Kiggundu v Diamond Trust Bank (U) Ltd & Another: Executive and Legislative lethargy punished or Judicial aloofness in overdrive? WARNING; VERY LONG THREAD

The Privatization Unit(PU) had just hired a legal wizard. It is rare to get a 1st Class degree in law from the School of Law

The Privatization Unit(PU) had just hired a legal wizard. It is rare to get a 1st Class degree in law from the School of Law

, Makerere University. The PU advertised for Expressions of Interest in the acquisition of the rights of government in the Uganda Cement Industries which owned two cement manufacturing plants; Hima in Kasese & at Tororo. That advert (unsurprisingly) had a few misrepresentations.

The successful party took over Hima Cement and renamed it Hima Cement (1994) Limited on 14th December 1994. In a messy divestiture process, the Hima and Tororo cement divestitures were excellent. The buyers paid well. Almost $20.5 million.

Very good money in 1994, as it looks & sounds like in 2020. Except, the request for EOI, that informed the bids and their acceptance had indicated that Hima Cement had limestone reserves of a particular quantity. It was partly true, the quantities were not necessarily as stated.

The buyers politely requested, on that basis, for a refund of $5 million from the state. This request, like others before it and after it, passed through many hands until the young lawyer was assigned to write a brief on the same, this is between 1995 to 2001.

The young lawyer sat down, read through the Public Enterprise Reform and Divestiture Act, 1993, the Constitution of the Republic of Uganda, and relevant laws. His opinion, as expected was sound. He advised against payment of that money to the said Hima cement (1994) Limited.

The then Attorney General, who was also Minister for Justice and Constitutional Affairs, was very kind to write back and note that the legal brief was as excellent, in fact, the most excellent he had ever had the fortune of reading.

However, that whereas it was legally excellent and sound, in life and the affairs of human management, there were other matters, non-legal, that may take precedence over the legality of issues at particular times in a country’s evolution & he would look at that request as AG...

from that angle. Devastated, the young man resigned his position as in-house counsel at the PU. He was wise enough NOT to write back to the AG but nonetheless resigned with deep disillusionment to the effect that his AG had not listened to what both he & the AG knew to be...

a sound opinion. At Law.

Incidentally, by 2001, both were not working with the government.

Incidentally, by 2001, both were not working with the government.

25 years later, the then AG is a retired man. His reading of the law is still one that says keep the structure, even if one part of the roof is leaking, until the opportune time to renovate the same, rather than demolishing the same, hoping that you will build a better one,..

the next day, because you have a new job.

The now old young man, is Chairman of the Board of a bank and heads the Uganda office of a Pan-African legal outfit. Obviously, that bank is a member of the Uganda Bankers Association.

The now old young man, is Chairman of the Board of a bank and heads the Uganda office of a Pan-African legal outfit. Obviously, that bank is a member of the Uganda Bankers Association.

The Association has in an unprecedented move, agreed to challenge the findings of the Head of the Commercial Court in Miscellaneous Application No. 654 of 2020 that saw one Kiggundu, trounce, in the most spectacular of fashions, DTB (U) Ltd and DTB (K) Ltd,...

that it is said that even he and his allies were surprised by the verdict, Diamond Trust Bank (U) Limited & Diamond Trust Bank (K) Limited. You can read the decision, here

https://ulii.org/ug/judgment/commercial-court-uganda/2020/32">https://ulii.org/ug/judgme...

https://ulii.org/ug/judgment/commercial-court-uganda/2020/32">https://ulii.org/ug/judgme...

The decision rests on the definition of a foreign bank under Section 3 of the Financial Institutions Act, 2004 (as amended) and the provisions of Section 117 (FIA,2004). We shall reproduce both.

Sec3 of the FIA provides thus;

"foreign bank" means a body corporate or entity incorporated or formed under the laws of a country other than Uganda that—

(a) is a bank according to the laws of any foreign country where it carries on business;...

"foreign bank" means a body corporate or entity incorporated or formed under the laws of a country other than Uganda that—

(a) is a bank according to the laws of any foreign country where it carries on business;...

(b) carries on a business in a country other than Uganda that if carried out in Uganda, would be wholly or to a significant extent, financial institution business;”

Never mind that the same Act defines "foreign company" which may prove significant, later, for being left out.

Never mind that the same Act defines "foreign company" which may prove significant, later, for being left out.

The other bais is Section 117 that provides;

“117 (1) A foreign bank may, in such form and in such manner as shall be prescribed by the Central Bank by statutory instrument apply to the Central Bank for permission to establish a representative office in Uganda to engage in such

“117 (1) A foreign bank may, in such form and in such manner as shall be prescribed by the Central Bank by statutory instrument apply to the Central Bank for permission to establish a representative office in Uganda to engage in such

limited activities, excluding the taking of deposits as the Central Bank may approve.”

First, the use of the word "may" in relation to a foreign bank. means that it is not a mandatory requirement for it to do so. I have read and re-read that provision and I cannot tell where it is mandatory for a foreign bank to comply with Section 117 of the FIA, 2004.

Second, the use of the word "shall" only applies in mandating the @BOU_Official to make provision for such (non-mandatory) forms in a statutory Instrument that the foreign banks MAY elect to use. @Isacmpanga and @odu_mercy may help me out here. I could be lost at sea.

I believe that it is the wording of this Section that has allowed for the @GovUganda and private entities to ALL apply for syndicated loans. @mtnug just recently got $100m to pay for its license. The @mofpedU has billions of dollars in syndicated loans.

I do not see any other interpretation of this Section& #39;s provisions other than the one I have humbly put out for debate. BOU and MOFPED have enough legal minds, together with the Attorney General& #39;s office to have discovered such loophole and plug it in time.

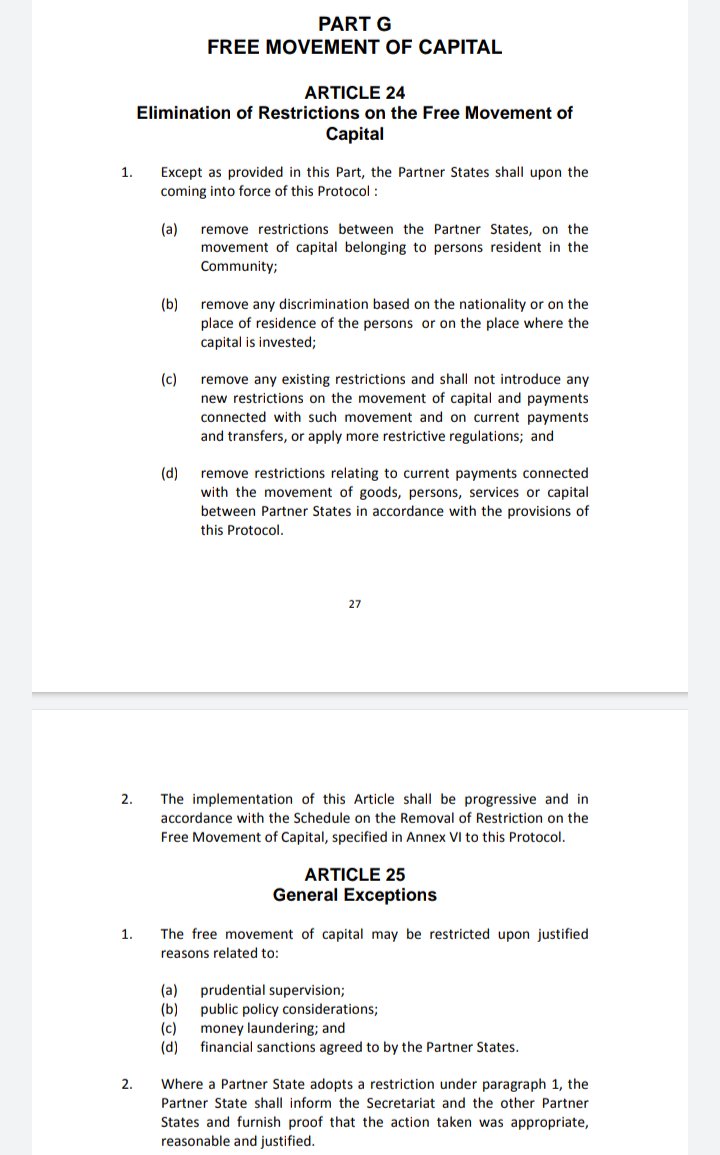

Even if that were the case, what about the provisions of Article 24 of the Common Market Protocol of the @jumuiya on free movement of capital in East Africa, at least?

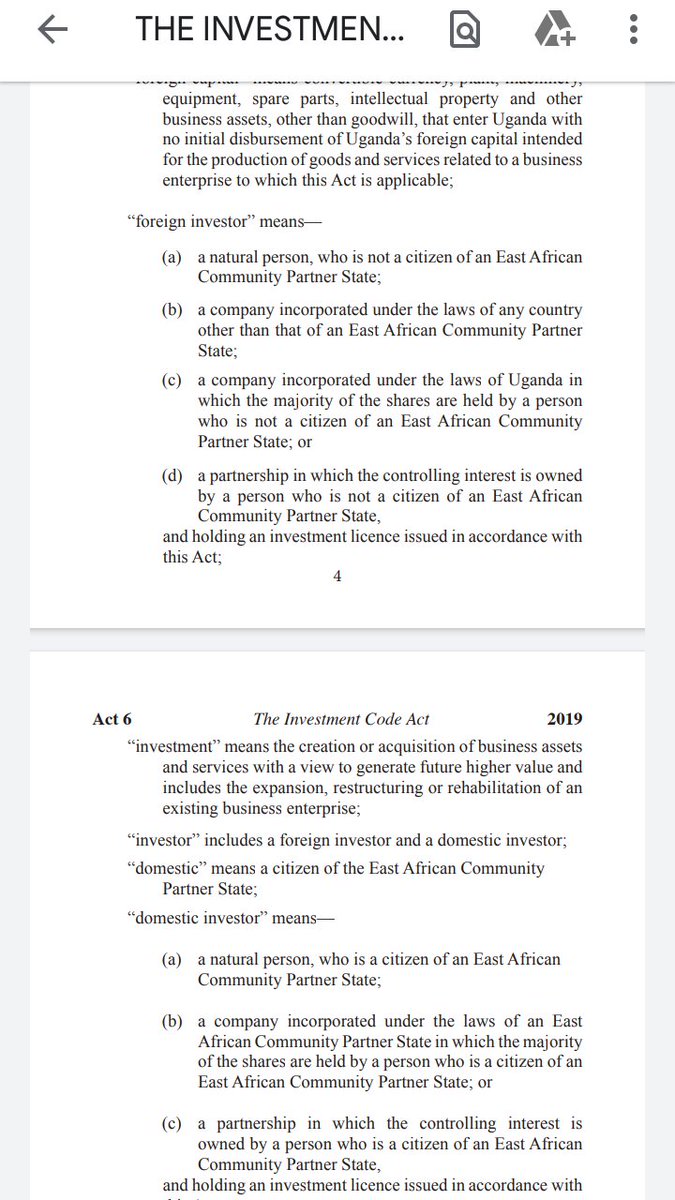

What about the provisions of Section 3 of the Investment Code Act, 2019 that define a domestic investor to include all East African Community companies? It may be reaching too far, but anything to throw at that decision is welcome.

Uganda has applied to re-enter the stand-by program of @IMFNews due to high debt levels and diminishing fiscal space. The news of this decision wasn& #39;t well received. Even if it was legally sound, which is in question, the decision should have looked at all these factors.

Had the different in-house counsel and their external teams surnised that this was the correct interpretation of Sec 117 of the FIA, 2004, we would cease to exist as a country UNLESS drastic legislation changes measures were instituted in record time.

If the decision were left to stand, it would represent a Material Adverse Change that would trigger Acceleration Clauses in almost all the agreements by which Uganda has borrowed money. God help us if that were to happen.

An acceleration clause is a contract provision that allows a lender to require a borrower to repay all of an outstanding loan if certain requirements are not met. It outlines the reasons that the lender can demand loan repayment & the repayment required.

Read on Twitter

Read on Twitter