1/ First let& #39;s set the stage: August has been a phenomenal month for DeFi bulls.

Now we& #39;re in the hangover phase of the DeFi party, with the DeFi perp on @FTX_Official pretty much completely retracing the August froth back to square one.

Now we& #39;re in the hangover phase of the DeFi party, with the DeFi perp on @FTX_Official pretty much completely retracing the August froth back to square one.

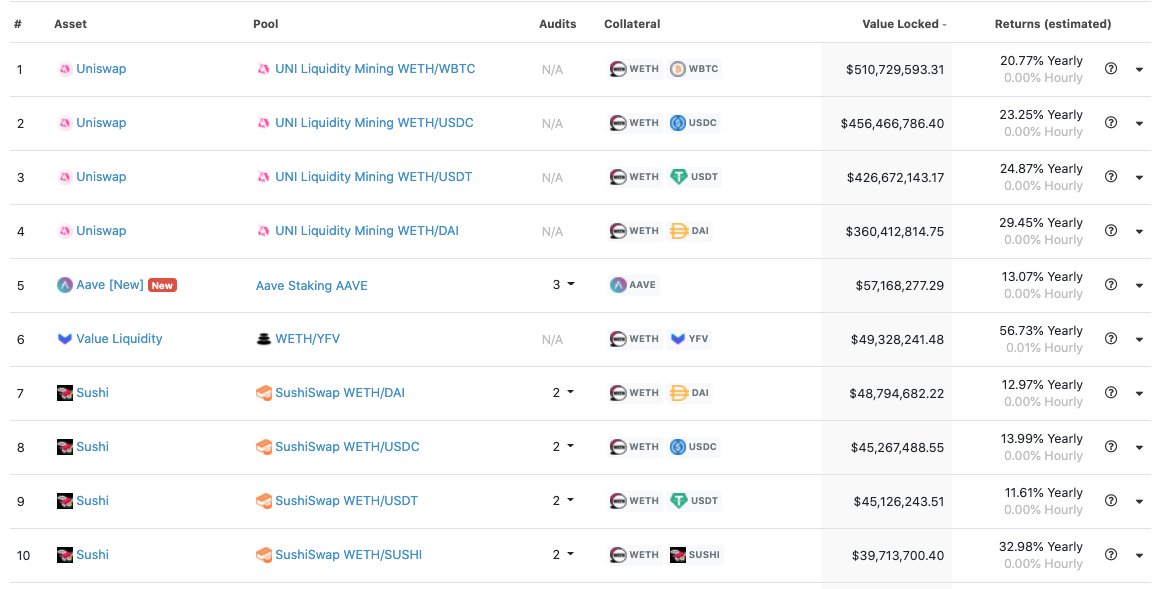

2/ Amidst the rout, there& #39;s clear signs of flight to quality in yield farming.

Despite the modest returns of "only" 20-30% APY, Uniswap accounts for ~70% of all TVL in yield farms even as a new farm.

Despite the modest returns of "only" 20-30% APY, Uniswap accounts for ~70% of all TVL in yield farms even as a new farm.

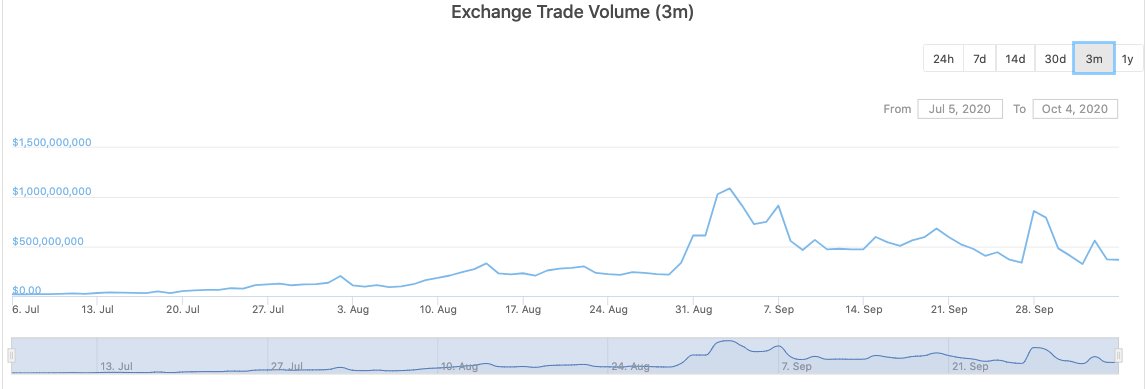

3/ Side note: given the most prolific farmers used @UniswapProtocol to dump their crops, the cool off in farming did have an impact on Uniswap volumes, but only marginally.

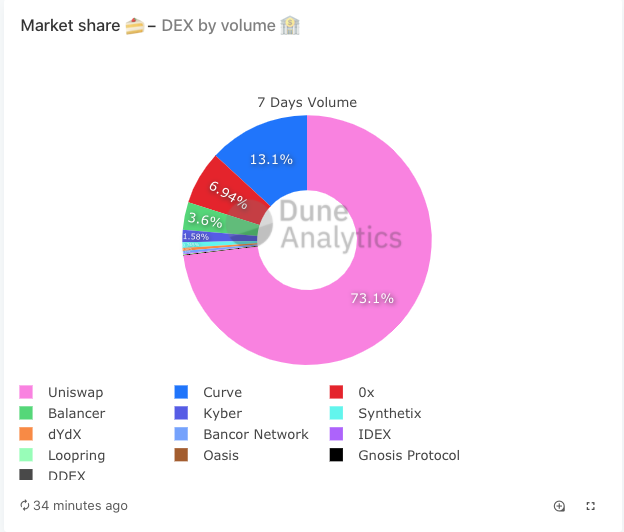

Uniswap is still processing 2-3x daily volumes compared to 2 months ago and owns 70%+ of dex market (!)

Uniswap is still processing 2-3x daily volumes compared to 2 months ago and owns 70%+ of dex market (!)

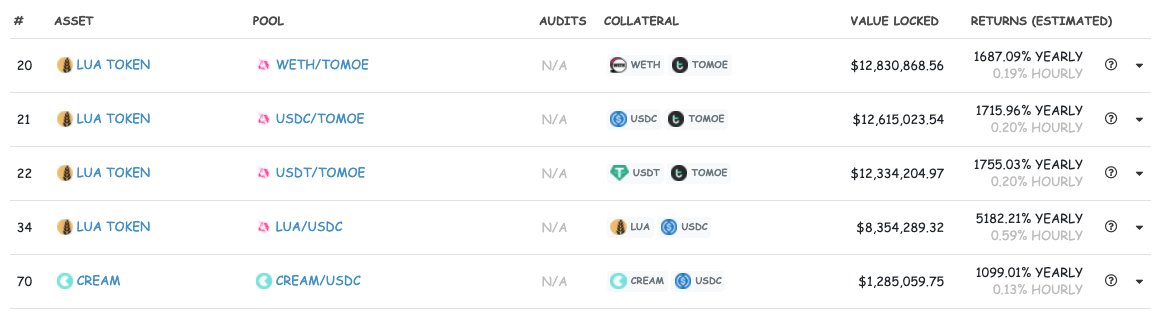

4/ Back to farming: the shift in sentiment was rapid.

Even "degen" farms offering north of 1500% APY are only attracting ~1/10th of the TVL they did just a month ago.

Even "degen" farms offering north of 1500% APY are only attracting ~1/10th of the TVL they did just a month ago.

5/ The drop is risk appetite and collapse in APY is a direct result of -ve price performance of new crop tokens.

Past 7 days alone:

- Basket of 84 top DeFi tokens fell by a median of 14%

- Basket of 33 yield farming tokens fell by 33%, more than double

Past 7 days alone:

- Basket of 84 top DeFi tokens fell by a median of 14%

- Basket of 33 yield farming tokens fell by 33%, more than double

6/ An easier way to visualize this - $YFI.

The poster boy of the yield farming craze, $YFI has been facing its 8th consecutive day of selling following a spectacular 1400% run within a month.

Every buyer at the first peak ($35K) is now underwater based on AVWAP.

The poster boy of the yield farming craze, $YFI has been facing its 8th consecutive day of selling following a spectacular 1400% run within a month.

Every buyer at the first peak ($35K) is now underwater based on AVWAP.

7/ Some on Twitter attribute this to @bluekirbyfi moving his funds/ Eminence degeneracy...but pikers will always try to find someone to blame when prices go down  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷♂️" title="Achselzuckender Mann" aria-label="Emoji: Achselzuckender Mann">

More likely reason for correction is continued suppression of APYs in yield farming.

Let& #39;s take a look...

More likely reason for correction is continued suppression of APYs in yield farming.

Let& #39;s take a look...

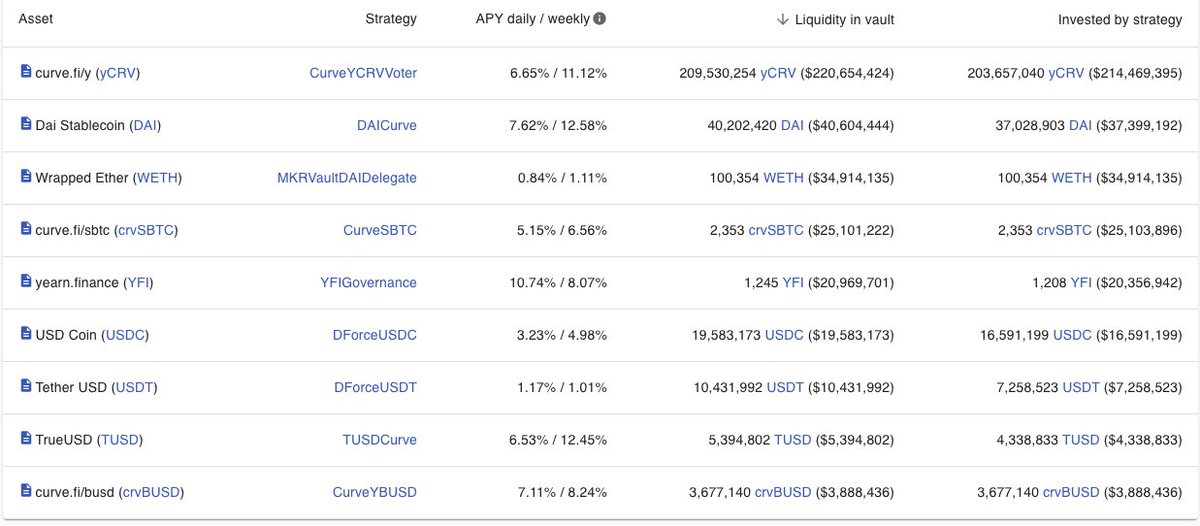

8/ As the DeFi roboadvisor, @iearnfinance offers 9 vaults - or collections of automated strategies - to make users money.

Today, ~60% of assets on yearn are locked in the yCRV vault.

What does that mean?

Today, ~60% of assets on yearn are locked in the yCRV vault.

What does that mean?

9/ That means the $220M in capital is deployed to the stablecoin pool (yPool) on @CurveFinance.

It farms $CRV with your stablecoins, dumps $CRV for more stablecoins, and thus generate a USD-denominated yield.

You can see the strategy live here: #tokentxns">https://etherscan.io/address/0xc999fb87AcA383A63D804A575396F65A55aa5aC8 #tokentxns">https://etherscan.io/address/0...

It farms $CRV with your stablecoins, dumps $CRV for more stablecoins, and thus generate a USD-denominated yield.

You can see the strategy live here: #tokentxns">https://etherscan.io/address/0xc999fb87AcA383A63D804A575396F65A55aa5aC8 #tokentxns">https://etherscan.io/address/0...

10/ Some back of the envelope math:

Currently the yCRV vault ($220M) accounts for roughly 40% ($589M) of the TVL of the y pool.

The y pool in turn accounts for 48% of the total TVL ($1.22B) on Curve.

i.e. @iearnfinance is earning + selling ~20% of all $CRV rewards daily.

Currently the yCRV vault ($220M) accounts for roughly 40% ($589M) of the TVL of the y pool.

The y pool in turn accounts for 48% of the total TVL ($1.22B) on Curve.

i.e. @iearnfinance is earning + selling ~20% of all $CRV rewards daily.

11/ The bigger point here is that a higher $CRV price benefits @iearnfinance APYs, and hence revenues + $YFI price...as long as yCRV vault remains a dominant strategy.

But the bigger the yCRV vault gets, the more sell pressure there is for $CRV...

But the bigger the yCRV vault gets, the more sell pressure there is for $CRV...

12/ Moreover, the outlook for $CRV is shit.

As I have stated since the launch of the token, @CurveFinance is a phenomenal product, one that I love and use personally.

But given the insane inflation, hard not to be bearish $CRV. https://twitter.com/lawmaster/status/1295103619101069313?s=20">https://twitter.com/lawmaster...

As I have stated since the launch of the token, @CurveFinance is a phenomenal product, one that I love and use personally.

But given the insane inflation, hard not to be bearish $CRV. https://twitter.com/lawmaster/status/1295103619101069313?s=20">https://twitter.com/lawmaster...

13/ tl;dr so far - $CRV is buckling under continual inflation sell pressure, which impacts yCRV APYs on @iearnfinance, and since it accounts for 60% of activity on Yearn, it& #39;s impacting projections for $YFI price...

So now what?

So now what?

14/ Imo, the key questions for $YFI bulls now are:

- Can @iearnfinance meaningfully diversify away from $CRV?

- Can @iearnfinance innovate to beyond simply yield farming strategies?

- Can $YFI capture revenue streams from new strategies?

My prediction: yes, yes and yes.

- Can @iearnfinance meaningfully diversify away from $CRV?

- Can @iearnfinance innovate to beyond simply yield farming strategies?

- Can $YFI capture revenue streams from new strategies?

My prediction: yes, yes and yes.

15/ On the first point, the biggest catalyst for @iearnfinance currently is the launch of new vaults and strategies - which will ideally diversify away from @CurveFinance-dependent strats.

In fact, anyone will be able to submit a strategy. https://twitter.com/fubuloubu/status/1311735846412967938?s=20">https://twitter.com/fubuloubu...

In fact, anyone will be able to submit a strategy. https://twitter.com/fubuloubu/status/1311735846412967938?s=20">https://twitter.com/fubuloubu...

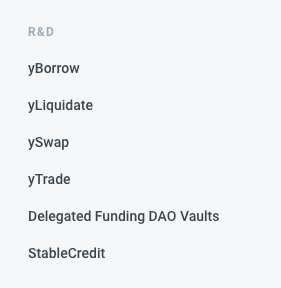

16/ Second, @iearnfinance is not "the yield farming index".

It is a bet on DeFi markets.

More specifically, I see it as a capital allocator. Farming strat is one, but once you have deposits you can deploy it anywhere (e.g. keeper + arb strats?)

Their R&D docs...

It is a bet on DeFi markets.

More specifically, I see it as a capital allocator. Farming strat is one, but once you have deposits you can deploy it anywhere (e.g. keeper + arb strats?)

Their R&D docs...

17/ As an aside, @iam__vance summed this up succinctly from a higher level https://twitter.com/iam__vance/status/1288508930771968000?s=20">https://twitter.com/iam__vanc...

18/ Third - on value accrual - is up to the community.

$YFI holders can seek to capture value from future @iearnfinance affiliated projects - StableCredit, Snowswap, Eminence etc. - from fee split/ airdrops.

I expect a mixture of both to create diversified revenue streams.

$YFI holders can seek to capture value from future @iearnfinance affiliated projects - StableCredit, Snowswap, Eminence etc. - from fee split/ airdrops.

I expect a mixture of both to create diversified revenue streams.

19/ Final point: the prevailing perception that @iearnfinance is @AndreCronjeTech& #39;s 1-man-show and valuation is only because of the "Dre premium" ....is wrong.

Yearn team is 20 person strong, not counting community organizers like @bluekirbyfi https://twitter.com/iearnfinance/status/1302888876302913536">https://twitter.com/iearnfina...

Yearn team is 20 person strong, not counting community organizers like @bluekirbyfi https://twitter.com/iearnfinance/status/1302888876302913536">https://twitter.com/iearnfina...

20/ I don& #39;t call bottoms, but my take:

Macro is uncertain (for every asset). YFI dump sucks. Part of that is because of $CRV price. But Yearn has plans to diversify out of yCRV. Team has grown 20x in 3 months. New products are coming.

Bullish $YFI

Macro is uncertain (for every asset). YFI dump sucks. Part of that is because of $CRV price. But Yearn has plans to diversify out of yCRV. Team has grown 20x in 3 months. New products are coming.

Bullish $YFI

It& #39;s 1:30 am so I probably got some stuff wrong, but welcome all feedback from my big brain friends @santiagoroel @Darrenlautf @Rewkang @Arthur_0x @HassanBassiri @QwQiao

Read on Twitter

Read on Twitter