If 2020 has taught us anything, it’s that life is uncertain.

That’s why @FARNOOSH has abandoned some conservative finance principles, including the aspiration of leaving a financial legacy https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

That’s why @FARNOOSH has abandoned some conservative finance principles, including the aspiration of leaving a financial legacy https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

The concept of bequeathing an inheritance just seems to make less sense today.

Instead why not experience your legacy by spending most of your money on meaningful experiences and investing in the people and causes you believe in https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

Instead why not experience your legacy by spending most of your money on meaningful experiences and investing in the people and causes you believe in https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

It’s a financial philosophy that’s grown increasingly popular with the ultra-wealthy, including:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Sting

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Sting

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Bill Gates

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Bill Gates

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Warren Buffett

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Warren Buffett

https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

Laurene Powell Jobs inherited over $20 billion from her late husband, Steve Jobs.

She’s vowed to give away all her assets during her living years, contributing to social and economic causes that need financial support https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

She’s vowed to give away all her assets during her living years, contributing to social and economic causes that need financial support https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

Bill Perkins, author of new book “Die With Zero,” says: “With each year that passes … our ability to convert dollars into positive life experiences declines over time.”

Because experiences drive happiness, he argues for spending cash in your living years https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

Because experiences drive happiness, he argues for spending cash in your living years https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

Of course, the challenge is to not die with less than zero.

Here are some tips for how to allocate your money while you’re alive https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

Here are some tips for how to allocate your money while you’re alive https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

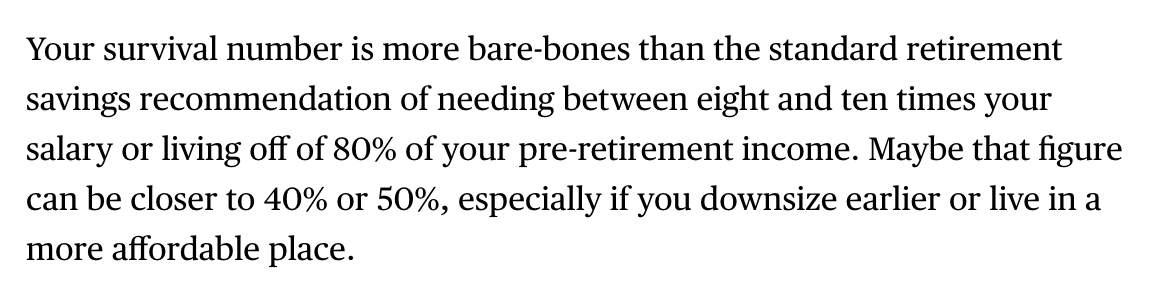

Nail down what your personal “survival” number is. That’s the amount you need to support yourself when you no longer have much income.

This can give you a specific monetary goal for retirement https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

This can give you a specific monetary goal for retirement https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

After determining what’s “enough,” map out the expenses and experiences that are critical to your fulfillment, and the impact you want to have on the world. This could be:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍎" title="Roter Apfel" aria-label="Emoji: Roter Apfel">Supporting your kids’ education

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍎" title="Roter Apfel" aria-label="Emoji: Roter Apfel">Supporting your kids’ education

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✈️" title="Flugzeug" aria-label="Emoji: Flugzeug">Traveling

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✈️" title="Flugzeug" aria-label="Emoji: Flugzeug">Traveling

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">Giving to charity

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">Giving to charity

https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

Rethink your retirement. Back in 1998, Stephen Pollan and Mark Levine proposed a four-step plan to utilize every dollar while you’re alive.

Step three is to “not retire.” It’s radical, but important to consider https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

Step three is to “not retire.” It’s radical, but important to consider https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

Then there’s your kids.

Not leaving an inheritance to your children doesn’t mean you don’t care about them. It means you can bestow your wealth on them while they’re young and need it

https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

Not leaving an inheritance to your children doesn’t mean you don’t care about them. It means you can bestow your wealth on them while they’re young and need it

https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

The U.S. taxes the transfer of money or property to another person above $15,000 a year, so one idea could be to fill up as many investment buckets as possible, from a 529 college savings plan to a custodial Roth IRA

https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

https://trib.al/TzF9lwo ">https://trib.al/TzF9lwo&q...

Read on Twitter

Read on Twitter

Stinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Bill Gateshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Warren Buffett https://trib.al/TzF9lwo&q..." title="It’s a financial philosophy that’s grown increasingly popular with the ultra-wealthy, including:https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Stinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Bill Gateshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Warren Buffett https://trib.al/TzF9lwo&q..." class="img-responsive" style="max-width:100%;"/>

Stinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Bill Gateshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Warren Buffett https://trib.al/TzF9lwo&q..." title="It’s a financial philosophy that’s grown increasingly popular with the ultra-wealthy, including:https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Stinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Bill Gateshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Pfeil nach rechts" aria-label="Emoji: Pfeil nach rechts">Warren Buffett https://trib.al/TzF9lwo&q..." class="img-responsive" style="max-width:100%;"/>

Supporting your kids’ educationhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✈️" title="Flugzeug" aria-label="Emoji: Flugzeug">Travelinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">Giving to charity https://trib.al/TzF9lwo&q..." title="After determining what’s “enough,” map out the expenses and experiences that are critical to your fulfillment, and the impact you want to have on the world. This could be:https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍎" title="Roter Apfel" aria-label="Emoji: Roter Apfel">Supporting your kids’ educationhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✈️" title="Flugzeug" aria-label="Emoji: Flugzeug">Travelinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">Giving to charity https://trib.al/TzF9lwo&q..." class="img-responsive" style="max-width:100%;"/>

Supporting your kids’ educationhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✈️" title="Flugzeug" aria-label="Emoji: Flugzeug">Travelinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">Giving to charity https://trib.al/TzF9lwo&q..." title="After determining what’s “enough,” map out the expenses and experiences that are critical to your fulfillment, and the impact you want to have on the world. This could be:https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍎" title="Roter Apfel" aria-label="Emoji: Roter Apfel">Supporting your kids’ educationhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✈️" title="Flugzeug" aria-label="Emoji: Flugzeug">Travelinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">Giving to charity https://trib.al/TzF9lwo&q..." class="img-responsive" style="max-width:100%;"/>