Here is also something going on in Indonesia:

Just passed the Investment Law overhaul. So what& #39;s in it?

*Reducing banned sectors to 6 from >300

*Centralize business permit w/ Investment Coordinating Board

*Foreigners can own freehold apt

*Scrap dividend tax if invested locally

Just passed the Investment Law overhaul. So what& #39;s in it?

*Reducing banned sectors to 6 from >300

*Centralize business permit w/ Investment Coordinating Board

*Foreigners can own freehold apt

*Scrap dividend tax if invested locally

Labor law is one that has been rather contentious in Indonesia:

Reduce max serverence pay by employers to 19 months from 32 months.

Another one is regarding land: centralize authority over land & permits to solve the issue of overlapping claims.

Reduce max serverence pay by employers to 19 months from 32 months.

Another one is regarding land: centralize authority over land & permits to solve the issue of overlapping claims.

Regarding land, it should be positive as decentralization has been a headache & centralizing it should make Indonesia more competitive for investment.

On labor, I also think while existing workers get less protection, it may bring in more jobs & that should help overall economy.

On labor, I also think while existing workers get less protection, it may bring in more jobs & that should help overall economy.

I& #39;m interested in details of this negative list reduced to six & what that means in practice. So far, developments are going in two directions:

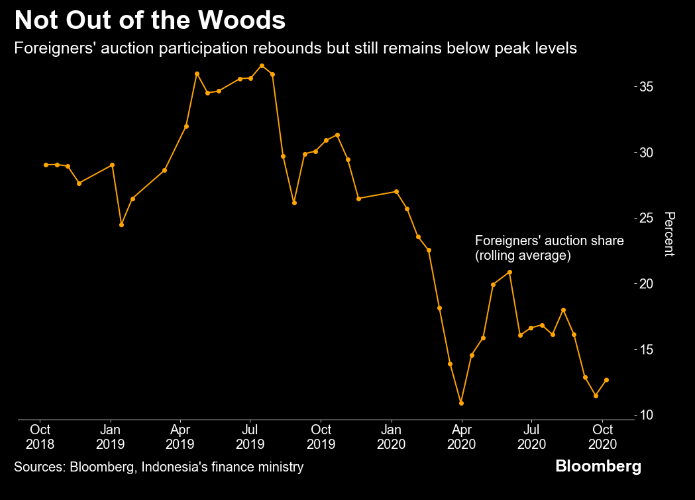

a) Facing issues of financing gap, gov is pressuring the central bank + local funds to buy government debt as foreigners turn away.

a) Facing issues of financing gap, gov is pressuring the central bank + local funds to buy government debt as foreigners turn away.

And of course foreign investors, who are a big deal in Indonesia as they own 1/3 of gov debt, are churning auctions as they see the developments of gov trying to take over BI as very negative.

Best to not do desperate measures & instill confidence in management vs tinkering.

Best to not do desperate measures & instill confidence in management vs tinkering.

b) It is finally passing the Investment Law reform to address the root of Indonesia problem: which is not enough investment to absorb labor & hence perpetual financing gap.

We& #39;ll find out next week on the implementation but it is a positive direction.

Too much of a mixed bag.

We& #39;ll find out next week on the implementation but it is a positive direction.

Too much of a mixed bag.

Meaning, they could have done without all this tinkering with monetary policy and pressuring local firms etc to buy debt & play up the Investment Reform overhaul, which in itself is a very convincing investment thesis for Indonesia.

Instead, we are here.

Instead, we are here.

If I were advising the government of Indonesia, I& #39;d do the following:

*Drop the whole changing BI mandate effort - counter productive & bad for business; foreign portfolio investors turned off & FDI investors questioning management

*Beat the drum on the investment reform bill.

*Drop the whole changing BI mandate effort - counter productive & bad for business; foreign portfolio investors turned off & FDI investors questioning management

*Beat the drum on the investment reform bill.

Read on Twitter

Read on Twitter