IMF and austerity post Covid-19. We review 80 IMF lending arrangements approved since March. Main findings in a "short"

TL/DR - IMF has learned nothing and forgotten nothing

https://www.eurodad.org/arrested_development">https://www.eurodad.org/arrested_... #endausterity

It may come as a shock, but there is quite a gap between IMF discourse and practice. Discourse is littered with calls for a strong, fair and green Covid-19 recovery. In practice, lending arrangements show a rather different IMF...

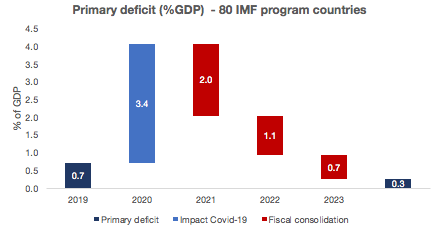

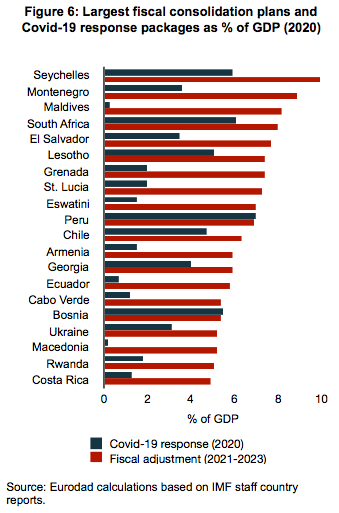

Austerity like never before. 72 countries will begin fiscal consolidation in 2021. Tax increases and expenditure cuts are to be implemented in all 80 IMF program countries by 2023. These will implement austerity measures worth on average 3.8 per cent of GDP over the next 3 years

Even by the IMF own standards, the adjustment is poorly designed. Austerity will be front-loaded and focused on expenditure/investment cuts (3/4 of total). More than half of the projected measures, equivalent to 2 per cent of GDP, will take place in 2021 @SGechert

A negative fiscal impulse of this magnitude, coordinated by the IMF across 80 countries, will derail any prospect of a global recovery. Adjustment will be substantial in many cases. There is no indication IMF has paid any attention to systemic implications of program design.

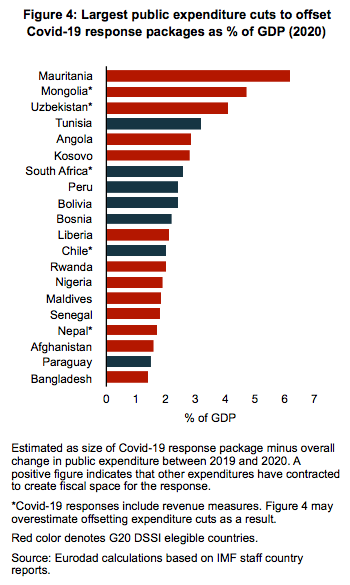

The "good" news is that we dont have to wait until 2021 for austerity. Its already here! Insufficient multilateral support has forced 40 countries to implement large public expenditure cuts in the middle of the pandemic to afford a response to it in 2020 #endausterity

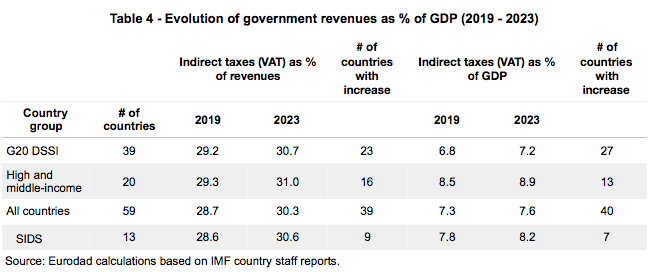

Austerity programs increase revenues through an increase of indirect taxes, and specifically VAT. Out of 59 countries, 40 are expected to increase indirect tax collection by 0.4 of GDP with respect to pre-crisis levels. Wonder where the IMF concern about equality went there?  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

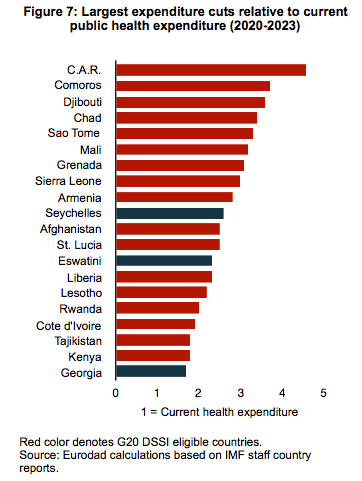

How countries will be able to Build Back Better https://abs.twimg.com/emoji/v2/... draggable="false" alt="™️" title="Registered-Trade-Mark-Symbol" aria-label="Emoji: Registered-Trade-Mark-Symbol">with expenditure cuts across the board? How will they be able to increase investment? 41 will be left with below pre-crisis public expenditure levels by 2023. 40 will implement cuts equivalent or greater than healthcare budgets.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="™️" title="Registered-Trade-Mark-Symbol" aria-label="Emoji: Registered-Trade-Mark-Symbol">with expenditure cuts across the board? How will they be able to increase investment? 41 will be left with below pre-crisis public expenditure levels by 2023. 40 will implement cuts equivalent or greater than healthcare budgets.

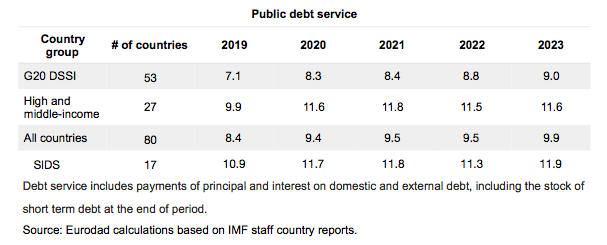

IMF DSAs characterize debt dynamics as “sustainable” in 76 countries. Yet, 55 countries have higher debt service by 2023. 30 countries will pay every year an additional amount equivalent to their 2020 Covid-19 packages to their creditors as increased debt service @ChristinaLaska1

Arrested development. Forget about the 2030 Agenda. There is no space for it in an IMF program. For 46 countries for which data is available, primary expenditure is expected to decline below pre-crisis levels while debt service increases by 2030 @NavidHanif_UN @IEfinanceHRs

Bonus track: Remember the IMF concerns regarding climate and the SDGs? In 80 reports comprising +4000 pages, they are mentioned 87 and 10 times respectively. To be fair, the IMF does care about the business climate (45 mentions).

Read on Twitter

Read on Twitter

" title="Austerity programs increase revenues through an increase of indirect taxes, and specifically VAT. Out of 59 countries, 40 are expected to increase indirect tax collection by 0.4 of GDP with respect to pre-crisis levels. Wonder where the IMF concern about equality went there? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">" class="img-responsive" style="max-width:100%;"/>

" title="Austerity programs increase revenues through an increase of indirect taxes, and specifically VAT. Out of 59 countries, 40 are expected to increase indirect tax collection by 0.4 of GDP with respect to pre-crisis levels. Wonder where the IMF concern about equality went there? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">" class="img-responsive" style="max-width:100%;"/>

with expenditure cuts across the board? How will they be able to increase investment? 41 will be left with below pre-crisis public expenditure levels by 2023. 40 will implement cuts equivalent or greater than healthcare budgets." title="How countries will be able to Build Back Betterhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="™️" title="Registered-Trade-Mark-Symbol" aria-label="Emoji: Registered-Trade-Mark-Symbol">with expenditure cuts across the board? How will they be able to increase investment? 41 will be left with below pre-crisis public expenditure levels by 2023. 40 will implement cuts equivalent or greater than healthcare budgets." class="img-responsive" style="max-width:100%;"/>

with expenditure cuts across the board? How will they be able to increase investment? 41 will be left with below pre-crisis public expenditure levels by 2023. 40 will implement cuts equivalent or greater than healthcare budgets." title="How countries will be able to Build Back Betterhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="™️" title="Registered-Trade-Mark-Symbol" aria-label="Emoji: Registered-Trade-Mark-Symbol">with expenditure cuts across the board? How will they be able to increase investment? 41 will be left with below pre-crisis public expenditure levels by 2023. 40 will implement cuts equivalent or greater than healthcare budgets." class="img-responsive" style="max-width:100%;"/>