The bond market, and not the equity market, provides perhaps the best assessment of the future of the economy. And these days, no matter how you parse the data, the bond market is telling a clear story: The corporate sector and the broader economy remain at risk.

This stress is bleeding into state and local governments, which face a decreasing ability to fulfill immediate needs and long-term financial obligations. At the same time, the Treasury market is pricing in expectations of another long period of extremely low short-term rates.

Perhaps most unsettling is the risk of a deflationary spiral that is being priced into the market, and the potential of an equity market bubble.

While the partial recovery of the manufacturing sector over the summer has not been reflected in the uptick in nominal 10-year Treasury yields, the secular decline in real interest rates suggests a long & arduous recovery for inflation, investment &, ultimately economic growth.

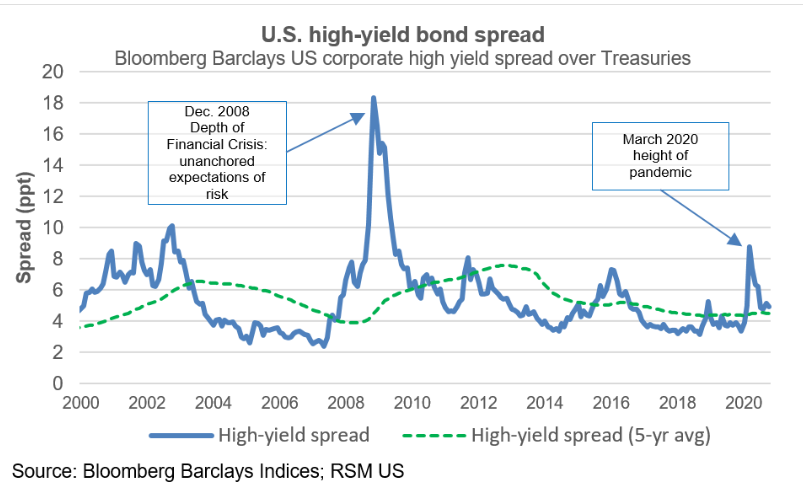

High-yield spreads suggest rising risk for marginal corporations.... High-yield spreads have backed off 25 basis points in the latest week, but the trend in increasing risk continues.

… as the risk spreads to the municipal bond market

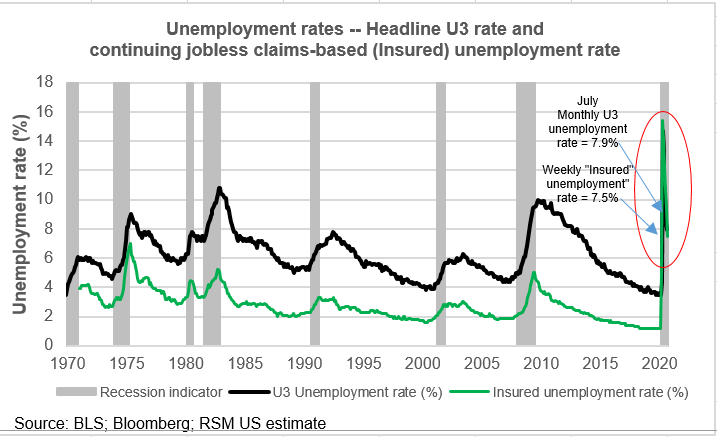

Municipal spreads have backed off, but increased risk of cash-strapped local governments continues. That implies additional layoffs for state and local employees.

Municipal spreads have backed off, but increased risk of cash-strapped local governments continues. That implies additional layoffs for state and local employees.

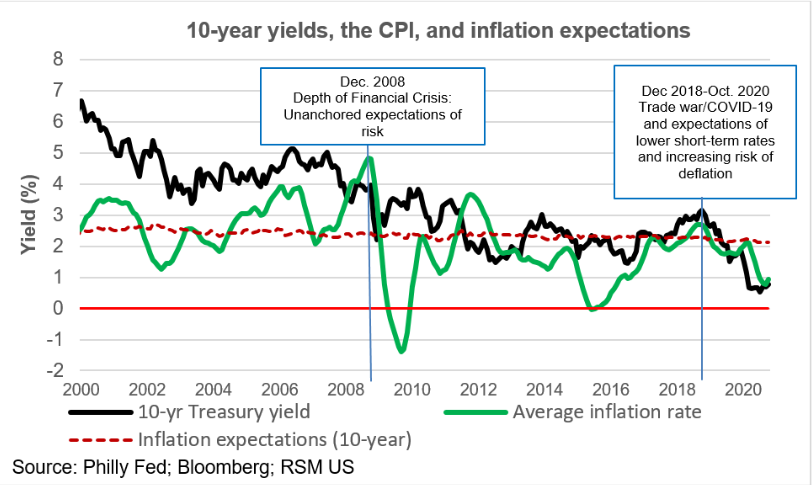

At the same time, inflation expectations and Treasury yields are falling …

Inflation expectations continue to drop toward the Fed’s 2% central target.

Inflation expectations continue to drop toward the Fed’s 2% central target.

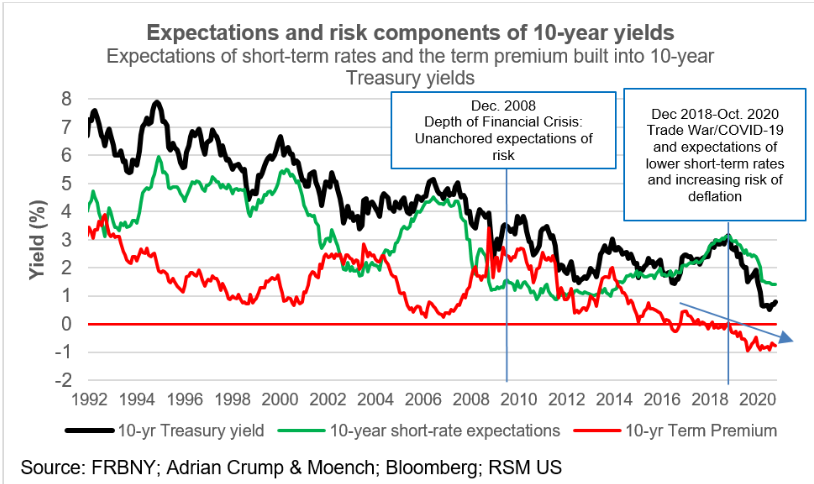

… as the term premium also continues to fall

The bond market continues to price in the risk of deflation, pushing the term premium further negative.

The bond market continues to price in the risk of deflation, pushing the term premium further negative.

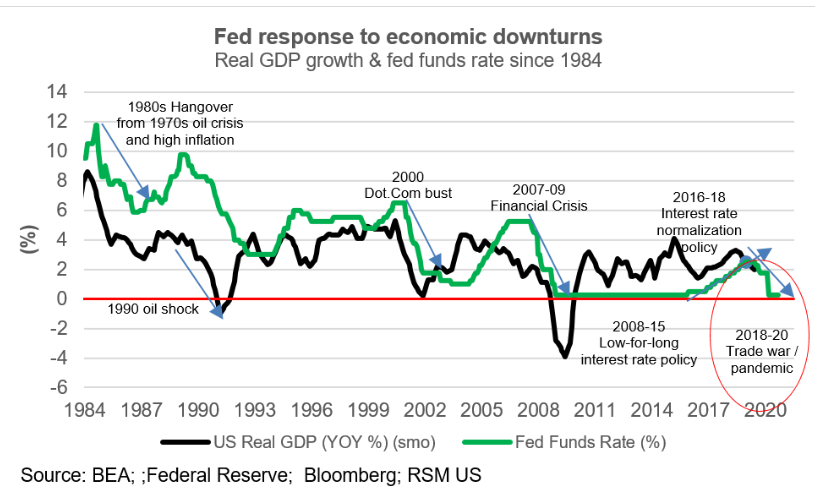

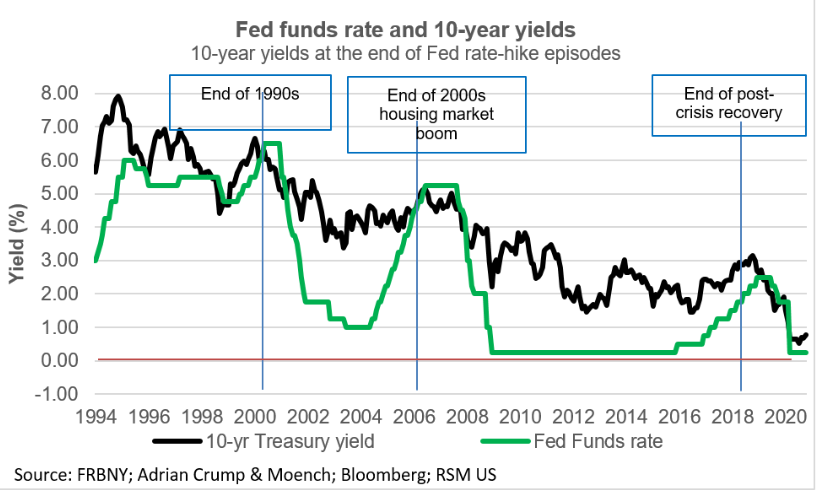

The reason? Fed policy remains consistent and appropriate …

The Fed’s manipulation of money market rates during episodes of duress has an effect on the entire yield curve, facilitating an economic recovery.

The Fed’s manipulation of money market rates during episodes of duress has an effect on the entire yield curve, facilitating an economic recovery.

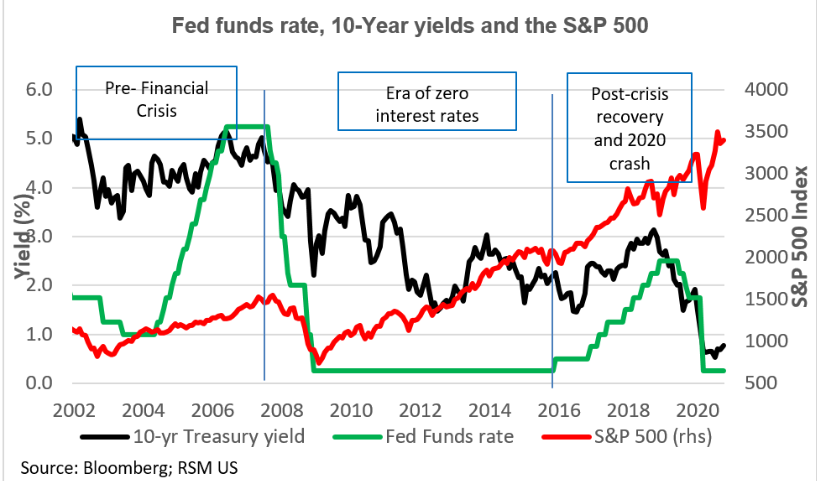

… as well as in the surging equity markets

We’ve always argued that “the stock market is not the economy,” particularly when interest rates are at the zero lower bound.

We’ve always argued that “the stock market is not the economy,” particularly when interest rates are at the zero lower bound.

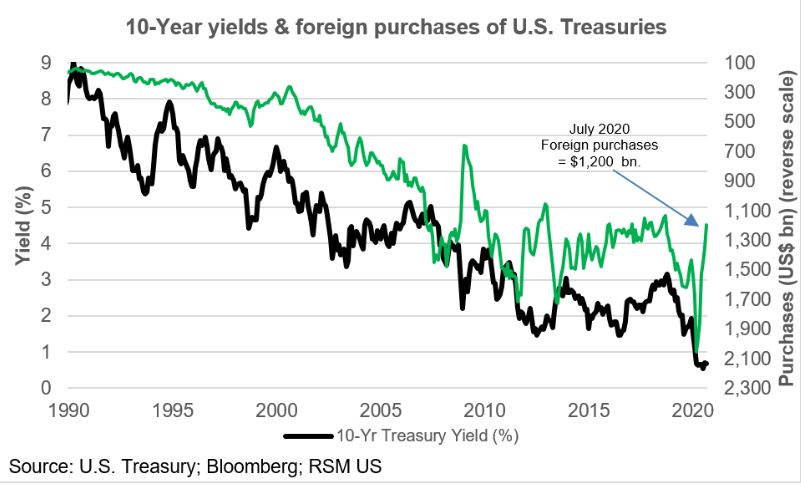

Meanwhile, foreign demand for Treasuries has fallen

Foreign demand for U.S. Treasuries dropped off during the pandemic. We attribute this to the drop in imports during the lockdown and the reduced need of foreign corporations to park profits.

Foreign demand for U.S. Treasuries dropped off during the pandemic. We attribute this to the drop in imports during the lockdown and the reduced need of foreign corporations to park profits.

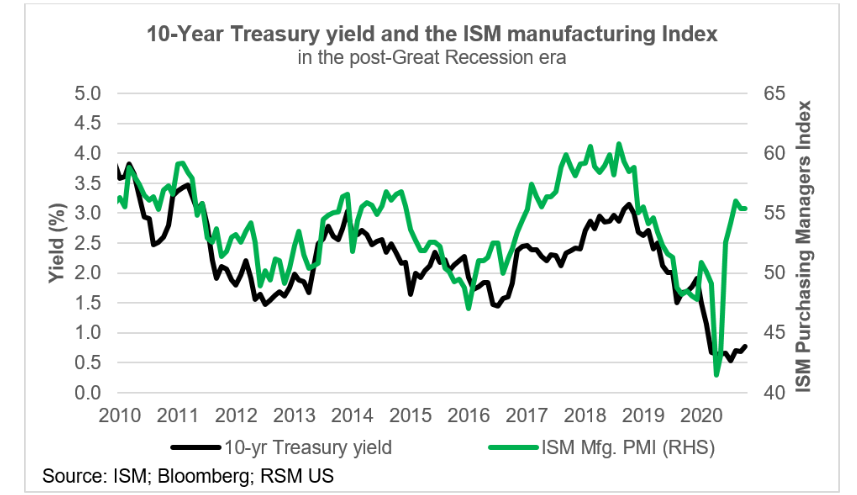

It all adds up to a bond market that is less optimistic despite a manufacturing recovery …

Though purchasing managers have signaled a recovery, the bond market has not budged all that much.

Though purchasing managers have signaled a recovery, the bond market has not budged all that much.

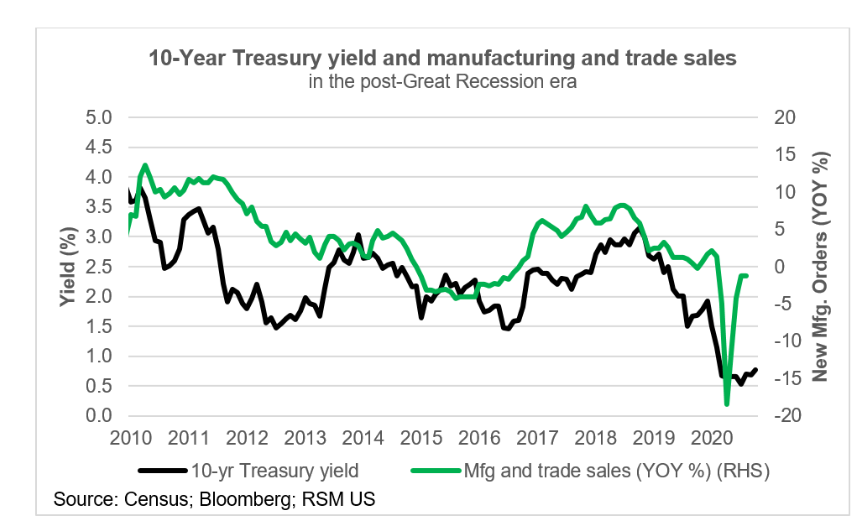

… despite increases in overall sales …

Manufacturing and trade (retail and wholesale) sales rebounded from pandemic lows.

Manufacturing and trade (retail and wholesale) sales rebounded from pandemic lows.

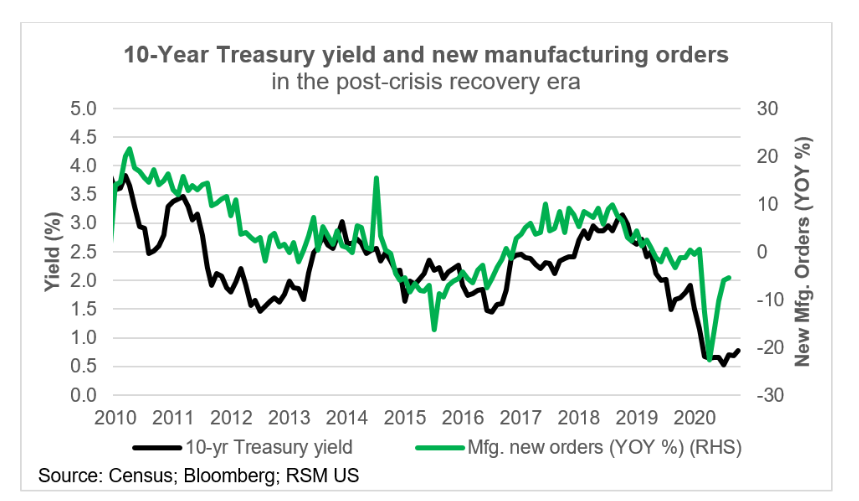

… and increases in new manufacturing orders

New manufacturing orders have rebounded from pandemic lows, but remain lower than 2019.

New manufacturing orders have rebounded from pandemic lows, but remain lower than 2019.

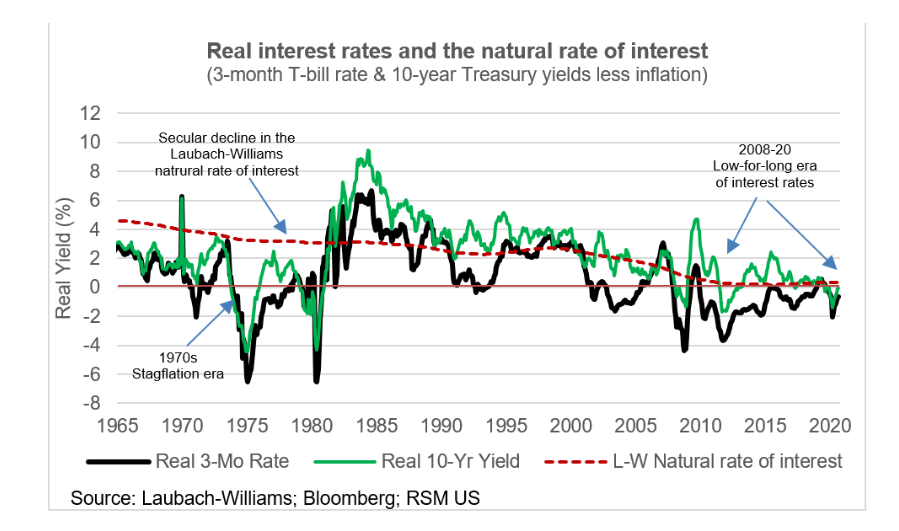

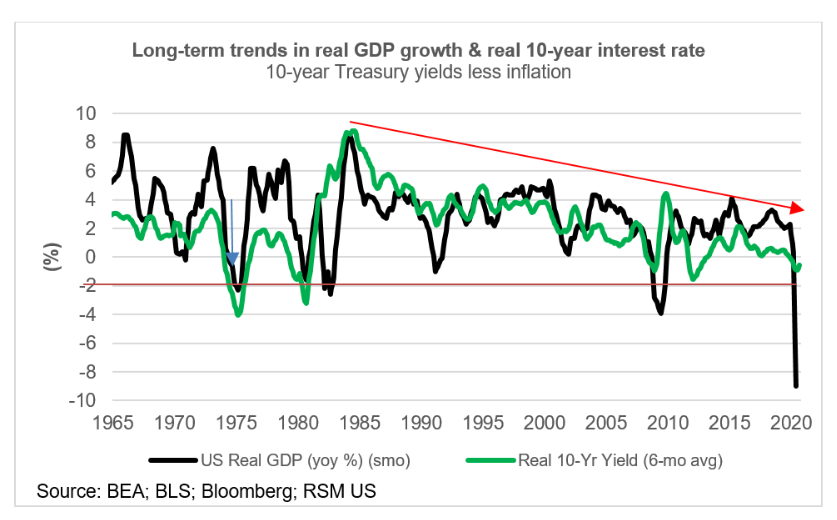

Finally, consider the long-term trends in real interest rates …Real interest rates (as measured by the yield of 10-year Treasury bonds less the inflation rate) have been trending lower since the 1980s, when the Fed (under Paul Volcker) and other central bankers squeezed...

the life out of inflation expectations. At the same time, there has been a secular decline in the natural rate of interest, the equilibrium rate of sustained growth at low levels of inflation.

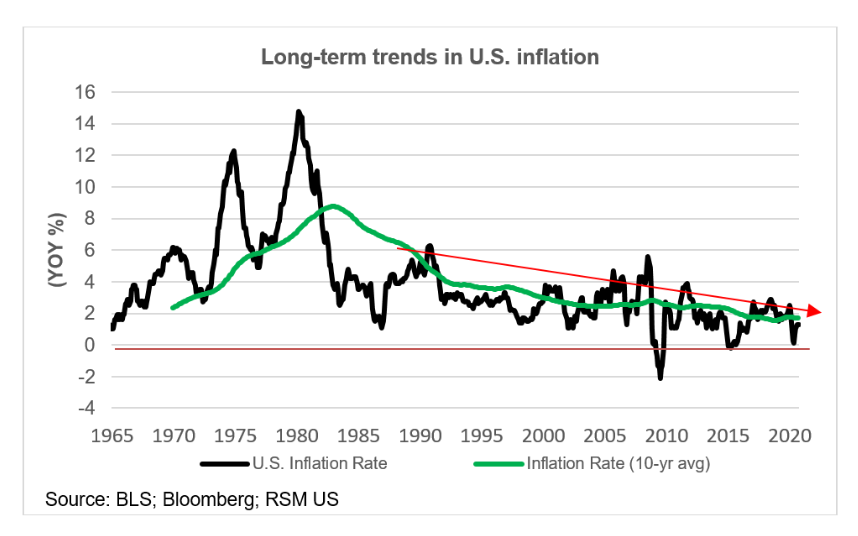

… which are falling, along with inflation …

The secular decline in real interest rates coincides with a secular decline in inflation.

The secular decline in real interest rates coincides with a secular decline in inflation.

… and, ultimately, that shows up in the rate of growth in GDP

The secular decline in real interest rates coincides with a moderation in economic output.

The secular decline in real interest rates coincides with a moderation in economic output.

If you& #39;ve made it all the way to the end of this post you have my permission to rip all of this off. Lets face it because you are anyways, its best that you have my permission.

xoxo,

JB

xoxo,

JB

Read on Twitter

Read on Twitter