So I& #39;ve noticed an increasing number of "more promising" #DeFi start-ups leveraging @TheDaoMaker& #39;s services; i.e. either they facilitate part of their fundraiser (SHO or DYCO) through them or integrate with their incentivized community (Social Mining).

/a thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔍" title="Nach links zeigende Lupe" aria-label="Emoji: Nach links zeigende Lupe">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔍" title="Nach links zeigende Lupe" aria-label="Emoji: Nach links zeigende Lupe">

/a thread

In a nutshell, @TheDaoMaker is a blockchain incubation consultancy offering a plethora of services from ideation to post-launch - think; community mgmt, influencers, exchange listing, market making, marketing via crypto socials, crypto compliance like KYC/AML, tokenomics etc

You& #39;re thinking "what& #39;s new?" and I hear you. Well, I& #39;d like to focus this thread on 3 concepts that @TheDaoMaker pioneered in the space and uniquely seperates them from the rest: 1. Social Mining 2. SHO 3. DYCO

How do these 3 key concepts fit together and came about? It& #39;s no secret that many projects& #39; fundraisers are a PnD due to investors going for a quick flip and jumping on to the next one. Post 2017 era, projects try to deal with this by introducing vesting scheme& #39;s for priv rounds.

Still even the initial unlocked portion typically gets insta-dumped and it& #39;s rinse and repeat on future unlocking dates - leading to increased volatility, dumps and community outrage. In the end, people looking for a quick flip run away with cash and holders get punished.

Anyways, @TheDaoMaker& #39;s services are inspired by the urge to protect their own community& #39;s as well as their client& #39;s interests and reward the loyal, strong holder. The purpose is to recognize those investors who are habitually the strongest value-adding holders.

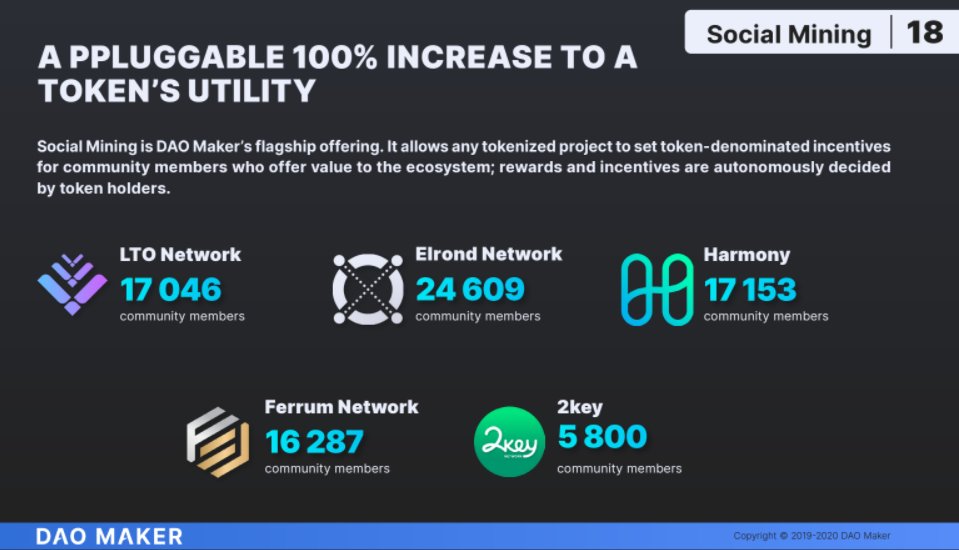

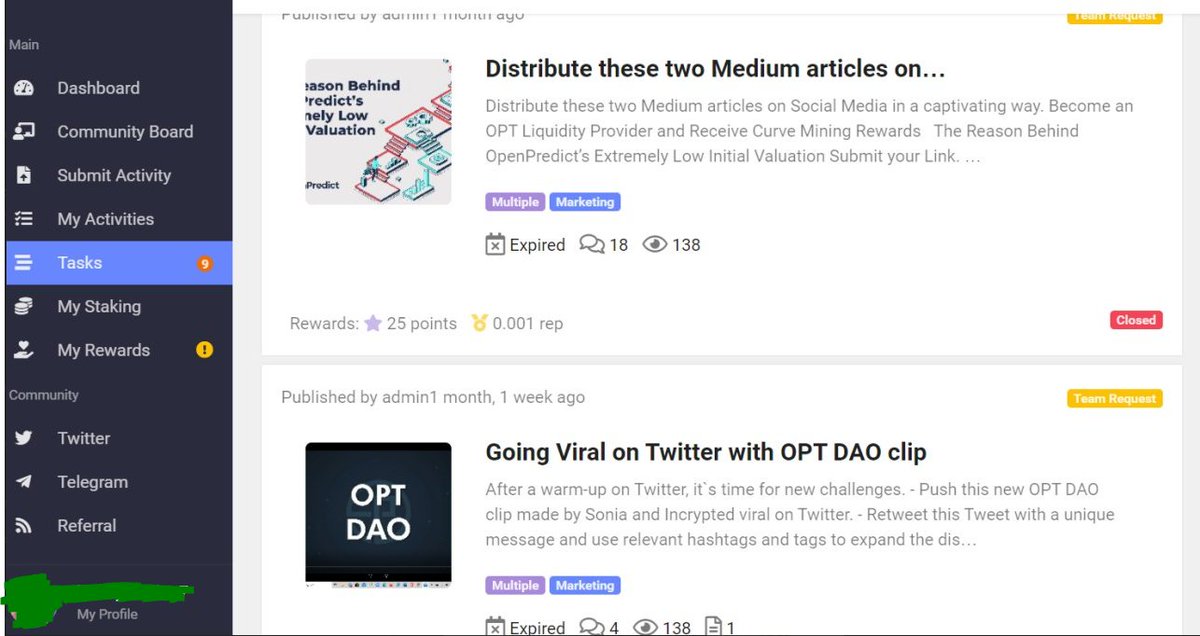

1. *Social Mining* is about increasing token utility by converting a project& #39;s tokenized ecosystem into a DAO. It allows any tokenized project to set token-denominated incentives for community members who offer value to the ecosystem through project-enhancing actions.

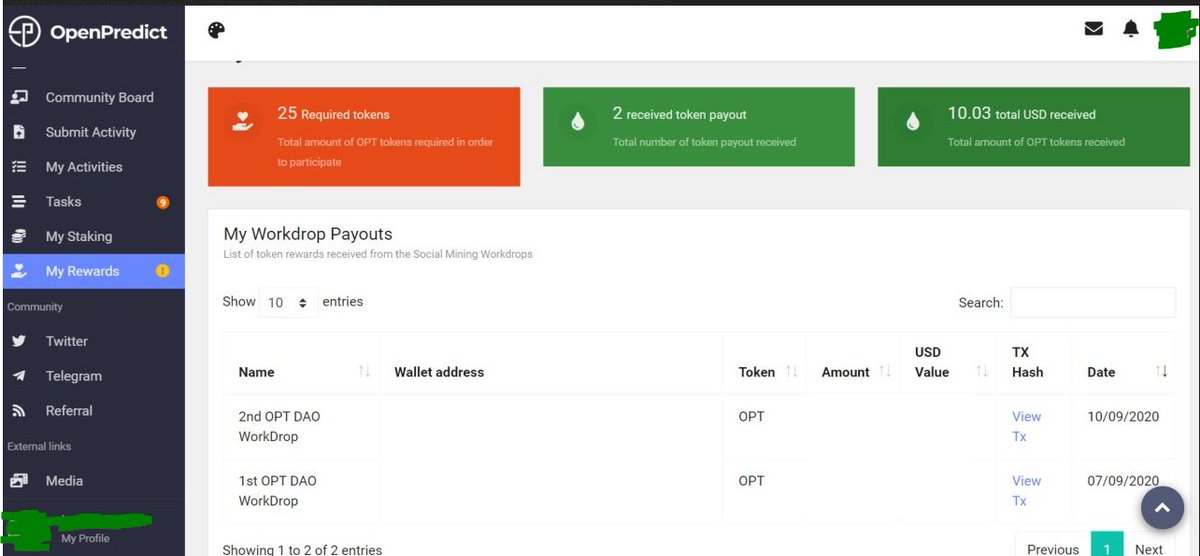

Basically you hold a certain number of tokens, you get access to tasks, task can be promote this tweet, call for articles etc and you get points for retweeting and liking tweets they post. This all sums up into a score and you take part in the "workdrop" that pays you.

2. In an *SHO* (Strong Holder Offering), % of client& #39;s tokens are dedicated to users with a proven track record of strong hands - I.e. people that have held (more of) a target token for a long time or provided liquidity will have a higher score for the SHO algorithm (HODL Index).

Purpose is to recognize people who are habitually the strongest value-adding holders. Hence, having a higher score by the index grants you more tickets to win a spot for participating in the SHO. A similar system was applied to the Dynamic Coin Offering (DYCO) of @orion_protocol

A DYCO offers its participants the ability to refund any token, no matter if they held them or sold them at a profit. 100% of the circulating supply is backed by USDC for the first 16 months after the Token Generation Event. The token supply remains static during this time.

If the token value falls by more than 20% from the initial price, DYCO participants can generate risk free profits by buying tokens from the market and refunding them. Refunded tokens are automatically burned reducing the circulating supply by up to 100%.

Some stats:

1st DYCO - @orion_protocol $ORN DYCO ath roi: 70x current roi: 18x

1st SHO - @OpenPredict $OPT SHO ath roi: 126x current roi: 15x

2nd SHO - @DeFinerOrg $FIN 6,000 unique participants

3rd SHO - @TryPlotX $PLOT SHO: 15x oversubscription, 6,000 unique participants

1st DYCO - @orion_protocol $ORN DYCO ath roi: 70x current roi: 18x

1st SHO - @OpenPredict $OPT SHO ath roi: 126x current roi: 15x

2nd SHO - @DeFinerOrg $FIN 6,000 unique participants

3rd SHO - @TryPlotX $PLOT SHO: 15x oversubscription, 6,000 unique participants

Lastly, @InjectiveLabs $INJ (backed by @BinanceLabs) recently joined the DAO Maker Ecosystem, by implementing the social mining software to accelerate their community. https://twitter.com/TheDaoMaker/status/1314170019715198976?s=20">https://twitter.com/TheDaoMak...

As always, the above does not constitue any financial advice whatsoever and please do your own research. If you like what I do then please like & retweet and join the discussion at http://t.me/DeFiRaccoons ">https://t.me/DeFiRacco...

Read on Twitter

Read on Twitter " title="So I& #39;ve noticed an increasing number of "more promising" #DeFi start-ups leveraging @TheDaoMaker& #39;s services; i.e. either they facilitate part of their fundraiser (SHO or DYCO) through them or integrate with their incentivized community (Social Mining)./a thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔍" title="Nach links zeigende Lupe" aria-label="Emoji: Nach links zeigende Lupe">" class="img-responsive" style="max-width:100%;"/>

" title="So I& #39;ve noticed an increasing number of "more promising" #DeFi start-ups leveraging @TheDaoMaker& #39;s services; i.e. either they facilitate part of their fundraiser (SHO or DYCO) through them or integrate with their incentivized community (Social Mining)./a thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔍" title="Nach links zeigende Lupe" aria-label="Emoji: Nach links zeigende Lupe">" class="img-responsive" style="max-width:100%;"/>