response Big Enough, Fast Enough?

We scraped >1/2 million transactions from the Bank& #39;s website to judge.

Blog: https://www.cgdev.org/blog/new-data-show-world-banks-covid-response-is-too-small-too-slow

Paper:">https://www.cgdev.org/blog/new-... https://www.cgdev.org/publication/world-banks-covid-crisis-lending-big-enough-fast-enough-new-evidence-loan-disbursements

with">https://www.cgdev.org/publicati... @duggan_julian

@Morris_ScottA & G Yang

1/

Why are we worried about the speed of World Bank response?

Well, the Bank& #39;s own projections show global poverty is rising for the first time in 2 decades -- and many poor countries have little or no fiscal space to respond.

2/

Well, the Bank& #39;s own projections show global poverty is rising for the first time in 2 decades -- and many poor countries have little or no fiscal space to respond.

2/

Meanwhile, World Bank President David Malpass (Trump& #39;s nominee) has dropped hints he& #39;s going to drag his feet -- and wants to make COVID relief conditional on "structural reforms".

Here& #39;s Malpass:

3/

Here& #39;s Malpass:

3/

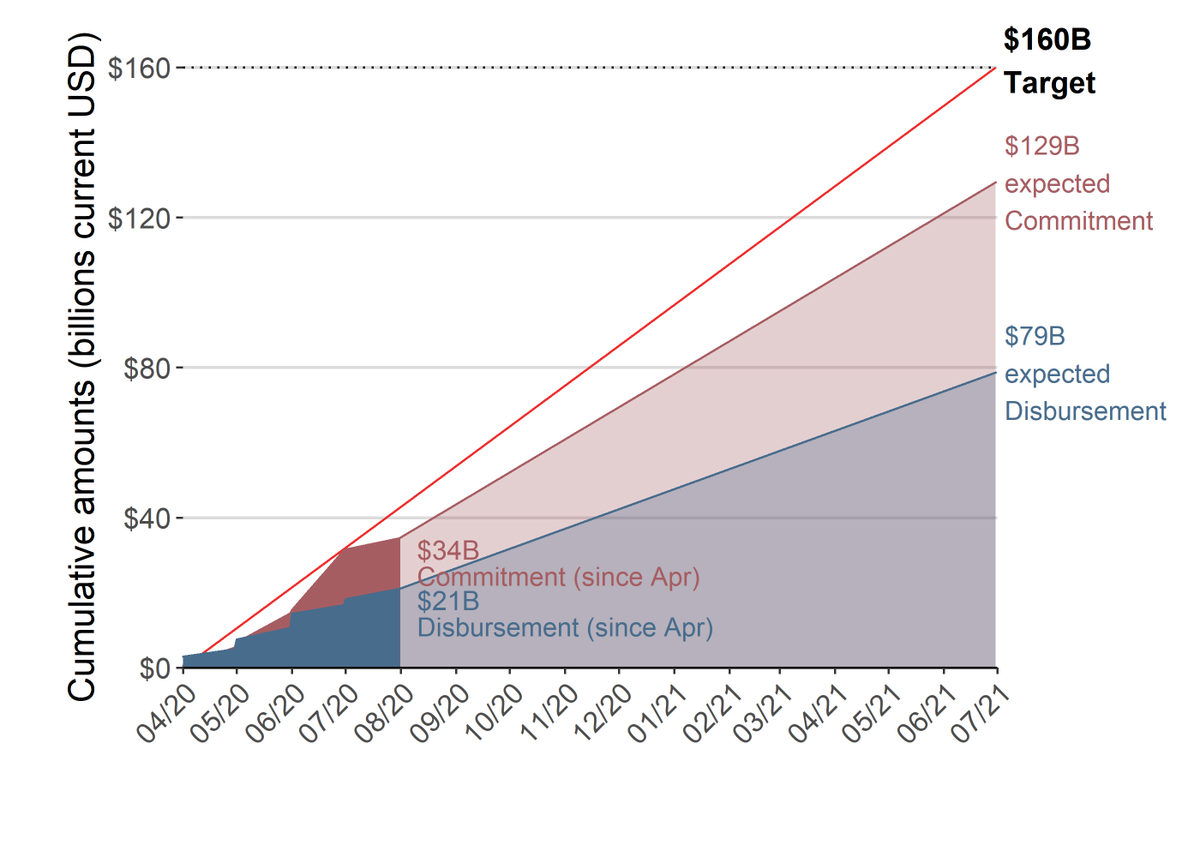

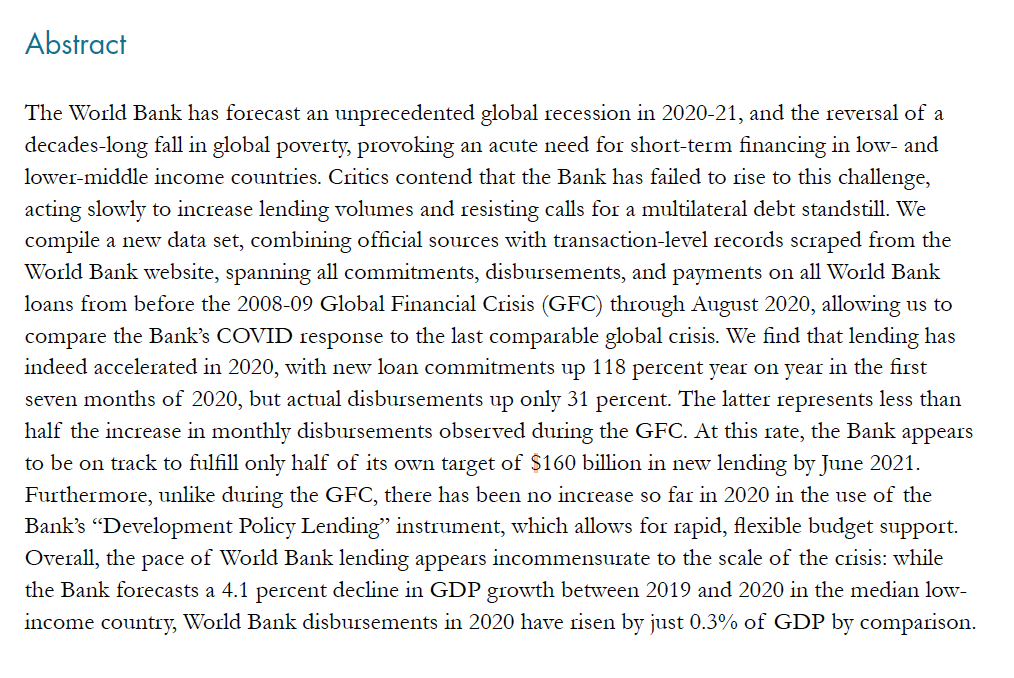

We see evidence of that foot dragging.

In February, the World Bank announced it would lend or grant $160 billion for COVID relief by June 2021 -- but right now, we find the Bank is on track to actually disburse only HALF that amount.

4/

In February, the World Bank announced it would lend or grant $160 billion for COVID relief by June 2021 -- but right now, we find the Bank is on track to actually disburse only HALF that amount.

4/

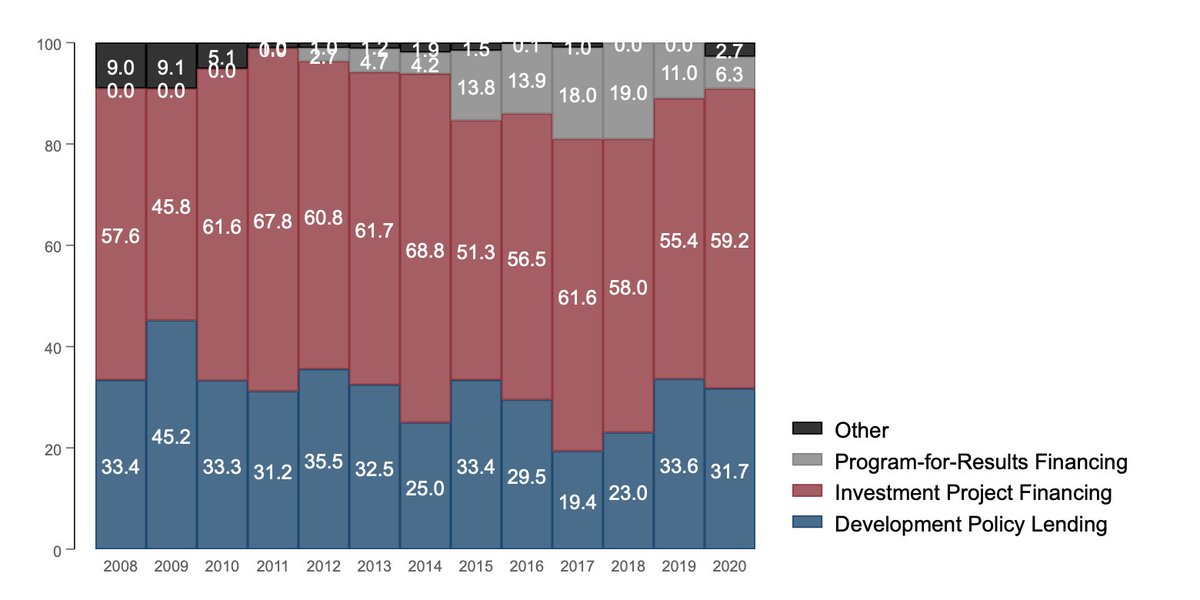

Why is the WB being so slow?

One reason is that unlike during the 2008-09 crisis, the WB has not pivoted to using its "development policy lending" instrument -- which can be disbursed quickly as general budget support.

It should!

5/

One reason is that unlike during the 2008-09 crisis, the WB has not pivoted to using its "development policy lending" instrument -- which can be disbursed quickly as general budget support.

It should!

5/

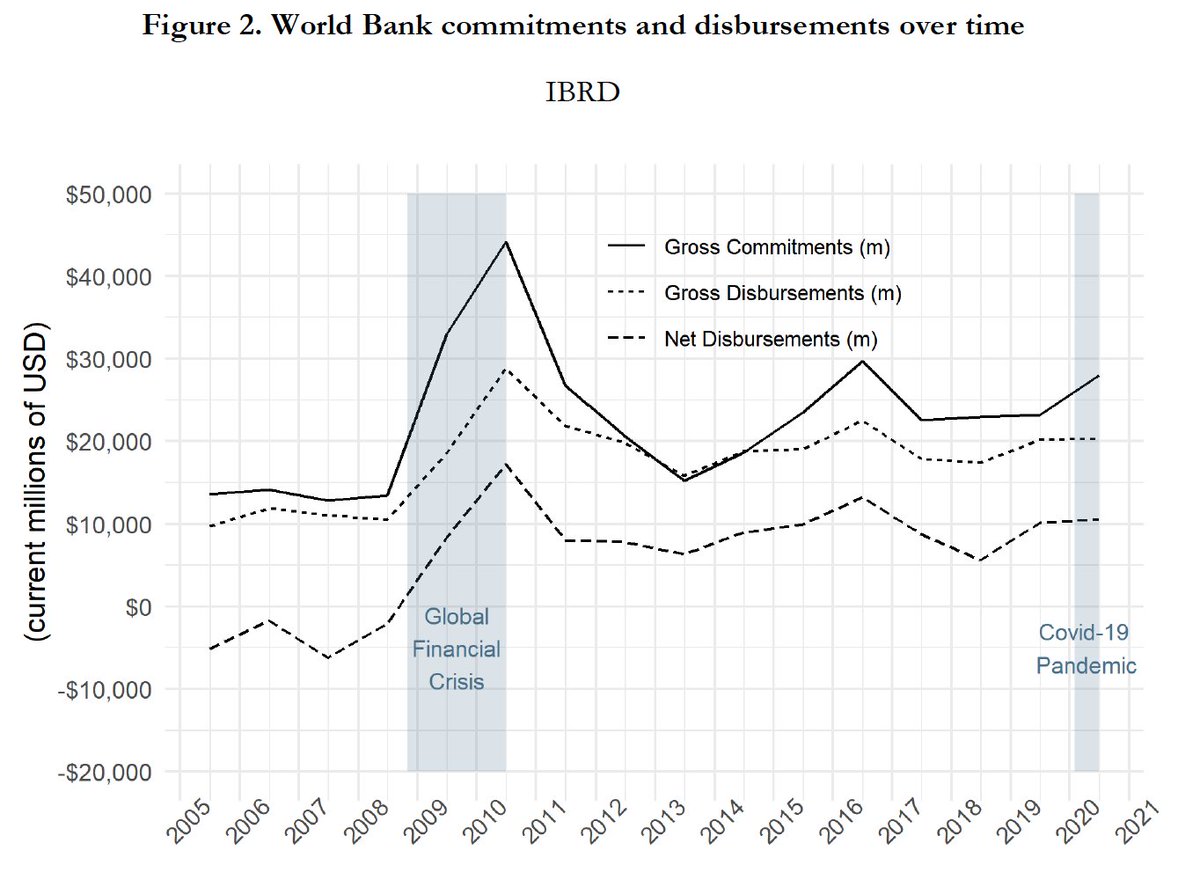

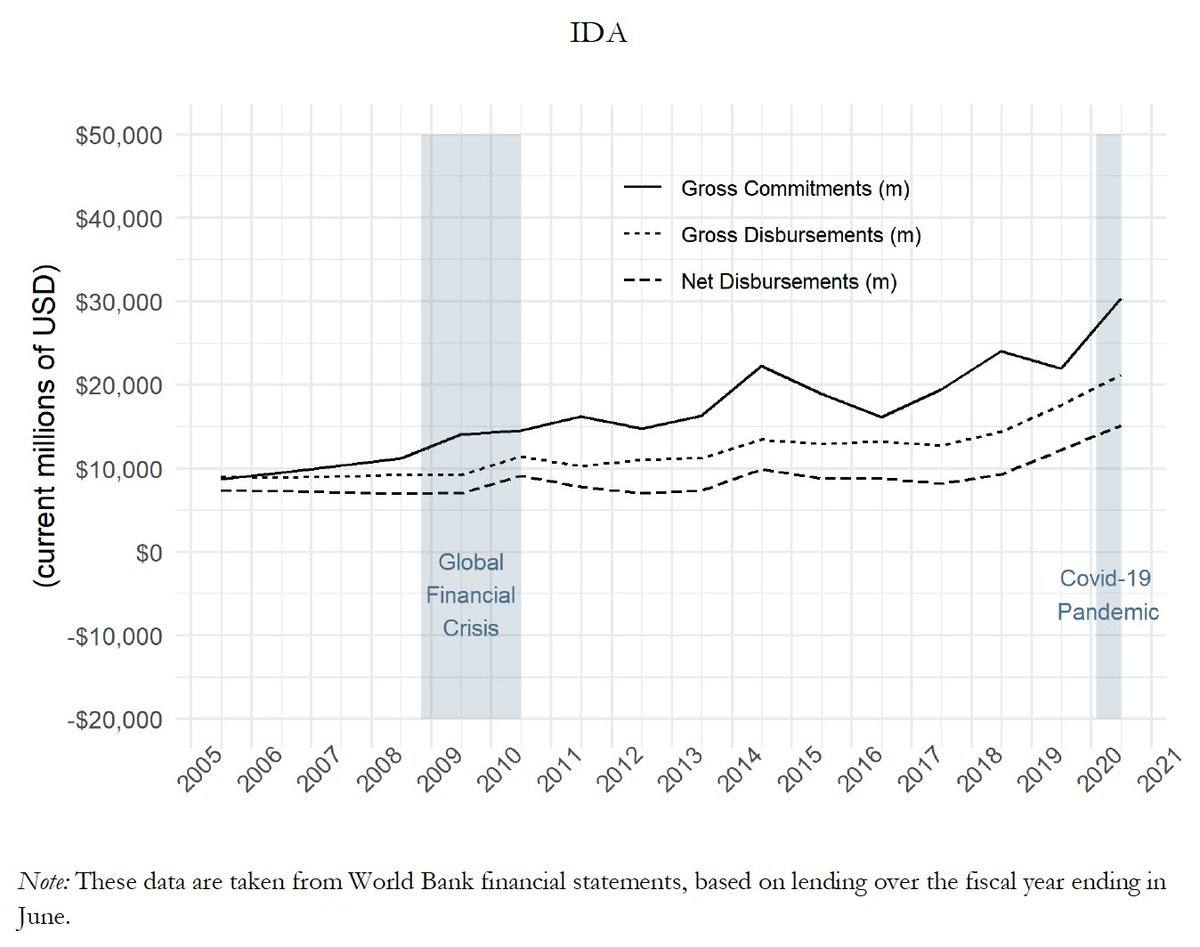

A positive point for the World Bank: relative to the 2008-09 crisis, the acceleration in IDA lending -- for the poorest countries -- appears to be faster this time. (Opposite is true for IBRD.)

Compare trajectories here:

6/

Compare trajectories here:

6/

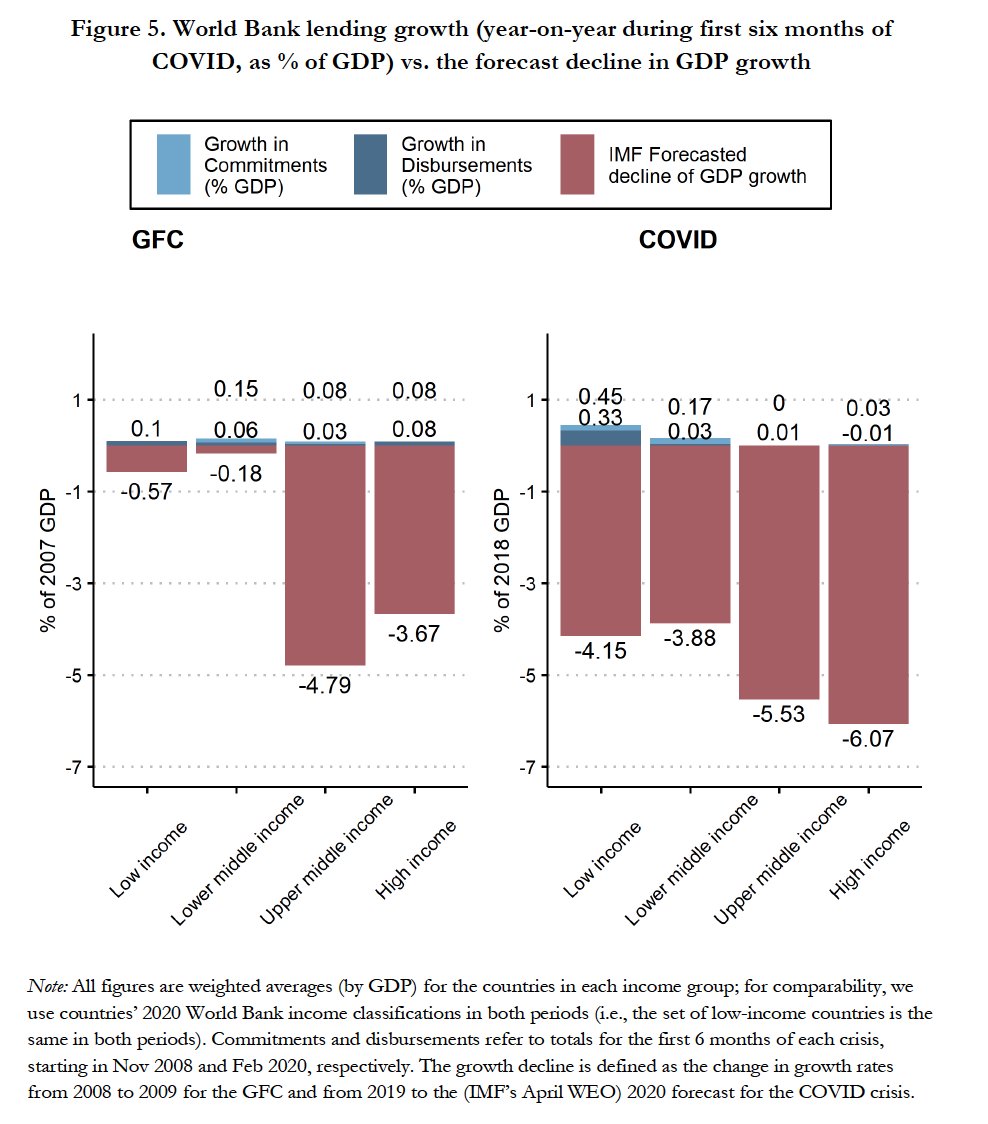

However, the poorest countries were relatively spared in 08-09 GFC. Not this time. So relative to the crisis -- e.g., relative to the forecast decline in growth -- the Bank& #39;s response looks fairly paltry right now.

Red: forecast growth decline.

Blue: WB response as % of GDP.

7/

Red: forecast growth decline.

Blue: WB response as % of GDP.

7/

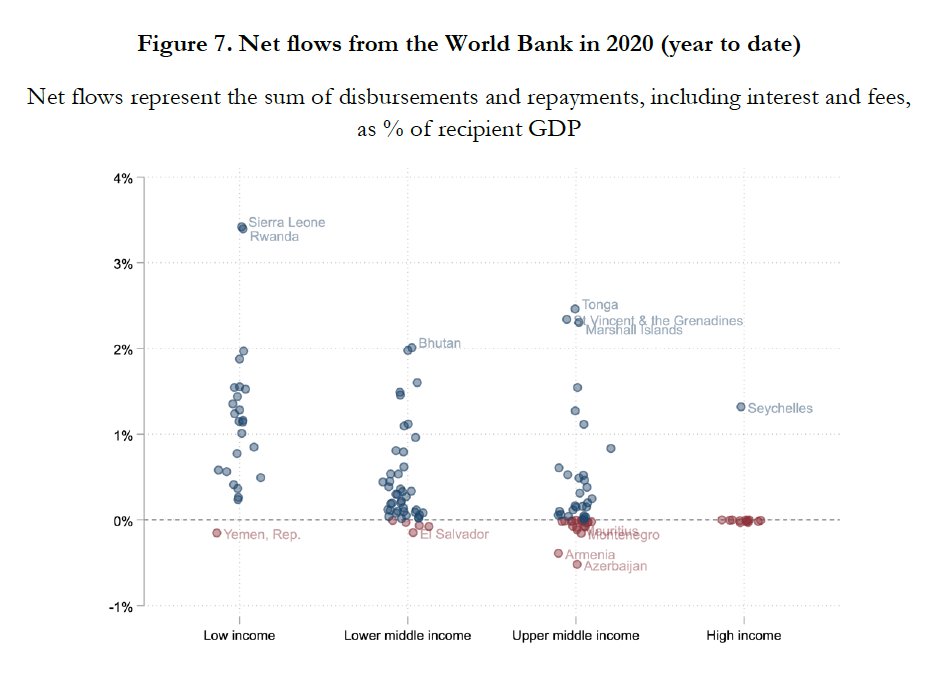

Finally, the World Bank has taken a lot of flak for boasting about its COVID lending -- while refusing to join the G20& #39;s debt standstill (aka DSSI) and freeze loan repayments from the same countries.

So we had a look at *net* flows to the World Bank.

8/

So we had a look at *net* flows to the World Bank.

8/

For the most part, poor borrowers are receiving quite a bit more in new loans than they& #39;re paying back to the World Bank right now. But there are exceptions (in red).

9/

9/

Evaluating the WB& #39;s argument that by collecting on debts now it preserves its AAA credit rating and retains the ability to lend more is beyond our scope -- but would be more credible if the Bank showed clearer signals of, um, actually lending more.

10/

10/

Read on Twitter

Read on Twitter NEW for WB/IMF annual meetingshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Is the World Bank’s COVID Response Big Enough, Fast Enough? We scraped >1/2 million transactions from the Bank& #39;s website to judge.Blog: https://www.cgdev.org/blog/new-... https://www.cgdev.org/publicati... @duggan_julian @Morris_ScottA & G Yang1/" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">NEW for WB/IMF annual meetingshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Is the World Bank’s COVID Response Big Enough, Fast Enough? We scraped >1/2 million transactions from the Bank& #39;s website to judge.Blog: https://www.cgdev.org/blog/new-... https://www.cgdev.org/publicati... @duggan_julian @Morris_ScottA & G Yang1/">

NEW for WB/IMF annual meetingshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Is the World Bank’s COVID Response Big Enough, Fast Enough? We scraped >1/2 million transactions from the Bank& #39;s website to judge.Blog: https://www.cgdev.org/blog/new-... https://www.cgdev.org/publicati... @duggan_julian @Morris_ScottA & G Yang1/" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">NEW for WB/IMF annual meetingshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Is the World Bank’s COVID Response Big Enough, Fast Enough? We scraped >1/2 million transactions from the Bank& #39;s website to judge.Blog: https://www.cgdev.org/blog/new-... https://www.cgdev.org/publicati... @duggan_julian @Morris_ScottA & G Yang1/">

NEW for WB/IMF annual meetingshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Is the World Bank’s COVID Response Big Enough, Fast Enough? We scraped >1/2 million transactions from the Bank& #39;s website to judge.Blog: https://www.cgdev.org/blog/new-... https://www.cgdev.org/publicati... @duggan_julian @Morris_ScottA & G Yang1/" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">NEW for WB/IMF annual meetingshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Is the World Bank’s COVID Response Big Enough, Fast Enough? We scraped >1/2 million transactions from the Bank& #39;s website to judge.Blog: https://www.cgdev.org/blog/new-... https://www.cgdev.org/publicati... @duggan_julian @Morris_ScottA & G Yang1/">

NEW for WB/IMF annual meetingshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Is the World Bank’s COVID Response Big Enough, Fast Enough? We scraped >1/2 million transactions from the Bank& #39;s website to judge.Blog: https://www.cgdev.org/blog/new-... https://www.cgdev.org/publicati... @duggan_julian @Morris_ScottA & G Yang1/" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">NEW for WB/IMF annual meetingshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Is the World Bank’s COVID Response Big Enough, Fast Enough? We scraped >1/2 million transactions from the Bank& #39;s website to judge.Blog: https://www.cgdev.org/blog/new-... https://www.cgdev.org/publicati... @duggan_julian @Morris_ScottA & G Yang1/">