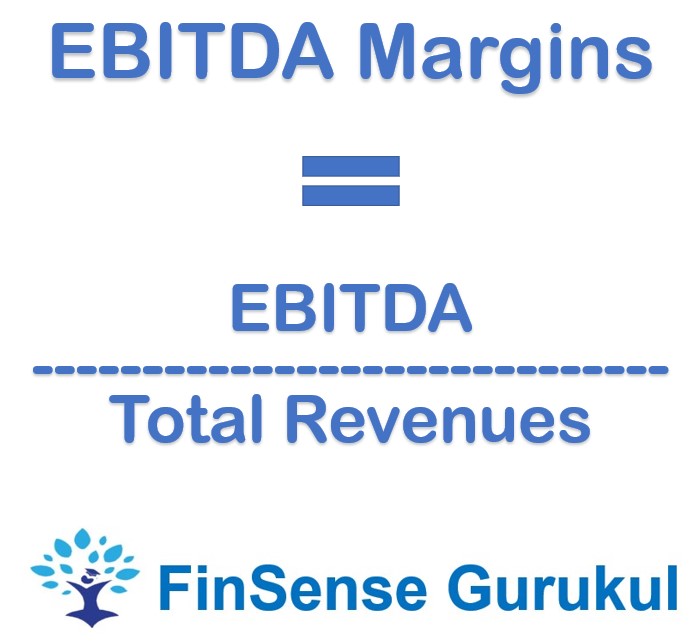

Thread: EBITDA Margins

EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization is a measure of companies operating profit as a percentage of its revenue.

EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization is a measure of companies operating profit as a percentage of its revenue.

EBITDA margins can be used to do peer comparison within the industry. It depicts how much operating cash is generated by the company for every rupee in revenues.

A company with improving EBITDA margins should be looked upon favorably as it shows the efficiencies are being achieved through effective cost-cutting or improved capabilities.

However, an investor should pay attention to higher EBITDA and lower PAT margins. This could be possible due to high debt and this should be properly analyzed, A company may show off their high EBITDA margins but never talk about Net margins due to high debt on books.

TIP: Companies with high debt levels should not be measured solely on the basis of EBITDA. Net margins play an important role in such cases.

by @RJGyanchandani

by @RJGyanchandani

Read on Twitter

Read on Twitter