1/ Why Value & Growth is no longer just about valuation.

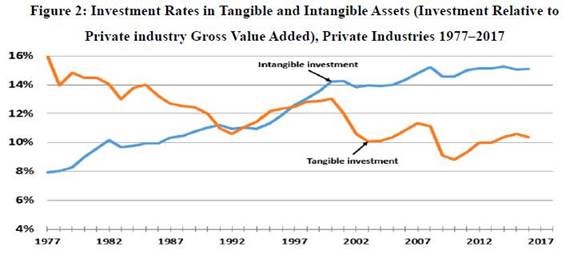

The nature of business is not static. While core principals are often timeless, the underlying dynamics can change dramatically over time. Case in point, this is one of the most important charts in investing.

The nature of business is not static. While core principals are often timeless, the underlying dynamics can change dramatically over time. Case in point, this is one of the most important charts in investing.

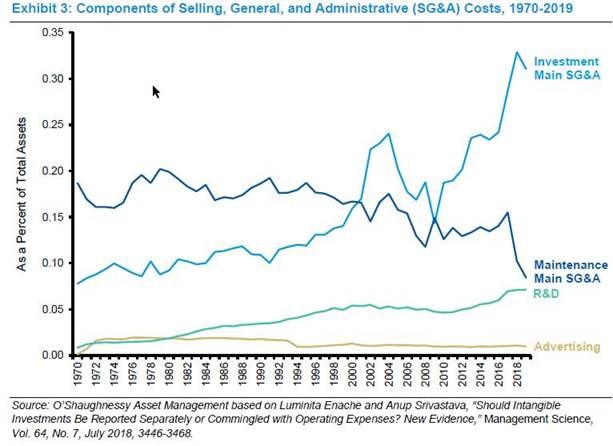

2/ Because GAAP accounting treats corporate investment in tangible assets differently than intangible assets, this shift changes what is deemed “earnings” and thus the meaning of many valuation measures.

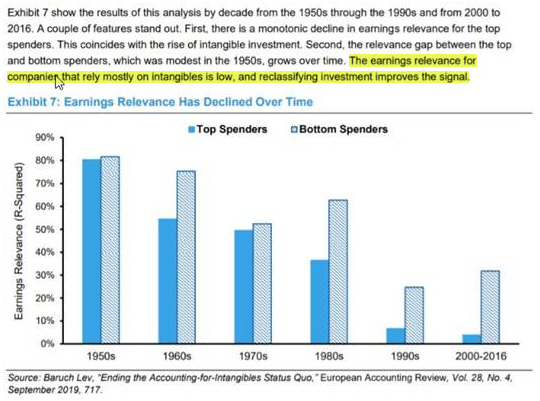

4/ Why would earnings become less relevant? Because reported earnings include immediate expensing of intangible investments, but not tangible investments. And during the last 10-20 years, intangible investments have gone up dramatically.

5/ The two charts above come from a recent paper by @mjmauboussin.

https://www.morganstanley.com/im/publication/insights/articles/articles_onejob.pdf?1600268687963">https://www.morganstanley.com/im/public...

https://www.morganstanley.com/im/publication/insights/articles/articles_onejob.pdf?1600268687963">https://www.morganstanley.com/im/public...

6/ This isn’t just an academic concept. Warren Buffett understands and embraces this change, even as many of his disciples refuse to recognize it. https://intrinsicinvesting.com/2017/05/16/warren-buffett-declares-new-phase-of-his-investment-philosophy/">https://intrinsicinvesting.com/2017/05/1...

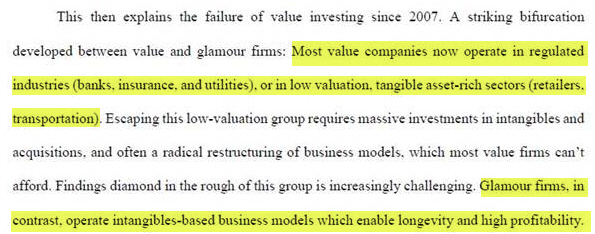

7/ Most investors think about the difference between Value and Growth stocks as being just about valuation. But during the last 10-15 years, Value/Growth has meant very different types of businesses too. From Explaining the Recent Failure of Value Investing:

8/ Does this mean value investing is dead? No! Not at all. It just means that historically useful valuation metrics are no longer as useful. But if you do the work to understand the cash economics of businesses and ignore the value/growth framework, you can find great bargains.

9/ The Failure of Value Investing study developed a systematic approach to adjusting reported financials to better account for intangible investments and found: “roughly 40-60% of value and glamour stocks changed classification due to our intangibles book value adjustments”:

10/ Here’s the full research report: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3442539">https://papers.ssrn.com/sol3/pape...

11/ So what does all this mean? Buying stocks for less than they are worth hasn’t stopped working and never will. But valuation multiples based on standard accounting are no longer directly comparable to the past and they won’t be in the future either.

12/ If your strategy is to do the hard work to understand a business’s cash economics and then to buy stocks that trade at a discount to the present value of the likely future cash flow stream, you’ll do just fine regardless of whether you buy "value" or "growth" stocks.

13/ But if your strategy is to buy classes of stocks which exhibit valuation metrics that appear “cheap,” all you’re really doing is shorting the rise of the intangible economy and hoping for mean reversion to a tangible asset past that will never return.

Read on Twitter

Read on Twitter