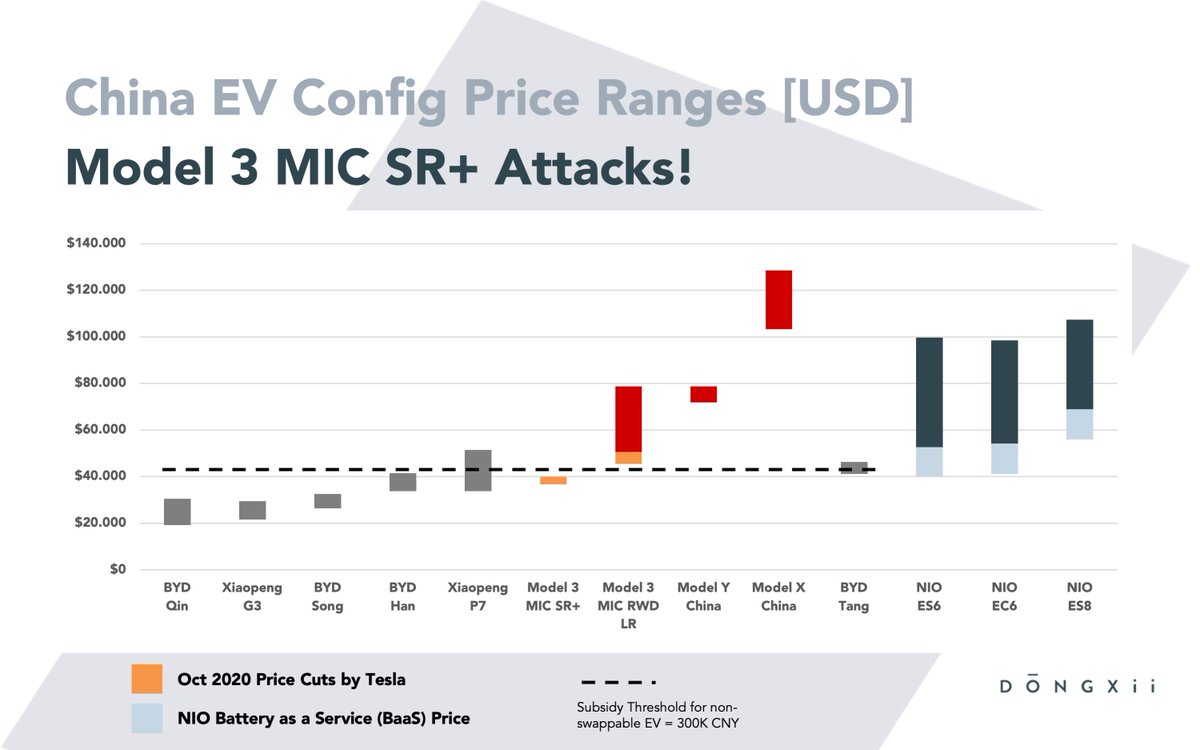

(1/6) After recent $TSLA Model 3 price cuts in #China the competitive pricing range landscape including $XPEV, $BYDDY, $NIO looks like this:

(2/6) Tesla is now directly attacking XPeng $XPEV P7 Sedan - the China copycat of Model 3. The Model 3 SR+ is now also sitting below the Chinese EV subsidy threshold.

(3/6) $NIO on the other hand has higher average sales prices but due to Battery as a Service (BaaS) entry pricing is on par with $TSLA Model 3 RWD and also #NIO EC6 looks competitive to Model Y. I expect #Tesla will cut Model Y China prices too.

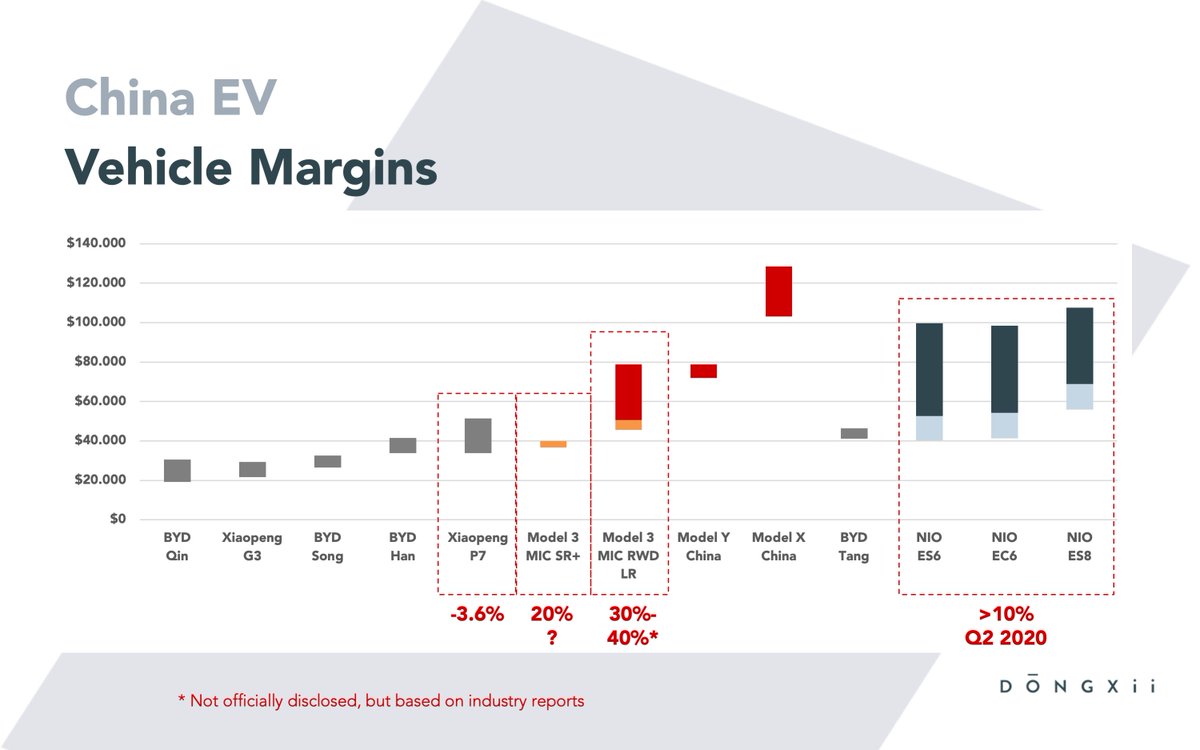

(4/6) In terms of margins, $TSLA is leading with rumored 30-40% MIC and XPeng $XPEV is selling at negative vehicle margin - but I think due to their September delivery beat, they will report positive margins in Q3.

(5/6) $NIO already reported double-digit positive vehicle margins and CEO Li Bin has just hinted that Q3 will see further improved margins.

$XPEV responded they won’t cut prices. But I think this is mainly due to the fact they can’t (margins + customer complaints)

$XPEV responded they won’t cut prices. But I think this is mainly due to the fact they can’t (margins + customer complaints)

(6/6) Price cuts were well received for $TSLA, while $LI and $XPEV tanked and $NIO was barely unaffected.

Read on Twitter

Read on Twitter

$TSLA $NIO $XPEV $LI $BYDDY " title="More info in my latest video on #China EV sales here: https://youtu.be/DjdzDbUXK... href="https://twitter.com/search?q=%24TSLA&src=ctag">$TSLA $NIO $XPEV $LI $BYDDY " class="img-responsive" style="max-width:100%;"/>

$TSLA $NIO $XPEV $LI $BYDDY " title="More info in my latest video on #China EV sales here: https://youtu.be/DjdzDbUXK... href="https://twitter.com/search?q=%24TSLA&src=ctag">$TSLA $NIO $XPEV $LI $BYDDY " class="img-responsive" style="max-width:100%;"/>