As I was listening to this excellent conversation between @DiMartinoBooth and @EconguyRosie, something dawned on me: the bizarre nature of markets these days has completely upended why people buy assets. (thread) https://twitter.com/DiMartinoBooth/status/1309202215207403524">https://twitter.com/DiMartino...

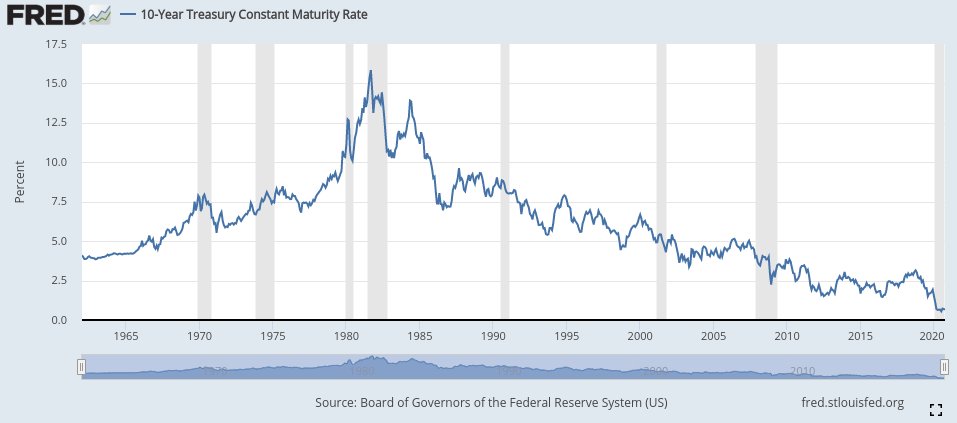

For example, I was recently baffled as to why anyone would want to be long bonds with rates so low.

It used to be that you bought bonds because there was actually a sizable coupon; you might expect, say, a 5% return on your money; meaning a 3% "real" return after inflation.

It used to be that you bought bonds because there was actually a sizable coupon; you might expect, say, a 5% return on your money; meaning a 3% "real" return after inflation.

(speaking of inflation: as much as I want to divert here to talk about why measures of inflation are bullshit and how the term itself is nearly meaningless absent a specifier, that& #39;s another thread for another cup of coffee)

Sorry, back to bonds.

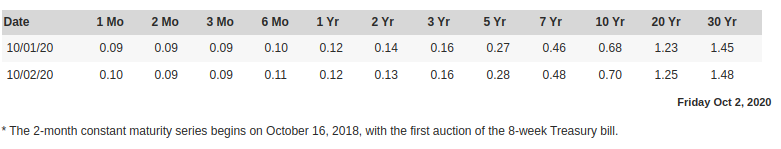

With the 10yr at 70 basis points and the 30yr at 125bps, you& #39;re not even beating inflation! You& #39;re losing money for the privilege of loaning the US government money!

Who in their right mind could be bullish these things!?

With the 10yr at 70 basis points and the 30yr at 125bps, you& #39;re not even beating inflation! You& #39;re losing money for the privilege of loaning the US government money!

Who in their right mind could be bullish these things!?

Well, because of bond convexity, small changes in rates on longish duration bonds equate to big price appreciation.

For example, if you buy a 30yr T-bond at 1.25% and the market rate drops to 0.75%, congratulations: you& #39;ve just made 11.3%! https://www.investopedia.com/terms/c/convexity.asp">https://www.investopedia.com/terms/c/c...

For example, if you buy a 30yr T-bond at 1.25% and the market rate drops to 0.75%, congratulations: you& #39;ve just made 11.3%! https://www.investopedia.com/terms/c/convexity.asp">https://www.investopedia.com/terms/c/c...

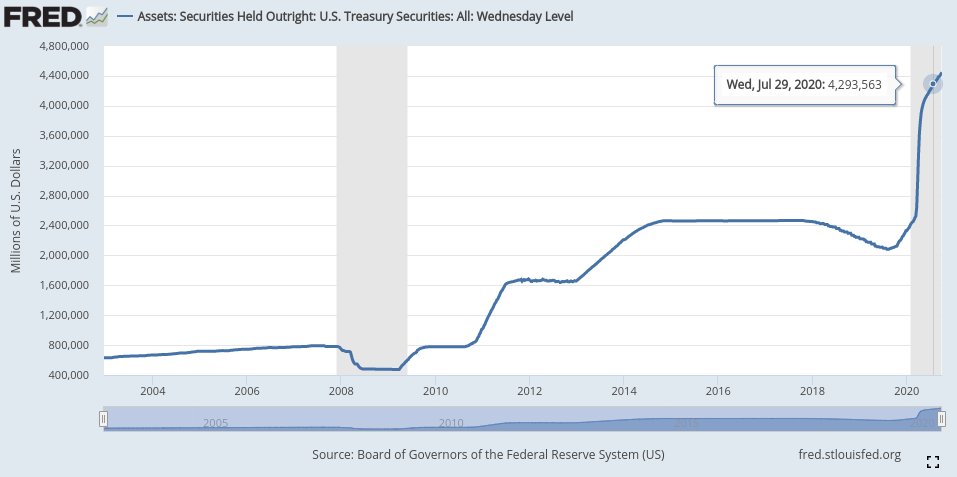

So if you& #39;d (rightly) assume that the Fed is going to continue huge, structural purchases of bonds to keep their cost of borrowing low (and heavily-indebted businesses alive), you& #39;d expect that these already insanely low rates could go lower.

And subsequently you& #39;d expect bond convexity to kick in and get you some pretty killer returns relative to stocks.

It& #39;s not sounding so crazy after all, is it?

It& #39;s not sounding so crazy after all, is it?

But my point is that this is a huge divergence from the fundamental reason people used to buy bonds: used to be they& #39;d get their money back with a little extra (in real terms). *Not* necessarily because they& #39;d expect someone else would buy their bonds for more before maturity.

Let& #39;s look at stocks. In fundamental terms, stocks are supposed to have value because they& #39;re a claim on a company& #39;s future earnings. Not so much the case anymore.

Price-to-earnings (P/E) TTM (or trailing twelve months) is essentially telling you "if I paid P for this stock, how many years would I have to wait for the earnings it generates to get me to breakeven."

As you& #39;ve probably heard, the values here are ridiculous at the moment.

As you& #39;ve probably heard, the values here are ridiculous at the moment.

Take for example Amazon, which I think is a really great business and whose share price has gone up massively this year, almost doubling in price.

Its P/E ratio is 120.

That means that in 120 YEARS, its earnings (based on last 12mo) will have covered your investment.

Its P/E ratio is 120.

That means that in 120 YEARS, its earnings (based on last 12mo) will have covered your investment.

If I& #39;m lucky, I& #39;ve got another, I dunno, 45 years left in me? And even at the end of my life, I won& #39;t see my investment repaid based on earnings alone.

Now obviously this is excluding considerations like dividends and is based on past (not future) earnings, but c& #39;mon.

Now obviously this is excluding considerations like dividends and is based on past (not future) earnings, but c& #39;mon.

(another side-note for another thread: I think the outrageously frothy equity market can be partially explained by the fact that a lot of people are implicitly trying to replace the reliable yields once got from sovereign credit with not-as-reliable blue chip dividend yield)

So in many cases, nobody& #39;s buying stock for the fundamental reason they used to: the idea that "this thing will kick off enough cashflow to make it worth my while."

No, they& #39;re buying it because they think they& #39;ll be able to sell it to the next guy for more.

No, they& #39;re buying it because they think they& #39;ll be able to sell it to the next guy for more.

With both stocks and bonds, people aren& #39;t buying these assets for their underlying value - they& #39;re buying them on the expectation that the assets can be sold for more later.

Funny, when people bring this up in the context of Bitcoin, they call it the "greater fool theory." https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙄" title="Gesicht mit rollenden Augen" aria-label="Emoji: Gesicht mit rollenden Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙄" title="Gesicht mit rollenden Augen" aria-label="Emoji: Gesicht mit rollenden Augen">

Funny, when people bring this up in the context of Bitcoin, they call it the "greater fool theory."

I& #39;ve known this was the case with stocks for a while, but it really strikes me as funny that a venerable, deep market like sovereign credit with wizened, sage proponents like Lacy Hunt is (in the words of Bitcoin critics everywhere) just a Ponzi scheme.

Read on Twitter

Read on Twitter