The focus on Prop A’s property tax cost is a flawed approach to evaluating its affordability implications. It erases renters & misinforms homeowners.

The true cost of Prop A will be lower than the initial property tax cost. Many Austinites will SAVE money. Data: 1/n

The true cost of Prop A will be lower than the initial property tax cost. Many Austinites will SAVE money. Data: 1/n

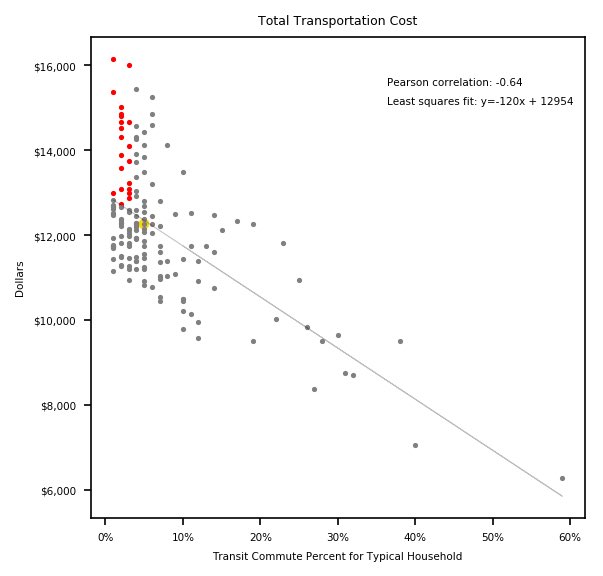

This plot visualizes 164 cities with population over 150k. It compares transit commute mode share for the typical household against household transportation costs. The red dots are below median transit use and above the trendline for cost. Austin is the yellow-bordered dot. 2/n

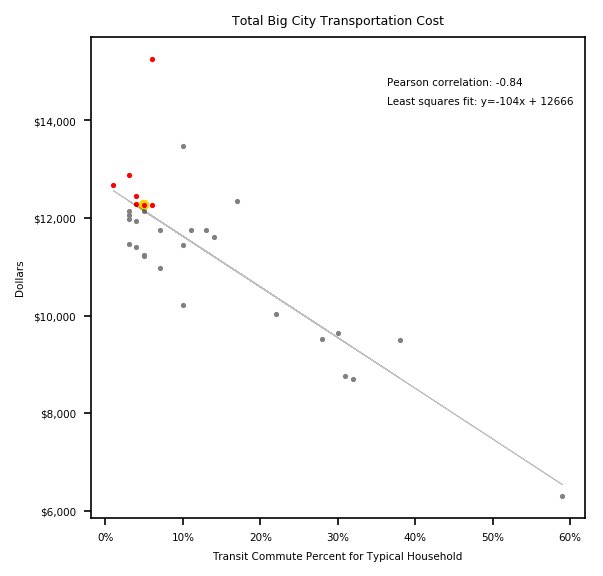

This version “zooms” in by examining the 32 US cities w/ populations over 500k. Compared to other “big cities”, Austin has low transit commute mode share and expensive household transportation costs. 3/n

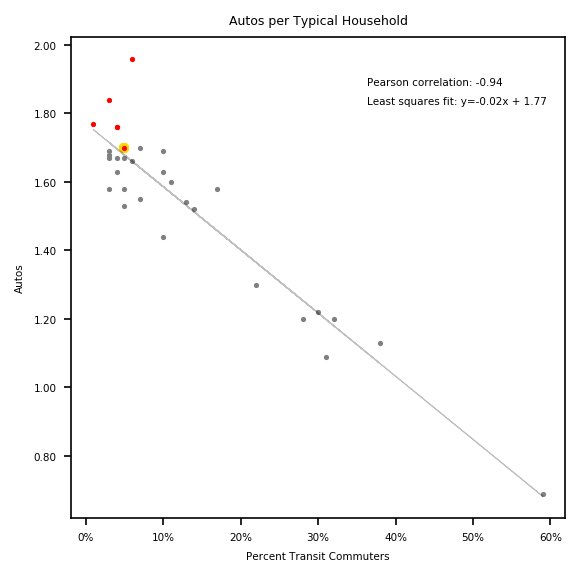

The reason for Austin’s expensive household transportation costs is pretty straightforward. Compared to other big cities, Austin’s typical household owns more cars than those in other big cities. 4/n

According to the Center for Neighborhood Technology, the typical Austin household spends $9,683/year on car ownership and another $2,508/y on mileage-based costs (gas). For the typical _homeowner_, just a reduction of ~3% of their car expense covers the property tax increase 5/n

For renters, as well as homeowners below the median value, the break-even is much lower. For the tens of thousands of Austinites that will substitute their commute into transit, this will save real money. There’s no net cost for many Austinites. This is under-explained. 6/n

At the national level, policy discourse has been poisoned by a fake objectivity that prioritizes bad faith arguments from a privileged few & emphasizes the cost of public goods, instead of their value. I hope local media and civic leaders won’t repeat this mistake w/ Prop A. 7/n

You can view data and calculations (and much more!) featured in this thread, here: [FIN] https://github.com/jga/informatx-notebooks/blob/master/affordable-transit/affordable-transit.ipynb">https://github.com/jga/infor...

Read on Twitter

Read on Twitter