1) Why the tech bubble might not pop in 2020 -

Due to my heavy tech exposure, over the past few months, I& #39;ve spent a lot of time thinking about the & #39;00-& #39;02 tech bust.

After all, COVID & #39;winners& #39; have now become mainstream and valuations have shot through the roof; so I& #39;m...

Due to my heavy tech exposure, over the past few months, I& #39;ve spent a lot of time thinking about the & #39;00-& #39;02 tech bust.

After all, COVID & #39;winners& #39; have now become mainstream and valuations have shot through the roof; so I& #39;m...

2)...naturally concerned about what may be lurking around the corner.

After considering all factors, I& #39;ve come to the conclusion that although we are in an & #39;incipient bubble& #39; the party isn& #39;t likely to end anytime soon due to two reasons...

After considering all factors, I& #39;ve come to the conclusion that although we are in an & #39;incipient bubble& #39; the party isn& #39;t likely to end anytime soon due to two reasons...

3) First and foremost, unlike early 2000, the Fed is currently extremely accommodative and creating hundreds of billions of new dollars. Furthermore, unlike early 2000, the yield curve is currently normal (not inverted).

Last but not least, unlike the 2000-2002...

Last but not least, unlike the 2000-2002...

4)...recession (when tech spending took a major hit and business fundamentals deteriorated rapidly); during the current recession, ecommerce/online payments/software companies have continued to report very strong numbers.

In fact, many companies& #39; revenue growth has...

In fact, many companies& #39; revenue growth has...

5)....accelerated during this crisis!

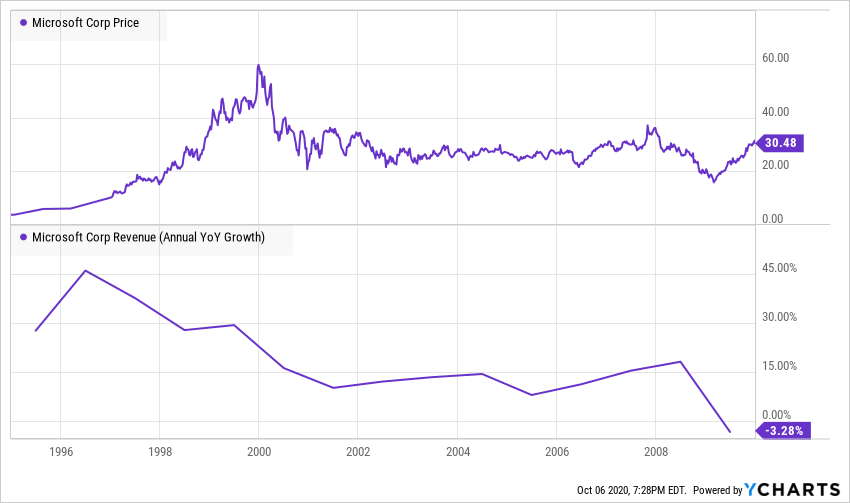

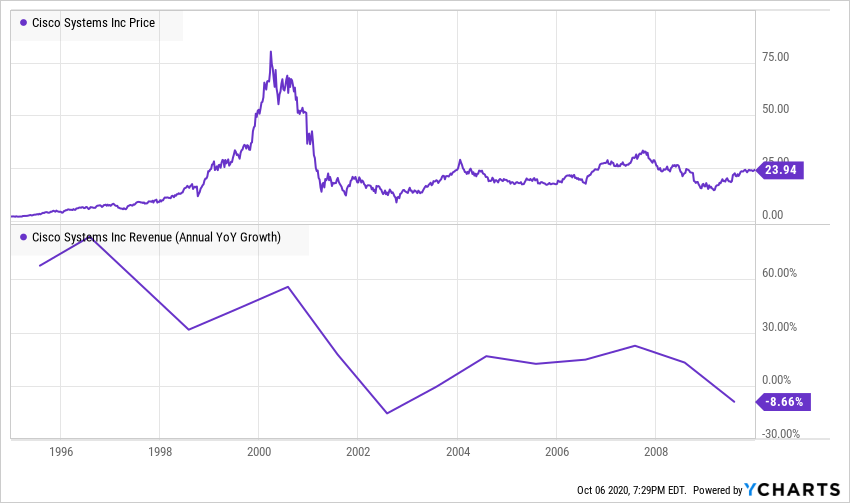

Below, I& #39;ve attached three charts of the late 90s & #39;tech darlings& #39; - stock price at the top, revenue growth in the bottom panel.

You& #39;ll see that the YOY revenue growth of these companies...

Below, I& #39;ve attached three charts of the late 90s & #39;tech darlings& #39; - stock price at the top, revenue growth in the bottom panel.

You& #39;ll see that the YOY revenue growth of these companies...

6)...decelerated sharply in 2000 and continued to drift lower for an entire decade.

So, when sky-high valuations collided with weakening business fundamentals, the bubble popped and these stocks imploded.

Chart A - Microsoft $MSFT

So, when sky-high valuations collided with weakening business fundamentals, the bubble popped and these stocks imploded.

Chart A - Microsoft $MSFT

9) In summary, ecommerce, online payments and software businesses today are reporting stellar results and in many cases, they are benefiting from COVID-19.

Finally, unlike early & #39;00 when the FFR was ~5.5%, today it is near ZERO!

This is why I think the end may not be nigh.

Finally, unlike early & #39;00 when the FFR was ~5.5%, today it is near ZERO!

This is why I think the end may not be nigh.

Read on Twitter

Read on Twitter