Read quarterly investor letter of Solidarity Investment Managers and provides good insights on when to sell or enter a stock, Why to sell positions in a staggered manner and why not to wait for a company to report dismal earnings and then sell immediately? ( https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">)

When to Sell?

4 situations – When made a mistake or when facts and/or thesis changes, due to risk mgmt reasons, when target price reaches in case of special situations. But the most difficult is to sell those companies which have good growth opp. but trading at euphoric valuation

4 situations – When made a mistake or when facts and/or thesis changes, due to risk mgmt reasons, when target price reaches in case of special situations. But the most difficult is to sell those companies which have good growth opp. but trading at euphoric valuation

We hear lot of FMs talking about selling early as most common mistake among all, but we need to keep in mind survivorship bias which might be into play here and so to determine if one is following a good process – one should focus on PF returns and not individual stock return.

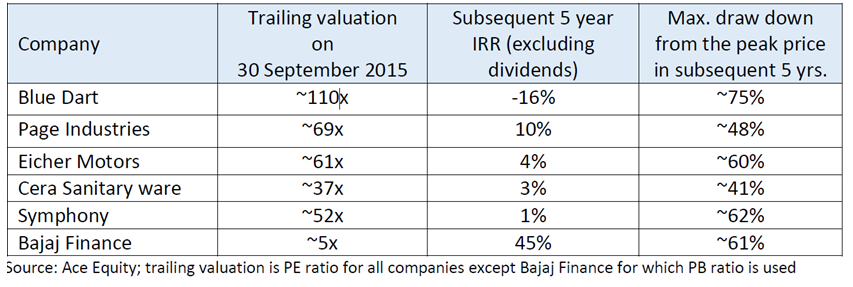

Good example proving the above point - Investors who held on to some good but richly valued businesses like Blue Dart, Pageind, Cera, when valuations were euphoric would be sitting with sub-par returns.

However, those who stayed invested in Bajaj Finance made sig. returns.

However, those who stayed invested in Bajaj Finance made sig. returns.

Solidarity’s Process for exit decisions:

Estimate exp. IRRs over 5-year rolling basis, determined on the basis of estimates of earnings/cash flow/book value and then deciding the range of multiples a stock should trade at end of 5 years(exit multiple).

Estimate exp. IRRs over 5-year rolling basis, determined on the basis of estimates of earnings/cash flow/book value and then deciding the range of multiples a stock should trade at end of 5 years(exit multiple).

Fair multiples are decided based on RoE, growth and its longevity and also looking at long term valuation bands. Exit decision is made when even in bull case IRRs fall below expected levels. Positions are trimmed aggressively in low liquid positions and gradually in liquid stocks

The challenge of this method is how to define euphoric valuations when stock has earning momentum

The answer to this question is easier to find in sectors like banking where companies have stayed within historical valuation bands and RoE is usually rangebound.

The answer to this question is easier to find in sectors like banking where companies have stayed within historical valuation bands and RoE is usually rangebound.

Same is the case for the manufacturing sector, where sudden growth is usually not possible as capacity acts as a constraint to growth.

However, in sectors like Digital, longevity of growth is hard to estimate. Digital tends to be high free cash flow, has no capacity constraints and is winner takes all with leaders often having dominant MS. This means comp. have pricing power and earnings growth can surprise.

Eg- Info Edge has used the cash flow from Naukri to build new verticals in RE, Matrimonial services and also via significant minority stakes in business models of the future like Zomato and Policy Bazaar which one could not have forecast if one was modelling it say a decade ago.

Why sell in a staggered manner instead of completely getting out of a position?

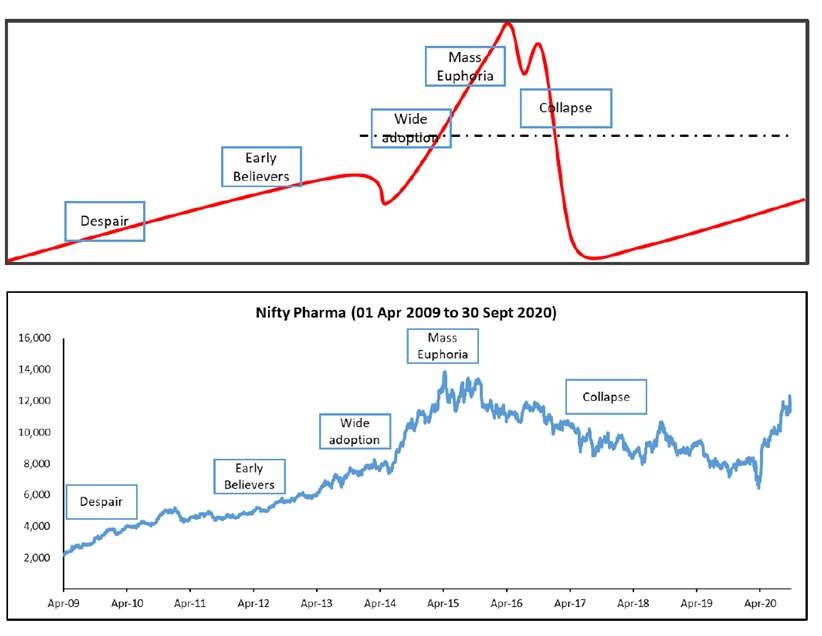

We need to recog. the role of cycles in PF actions. Capital tends to chase a sector with earnings momentum. That results in valuation excesses till a trigger point causes stock prices to correct.

We need to recog. the role of cycles in PF actions. Capital tends to chase a sector with earnings momentum. That results in valuation excesses till a trigger point causes stock prices to correct.

This is what happened in the Pharma sector between 2012- 2020. The same story played out in NBFCs (2015-2018). Stock prices can remain elevated for significant periods as long as the earnings momentum lasts. Selling too early could leave significant gains on the table.

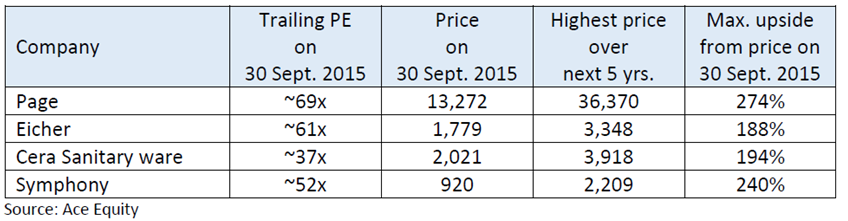

The table below illustrates how stock prices can continue to rally ~200-300% from expensive to euphoric valuations before they eventually correct.

By gradually trimming over time, one also has the ability to re-examine assumptions as good companies can surprise on the upside.

By gradually trimming over time, one also has the ability to re-examine assumptions as good companies can surprise on the upside.

So, the final point being why not stay invested till the last point and exit as soon as a company reports dismal earnings?

One cannot conclude, whether the earnings disappointment is temp. based on macro events, competitive behaviour or reflects a more fundamental challenge.

One cannot conclude, whether the earnings disappointment is temp. based on macro events, competitive behaviour or reflects a more fundamental challenge.

And also, short term players might sell aggressively at that point which might result in huge correction in prices say – 30-40% drop, and at that point the valuations might seem to be already pricing this and makes no sense to exit if valuations are in favour.

Link to the letter - https://bit.ly/3ncWF0k

https://bit.ly/3ncWF0k&q... href="https://twitter.com/MGSolidarity">@MGSolidarity Thanks for uploading your letter on the public domain.

@alphaideas @dmuthuk @Dinesh_Sairam @Kuntalhshah @contrarianEPS @tapak7

@alphaideas @dmuthuk @Dinesh_Sairam @Kuntalhshah @contrarianEPS @tapak7

Read on Twitter

Read on Twitter