remember 2008 GFC, when we became experts on shadow banking & regulators finally accepted securitization can create systemic risk instead of better distributing it?

12 years later, European Banking Authority + European Commission quietly dismantling that regulatory regime.

12 years later, European Banking Authority + European Commission quietly dismantling that regulatory regime.

when Lord Hill got Finance portfolio at European Commission as olive branch to Cameron government in 2014, we got #CapitalMarketsUnion - a Trojan horse for private finance lobbies to fight back against FTT and bank structural separation plans of European Parliament

CMU rapidly became market-building strategy: & #39;we are back to working with, not on, finance& #39; (Lord Hill) to breathe new life into European securitization market through STS initiative: simple, transparent & standardised securitization.

Senior STS tranche = preferential regulation

Senior STS tranche = preferential regulation

with @forfinancewatch and others, we worked with European Parliament to ensure at least some tight rules on STS - https://www.europarl.europa.eu/cmsdata/103517/Gabor_STS_EP_PublicHearing.pdf">https://www.europarl.europa.eu/cmsdata/1...

private finance wanted synthetic securitization in STS, EP prevailed and kept them out - with exception of on-balance-sheet synthetics on SME loans (SMEs are the Panda bears of capital market lobbies and Commission)

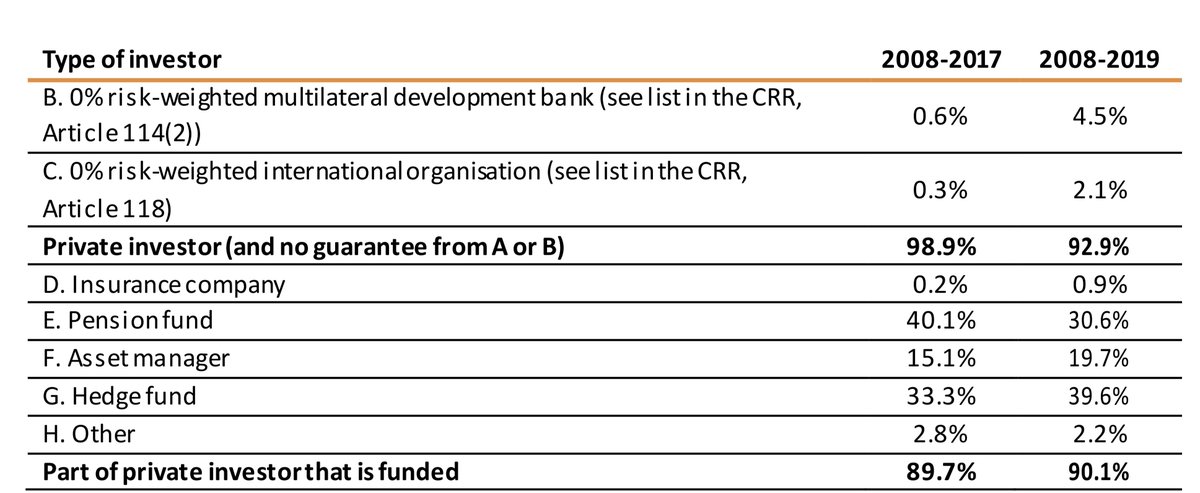

then European Banking Authority wrote a legal opinion that supports extension of STS preferential treatment to senior tranches of balance-sheet-synthetic securitisation in 2019, based on data provided by TBTF banks

the STS framework already included balance sheet synthetics on SME loans, provided buyer of credit risk was either public institution or private institutional investor fully collateralised position (reducing systemic interconnectedness)

in revised proposals Commission is trying to bulldoze through European Parliament, STS preferential treatment would benefit a) large corporates on the underlying assets and b) hedge funds on buyer side

you may wonder, how do Commission plans articulate with its Sustainable Finance taxonomy? is it about to extend preferential treatment to senior tranche of synthetically securitised dirty corporate loans? who knows, cause there is no impact assessment

even more exciting - the Commission, w EBA support, plans to weaken rules on securitisation of non-performant exposures. yes, like subprime but after default.

there is political momentum for it because COVID19.

there is political momentum for it because COVID19.

but securitization of NPE loans may become Trojan horse for better regulatory treatment of stranded assets that tighter climate rules promise to bring us.

that is, implicit subsidies for dirty activities when European institutions sing from hymn sheet of low-carbon transition

that is, implicit subsidies for dirty activities when European institutions sing from hymn sheet of low-carbon transition

Read on Twitter

Read on Twitter