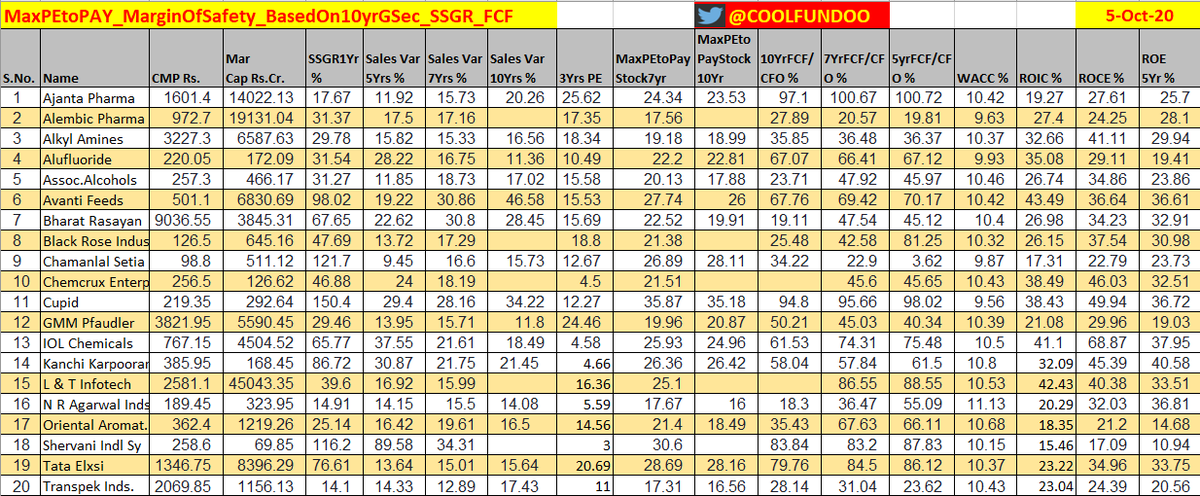

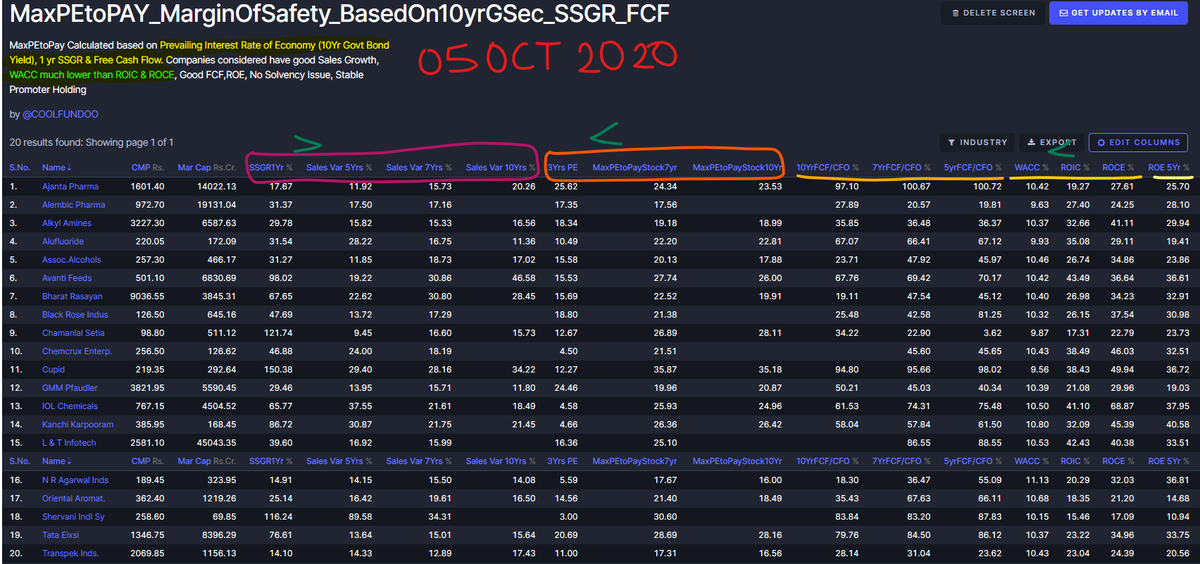

MaxPEtoPAY_MarginOfSafety_BasedOn10yrGSec_SSGR_FCF

Ist Upd-05Oct2020

#investment

PE is most controversial ratio to determine valuation.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">How much Max/Ideal PE to pay for a #stock to ensure Margin of Safety?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">How much Max/Ideal PE to pay for a #stock to ensure Margin of Safety?

This #screeener based on @drvijaymalik study!

@Atulsingh_Asan

1

Ist Upd-05Oct2020

#investment

PE is most controversial ratio to determine valuation.

This #screeener based on @drvijaymalik study!

@Atulsingh_Asan

1

3 primary Factors determining Ideal PE Ratio for a Stock->

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Prevailing interest rate in the economy

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Prevailing interest rate in the economy

(10yr Govt of India Bond Yield)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Competitive advantage (moat) enjoyed by the company

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Competitive advantage (moat) enjoyed by the company

(Self Sustainable Growth Rate

Free Cash Flow)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Circle of competence of the investor

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Circle of competence of the investor

2

(10yr Govt of India Bond Yield)

(Self Sustainable Growth Rate

Free Cash Flow)

2

Investor compare expected returns from stocks with the alternatives available to them like Debt Funds, whose return depends a lot on the prevailing interest rates.

3

Interest Rate  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> Debt Fund Return

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> Debt Fund Return  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">-> Money Shifts to Stock Market

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">-> Money Shifts to Stock Market  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Stock Prices

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Stock Prices  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Rückhand Zeigefinger nach oben" aria-label="Emoji: Rückhand Zeigefinger nach oben">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Rückhand Zeigefinger nach oben" aria-label="Emoji: Rückhand Zeigefinger nach oben">

Interest Rate https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Rückhand Zeigefinger nach oben" aria-label="Emoji: Rückhand Zeigefinger nach oben"> Debt Fund Return

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Rückhand Zeigefinger nach oben" aria-label="Emoji: Rückhand Zeigefinger nach oben"> Debt Fund Return  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Rückhand Zeigefinger nach oben" aria-label="Emoji: Rückhand Zeigefinger nach oben">->Money Shifts away from Stock Market

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Rückhand Zeigefinger nach oben" aria-label="Emoji: Rückhand Zeigefinger nach oben">->Money Shifts away from Stock Market  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Stock Prices

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Stock Prices  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Moreover, low interest rates lead to easier and cheaper availability of credit/loans to companies

4

Interest Rate

Moreover, low interest rates lead to easier and cheaper availability of credit/loans to companies

4

and in turn help them grow and post good results/profits. So investors buy stocks and stock prices goes high in low interest rate situations.

The reverse happens when interest rates are high. Profits of companies decline and the investors push the stock prices lower.

5

The reverse happens when interest rates are high. Profits of companies decline and the investors push the stock prices lower.

5

Earnings Yield (EY) is inverse of Price to Earnings (PE) ratio.

Benjamin Graham advised comparing EY with Treasury Yield(USA), similar to 10yr India Govt Bond Yield(G-Sec).

6

7

8

SSGR utilizes net profit margin (NPM), dividend pay-out ratio (DPR), depreciation (Dep) and net fixed asset turnover (NFAT) to arrive at the sales growth rate that the company can achieve without leveraging itself.

SSGR = NFAT*NPM*(1-DPR) – Dep

9

SSGR = NFAT*NPM*(1-DPR) – Dep

9

If SSGR > Sales Growth then

Company’s business features (NPM, NFAT & DPR) allow it to grow its sales at a higher rate than the current growth rate

10

Company’s business features (NPM, NFAT & DPR) allow it to grow its sales at a higher rate than the current growth rate

10

During economic downturn, company can safely:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">reduce its profitability to generate higher demand

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">reduce its profitability to generate higher demand

(NPM)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">reduce dividends to conserve funds to make additional investments (DPR)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">reduce dividends to conserve funds to make additional investments (DPR)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">invest in fixed assets to improve its plant & machinery/technology (leading to lower NFAT)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">invest in fixed assets to improve its plant & machinery/technology (leading to lower NFAT)

11

(NPM)

11

This ability to sustain the growth rate in times of stress without impacting the returns to shareholders makes such companies eligible to be paid a premium while purchasing their stocks.

So higher PE over Ideal PE ratio (10YrGsecYield)

12

So higher PE over Ideal PE ratio (10YrGsecYield)

12

Rough guideline - Premium of incremental PE ratio of 1 for every 10% cushion of SSGR over the 7/10 years sales growth to arrive at the ideal PE ratio.

Used same for the #screener !

13

Free cash flow (FCF) is the most essential feature of any business as it amounts to the surplus/discretionary cash that the business/company is able to generate for its shareholders.

14

If a company does not have +FCF, it means it is spending beyond its means.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Such companies has to raise funds from additional sources like debt or equity dilution to meet its requirements.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Such companies has to raise funds from additional sources like debt or equity dilution to meet its requirements.

Debt, would decrease profitability by interest expense & increase bankruptcy risk

15

Debt, would decrease profitability by interest expense & increase bankruptcy risk

15

In both situation (Debt/Equity) it becomes less attractive for investors as compared to the companies that are able to meet their funds requirements from their cash flow from operations (CFO)

16

It may be possible that company is taking Debt to fund its future Revenue & Profit growth but in longer period say 7 or 10 yrs if company is not able to generate FCF then it is just a cash guzzling machine.

So over long period FCF is important.

17

So over long period FCF is important.

17

FCF = CFO - Capex

If company has achieved sales growth using minimum amount of Capex then it has higher Margin of Safety compared to company which has all or most of its CFO.

18

If -ive FCF then Company is going towards Debt Burden. In economy down turn when cash dry up it would be difficult for such companies.

If company is spending 100% of CFO then also slightest decline in CFO will impact its operations.

19

If company is spending 100% of CFO then also slightest decline in CFO will impact its operations.

19

So companies with Higher Proportion of FCF wrt to CFO makes them eligible for premium while purchasing their stock.

So higher PE over Ideal PE ratio (10YrGsecYield)

20

So higher PE over Ideal PE ratio (10YrGsecYield)

20

Rough Guideline - Incremental P/E ratio of 1 for every 10% cushion of free cash flow (FCF) % above minimum 25-30% for companies that have been growing their sales above 15% per annum for last 7/10 years.

Used same for the #screener !

21

Investor may pay a little premium to invest in stocks, which are within her circle of competence

Stocks may be from the existing portfolio, selected after sufficient research OR from industry that the investor knows thoroughly about.

22

Excellent Sales Growth 7 or 10yr

1Yr SSGR above Sales Growth 7 or 10yr

+ive FCF

Great FCF wrt CFO

WACC Much Lower Than ROIC & ROCE

Median PE 3 yrs <~ MaxPEtoPay 7or 10yr

Good ROE

No Solvency Issue

Good Promoter Holding

D/E<.8

23

I know people were waiting for this #thread. Some people have messaged me too.

Apologies for the delay, I wanted to make sure that I have covered everything & explain my thought process effectively.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">If you like it do SHARE & RETWEET !

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">If you like it do SHARE & RETWEET !

TIA

24

Apologies for the delay, I wanted to make sure that I have covered everything & explain my thought process effectively.

TIA

24

Read on Twitter

Read on Twitter How much Max/Ideal PE to pay for a #stock to ensure Margin of Safety?This #screeener based on @drvijaymalik study! @Atulsingh_Asan 1" title="MaxPEtoPAY_MarginOfSafety_BasedOn10yrGSec_SSGR_FCFIst Upd-05Oct2020 #investment PE is most controversial ratio to determine valuation. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">How much Max/Ideal PE to pay for a #stock to ensure Margin of Safety?This #screeener based on @drvijaymalik study! @Atulsingh_Asan 1">

How much Max/Ideal PE to pay for a #stock to ensure Margin of Safety?This #screeener based on @drvijaymalik study! @Atulsingh_Asan 1" title="MaxPEtoPAY_MarginOfSafety_BasedOn10yrGSec_SSGR_FCFIst Upd-05Oct2020 #investment PE is most controversial ratio to determine valuation. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">How much Max/Ideal PE to pay for a #stock to ensure Margin of Safety?This #screeener based on @drvijaymalik study! @Atulsingh_Asan 1">

How much Max/Ideal PE to pay for a #stock to ensure Margin of Safety?This #screeener based on @drvijaymalik study! @Atulsingh_Asan 1" title="MaxPEtoPAY_MarginOfSafety_BasedOn10yrGSec_SSGR_FCFIst Upd-05Oct2020 #investment PE is most controversial ratio to determine valuation. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">How much Max/Ideal PE to pay for a #stock to ensure Margin of Safety?This #screeener based on @drvijaymalik study! @Atulsingh_Asan 1">

How much Max/Ideal PE to pay for a #stock to ensure Margin of Safety?This #screeener based on @drvijaymalik study! @Atulsingh_Asan 1" title="MaxPEtoPAY_MarginOfSafety_BasedOn10yrGSec_SSGR_FCFIst Upd-05Oct2020 #investment PE is most controversial ratio to determine valuation. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">How much Max/Ideal PE to pay for a #stock to ensure Margin of Safety?This #screeener based on @drvijaymalik study! @Atulsingh_Asan 1">

Stocks with Higher Earnings Yield (EY) i.e. the ones with low PE ratio, would provide a higher cushion to the investor during tough times.7" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Stocks with Higher Earnings Yield (EY) i.e. the ones with low PE ratio, would provide a higher cushion to the investor during tough times.7" class="img-responsive" style="max-width:100%;"/>

Stocks with Higher Earnings Yield (EY) i.e. the ones with low PE ratio, would provide a higher cushion to the investor during tough times.7" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📌" title="Reißzwecke" aria-label="Emoji: Reißzwecke">Stocks with Higher Earnings Yield (EY) i.e. the ones with low PE ratio, would provide a higher cushion to the investor during tough times.7" class="img-responsive" style="max-width:100%;"/>