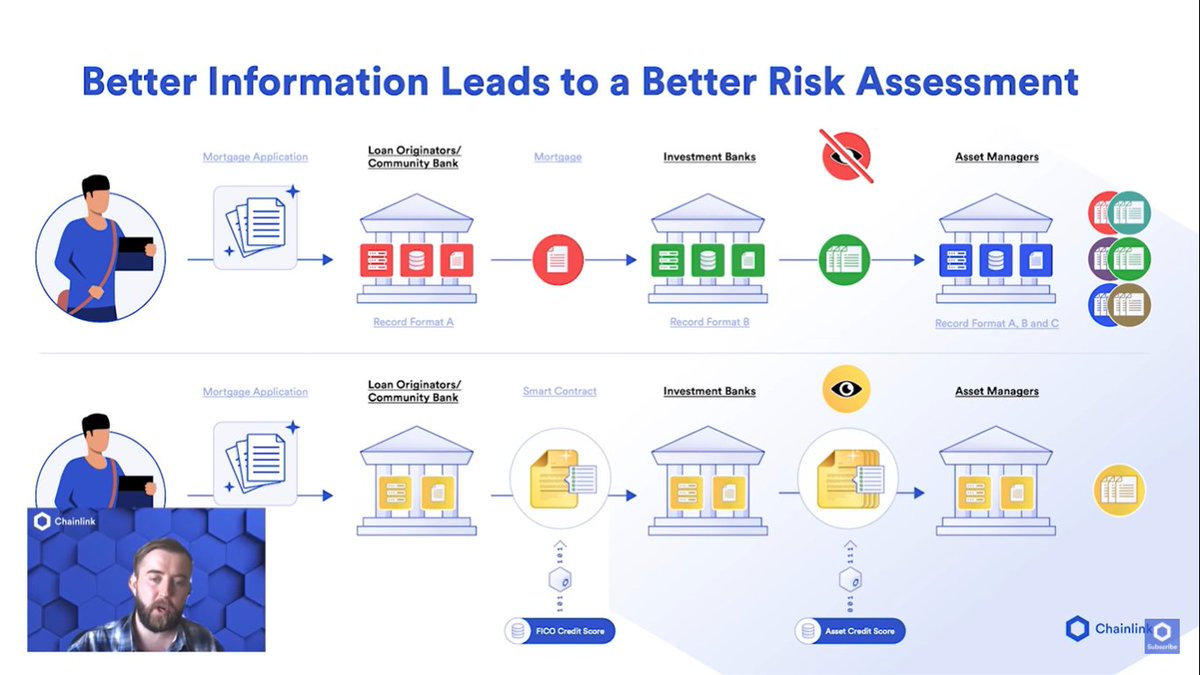

Conversely if & #39;08 was in a single source of truth model using smart contracts... $LINK

- Loan originator would have generated individual smart contract for each loan holder, they could’ve have a appended additional data to that contract like their FICO score. https://twitter.com/ButtersDankLink/status/1314279437639258113">https://twitter.com/ButtersDa...

- Loan originator would have generated individual smart contract for each loan holder, they could’ve have a appended additional data to that contract like their FICO score. https://twitter.com/ButtersDankLink/status/1314279437639258113">https://twitter.com/ButtersDa...

- Individual records can then at a much greater efficiency (therefore lower cost) be packaged up by ppl who securitize and make asset backed securities like investment banks.

- And finally, the final assets that make it to the asset managements are transparent so u don’t have basket of a million assets where who knows what they were rated or by who etc

It gives you the ability to dig in to the incremental detailed view of every loan holder. Bc u have a container that moves from institution to institution with ea additional important insight each institution has being able to be appended on to it...

When it finally reaches market, you have breadth and depth of data on each indiv asset and its value and its actually its underlying dynamic. And it is this interaction with detailed data that not only mitigates risk but allows asset managers to interact...

...with more advanced assets/ products bc now the quality of the data is so clear on asset by asset basis and proved to be so true that u can generate new assets at a much higher efficiency

In & #39;08, if each indiv had smart contract, that smart contract as a container would have moved from loan originator to the investment bank and then to asset manager, along the way amended by fico score and other relevant data....

...it makes u wonder.. if the asset managers had the ability to look into the underlying asset fundamentals at a very high degree of accuracy that is this single source of truth, maybe & #39;08 would& #39;ve been alot less painful for so many.

#Chainlink

#Chainlink

Read on Twitter

Read on Twitter