1/ New #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses were absolutely off the charts last week.

https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses were absolutely off the charts last week.

The backstory is bullish and intriguing — a unique view on a new bull market catalyst.

I’m about to break this down https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

#BTC https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

The backstory is bullish and intriguing — a unique view on a new bull market catalyst.

I’m about to break this down

#BTC

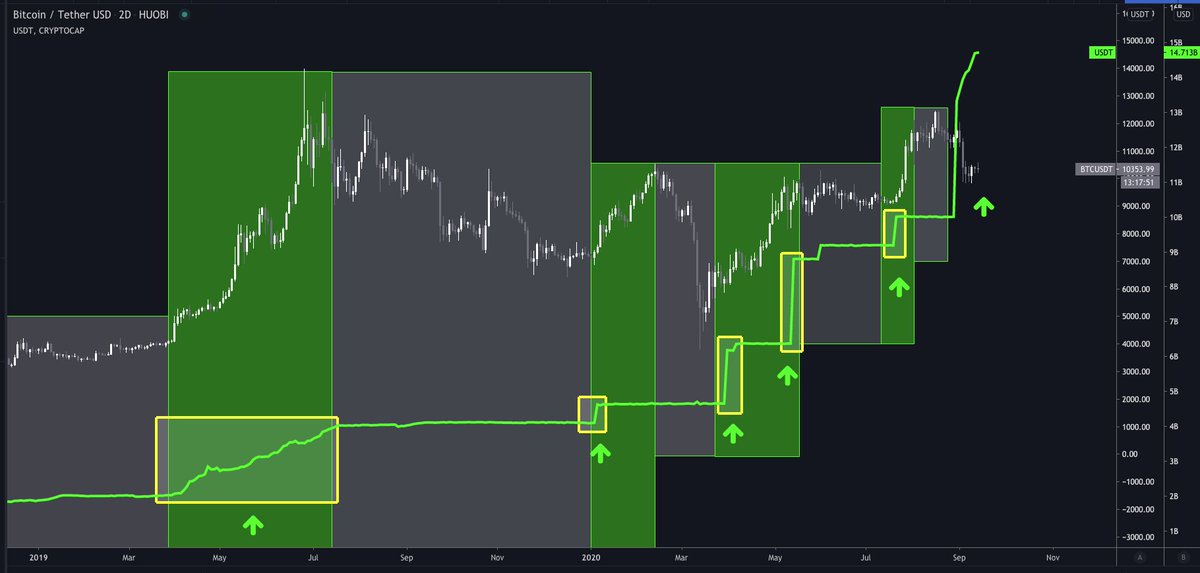

2/ First: volume precedes price.

And #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> active address counts are an OG on-chain leading indicator of volume. https://mobile.twitter.com/woonomic/status/1311259900517867520">https://mobile.twitter.com/woonomic/...

https://abs.twimg.com/hashflags... draggable="false" alt=""> active address counts are an OG on-chain leading indicator of volume. https://mobile.twitter.com/woonomic/status/1311259900517867520">https://mobile.twitter.com/woonomic/...

And #bitcoin

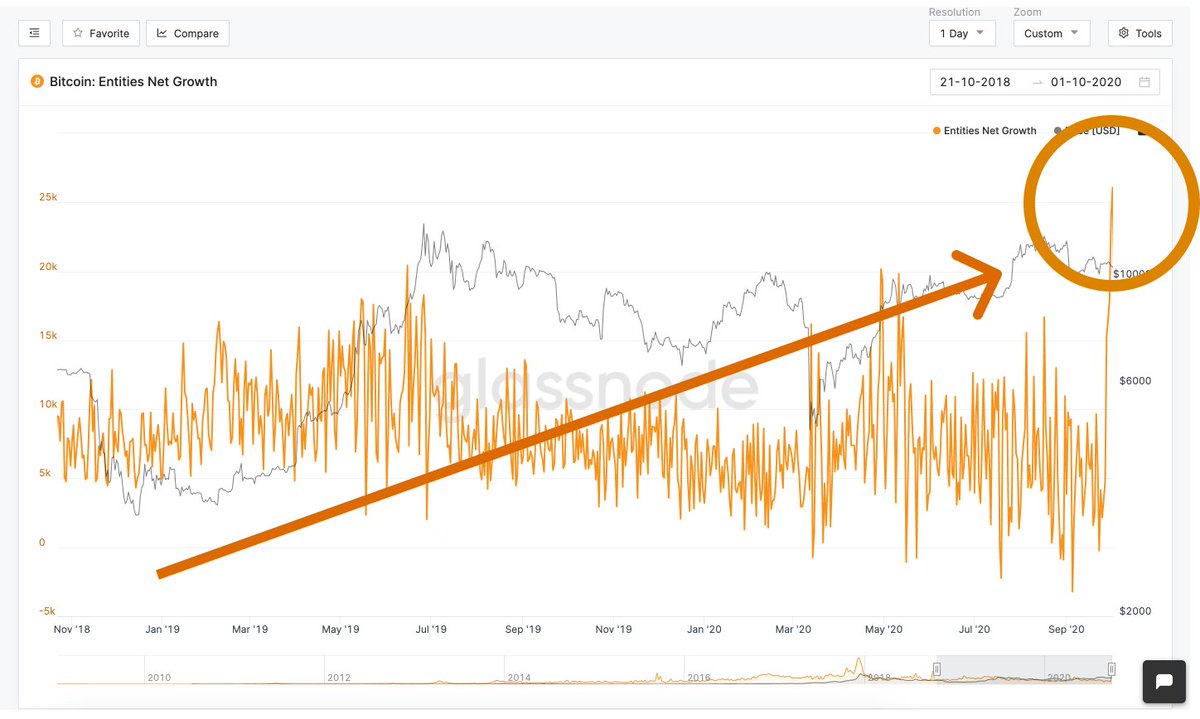

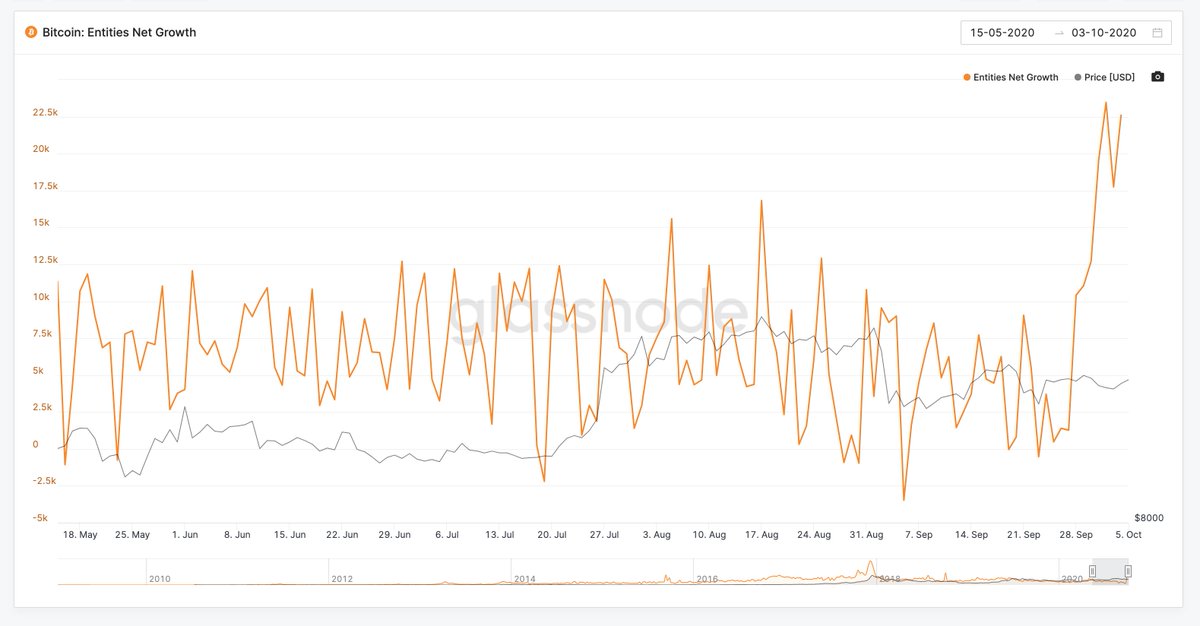

3/ We typically see 5-10k new #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses / day.

https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses / day.

That figure grew it its highest level in over two years last week, peaking above 22k.

data // @glassnode // indispensable

That figure grew it its highest level in over two years last week, peaking above 22k.

data // @glassnode // indispensable

4/ Where are these new #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses coming from?

https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses coming from?

We’ll never know for sure — but here& #39;s my suspicion:

It& #39;s a story from last week that mostly passed under the radar — despite being the most bullish force I can imagine.

We’ll never know for sure — but here& #39;s my suspicion:

It& #39;s a story from last week that mostly passed under the radar — despite being the most bullish force I can imagine.

5/ Last week the Chinese government began a coordinated marketing campaign to focus Chinese retail investor psyche on crypto.

Yes, this is really happening. https://www.coindesk.com/china-crypto-best-performing-asset">https://www.coindesk.com/china-cry...

Yes, this is really happening. https://www.coindesk.com/china-crypto-best-performing-asset">https://www.coindesk.com/china-cry...

https://mobile.twitter.com/DoveyWan/status/1309352583492845568">https://mobile.twitter.com/DoveyWan/...

7/ The Chinese government seems to want to ignite the bull market. https://mobile.twitter.com/cz_binance/status/1309373959410864129">https://mobile.twitter.com/cz_binanc...

8/ But doesn’t China have a long track record of suppressing crypto?

Yes...but the reality is more complex. Simplified:

Chinese leadership promotes whatever narrative benefits their position, at any given time.

Yes...but the reality is more complex. Simplified:

Chinese leadership promotes whatever narrative benefits their position, at any given time.

9/ Why the new narrative? My guess:

China dominates $BTC mining — and no doubt holds more $BTC than any other country, by a wide margin.

#Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> is China’s national treasure.

https://abs.twimg.com/hashflags... draggable="false" alt=""> is China’s national treasure.

Sooner or later, maximizing $BTC& #39;s potential becomes an unavoidable economic incentive.

China dominates $BTC mining — and no doubt holds more $BTC than any other country, by a wide margin.

#Bitcoin

Sooner or later, maximizing $BTC& #39;s potential becomes an unavoidable economic incentive.

10/ The recent explosion in #Tether printing might have been a leading precursor to China& #39;s marketing campaign.

China dominates $USDT volume globally -- and #Tether dominates their fiat onramp liquidity.

China dominates $USDT volume globally -- and #Tether dominates their fiat onramp liquidity.

11/ And of course, #Tether printing has been an effective leading indicator for years.

h/t @BTC_JackSparrow

h/t @BTC_JackSparrow

12/ I suspect Chinese retail buying interest helped #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> absorb last week’s bearish headlines. https://mobile.twitter.com/iamjosephyoung/status/1311945753909108736">https://mobile.twitter.com/iamjoseph...

https://abs.twimg.com/hashflags... draggable="false" alt=""> absorb last week’s bearish headlines. https://mobile.twitter.com/iamjosephyoung/status/1311945753909108736">https://mobile.twitter.com/iamjoseph...

13/ I’d love to validate the overall theory with OkEx, Huobi & Binance volume, but it doesn’t work that way.

New retail buyers won’t make a statistically significant impact on exchange volume that& #39;s dominated by much larger players, already in excess of a billion dollars/day.

New retail buyers won’t make a statistically significant impact on exchange volume that& #39;s dominated by much larger players, already in excess of a billion dollars/day.

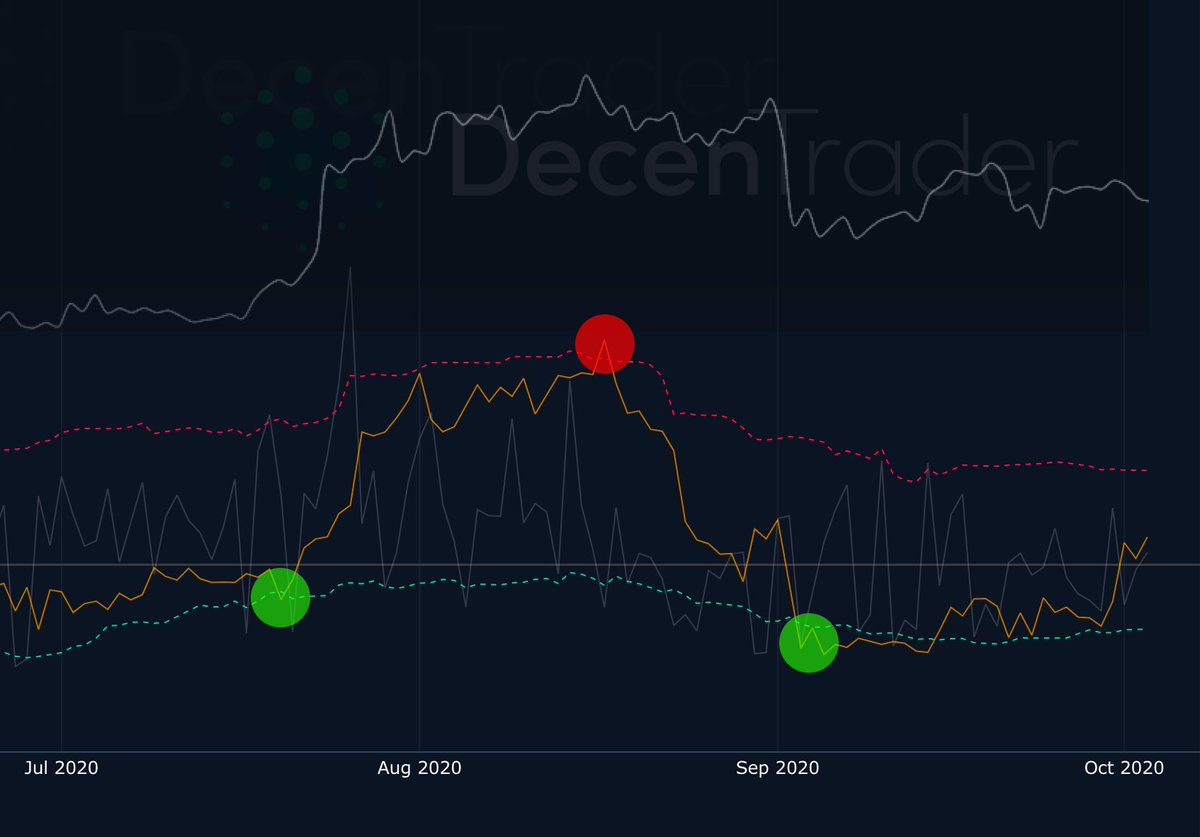

14/ Daily active addresses likely offers advanced signals on big moves throughout this bull market.

A great lens on that is Active Address Sentiment — the brainchild of my friends at @decentrader.

( @filbfilb + @philipswift) https://twitter.com/PositiveCrypto/status/1310619218023505923">https://twitter.com/PositiveC...

A great lens on that is Active Address Sentiment — the brainchild of my friends at @decentrader.

( @filbfilb + @philipswift) https://twitter.com/PositiveCrypto/status/1310619218023505923">https://twitter.com/PositiveC...

15/ Active Address Sentiment is a cross-discipline indicator:

It does technical analysis on fundamental data.

It’s a leading indicator with a history of solid bull market signals.

It does technical analysis on fundamental data.

It’s a leading indicator with a history of solid bull market signals.

16/ Bottom line -- this news is incredibly bullish, and appears to have fundamental confirmation.

I definitely I expect more shakeouts and sideways price action moving forward.

But I& #39;m fundamentally bullish on $BTC.

And I think hodlers will be grinning by Christmas. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎄" title="Weihnachtsbaum" aria-label="Emoji: Weihnachtsbaum">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎄" title="Weihnachtsbaum" aria-label="Emoji: Weihnachtsbaum">

I definitely I expect more shakeouts and sideways price action moving forward.

But I& #39;m fundamentally bullish on $BTC.

And I think hodlers will be grinning by Christmas.

Read on Twitter

Read on Twitter addresses were absolutely off the charts last week. The backstory is bullish and intriguing — a unique view on a new bull market catalyst.I’m about to break this down https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> #BTC https://abs.twimg.com/hashflags... draggable="false" alt="">" title="1/ New #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses were absolutely off the charts last week. The backstory is bullish and intriguing — a unique view on a new bull market catalyst.I’m about to break this down https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> #BTC https://abs.twimg.com/hashflags... draggable="false" alt="">" class="img-responsive" style="max-width:100%;"/>

addresses were absolutely off the charts last week. The backstory is bullish and intriguing — a unique view on a new bull market catalyst.I’m about to break this down https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> #BTC https://abs.twimg.com/hashflags... draggable="false" alt="">" title="1/ New #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses were absolutely off the charts last week. The backstory is bullish and intriguing — a unique view on a new bull market catalyst.I’m about to break this down https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> #BTC https://abs.twimg.com/hashflags... draggable="false" alt="">" class="img-responsive" style="max-width:100%;"/>

addresses / day. That figure grew it its highest level in over two years last week, peaking above 22k. data // @glassnode // indispensable" title="3/ We typically see 5-10k new #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses / day. That figure grew it its highest level in over two years last week, peaking above 22k. data // @glassnode // indispensable" class="img-responsive" style="max-width:100%;"/>

addresses / day. That figure grew it its highest level in over two years last week, peaking above 22k. data // @glassnode // indispensable" title="3/ We typically see 5-10k new #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses / day. That figure grew it its highest level in over two years last week, peaking above 22k. data // @glassnode // indispensable" class="img-responsive" style="max-width:100%;"/>