This is a (long) thread on how financialisation impacts the housing market, and why I have singled out the below tweet (spoiler alert: because the same happens in the housing market). Financialisation is defined as ‘the increasing importance of finance, financial markets, https://twitter.com/joe_of_the_90/status/1314151881996931073">https://twitter.com/joe_of_th...

and financial institutions to the workings of the economy’. (Investopedia) Since the 1980s, finance took an increasing importance in the economy. This brought about the creation of many different, ‘exotic’ financial instruments and schemes created by bankers, such as

collaterialised debt obligations (CDOs) or Help to Buy, and the neoliberal deregulation of the banks over consequent years and decades. These instruments often get securitised and sold to investors at huge profits for the seller (bank), while the schemes are created to create the

demand. How does this tie in to the current, dysfunctional housing market? Before financialisation took hold, houses were mere places to live in, but in the advent of financialisation, houses turned into a financial asset that could be traded via credit as if it was a stock.

Essentially, the credit became the product, and not the house. This new market mechanism was not just a quickbuck scheme, but it was essential to central banks too, who by the 1970s expanded credit in ever larger doses. https://twitter.com/drsparwaga/status/1314152180920848384">https://twitter.com/drsparwag...

Credit inflation is the CBs tool of getting an econ’s engine going, while credit deflation is a way of killing it. These are the ‘boom & bust’ phases often refer to. I describe this mechanism and the reasoning behind it here. https://twitter.com/drsparwaga/status/1312405529382313984">https://twitter.com/drsparwag...

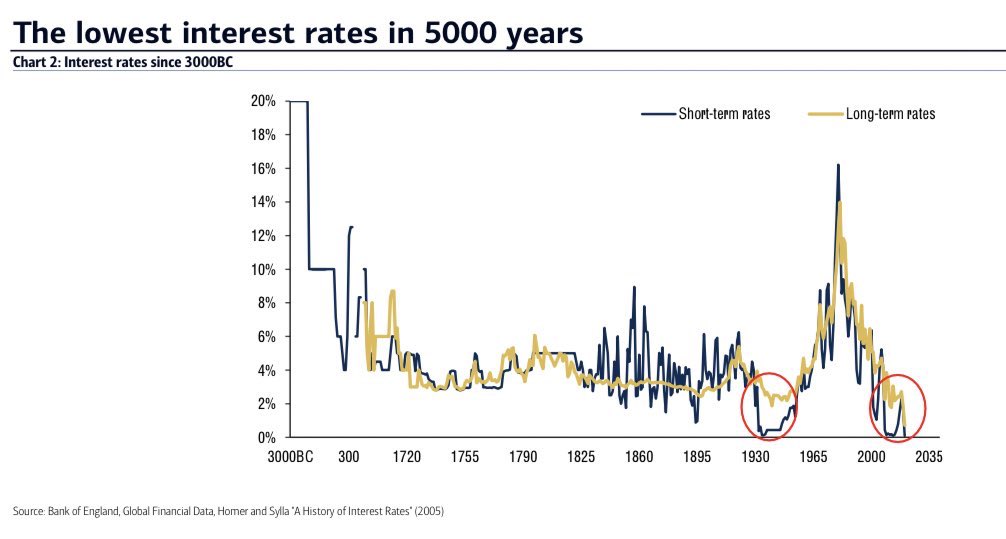

One important takeaway from that thread is the importance of IRs. IRs have a huge influence on market psychology. They determine the demand, and as a result the supply dynamics. When banks offer credit (their product) at high IRs, the pool of eligible applicants is proportionally

small because people view that credit (their product) as expensive (IRs set the cost of credit), and vice versa when IRs are low. IRs also function as a guard to prevent risk, leverage, and speculation building up. For example, if too many people demand credit (their product),

naturally IRs would rise to prevent excess risk, leverage, and speculation building up in the system. CBs have long prevented this free market mechanism from taking hold by meddling in/manipulating the credit (bond) market via QE and yield curve control (which is what it is, https://twitter.com/drsparwaga/status/1314321843562729472">https://twitter.com/drsparwag...

they just don’t call it that) in order to prevent their credit bubble from imploding. Now, the problem with lowering IRs constantly then is it widens the scope of eligible applicants every time they are lowered. As a result, it increases the risk of the number of ‘subprime’ or https://twitter.com/drsparwaga/status/1314316712871899137">https://twitter.com/drsparwag...

‘poor’ borrowers falling within that scope, which in turn creates risks on many levels. The problem is that bankers have a tendency not to care in good times who they lend to, because the ‘exotic’ products and schemes they profit from need ever more applicabts to go into debt.

Before banks do that, they run checks etc. on applicants. Again, the propensity of these checks to be a total joke has been evident for many years in a variety of sectors, including the housing market. One indicator they use is the monthly affordability payments. This is ever

more possible to pass when IRs are low and contracts can be stretched out as the monthly payments get lowered. On paper, this may sound nice to highlight ‘affordability’, but being able to pay the monthly payments does not mean it’s affordable to the applicant to pay the entire

loan. What it does though is increase the personal leverage and risk profile, which get revealed in downturns. This is why analysts highlight when a particular market entered a ‘bubble phase’ before the econ eventually does turn, such as the UK auto market, housing market,

corp debt market, etc. are right now. This mentality of taking on debt because the monthly payments are affordable was the reason why we had the prior busts as cheapened credit was given to clueless and stupid people who should have never received it in the first place. This is https://twitter.com/drsparwaga/status/1314708636728426496">https://twitter.com/drsparwag...

referred to as ‘misallocation of capital’. Another consequence of this is the amount of people with capital running around are now chasing the assets out there. This ends up creating ‘supply shortages’. Ofc, there are other shenanigans with the supply side, but I wont go into

that here, except to say that they will make sure the credit sizes remain large in order to feed the system, and supply is one lever to do that. What’s important here is that the problem is not the supply. It’s the number of people given access to cheap credit (their product)

who can’t actually afford to ever pay the loans (their products) in full, f.e. the Help to Buy scheme (their product). This scheme is high risk lending regardless who the borrower is, and has many flaws once a downturn starts, but because customers could ‘afford’ the monthlies in

good times, the banks looked away and profited from this via the ‘exotic’ products, while the system needed ever expanding debt in large/r sizes. It’s a shortterm win situation. Now, this is what I want to highlight from

all of this by using this quote: ‘There is always a “housing shortage” and an “inventory shortage”, until there suddenly isn’t.’ The reality is the supply isnt short, but it’s the number of clueless and stupid people crowded into this sector due to access https://twitter.com/drsparwaga/status/1313997243700187137">https://twitter.com/drsparwag...

to cheap credit (their product) that’s the real problem. The income-to-house price ratio has been in lunatic territory for a long time, which is a good indicator to me (besides others) that the loans (their products) will never be repaid. Regular followers will know my view that

we are entering an economic depression. I believe when this depression hits properly once the gov/banks stop their extend and pretend games with the multiple debt deferrals, all the ‘stimulus’ feeds through, inflation will pick up substantially, and IRs subsequently will go up

too (by a lot, imo to double digit eventually). Millions of clueless and stupid people will go bankrupt and fall into poverty as a result over the years. Once this happens, there will be a tsunami of housing stock on the market that will lie empty and rot for many many years.

It will reveal the extent of the overbuilding in proportion to the credit creation in my opinion, as billionaire Sam Zell warned will happen. A lot of the stock will be useless, non-inhabitable, and worthless (flats with cladding and new build homes f.e.), as speculation

Read on Twitter

Read on Twitter