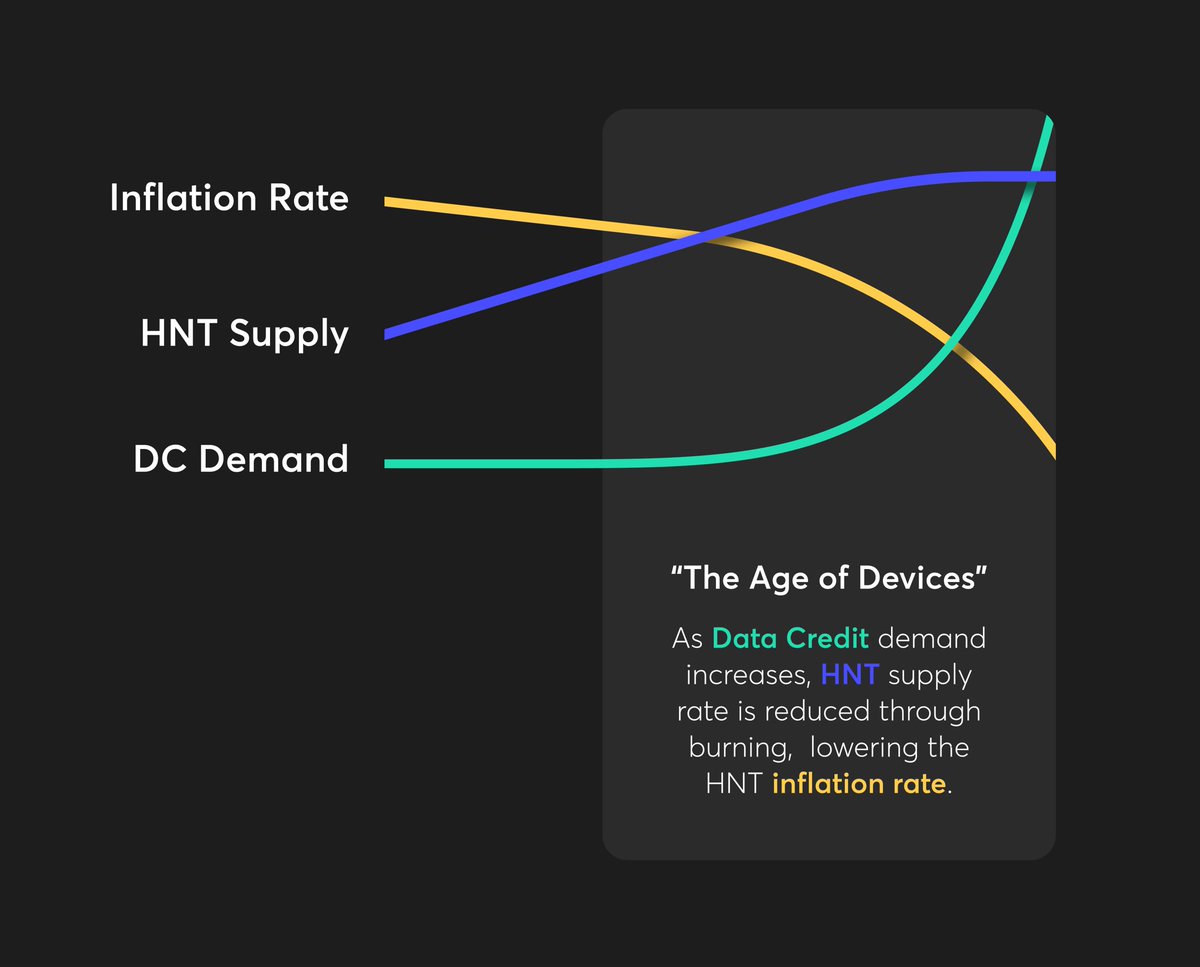

Yesterday, we shared a thread on $HNT economics and the burn-and-mint model. This graph demonstrates what the burn-and-mint model is intended to look like. But what does inflation rate mean, and what does it mean for the supply and demand of the network?

$HNT supply comes from mining with a compatible Hotspot that both mines $HNT and creates #LoRaWAN network coverage for #IoT devices. All $HNT was mined from genesis, and gets created at a fixed 5M/mo rate.

Data Credits reflect demand based on usage of the network. To create DCs, $HNT must be burned from circulation. DCs are non-transferable or resellable, and can only be used for data transmission on the network.

Read on Twitter

Read on Twitter