0/ The world has morphed into one big macro trade.

Asset prices are increasingly driven by global policy expectations rather than underlying fundamentals.

Deflation + insolvency risk is rising.

Potential knock-on effects are too important to ignore.

Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Asset prices are increasingly driven by global policy expectations rather than underlying fundamentals.

Deflation + insolvency risk is rising.

Potential knock-on effects are too important to ignore.

Thread

1/ There& #39;s still many “known unknowns” i.e. risks we know about but don& #39;t know if/when they’ll materialize.

Powell & Co. could send markets flying on a whim. Trump could send markets flailing with one tweet.

But 1 thing is certain: our reality has changed & the risks are real.

Powell & Co. could send markets flying on a whim. Trump could send markets flailing with one tweet.

But 1 thing is certain: our reality has changed & the risks are real.

2/ TLDR; greater deflation + insolvency risk could create a potentially challenging environment for asset prices.

The key to the recovery & inflation narrative lies in the banking system, not QE + record low rates.

Consensus is heavily skewed towards a weaker USD.

The key to the recovery & inflation narrative lies in the banking system, not QE + record low rates.

Consensus is heavily skewed towards a weaker USD.

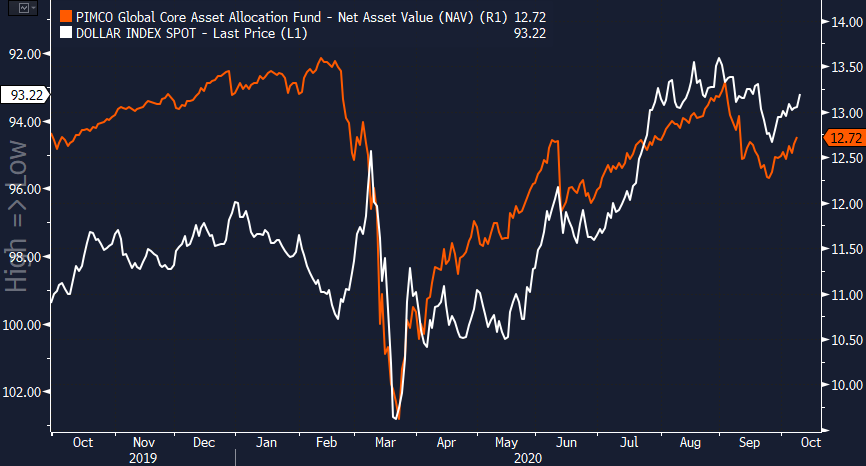

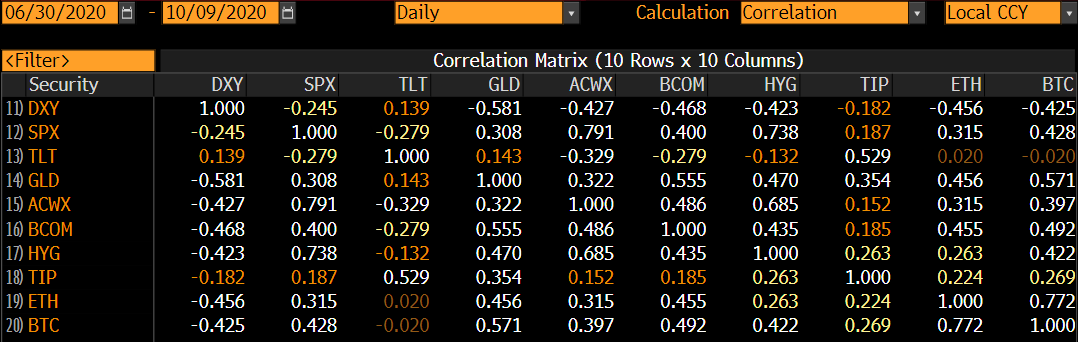

3/ The “one big macro trade” idea is critical to understand for several reasons.

Financial markets are increasingly driven by global policy expectations rather than underlying fundamentals.

Elevated intermarket correlations puts markets on fragile ground...

Financial markets are increasingly driven by global policy expectations rather than underlying fundamentals.

Elevated intermarket correlations puts markets on fragile ground...

4/ If the market starts pricing in greater deflation + insolvency risk, it will create a challenging environment for asset prices.

But won’t massive amounts of QE and low rates and a fresh fiscal stimulus package absolve these concerns?

Not exactly...

But won’t massive amounts of QE and low rates and a fresh fiscal stimulus package absolve these concerns?

Not exactly...

5/ We all know global central banks have launched asset purchase programs of unprecedented size, but the Fed can only go so far in its efforts to stimulate economic activity.

The real arbiters in the battle against weak (or contracting) growth and deflation are the banks!

The real arbiters in the battle against weak (or contracting) growth and deflation are the banks!

6/ In a debt-driven economy, the key to any sustainable recovery lies in the availability & cost of credit.

The Fed can scream all it wants but if banks don’t take on more risk, their words will fall on deaf ears.

We need banks to extend credit and lend to the real economy.

The Fed can scream all it wants but if banks don’t take on more risk, their words will fall on deaf ears.

We need banks to extend credit and lend to the real economy.

7/ QE isn’t directly inflationary because banks don’t act simply as pass throughs lending out their growing pile of reserves.

In order to jumpstart the real economy, banks need to be willing and able to extend credit and make loans...but they’re not.

In order to jumpstart the real economy, banks need to be willing and able to extend credit and make loans...but they’re not.

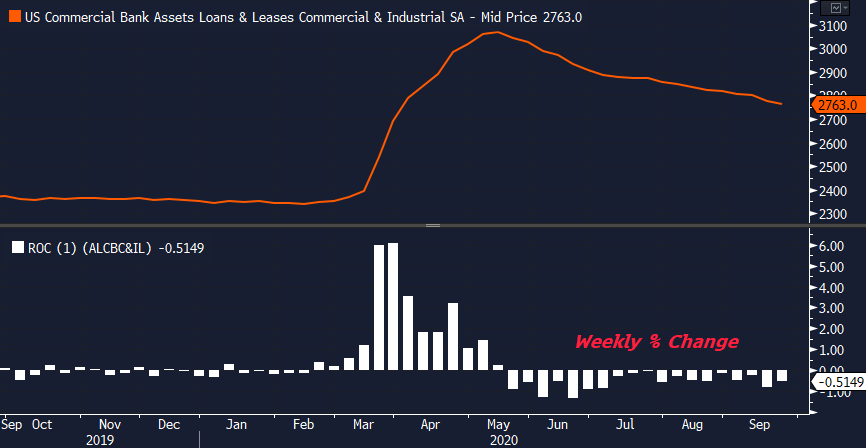

8/ Commercial and industrial (C&I) loan growth has declined since mid-May after an initial spike in March-April…

9/ ...likewise consumer loan growth remains weak as well.

Even real estate lending has begun to plateau in recent weeks.

Even real estate lending has begun to plateau in recent weeks.

10/ If you recall, the Fed acted aggressively in late March, announcing several lending facilities to “support the flow of credit to American families and businesses”.

Markets rejoiced despite dire warnings of the longer term consequences of such intervention.

Markets rejoiced despite dire warnings of the longer term consequences of such intervention.

11/ A major challenge today is pinpointing what the data doesn’t tell us.

Tighter financial conditions, massive debt forbearance, & extreme unemployment are just the start.

And when lenders come knocking, many people are going to get squeezed...

Tighter financial conditions, massive debt forbearance, & extreme unemployment are just the start.

And when lenders come knocking, many people are going to get squeezed...

12/ Yet despite deteriorating conditions, the Fed’s Board of Governors “continues to expect that the [PDCF, CPFF, MMLF, CCFs, TALF, MLF, PPPLF] will not result in losses to the Federal Reserve."

Which means the banks need to shoulder some risk if they decide to lend...

Which means the banks need to shoulder some risk if they decide to lend...

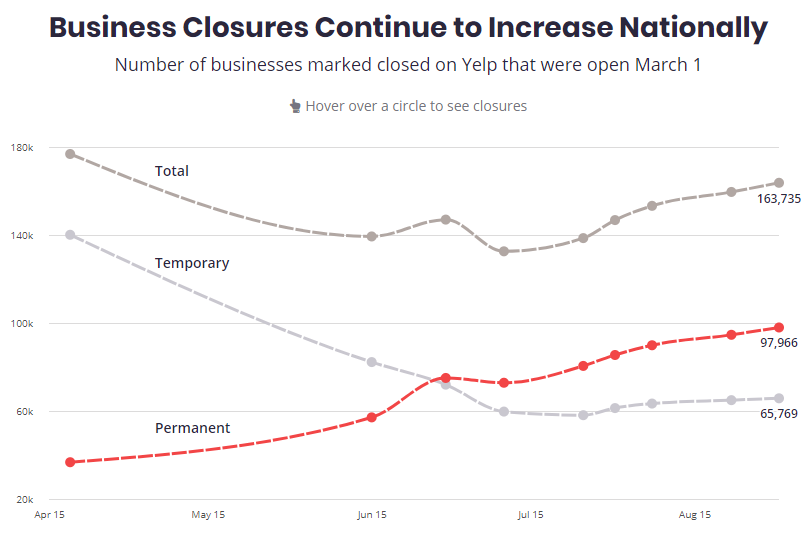

13/ But why would they? We’re still reeling from one of the worst economic downturns in modern history.

Businesses are closing at a staggering pace, consumer & corporate balance sheets are impaired, and there’s still no light at the end of the tunnel.

Businesses are closing at a staggering pace, consumer & corporate balance sheets are impaired, and there’s still no light at the end of the tunnel.

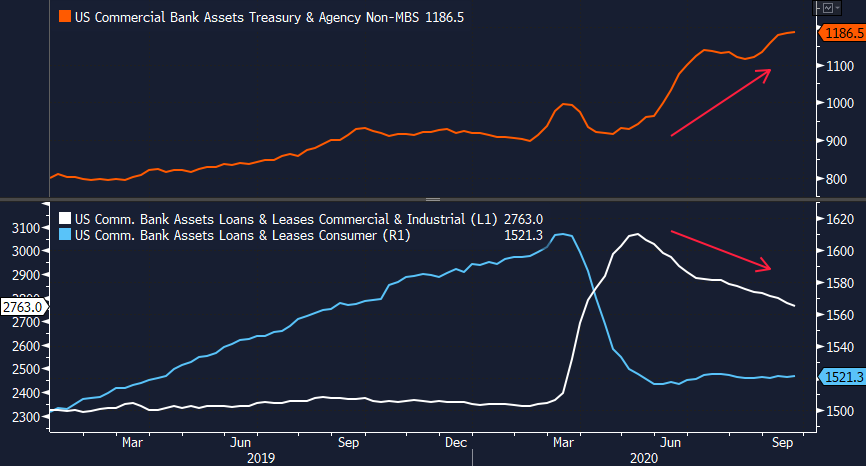

14/ Instead, banks are hoarding cash and shying away from unnecessary risk.

If bankers truly believed in this hyperinflation narrative, they wouldn’t be shoring up highly liquid assets like Treasuries.

The banking system is telling us the risk of deflation is very real.

If bankers truly believed in this hyperinflation narrative, they wouldn’t be shoring up highly liquid assets like Treasuries.

The banking system is telling us the risk of deflation is very real.

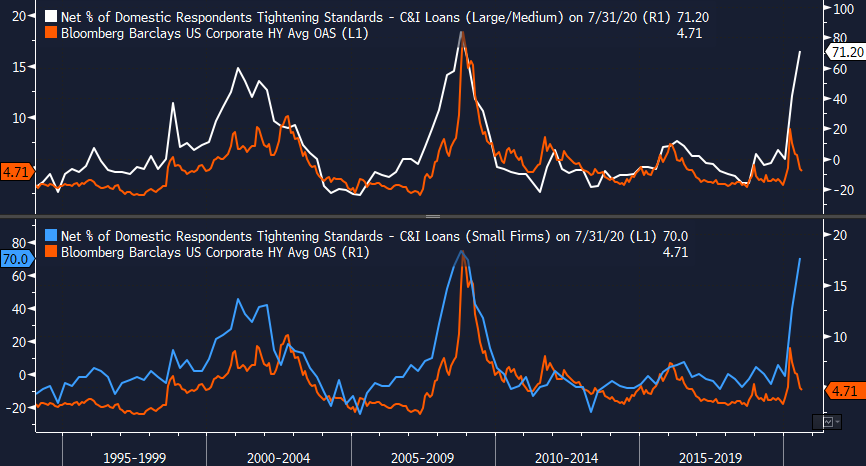

15/ On top of that, banks are tightening lending standards across just about every segment (commercial, industrial, consumer, etc.) at a time when credit is needed most.

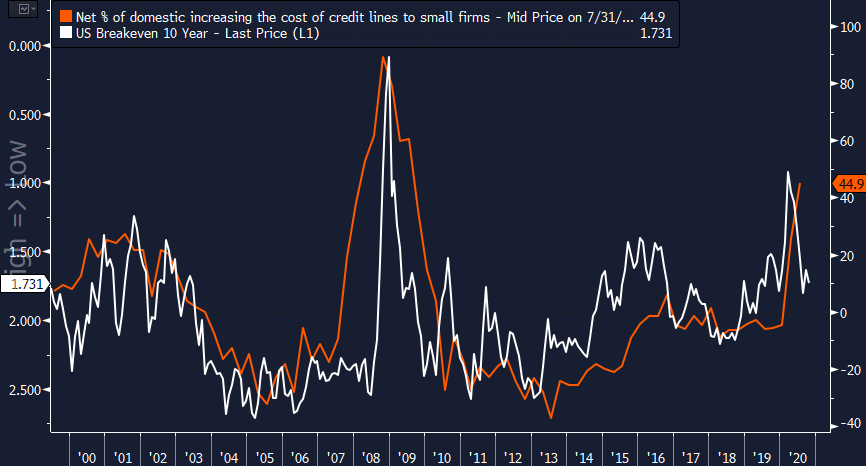

16/ Tighter credit conditions also suggest breakevens may have gotten ahead of themselves, unless we assume banks will loosen lending standards in the face of rising insolvency risk.

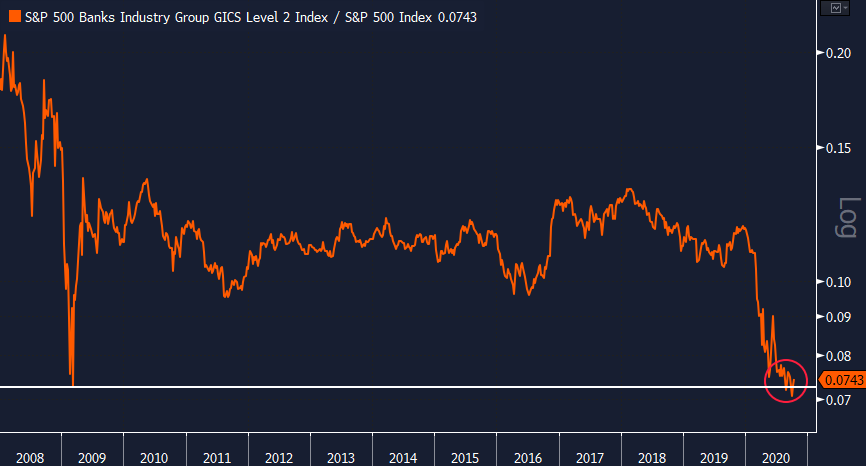

17/ Notably, U.S. bank stocks have fallen to a new relative low vs. the $SPX, reflecting rising insolvency risks given their more direct ties to Main Street and the consequences if NPLs start to stack up...

18/ Policymakers are reactive. QE is a reaction to a massive economic crisis.

Meaning it may take another down leg in asset prices to light a fire under lawmakers to get a real deal done.

Meaning it may take another down leg in asset prices to light a fire under lawmakers to get a real deal done.

19/ If Powell & Co. believed inflation was right around the corner, they wouldn’t be conducting large-scale asset purchases.

If they really believed their policy actions were working, they wouldn’t be desperately calling on their fiscal counterparts for more “stimulus”.

If they really believed their policy actions were working, they wouldn’t be desperately calling on their fiscal counterparts for more “stimulus”.

20/ But loose fiscal policy in times like this is not “stimulus” as it’s advertised; it’s a last resort to keep the economy’s head above water.

The problem is we’re fighting a recession with more and more deficit spending, in turn causing sovereign-debt-to-GDP ratios to explode.

The problem is we’re fighting a recession with more and more deficit spending, in turn causing sovereign-debt-to-GDP ratios to explode.

21/ Eventually, borrowed money must be paid back. Loan forgiveness - to the degree it exists - just shifts private sector debts to the public.

Meanwhile, each day lawmakers fail to pass another much-needed stimulus bill, it increases the likelihood of a major insolvency crisis.

Meanwhile, each day lawmakers fail to pass another much-needed stimulus bill, it increases the likelihood of a major insolvency crisis.

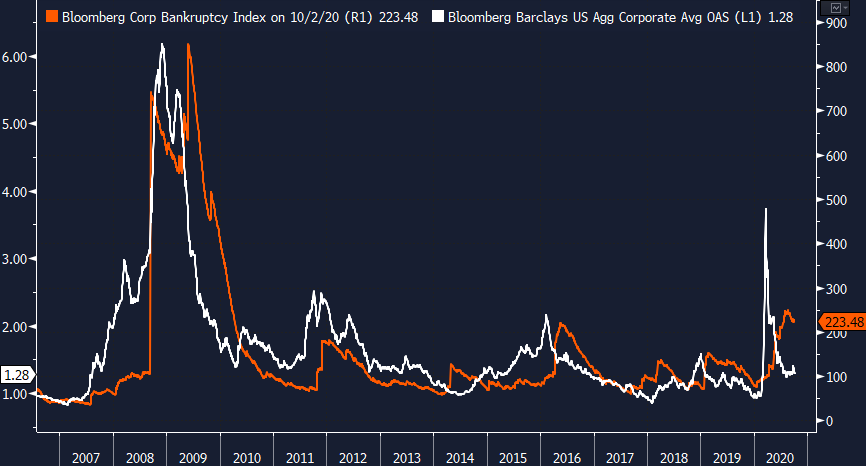

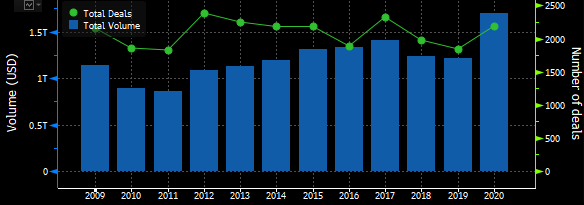

22/ Capital markets came roaring back this year, acting as a lifeboat to hundreds of entities that otherwise may not have survived.

The liquidity backstop helped suppress corp credit spreads back to mundane levels.

Question is: have we already reached peak bankruptcy levels...?

The liquidity backstop helped suppress corp credit spreads back to mundane levels.

Question is: have we already reached peak bankruptcy levels...?

23/ At the same time, the bifurcation between the “haves” and “have nots” (now more formally known as the “K-shaped” recovery) continues to widen.

US IG credit issuance for the year just broke $1.7 trillion, up ~40% vs. total issuance in all of 2019.

US IG credit issuance for the year just broke $1.7 trillion, up ~40% vs. total issuance in all of 2019.

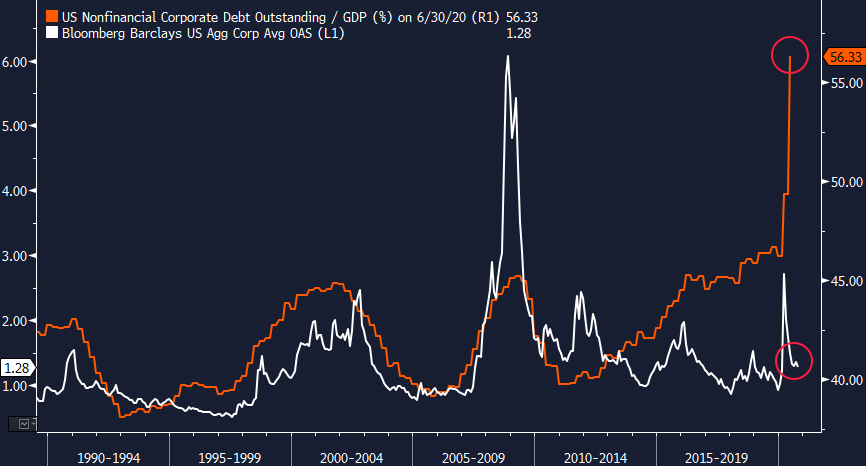

24/ This helped push nonfinancial corp debt > 55% of US nominal GDP & total nonfin business debt to 90% of US GDP…

...yet the avg yield spread on US IG corp debt is back below late 2018 levels despite the obvious deterioration in credit conditions.

(Part II of thread en route)

...yet the avg yield spread on US IG corp debt is back below late 2018 levels despite the obvious deterioration in credit conditions.

(Part II of thread en route)

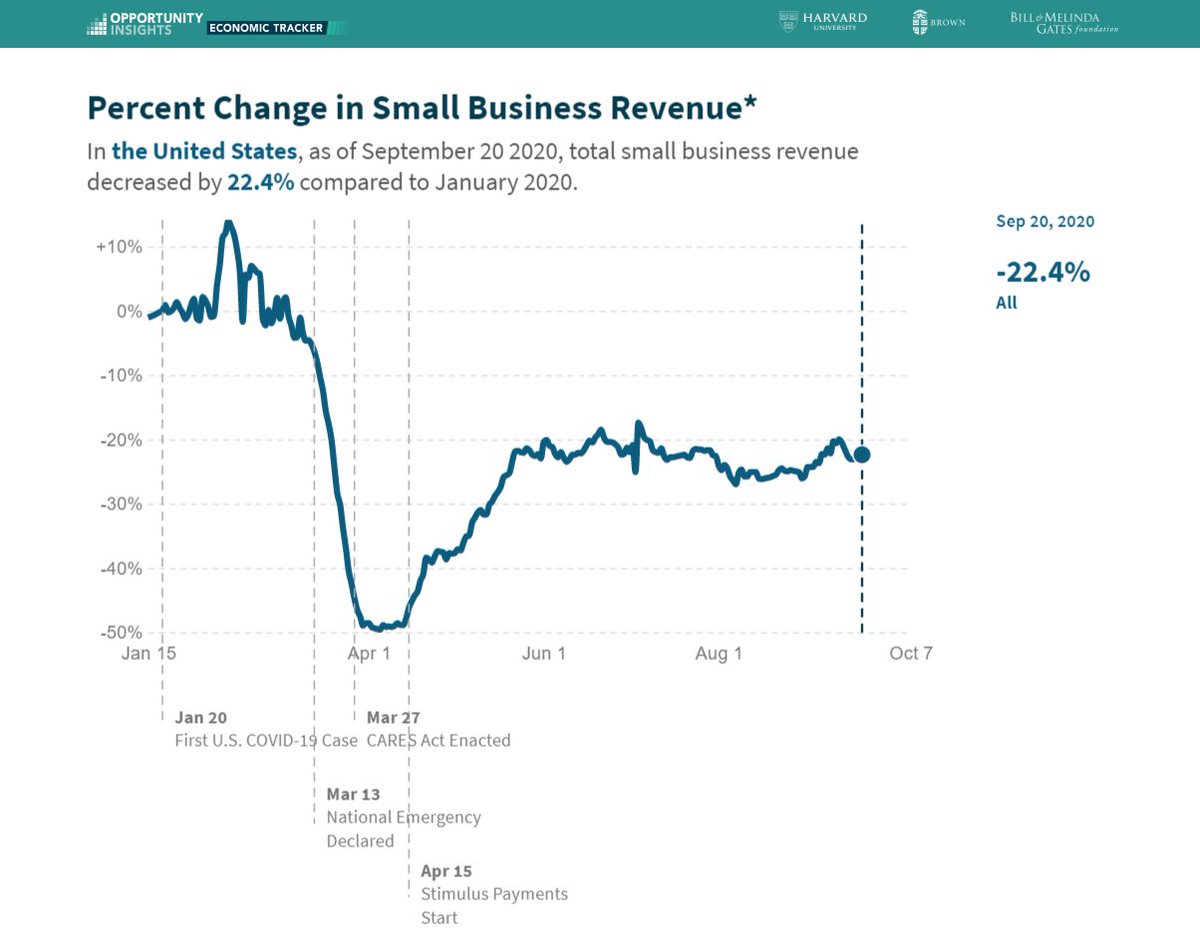

25/ Meanwhile, hundreds of thousands of small businesses have had very little luck finding relief and the modest recovery in revenues appears to have plateaued.

26/ As a result, thousands of small businesses are closing their doors every month.

Yelp’s latest September economic report indicates almost 100,000 businesses on its platform have closed permanently, a ~34% increase since mid-July.

Yelp’s latest September economic report indicates almost 100,000 businesses on its platform have closed permanently, a ~34% increase since mid-July.

27/ All in all, the big companies with access to capital markets are rowing around in a lifeboat while thousands of small and medium-sized businesses continue struggling to

stay afloat.

stay afloat.

28/ The need for more fiscal support is obvious.

We’re still facing a massive growth shortfall, the repercussions of which fall disproportionately on those least capable of bearing the burden.

Remember, the average person can’t just tap the bond market…

We’re still facing a massive growth shortfall, the repercussions of which fall disproportionately on those least capable of bearing the burden.

Remember, the average person can’t just tap the bond market…

29/ Certain pockets of the market signal more deflationary pressure - look no further than Treasuries, where demand remains strong despite today’s inflationary rhetoric.

However, the extent of deflation risk is still underappreciated IMO.

However, the extent of deflation risk is still underappreciated IMO.

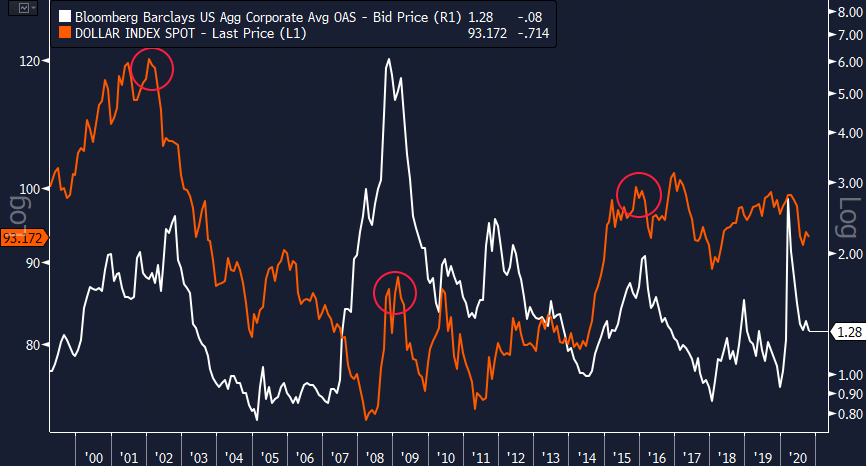

30/ The US dollar also serves as a barometer for the reflation trade and optimism (or pessimism) towards global growth.

Over the long run, we expect the dollar to weaken materially, but current conditions indicate greater upside risk to the USD trade.

Why is this so important?

Over the long run, we expect the dollar to weaken materially, but current conditions indicate greater upside risk to the USD trade.

Why is this so important?

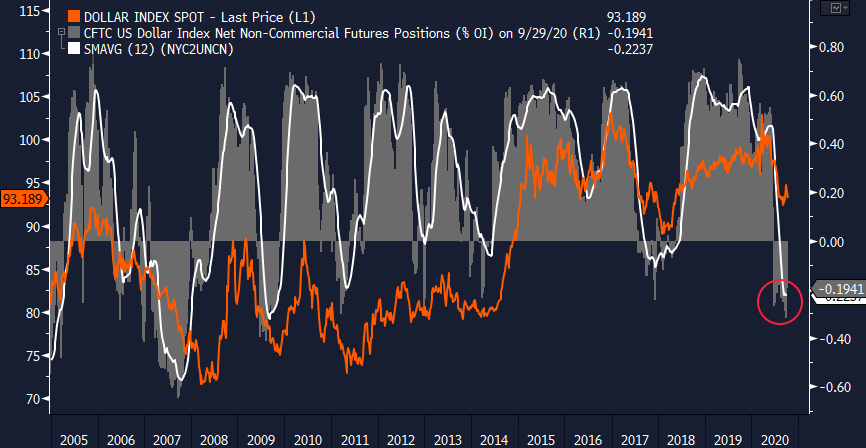

31/ Arguably, the most dominant trend in recent months has been the rapid sell-off in the US dollar.

Conversely, one of our biggest concerns has been how exposed investors are to a reversal in the USD as many of today’s most popular trades have an implicit short USD bias.

Conversely, one of our biggest concerns has been how exposed investors are to a reversal in the USD as many of today’s most popular trades have an implicit short USD bias.

32/ Precious metals (e.g. gold) are highly levered to a weaker USD, but we’ve seen similar price action in broad commodities, global equities, HY credit; even BTC/crypto.

The inverse correlation btwn $DXY and general asset prices has strengthened considerably since late June.

The inverse correlation btwn $DXY and general asset prices has strengthened considerably since late June.

33/ Yet after one of the worst stretches in recent memory, the dollar has started to show signs of life, prompting the DXY to break out of its recent descending price channel.

I cited this breakout a month ago as it threatened several popular trades. https://twitter.com/Kevin_Kelly_II/status/1303325188755423232?s=20">https://twitter.com/Kevin_Kel...

I cited this breakout a month ago as it threatened several popular trades. https://twitter.com/Kevin_Kelly_II/status/1303325188755423232?s=20">https://twitter.com/Kevin_Kel...

34/ This comes after the DXY hit its most oversold level in 10+ yrs while several indicators suggested upside dollar risk was rising.

Extreme short positioning, political gridlock, a souring economic outlook, and rising insolvency & deflation risk are just a few.

Extreme short positioning, political gridlock, a souring economic outlook, and rising insolvency & deflation risk are just a few.

35/ For starters, net speculative positioning on the DXY has hit extreme levels, indicating we may be at (or near) peak levels of pessimism.

The DXY’s Daily Sentiment Index (DSI) has also been telling a similar story (h/t @TeddyVallee).

The DXY’s Daily Sentiment Index (DSI) has also been telling a similar story (h/t @TeddyVallee).

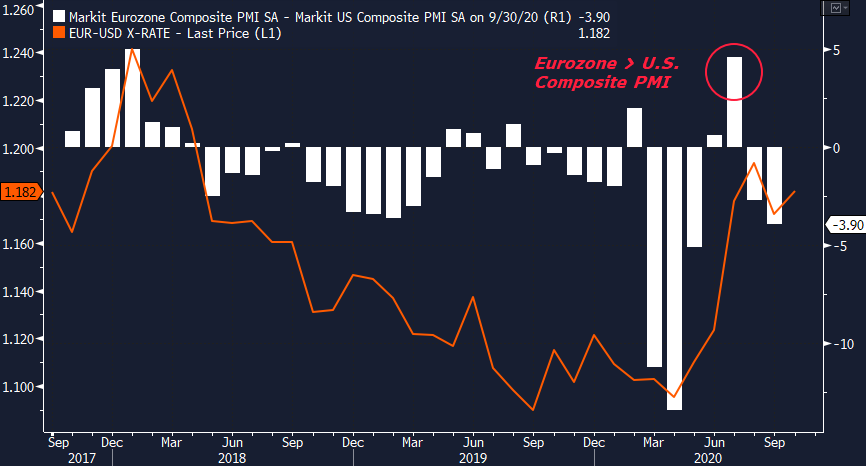

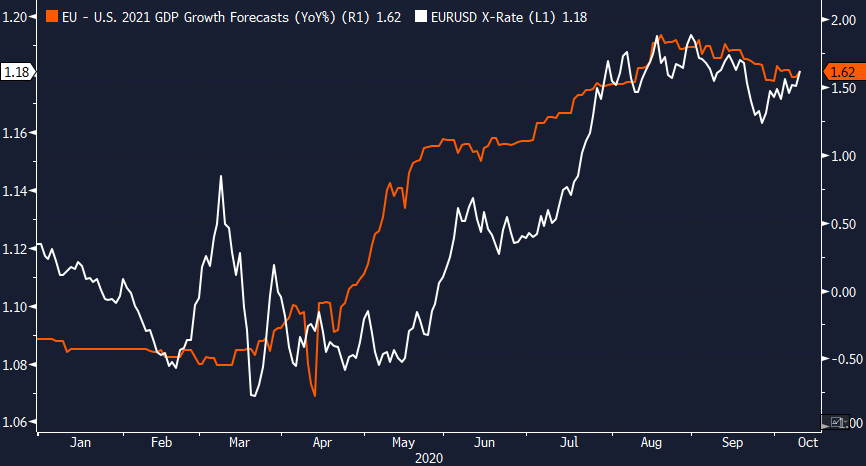

36/ But currencies are all relative and the $EUR was a critical driver of a weaker USD.

Part of the narrative driving a stronger $EUR was the strength of the euro area’s recovery relative to the US, which initially struggled to contain the virus.

Part of the narrative driving a stronger $EUR was the strength of the euro area’s recovery relative to the US, which initially struggled to contain the virus.

37/ But recent economic data suggests a stalling recovery across the pond while growth in confirmed cases is on the rise again.

38/ The spread between next year’s GDP forecasts have also begun to roll over after plateauing in August.

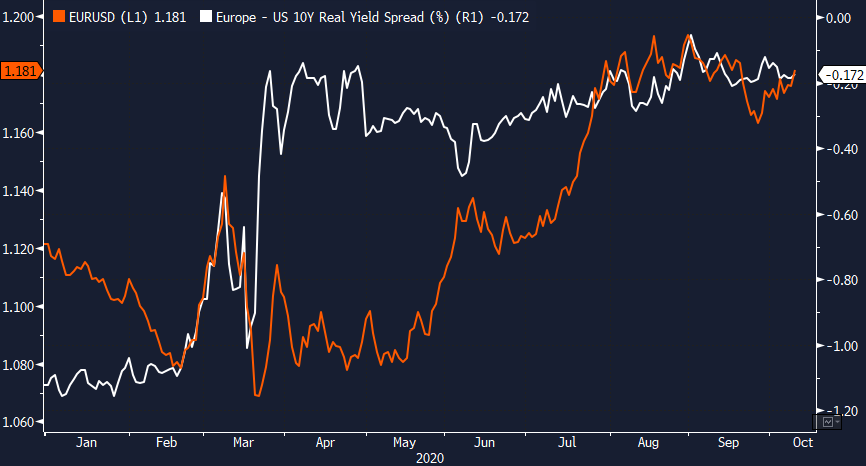

39/ Similarly, the spread between real yields in Europe vs. the US has started to widen again after narrowing considerably since early March, removing a key pillar behind the euro’s recent strength.

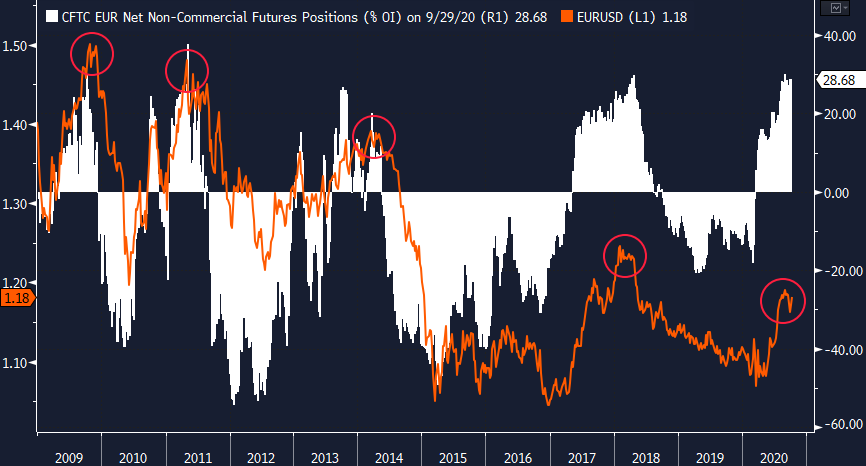

40/ In addition, EURUSD breached overbought levels on its 14-week RSI in mid-August, so a short-term pullback was warranted.

Coincidentally, net speculative positioning on the EUR just hit its highest level since April & #39;18, which happened to mark a top in EURUSD as well.

Coincidentally, net speculative positioning on the EUR just hit its highest level since April & #39;18, which happened to mark a top in EURUSD as well.

41/ This isn’t just a euro story either; several major currency pairs are either flirting with or have broken below key support levels.

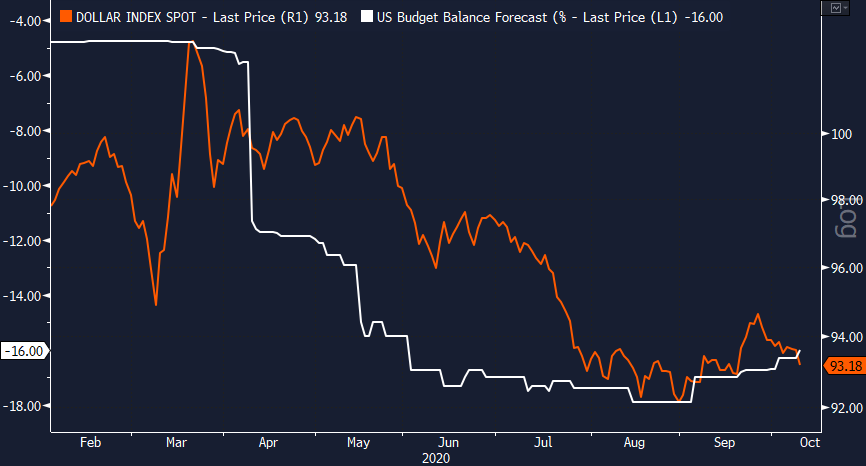

42/ In addition, forecasts for the US budget deficit in 2020 (as % GDP) have ticked slightly higher since bottoming in early September, reflecting less optimism towards another massive stimulus deal this year...

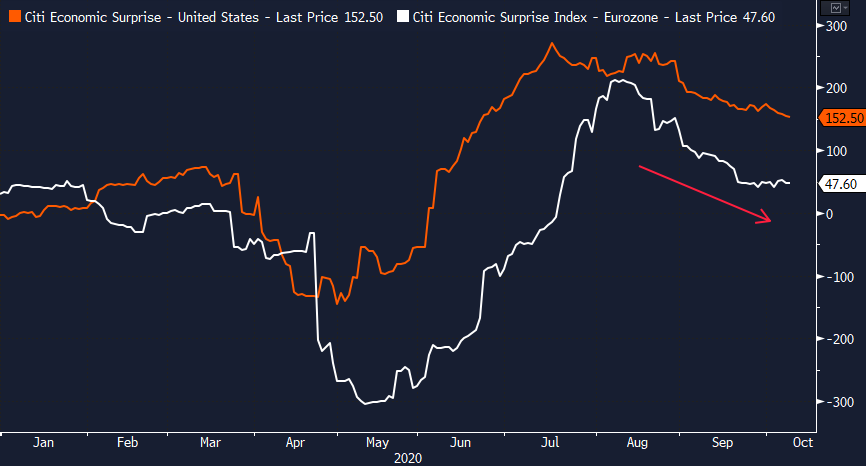

43/ ...even as incoming data warns of further deterioration in economic conditions.

The Citi US Economic Surprise Index, for example, peaked in mid-July; the Eurozone was close behind...

The Citi US Economic Surprise Index, for example, peaked in mid-July; the Eurozone was close behind...

44/ ...and if insolvency risk rises, it could drive the dollar higher in another major risk-off move.

The cascading effects of defaults, bankruptcies, & debt write-downs are powerful enough to upend the system.

Policymakers will do whatever it takes to avoid a death spiral.

The cascading effects of defaults, bankruptcies, & debt write-downs are powerful enough to upend the system.

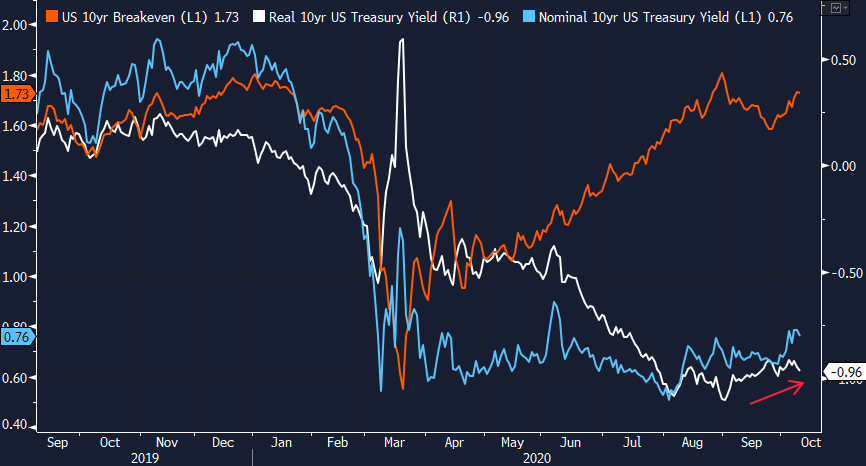

Policymakers will do whatever it takes to avoid a death spiral.

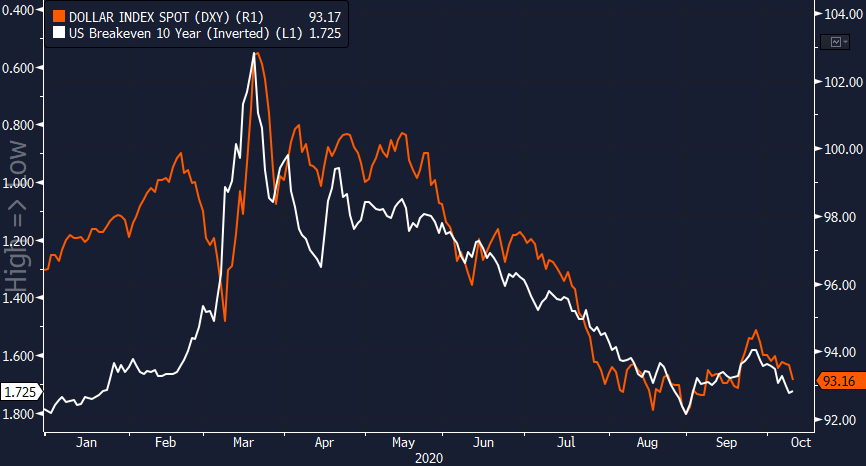

45/ Falling inflation expectations (i.e. lower breakevens) also coincide with a stronger dollar as the risk of deflation rises...

46/ ...and with a weakening economic outlook and nominal Treasury yields seemingly anchored, real yields have started to turn higher (albeit they remain near historic lows).

(Part III of thread incoming)

(Part III of thread incoming)

47/ Monetary policymakers are trying to convince the market inflation is around the corner. Why?

Bc they’re desperate to stave off its evil twin: deflation.

Yes, the market has Powell on speed dial if things turn south, but more QE isn’t going to solve the underlying problem.

Bc they’re desperate to stave off its evil twin: deflation.

Yes, the market has Powell on speed dial if things turn south, but more QE isn’t going to solve the underlying problem.

48/ Looser financial conditions + greater risk appetite among lenders is crucial to stave off a major insolvency event.

But even so, the fallout from mandated shutdowns and the new social distancing norm is yet to fully take shape.

Again, we’re not out of the woods yet...

But even so, the fallout from mandated shutdowns and the new social distancing norm is yet to fully take shape.

Again, we’re not out of the woods yet...

49/ We’ve spent the last few years outlining the macro bull case for BTC & crypto, so it should come as no surprise we’re still here arguing the backdrop has never been more conducive for this industry to thrive.

50/ But despite our long-term conviction, we also believe it’s important to acknowledge the risks that could weigh on markets in the short-to-intermediate term.

Historical Q4 performance suggests we could push to new highs, but eventually these risks must be resolved.

Historical Q4 performance suggests we could push to new highs, but eventually these risks must be resolved.

51/ Now, it’s clear deflation, insolvencies, and upside dollar risk are of paramount concern for markets (including BTC and crypto).

But what could derail this?

But what could derail this?

52/ The most likely and obvious answer is the market’s reaction to more fiscal spending. But will that be enough?

It depends on the size of the stimulus & how effective the market believes it will be in curbing the economic downturn.

It depends on the size of the stimulus & how effective the market believes it will be in curbing the economic downturn.

53/ Again, policymakers can only go so far; it’s the lenders (i.e. banks) that need to take the wheel.

54/ The market flip flops on the potential for another large stimulus package, so it’s possible asset prices rip higher on the mere sign of progress.

OTOH, markets may be pricing in a smaller deal, in which case it would take more than signs of progress to turn sentiment around.

OTOH, markets may be pricing in a smaller deal, in which case it would take more than signs of progress to turn sentiment around.

55/ Tighter monetary policy abroad would also threaten the dollar bull thesis, specifically from the ECB.

We view this as an unlikely outcome, however, given President Lagarde’s dovish stance and the reality that rising insolvency risk is not just a US issue either.

We view this as an unlikely outcome, however, given President Lagarde’s dovish stance and the reality that rising insolvency risk is not just a US issue either.

56/ Less likely, but still within the realm of possibility, is that the fears over a COVID-19 resurgence really are overblown and global growth returns to prior levels.

But even if a massive second wave fails to take hold, deflationary pressure and insolvency risk still remain.

But even if a massive second wave fails to take hold, deflationary pressure and insolvency risk still remain.

57/ Maybe we& #39;re missing something and conditions are more supportive than we& #39;re giving credit.

We can only hope that& #39;s the case because the alternative paints a far more ominous picture...

We can only hope that& #39;s the case because the alternative paints a far more ominous picture...

58/ Our recent Macro Outlook published in late September goes into more detail on all of these key topic areas.

Sign up today for access to the entire report and database of @Delphi_Digital content! http://delphidigital.io/research ">https://delphidigital.io/research&...

Sign up today for access to the entire report and database of @Delphi_Digital content! http://delphidigital.io/research ">https://delphidigital.io/research&...

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="0/ The world has morphed into one big macro trade.Asset prices are increasingly driven by global policy expectations rather than underlying fundamentals.Deflation + insolvency risk is rising.Potential knock-on effects are too important to ignore.Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="0/ The world has morphed into one big macro trade.Asset prices are increasingly driven by global policy expectations rather than underlying fundamentals.Deflation + insolvency risk is rising.Potential knock-on effects are too important to ignore.Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

![12/ Yet despite deteriorating conditions, the Fed’s Board of Governors “continues to expect that the [PDCF, CPFF, MMLF, CCFs, TALF, MLF, PPPLF] will not result in losses to the Federal Reserve."Which means the banks need to shoulder some risk if they decide to lend... 12/ Yet despite deteriorating conditions, the Fed’s Board of Governors “continues to expect that the [PDCF, CPFF, MMLF, CCFs, TALF, MLF, PPPLF] will not result in losses to the Federal Reserve."Which means the banks need to shoulder some risk if they decide to lend...](https://pbs.twimg.com/media/Ej4-rnqXYAAsAa5.png)