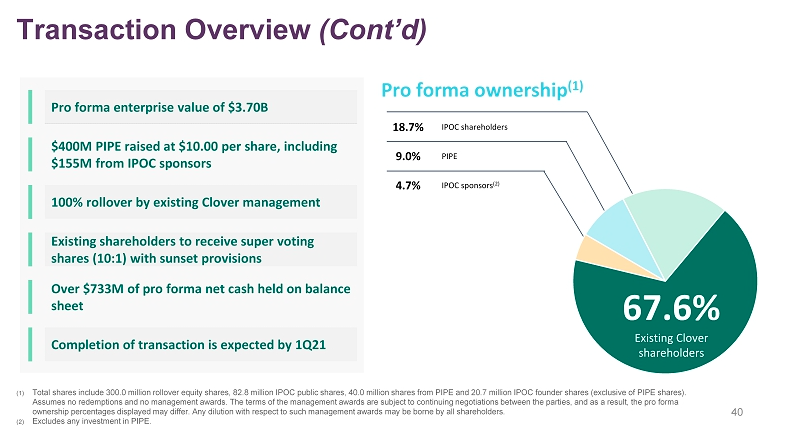

0/ $IPOC announced the acquisition of Clover Health for $3.7B inclusive of a $400M PIPE (w/ $100M from @chamath). This values the company at 4.2x EV/Rev & 2.1x & #39;23 revenue. Importantly management is rolling over 100% of their equity

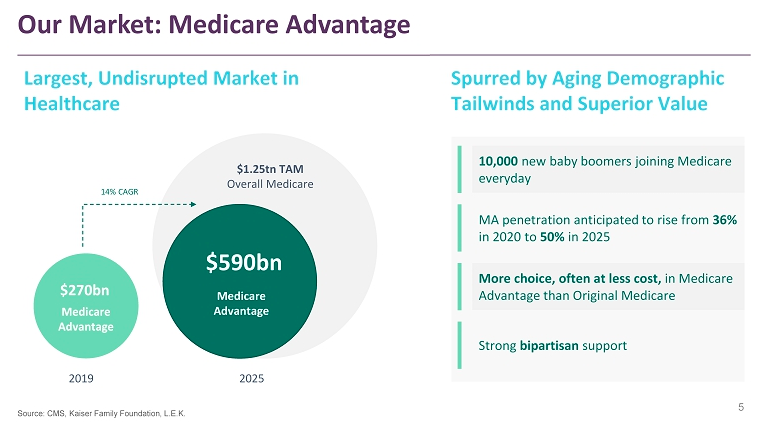

1/ The Medicare Advantage ("MA") Market is expected to grow from $270B in & #39;19 to $590B in & #39;25 as 10,600 baby boomers join MA every day.

3/ Clover offers a "true payor / provider partnership model." Through the use of data they enable high-quality personalized care; increasing access & benefits while reducing costs. Clover enables faster payment w/ 2x industry reimbursement rates & just 4 days for the avg payment

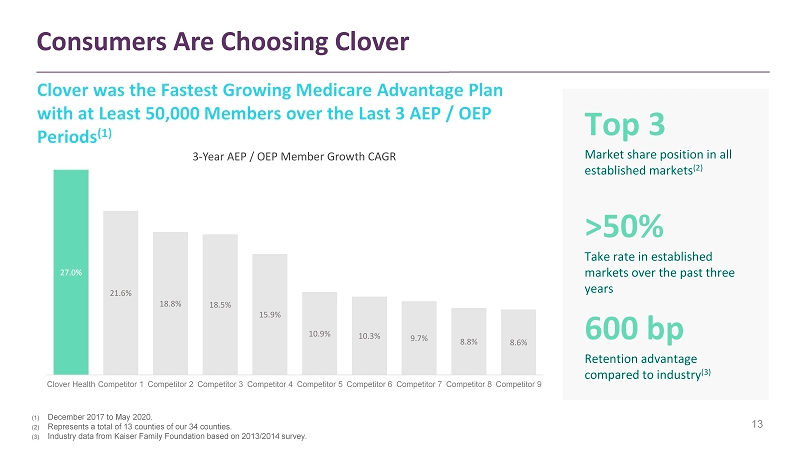

4/ Clover was the fastest growing MA plan with at least 50,000 members. They have a Top 3 market share position in established markets, >50% take rates, and 600bp retention advantage vs. peers.

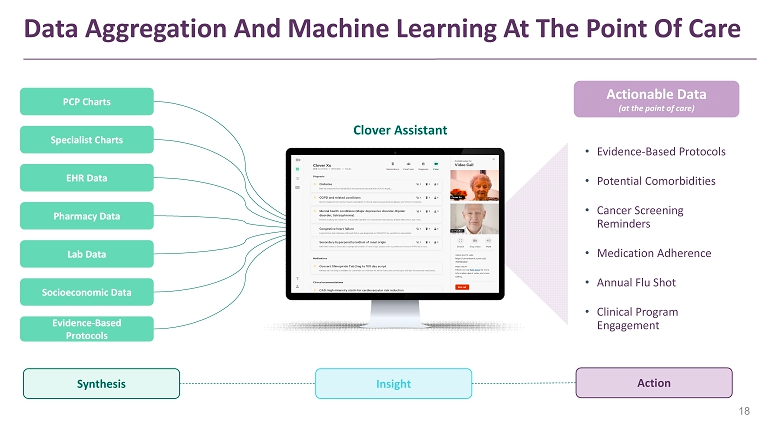

5/ The Clover Assistant delivers data-driven insights to physicians at the Point of Care. They are able to combine PCP & Specialist Charts, with a variety of data sources & evidence-based protocols to provide actionable data.

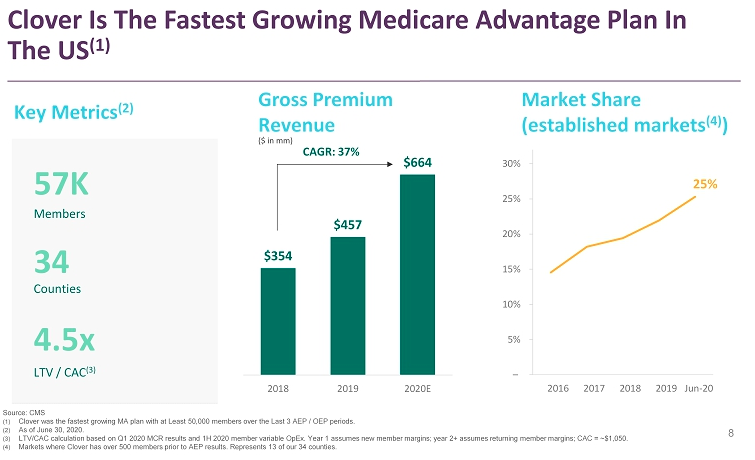

6/ It& #39;s still early as they are in 34 counties representing 3.1M MA Lives. In those counties they have 25% mkt share w/ 57K members, 8% market share, & $664M of gross premium revenue.

By & #39;21E they expect to be in 108 counties representing 4.4M MA lives & $872M of gross premium.

By & #39;21E they expect to be in 108 counties representing 4.4M MA lives & $872M of gross premium.

7/ They believe there is a path to $25B in revenue with 28M MA lives, if they were in 40% of US markets & had 12% market share.

For comparison publicly traded $HUM is the largest player in this market has has $62.9B in premium & annuity revenue

For comparison publicly traded $HUM is the largest player in this market has has $62.9B in premium & annuity revenue

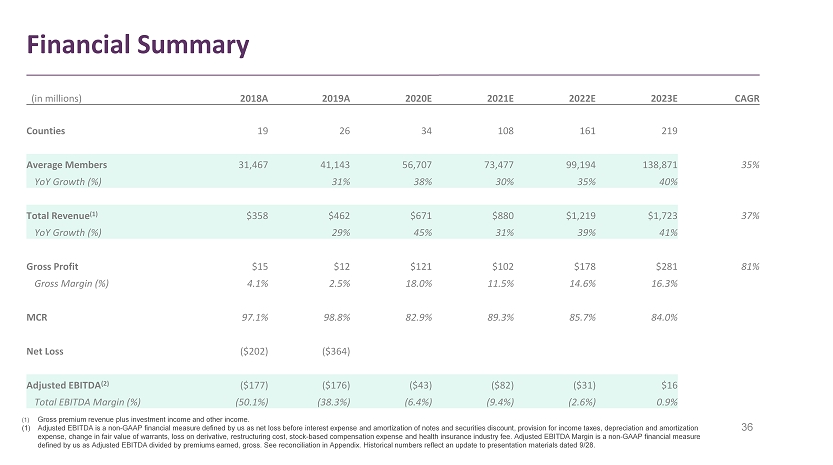

8/ In terms of financials gross premium revenue has growth at a 37% CAGR from $354M in & #39;18 to a $664M run-rate in 1H20. Their EBITDA margin is now (-1.0%) up from (-50.1% in & #39;18).

9/ They walk out a path to profitability by & #39;23E on what seems to be realistic assumptions based on their recent 3 year track record; with the growing market.

10/ There& #39;s been a lot of confusion in the market over what pro-forma ownership looks like for a SPAC. They break it out showing existing Clover S/H will own 67.6% of the company with $IPOC s/h owning 18.7%, the PIPE owning 9.0%, ad the IPOC sponsors at 4.7%.

11/ If we look at the last 2 deals @chamath has done with $IPOB & $IPOC it& #39;s clear he& #39;s elephant hunting from a market perspective looking at RE & HC; two incredibly large TAM& #39;s with limited technical disruption.

Will be fascinating to see $IPOD, $IPOE, $IPOF-Z.

Will be fascinating to see $IPOD, $IPOE, $IPOF-Z.

12/ @chamath is making the bull thesis on CNBC & noted that he continues to look for virtuous cycle outcomes that occurs when you combine technology with a great market & scale you can build durable moats & a defensible business thats hard for laggards to compete with.

Read on Twitter

Read on Twitter