JPM& #39;s move out of financing oil and gas is a really big deal because it& #39;s the largest lender in the reserved-based lending facility model.

This credit line is what allowed US shale to grow at any cost. Companies were incentivized to keep de-risking inventory.

1/n

This credit line is what allowed US shale to grow at any cost. Companies were incentivized to keep de-risking inventory.

1/n

As oil prices kept going up, PDP reserve values increased, and banks saw a higher margin of cushion. This virtuous cycle continued even through the 2016 oil price crash.

And it wasn& #39;t until the Saudi price war 2.0 of 2020 and COVID that made the banks change their view.

2/n

And it wasn& #39;t until the Saudi price war 2.0 of 2020 and COVID that made the banks change their view.

2/n

All of a sudden, the reserved-based lending model just didn& #39;t work. If you underwrote any producer today using mid-$30 oil price forecast, PDP will be close to negative, which means no value to the banks.

3/n

3/n

And with the RBL model already in deep trouble and likely to be extinct, the announcement by JPM today that it& #39;s looking to exit oil and gas financing is the death kneel.

4/n

4/n

JPM is the largest lender for US shale RBL facilities and with it now choosing to exit oil and gas financing, this means that the lead syndicate will have to be replaced by another bank.

JPM has an exposure of $250+ billion to oil and gas, so even if a fraction is RBL.

5/n

JPM has an exposure of $250+ billion to oil and gas, so even if a fraction is RBL.

5/n

That is really bad news for any energy companies with JPM in their credit facility. So if these energy companies can& #39;t find another bank to replace JPM, then they will be forced to pay down the debt via other financing methods or the old straight up approach of FCF.

6/n

6/n

And with oil prices at $40 today, no other bank will want to take on additional oil and gas exposure even if they don& #39;t care about ESG. In addition, because no one is truly generating FCF in today& #39;s oil price environment, it means bare minimum capex and all FCF into debt.

7/n

7/n

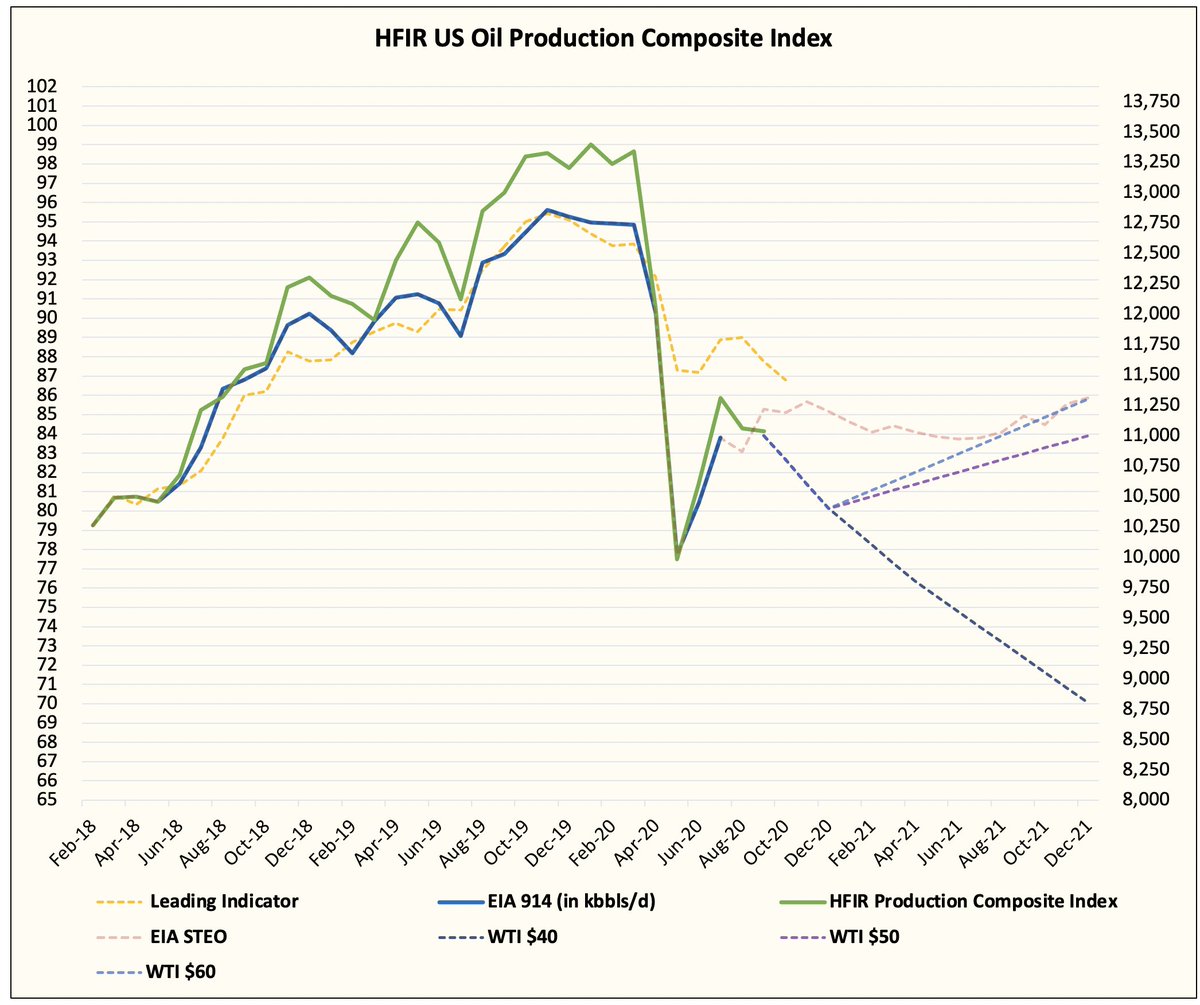

The US oil production outlook for 2021 was already ridiculously shit at $40/bbl, and this news about JPM is about to only make it worse.

8/n

8/n

What does all this mean? See screenshot.

And for those interested in the full article, see here: https://seekingalpha.com/research/5006891-hfir/5506264-update-jpms-shift-away-from-financing-oil-and-gas-will-spell-death-of-reserved-based-lending">https://seekingalpha.com/research/...

And for those interested in the full article, see here: https://seekingalpha.com/research/5006891-hfir/5506264-update-jpms-shift-away-from-financing-oil-and-gas-will-spell-death-of-reserved-based-lending">https://seekingalpha.com/research/...

Read on Twitter

Read on Twitter