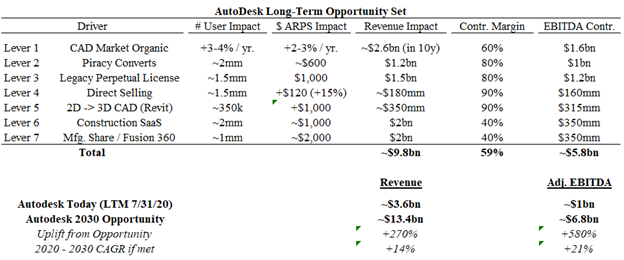

Below is a long thread on 7 key levers that will drive growth at $ADSK for the next decade. Investors have been fixated on mgmt.’s guided $2.4bn FCF by Jan ‘22, but I believe there is vast opportunity beyond that point. First, a summary of the drivers. I will expand on each one:

It may not be immediately obvious why an already dominant, mature CAD business is an attractive growth story 40 years after its founding. Hopefully this thread makes the thesis clearer. This is just a fingerpainting exercise to size up some of the important initiatives underway.

Lever 1: Growth of the core Computer-Aided-Design (“CAD”) business, which offers design software to the AEC (architecture/engineer/constr.) and manufacturing sectors. CAD is fairly mature, w/ 3-4% user growth and 2-3% “cost of living” price increases combining for 5-7% mkt growth

While 5-7% sounds modest, this biz is recurring, sticky, and slow changing (R&D costs will scale). Thus, modest growth carries high contribution margin. 5-7% growth should produce ~$2.6bn or so of incremental revenue in a decade, with perhaps ~60% or $1.6bn falling to Adj. EBITDA

Lever 2: Piracy conversions. ADSK has 5mm paying subs, but 12mm pirated users. Mgmt. expects many of these pirates to eventually become paying subs, but it won’t happen overnight. There are 3 primary reasons for so many pirated versions of ADSK software (Contd.)

#1 ADSK has historically distributed w/ 3rd parties: consultants who buy software at 30% discount and resell at full price. Sometimes resellers facilitate or “look the other way” on pirating licenses, if it helps them sell a few others. ADSK has worked to cull these bad actors.

#2 is that ADSK fights piracy w/ a gentle touch. They actually prefer a firm pirate their tools than buy from a competitor. Oddly, prevalent pirating of ADSKs software helped make it the industry standard. They want these to eventually become a sub rather than just pull the plug

#3 historically ADSK software was sold packaged, making it easy to replicate. Today it is downloaded via the internet and as it becomes more cloud-enabled, ADSK can “turn it off” on pirating devices if they choose. However as mentioned, they choose not to use this nuclear option

How does ADSK convert pirates? The software has collaboration, storage, backup, security features that are only enabled for paying users. Given frequent multi-firm collaboration on design projects, users of pirated versions will run into limitations that incents compliance

ADSK is beginning to convert pirates with growing momentum. Converting 2mm pirates at a 25% haircut to current Avg. Revenue per Sub (ARPS) would be $1.2bn of incremental revenue, most of it falling to profit (they’re already providing the software, just not charging for it)

Lever 3: Legacy perpetual licensers. ~2mm users purchased software before ADSK moved to subscription in & #39;17. Every year some adopt the subscription offering. Assuming ADSK is able to retain 75% of them at an average price of $1k per subscriber, this group could add $1.5bn in rev.

Lever 4: Direct selling. Software is more easily sold online today, avoiding a reseller& #39;s cut. ADSK sees 50% of its business being direct in time, up from 30% today. This means 20% of the biz (most of the growth) will see significant ARPS inflection by removing reseller discounts

Lever 5: 2D to 3D CAD. AutoCAD is a 2D design tool which is ADSKs most popular product. But 3D design tools such as Revit/Inventor offer far more value and are growing in use. ~30% of US/UK construction is done in 3D (called BIM), vs. ~1% in emerging markets like India and China

BIM models are data rich, useful to run simulations, budget, forecast timelines, bid projects, and for project mgmt. BIM software is being mandated by some gov& #39;t/owners to improves outcomes. Revit sells +50% price vs. AutoCAD, thus increasing BIM adoption is a tailwind to ARPS

Lever 6: Construction SaaS. ADSK offers a suite of construction tools used for project mgmt., documentation, bidding, estimating, and many other functions (leveraging BIM data). This is a small, unprofitable business, but growing rapidly. Mgmt. believes it will soon be >$1bn

The market for construction software is shaping into a duopoly between ADSK and Procore, which are sophisticated platforms displacing existing point solutions. SaaS adoption in construction is in infancy, but there is real potential for this opportunity in the billions of dollars

Lever 7: Manufacturing share gains. Autodesk is the 3rd largest provider of design software to the manufacturing industry, but it is growing faster than the #1 and #2 players (Dassault and PTC).

Fusion 360 is a disruptive software suite that can displace multiple competing products at a fraction of the price. Small today, it offers another multi-$bn opportunity still in its infancy. It has demonstrated impressive traction during COVID, adding 10k subscribers in 2Q.

To summarize, $ADSK has many levers it is pulling to drive top/bottom-line growth in the business for a very long time. These will unfold at different paces, and there may well be stumbles along the way. A prolonged recession, mistaken strategic decisions, new competition, etc.

However, the company is making impressive strides in each effort. @andrew_anagnost has managed admirably. In conjunction, these opportunities could result in a business that is multiples the size of current revenue/profitability. And it will generate substantial FCF along the way

Read on Twitter

Read on Twitter