Thread: Working Capital Cycle (Operating Cycle)

The book definition of WCC refers to number of days required for the entire process of business from the purchase of raw material to the realization from the customers.

The book definition of WCC refers to number of days required for the entire process of business from the purchase of raw material to the realization from the customers.

Let us, deep-dive, into the process and understand how we can apply this in the analysis of a company.

Eg: A Footwear Manufacturer:

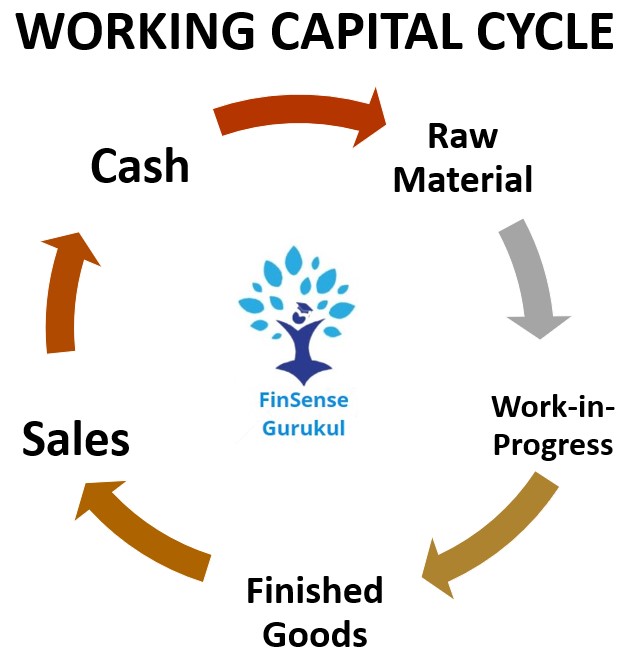

As the image above shows, first, the company procures raw material (rubber) and starts processing it to derive the final product that is Footwear.

Eg: A Footwear Manufacturer:

As the image above shows, first, the company procures raw material (rubber) and starts processing it to derive the final product that is Footwear.

The process involved is known as Work-in-progress and the final product is called Finished Goods. Once the raw material is converted into finished goods, they are sold to customers which concludes the Sales part of the cycle.

The last part of the cycle is dealing with the realizations from customers i.e. recovery from debtors (Cash). Once the cash is received, the cycle is complete. There is one more piece to this puzzle,

as we are buying raw material from some other company, we will also receive some credit period for the same. These period/days are to be reduced from the above days to arrive at Working Capital Cycle.

Eg: Let us say a process requires 15 days to covert raw material to finished goods and another 10 days for the goods to be sold. Also, the company allows 30 days credit period to customers and receives a 15 days credit period from its supplier.

The WCC comes to 40 Days (15+10+30-15). i.e. It takes company 40 days to rotate and entire operating cycle.

TIP: Lower the number of days required to complete the entire cycle better it is for the company. Always look for companies with the least possible working capital cycle.

TIP: Lower the number of days required to complete the entire cycle better it is for the company. Always look for companies with the least possible working capital cycle.

Read on Twitter

Read on Twitter