A step-by-step solution for this table problem. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

• Step 1: Find the Key Terms + Assumptions

• Step 2: PPS + Share # for Note (Pre-Money)

• Step 3: Share # + PPS for Safe (Post-Money)

• Step 4: Option Exp.

• Step 5: Share # for Series Seed Preferred https://twitter.com/ChrisHarveyEsq/status/1309585760979361792?s=20">https://twitter.com/ChrisHarv...

• Step 1: Find the Key Terms + Assumptions

• Step 2: PPS + Share # for Note (Pre-Money)

• Step 3: Share # + PPS for Safe (Post-Money)

• Step 4: Option Exp.

• Step 5: Share # for Series Seed Preferred https://twitter.com/ChrisHarveyEsq/status/1309585760979361792?s=20">https://twitter.com/ChrisHarv...

Step #1: Key Terms + Assumptions

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel"> What are the Conversion Terms of the Note? (see @rlj_law tweet)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔑" title="Schlüssel" aria-label="Emoji: Schlüssel"> What are the Conversion Terms of the Note? (see @rlj_law tweet)

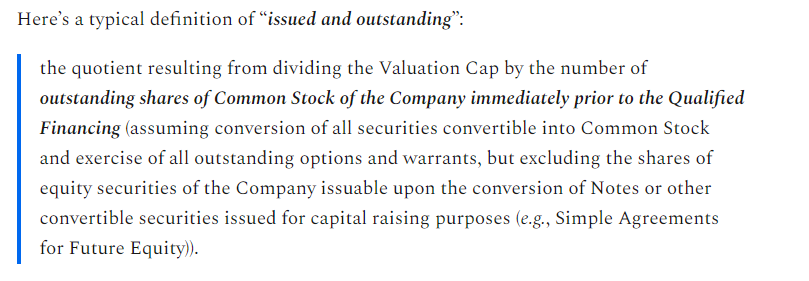

Two basic ways to calculate Pre-Money Shares:

a) Issued & Outstanding

b) Fully-Diluted

This cap table problem uses both ways:

• Note = a

• Safe = b https://twitter.com/rlj_law/status/1310059341081440256?s=20">https://twitter.com/rlj_law/s...

Two basic ways to calculate Pre-Money Shares:

a) Issued & Outstanding

b) Fully-Diluted

This cap table problem uses both ways:

• Note = a

• Safe = b https://twitter.com/rlj_law/status/1310059341081440256?s=20">https://twitter.com/rlj_law/s...

1a) Issued & Outstanding

The first way is simple: Calculate the total outstanding pre-money shares, including:

• Common Stock Issued

• Options Granted

*BUT excluding Currently Available Options & Expanded Option Pool. "Reserves" are silent here which means they& #39;re excluded.

The first way is simple: Calculate the total outstanding pre-money shares, including:

• Common Stock Issued

• Options Granted

*BUT excluding Currently Available Options & Expanded Option Pool. "Reserves" are silent here which means they& #39;re excluded.

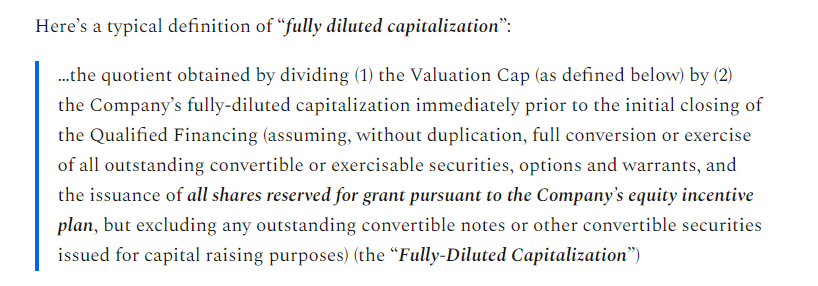

1b) Fully-Diluted Basis

The second way is more complex: Calculate all securities on a fully-diluted basis (including reserved plan and ungranted options) so that the existing common stockholders will assume the dilutive effects when those options are issued and exercised.

The second way is more complex: Calculate all securities on a fully-diluted basis (including reserved plan and ungranted options) so that the existing common stockholders will assume the dilutive effects when those options are issued and exercised.

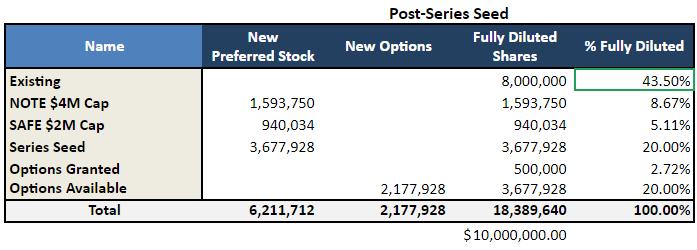

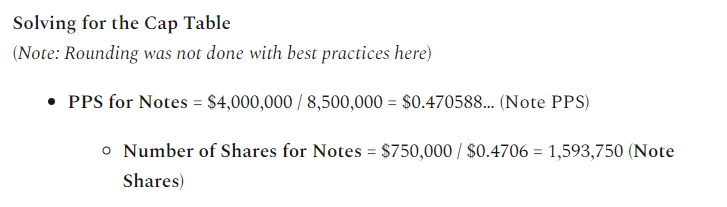

Step #2: Calculate the PPS + Share # for the Note (Pre-Money)

• m (PPS) = Valuation Cap (a) / Issued & Outstanding Shares (x)

• n (# Note Shares) = Principal + Interest on Note (d) / m

Calculating:

• m = $4M / 8.5M = $0.470588

• n = $750K / $0.470588 = 1,593,750

• m (PPS) = Valuation Cap (a) / Issued & Outstanding Shares (x)

• n (# Note Shares) = Principal + Interest on Note (d) / m

Calculating:

• m = $4M / 8.5M = $0.470588

• n = $750K / $0.470588 = 1,593,750

Step #3: Solve the Share # + PPS for Safe

This is where things get #Tricky.

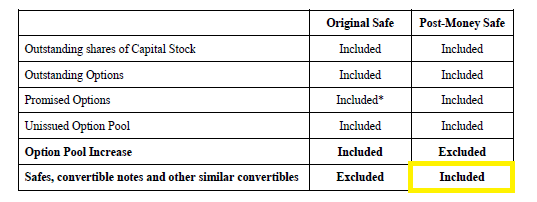

Post-Money Safes convert on a fully diluted basis + all other Safes, notes and convertibles ("Company Capitalization"). If stacked, Safes can be dilutive.

🖩 ALL SHARES but the Option Pool Expansion:

This is where things get #Tricky.

Post-Money Safes convert on a fully diluted basis + all other Safes, notes and convertibles ("Company Capitalization"). If stacked, Safes can be dilutive.

🖩 ALL SHARES but the Option Pool Expansion:

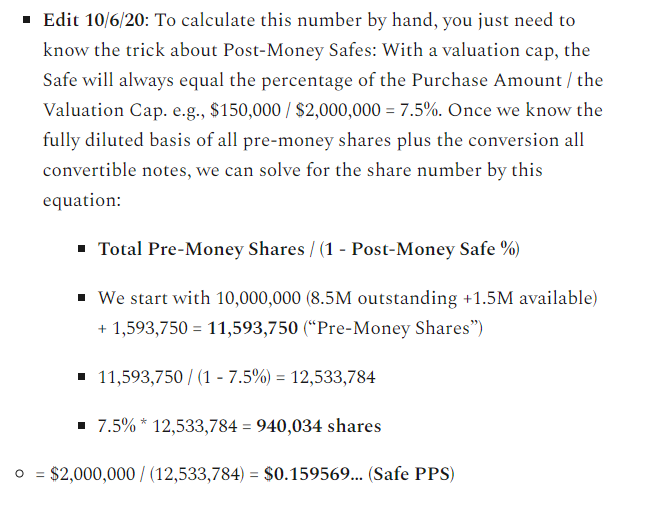

Step #3 (cont): Calculating the Share # + PPS for Safe

Purchase Amount ($150K) / Valuation Cap ($2M) = 7.5%

Add 7.5% to the Total # of Pre-Money Shares:

• Total # = 11,593,750 / (1 - 7.5%)

• Cap ($2M) / Total # (12,533,784) = $0.15957 (PPS)

• Safe #=7.5% * Total # = 940,034

Purchase Amount ($150K) / Valuation Cap ($2M) = 7.5%

Add 7.5% to the Total # of Pre-Money Shares:

• Total # = 11,593,750 / (1 - 7.5%)

• Cap ($2M) / Total # (12,533,784) = $0.15957 (PPS)

• Safe #=7.5% * Total # = 940,034

Step 4: Calculate Option Pool Expansion

Two ways to solve it:

1. The "easy way": Circular reference in Excel.

2. The "hard way": F*#&!ng Math.

Option Pool Expansion = [(x * n * u * o * t) / p - (o * t)]

Variables are attached on this neat lil& #39; cheat sheet

= 3,677,928

Two ways to solve it:

1. The "easy way": Circular reference in Excel.

2. The "hard way": F*#&!ng Math.

Option Pool Expansion = [(x * n * u * o * t) / p - (o * t)]

Variables are attached on this neat lil& #39; cheat sheet

= 3,677,928

Step 5: Calculate PPS & Share # for the Seed Preferred

If you& #39;re still with me, I& #39;m impressed!

Final numbers:

• Seed PPS (v) = Pre-Money Valuation / (Pre-Money Shares (x) + Note # (n) + Safe # (u) + Option # (Y) = $0.543784

• Investor # (Z) = $2M / $0.543784 = 3,677,928

If you& #39;re still with me, I& #39;m impressed!

Final numbers:

• Seed PPS (v) = Pre-Money Valuation / (Pre-Money Shares (x) + Note # (n) + Safe # (u) + Option # (Y) = $0.543784

• Investor # (Z) = $2M / $0.543784 = 3,677,928

Law of VC #9 explains this in more detail

(cap table URLs to follow) https://lawofvc.substack.com/p/9-episode-the-mutable-laws-of-vc">https://lawofvc.substack.com/p/9-episo...

(cap table URLs to follow) https://lawofvc.substack.com/p/9-episode-the-mutable-laws-of-vc">https://lawofvc.substack.com/p/9-episo...

Cap Table #1 (modified from @VentureHacks):

https://docs.google.com/spreadsheets/d/19mrm8tPDW69VLBY_14YMbzeP741pkSAiL-INCps4-Kw/edit?usp=sharing

Cap">https://docs.google.com/spreadshe... Table #2 (h/t to @jbkupperman for the original template): https://docs.google.com/spreadsheets/d/1BPix24rW929n-CBSvD-PQleD06HoXyZqsrAAXvF01Lw">https://docs.google.com/spreadshe...

https://docs.google.com/spreadsheets/d/19mrm8tPDW69VLBY_14YMbzeP741pkSAiL-INCps4-Kw/edit?usp=sharing

Cap">https://docs.google.com/spreadshe... Table #2 (h/t to @jbkupperman for the original template): https://docs.google.com/spreadsheets/d/1BPix24rW929n-CBSvD-PQleD06HoXyZqsrAAXvF01Lw">https://docs.google.com/spreadshe...

Read on Twitter

Read on Twitter

![Step 4: Calculate Option Pool ExpansionTwo ways to solve it:1. The "easy way": Circular reference in Excel.2. The "hard way": F*#&!ng Math.Option Pool Expansion = [(x * n * u * o * t) / p - (o * t)]Variables are attached on this neat lil& #39; cheat sheet= 3,677,928 Step 4: Calculate Option Pool ExpansionTwo ways to solve it:1. The "easy way": Circular reference in Excel.2. The "hard way": F*#&!ng Math.Option Pool Expansion = [(x * n * u * o * t) / p - (o * t)]Variables are attached on this neat lil& #39; cheat sheet= 3,677,928](https://pbs.twimg.com/media/EjrMBx_U8AEmImT.png)