Half of Americans aren’t saving enough for retirement.

Some say that’s due to low wages or irresponsible choices, but there’s another culprit: an expensive and antiquated 401(k) system https://trib.al/2D99X5I ">https://trib.al/2D99X5I&q...

Some say that’s due to low wages or irresponsible choices, but there’s another culprit: an expensive and antiquated 401(k) system https://trib.al/2D99X5I ">https://trib.al/2D99X5I&q...

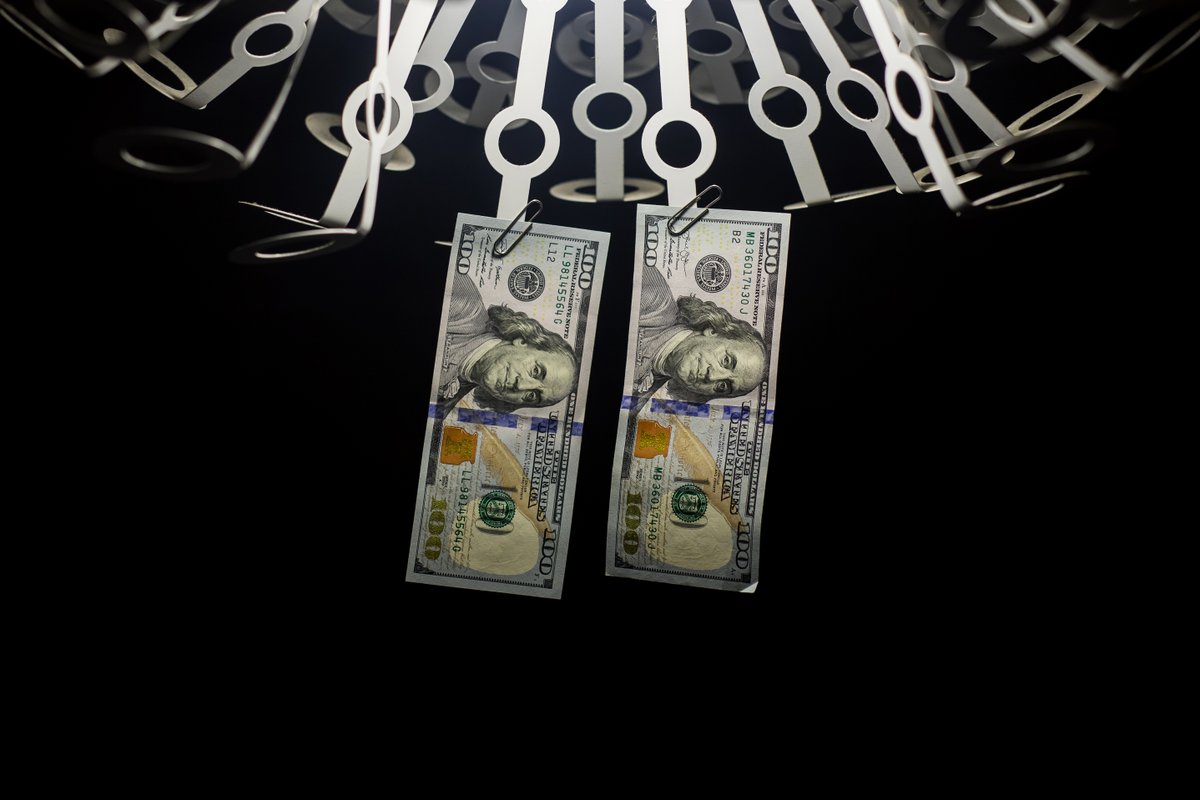

Our current system favors costly middlemen. The average fees levied on 401(k) savings hover in the range of 0.5% annually.

That compares to annual expenses well under 0.1%, and often near zero, offered by stock and bond index funds and ETFs http://trib.al/2D99X5I ">https://trib.al/2D99X5I&q...

That compares to annual expenses well under 0.1%, and often near zero, offered by stock and bond index funds and ETFs http://trib.al/2D99X5I ">https://trib.al/2D99X5I&q...

An excess cost — roughly 0.4% annually — may not sound like much.

But for a worker who dutifully puts $10,000 a year for 40 years into a portfolio that earns 6% annually, the difference in final savings can be north of $150,000 http://trib.al/2D99X5I ">https://trib.al/2D99X5I&q...

But for a worker who dutifully puts $10,000 a year for 40 years into a portfolio that earns 6% annually, the difference in final savings can be north of $150,000 http://trib.al/2D99X5I ">https://trib.al/2D99X5I&q...

With more than $5.5 trillion invested in 401(k) plans, cutting costs to savers by even 0.4% would add more than $20 billion annually to the nest eggs of American workers http://trib.al/2D99X5I ">https://trib.al/2D99X5I&q...

To cut costs, policy makers should eliminate 401(k) intermediaries.

Let American workers save for retirement using their choice of designated, IRA-like accounts offering the same, cheap index-tracking funds and ETFs available outside of retirement plans http://trib.al/2D99X5I ">https://trib.al/2D99X5I&q...

Let American workers save for retirement using their choice of designated, IRA-like accounts offering the same, cheap index-tracking funds and ETFs available outside of retirement plans http://trib.al/2D99X5I ">https://trib.al/2D99X5I&q...

There’s plenty of precedent for a better, cheaper approach to saving.

Take the 529 plans sponsored by states. New York’s plan offers a range of index and age-based fund choices, many with expenses as low as 0.13% http://trib.al/2D99X5I ">https://trib.al/2D99X5I&q...

Take the 529 plans sponsored by states. New York’s plan offers a range of index and age-based fund choices, many with expenses as low as 0.13% http://trib.al/2D99X5I ">https://trib.al/2D99X5I&q...

In addition, most 401(k) participants don’t even allocate their investments efficiently.

For any degree of risk, 401(k) savers are getting sub-optimal returns out of expensive funds dominated by offerings from fund sponsors http://trib.al/2D99X5I ">https://trib.al/2D99X5I&q...

For any degree of risk, 401(k) savers are getting sub-optimal returns out of expensive funds dominated by offerings from fund sponsors http://trib.al/2D99X5I ">https://trib.al/2D99X5I&q...

40 years ago …

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Cheap index mutual funds were new

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Cheap index mutual funds were new

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Information was delivered in the mail

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Information was delivered in the mail

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Investments had to be directed via pen and paper

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Investments had to be directed via pen and paper

In such an opaque world, employees arguably needed employers, intermediaries and fiduciaries to help them http://trib.al/2D99X5I ">https://trib.al/2D99X5I&q...

In such an opaque world, employees arguably needed employers, intermediaries and fiduciaries to help them http://trib.al/2D99X5I ">https://trib.al/2D99X5I&q...

The financial system is now vastly more efficient, liquid and transparent.

It’s time to reform 401(k)s, cut out intermediaries and take the burden off of employers, so that workers can enjoy every penny of their hard-earned savings http://trib.al/2D99X5I ">https://trib.al/2D99X5I&q...

It’s time to reform 401(k)s, cut out intermediaries and take the burden off of employers, so that workers can enjoy every penny of their hard-earned savings http://trib.al/2D99X5I ">https://trib.al/2D99X5I&q...

Read on Twitter

Read on Twitter

Cheap index mutual funds were newhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Information was delivered in the mailhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Investments had to be directed via pen and paperIn such an opaque world, employees arguably needed employers, intermediaries and fiduciaries to help them https://trib.al/2D99X5I&q..." title="40 years ago …https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Cheap index mutual funds were newhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Information was delivered in the mailhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Investments had to be directed via pen and paperIn such an opaque world, employees arguably needed employers, intermediaries and fiduciaries to help them https://trib.al/2D99X5I&q..." class="img-responsive" style="max-width:100%;"/>

Cheap index mutual funds were newhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Information was delivered in the mailhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Investments had to be directed via pen and paperIn such an opaque world, employees arguably needed employers, intermediaries and fiduciaries to help them https://trib.al/2D99X5I&q..." title="40 years ago …https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Cheap index mutual funds were newhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Information was delivered in the mailhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts"> Investments had to be directed via pen and paperIn such an opaque world, employees arguably needed employers, intermediaries and fiduciaries to help them https://trib.al/2D99X5I&q..." class="img-responsive" style="max-width:100%;"/>