1. This is one of the best resources I& #39;ve come across for implementing emergency hedges using options in a cost effective manner. Now more than ever I think Hari& #39;s wisdom can be applied to manage risk within the crypto options space especially before things get interesting...

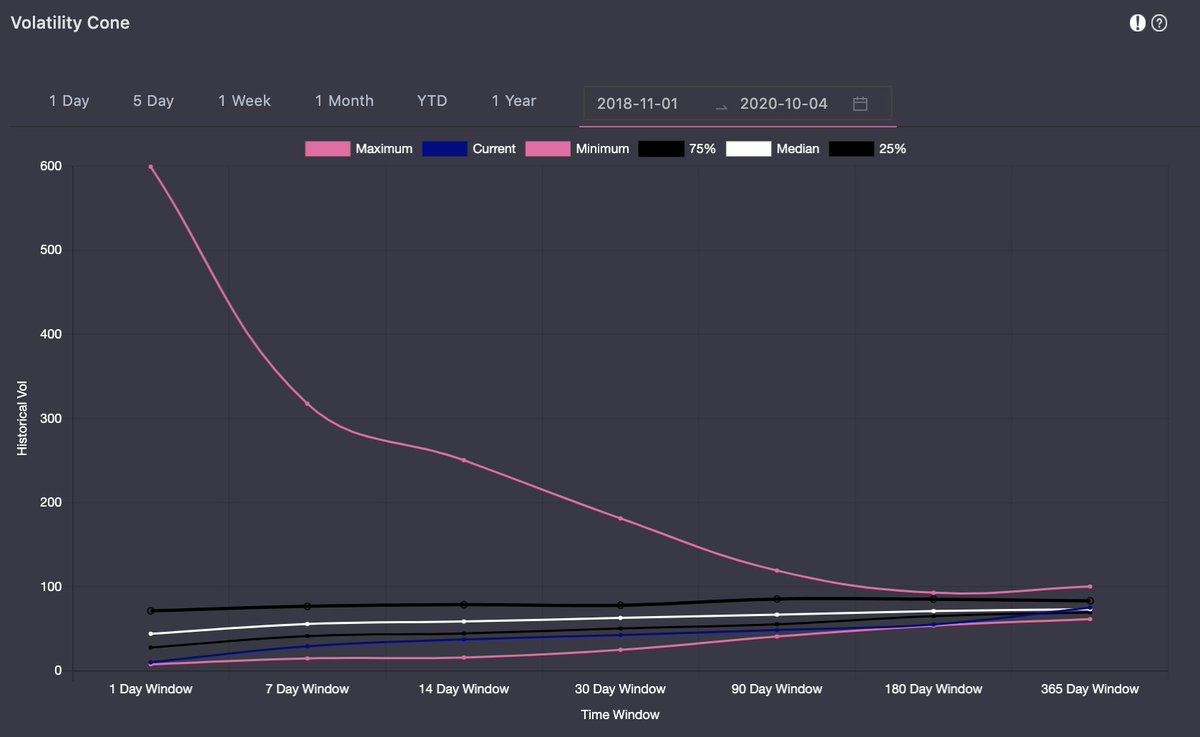

2. As @zackvoell mentioned in this note, #BTC  https://abs.twimg.com/hashflags... draggable="false" alt=""> 180 day rolling realized vol is at nearly a 2 year low. Vol has several characteristic features across every market - one of them is the concept of mean-reversion. https://twitter.com/CoinDesk/status/1312783100016025601">https://twitter.com/CoinDesk/...

https://abs.twimg.com/hashflags... draggable="false" alt=""> 180 day rolling realized vol is at nearly a 2 year low. Vol has several characteristic features across every market - one of them is the concept of mean-reversion. https://twitter.com/CoinDesk/status/1312783100016025601">https://twitter.com/CoinDesk/...

3. We may not know when, but vol tends to go back to its average long-term value. Since realized vol is so low right now, I& #39;d be risk-averse to place large short vol trades. It feels as though things have quieted down a little too much - seems a bit off.

4. Furthermore, using @GenesisVol& #39;s excellent analytics, we can see that current vol up to 180 days is below the median and 25th percentile. Again, this doesn& #39;t give me a lot of confidence for having net short vol exposures.

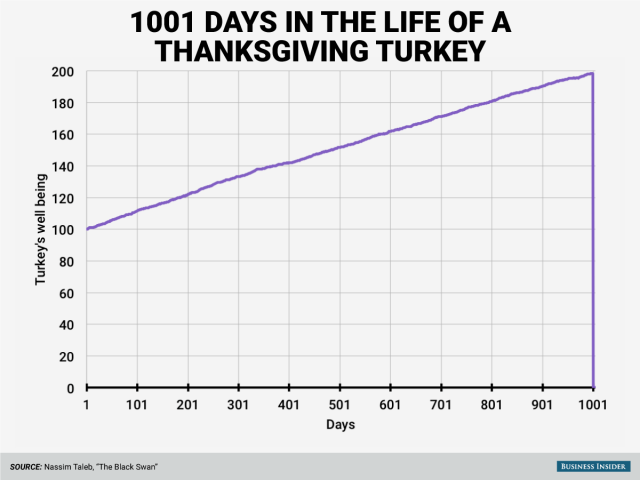

5. Recently we& #39;ve seen several crypto funds focused on selling options for "generating yield". This strategy is often described as collecting pennies infront of a steam-roller. @nntaleb has a grim analogy for short vol strats: "A turkey has a great life until Thanksgiving day".

6. These short-vol trades end up in this type of catastrophe when unbounded tail-risks aren& #39;t hedged. I& #39;m confident these funds have sufficient risk-management policies in place to hedge their downsides accordingly - otherwise that& #39;s just gambling.

7. Suppose a trader wants to hedge #BTC  https://abs.twimg.com/hashflags... draggable="false" alt=""> covered call tail risk. Hedging with puts is costly as these are high in demand from people wanting to protect the downside. Even with major moves down, rolling OTM puts likely won& #39;t breakeven due to the cost.

https://abs.twimg.com/hashflags... draggable="false" alt=""> covered call tail risk. Hedging with puts is costly as these are high in demand from people wanting to protect the downside. Even with major moves down, rolling OTM puts likely won& #39;t breakeven due to the cost.

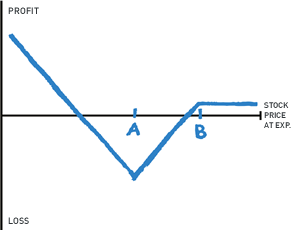

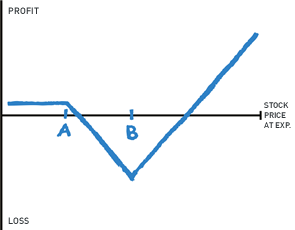

8. Instead, Hari proposes another method - selling a 1x2 put ratio (aka put backspread). As an example, this consists of selling 1x 25d put and buying 2x 10d puts. This gives us exposure to being long downside tail risk while selling expensive put skew along the way.

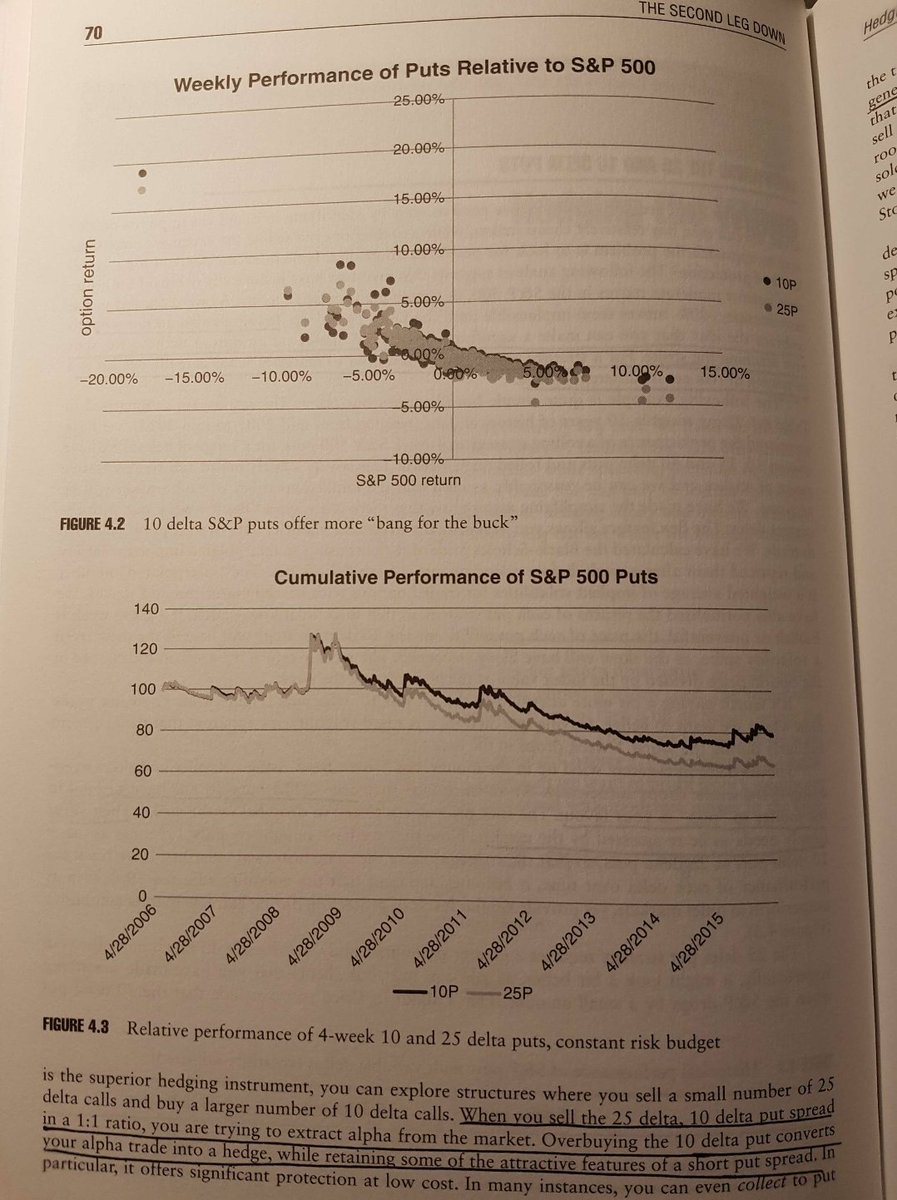

9. The nice thing about this strategy is that you can place this trade for minimal cost (sometimes you can even get a net credit). This prevents a trader from burning their capital with expensive hedges while staying protected from the extreme down moves.

10. Based on Hari& #39;s research, both the 10d and 25d SPX puts trade closely in line, so by selling 1x 25d put and buying 2x 10d puts, you can get a nice payoff in case things get *really* bad on the downside.

11. Crypto isn& #39;t the same market as the S&P500 so the exact delta values to choose for the trade will likely be different than 25/10. The point here is to present strategies for hedging rather than exact parameters.

12. A key drawback of this strategy is that it will lose money for "normal" down moves. A 10% move down in #BTC  https://abs.twimg.com/hashflags... draggable="false" alt=""> may not be enough for this trade to be in the green, but once things really start falling down (similar to Black Thursday), this position will kick in.

https://abs.twimg.com/hashflags... draggable="false" alt=""> may not be enough for this trade to be in the green, but once things really start falling down (similar to Black Thursday), this position will kick in.

13. It generally isn& #39;t wise to hold this position to expiry due to the massive theta bleed, rather it& #39;s best to roll over to a longer dated maturity. Managing tx costs and slippage is key for this - that& #39;s why large funds need to use a service like @tradeparadigm.

14. On the other hand, if a trader wants to hedge right-tailed risk (prices going up a lot), they can enter a call backspread. Same thing here except we use calls - sell 1x 25d call and buy 2x 10d calls. This strategy will only deliver if prices *really* go up.

In summary:

- Current realized vol is very low relative to its long-term average (expect mean-reversion)

- Having open-ended tail risk is extremely dangerous in a short vol trade

- Hedging the tails cheaply allows one to be short vol but stay protected from extreme moves

- Current realized vol is very low relative to its long-term average (expect mean-reversion)

- Having open-ended tail risk is extremely dangerous in a short vol trade

- Hedging the tails cheaply allows one to be short vol but stay protected from extreme moves

Some useful links for more info on these strategies:

https://www.optionsplaybook.com/option-strategies/put-backspread/

https://www.optionsplaybook.com/option-st... href=" https://www.optionsplaybook.com/option-strategies/call-backspread/

I& #39;d">https://www.optionsplaybook.com/option-st... be interested to learn how other players in this space think about hedging in this market. @kyled116 @fb_gravitysucks @rambo1stbld @vkik94 @JSterz

https://www.optionsplaybook.com/option-strategies/put-backspread/

I& #39;d">https://www.optionsplaybook.com/option-st... be interested to learn how other players in this space think about hedging in this market. @kyled116 @fb_gravitysucks @rambo1stbld @vkik94 @JSterz

Read on Twitter

Read on Twitter