The OECD blueprints for corporate tax reform are out today, but I must confess they& #39;ve been so comprehensively leaked in advance, and are so disappointing, that I& #39;d forgotten we should be saying something public.

Press release to follow. But in the meantime, a few key points...

1) My word, it& #39;s disappointing. When the process began in Jan.2019, there were such high hopes. The OECD promised the & #39;Inclusive Framework& #39; would make the decisions; that they would go beyond arm& #39;s length pricing (to unitary/formulary), and also introduce a minimum tax rate.

The overall pitch was equally compelling: unlike the failed BEPS process (2013-2015), which only really delivered (private) country by country reporting, this time the OECD would address the global distribution of taxing rights.

Where has the OECD arrived? First and foremost, the Inclusive Framework has been cut out entirely, in favour of US-French-G7 decision-making.

Second, despite the in-principle embrace of formulary apportionment, it& #39;s a small bit only of pillar 1 that does move beyond the arm& #39;s length principle - and with enormous complexity and uncertainty, and such limited ambition, that it& #39;s hard to see the point of continuing.

The minimum tax rate is still there, but is minimal (we need to be talking about 25% or more); and is again exceptionally complex, meaning the results are also uncertain; and the power remains very much with headquarters countries (i.e. OECD members).

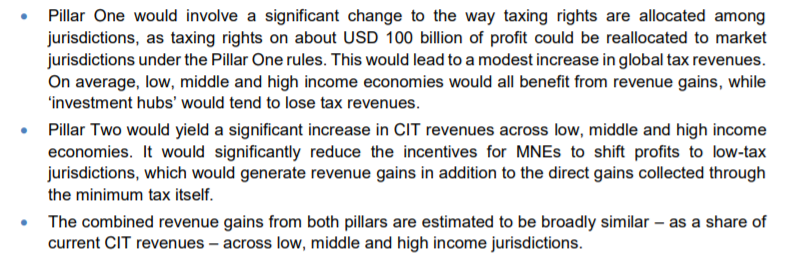

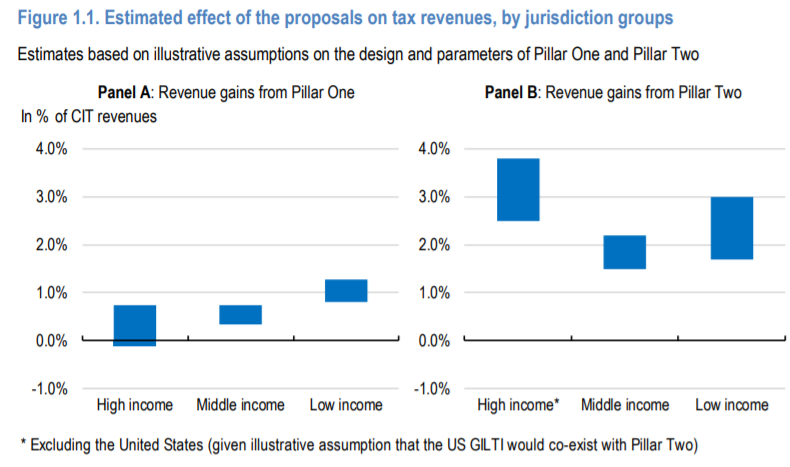

So overall, are we seeing any delivery on the redistribution of taxing rights? Not much at all. Here& #39;s the impact analysis, which kind of looks ok - but careful with this...

Two problems. First, the analysis appears to group high-income countries together with at least some profit shifting jurisdictions - meaning that the benefits to this group appear lower than they are (for non-havens).

Second, lower-income countries suffer much higher losses as a share of current tax revenues. So a reform that is & #39;equally& #39; good for all, is in fact disproportionately benefiting high-income countries. That is: OECD proposal prioritises interests of OECD members.

And then the politics: even after making so many concessions to their members; even after marginalising pretty much the entire Inclusive Framework; even after limiting the ambition so deeply; there is still not political consensus *among OECD members*.

Which leaves us with: where next? The immediate effect is likely to be a return to the unilateral measures and splintering that previously saw the spread of (largely small and rubbish) DSTs. This time, unilateral measures could be more comprehensive and ambitious - why wait?

At the same time, the failing BEPS 2.0 process is giving a major boost to the prospects of the UN taking a larger role on international tax matters. The only truly inclusive forum, and established for the purpose of just this type of complex global negotiation. Is it time?

Adding a few important responses from others. Here& #39;s a key piece - with so little revenue (and no meaningful voice) potentially available, why should lower-income countries even engage any further? https://twitter.com/martinhearson/status/1315593262372212736?s=20">https://twitter.com/martinhea...

Here& #39;s the BEPS Monitoring Group& #39;s response: "This would do little or nothing for the majority of small and poor countries... Perhaps this interregnum will allow for a rethink [...] which should build on the growing support for formulary methods." https://www.bepsmonitoringgroup.org/news/2020/10/12/bmg-comments-on-oecd-report-on-blueprints">https://www.bepsmonitoringgroup.org/news/2020...

And the scathing verdict of the @icrict commissioners:

"the OECD has not delivered... What is needed is an inclusive process, global leadership and proposals for fundamental reform in the public – rather than corporate - interest." https://www.icrict.com/press-release/2020/10/11/52n5njz8ja42ukkws0z7vgppuuse4b">https://www.icrict.com/press-rel...

"the OECD has not delivered... What is needed is an inclusive process, global leadership and proposals for fundamental reform in the public – rather than corporate - interest." https://www.icrict.com/press-release/2020/10/11/52n5njz8ja42ukkws0z7vgppuuse4b">https://www.icrict.com/press-rel...

. @JoseA_Ocampo:

“The OECD& #39;s announcement is bad news for multilateralism... it is time for countries to move unilaterally or at regional level to introduce interim measures. This will both deliver desperately needed resources now and create the necessary pressure to force change"

“The OECD& #39;s announcement is bad news for multilateralism... it is time for countries to move unilaterally or at regional level to introduce interim measures. This will both deliver desperately needed resources now and create the necessary pressure to force change"

. @Jayati1609:

"The OECD process offered only marginal changes, but now even those have not been delivered. [G]overnments must now... form coalitions that push through changes that introduce unitary taxation based on shares of sales/users and employment in different countries"

"The OECD process offered only marginal changes, but now even those have not been delivered. [G]overnments must now... form coalitions that push through changes that introduce unitary taxation based on shares of sales/users and employment in different countries"

. @JosephEStiglitz:

"The OECD proposals are simply not adequate, they represent the capture of this agenda by MNEs... The old system of taxation is not fit for purpose. We have to shift to a formulaic principle where you allocate profits in proportion to sales, employment..."

"The OECD proposals are simply not adequate, they represent the capture of this agenda by MNEs... The old system of taxation is not fit for purpose. We have to shift to a formulaic principle where you allocate profits in proportion to sales, employment..."

. @OVONJI:

"It is time for developing countries to require evidence, based on data, of the projected impact of OECD proposals... UN is the only truly inclusive legitimate negotiating forum to achieve new taxing rights based on where economic activities that add value take place"

"It is time for developing countries to require evidence, based on data, of the projected impact of OECD proposals... UN is the only truly inclusive legitimate negotiating forum to achieve new taxing rights based on where economic activities that add value take place"

. @LEONCENDIKUMANA:

"The announcements of the OECD, which promotes the interests of multinationals over those of the most disadvantaged populations, leave no doubt: African countries can no longer wait. They must begin to introduce unilateral measures..."

"The announcements of the OECD, which promotes the interests of multinationals over those of the most disadvantaged populations, leave no doubt: African countries can no longer wait. They must begin to introduce unilateral measures..."

. @EvaJoly:

"It is a terrible disappointment that in these Coronavirus times, with the States needing so desperately to get more tax revenues, the OECD has once more only the interests of the multinational companies in focus"

"It is a terrible disappointment that in these Coronavirus times, with the States needing so desperately to get more tax revenues, the OECD has once more only the interests of the multinational companies in focus"

This is a good point. There& #39;s appetite for global multilateral agreement that the OECD, self-evidently, cannot deliver on. But the UN has thus far been blocked (by OECD members) from developing such a forum either. Which way will the world go? https://twitter.com/martinhearson/status/1315610547510030336?s=20">https://twitter.com/martinhea...

Valuable thread here, from one of the OECD& #39;s impact analysis team - who bear *no* blame for the lack of transparency on country-level revenue effects, or the refusal to publish the underlying data of their modelling https://twitter.com/PierceOReilly/status/1315614429699076096?s=20">https://twitter.com/PierceORe...

Finally, as promised, our press release:

OECD’s “tax haven lite” blueprint fails pandemic-gripped world

https://www.taxjustice.net/2020/10/12/oecds-tax-haven-lite-blueprint-fails-pandemic-gripped-world/">https://www.taxjustice.net/2020/10/1...

OECD’s “tax haven lite” blueprint fails pandemic-gripped world

https://www.taxjustice.net/2020/10/12/oecds-tax-haven-lite-blueprint-fails-pandemic-gripped-world/">https://www.taxjustice.net/2020/10/1...

Read on Twitter

Read on Twitter