In the latest market update we explore September& #39;s pullback. Should we be worried about another winter?

A thread with the highlights of our take https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> https://twitter.com/hartmanncap/status/1312164854849888256">https://twitter.com/hartmannc...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> https://twitter.com/hartmanncap/status/1312164854849888256">https://twitter.com/hartmannc...

A thread with the highlights of our take

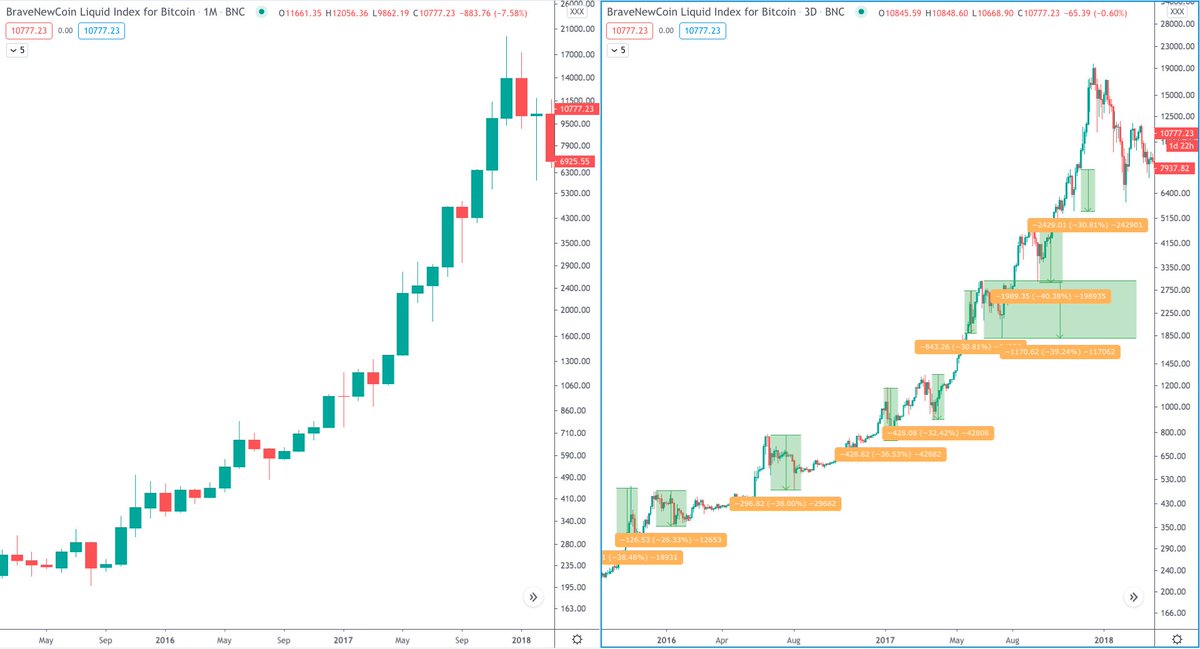

1/ In the 2016/2017 bull market we saw eight 30-40% pull backs.

HODL has been the best strategy for most... unless fundamentals become far detached from reality as they did in December 2017... when HODL suddenly becomes a nightmare.

So how are fundamentals now?

HODL has been the best strategy for most... unless fundamentals become far detached from reality as they did in December 2017... when HODL suddenly becomes a nightmare.

So how are fundamentals now?

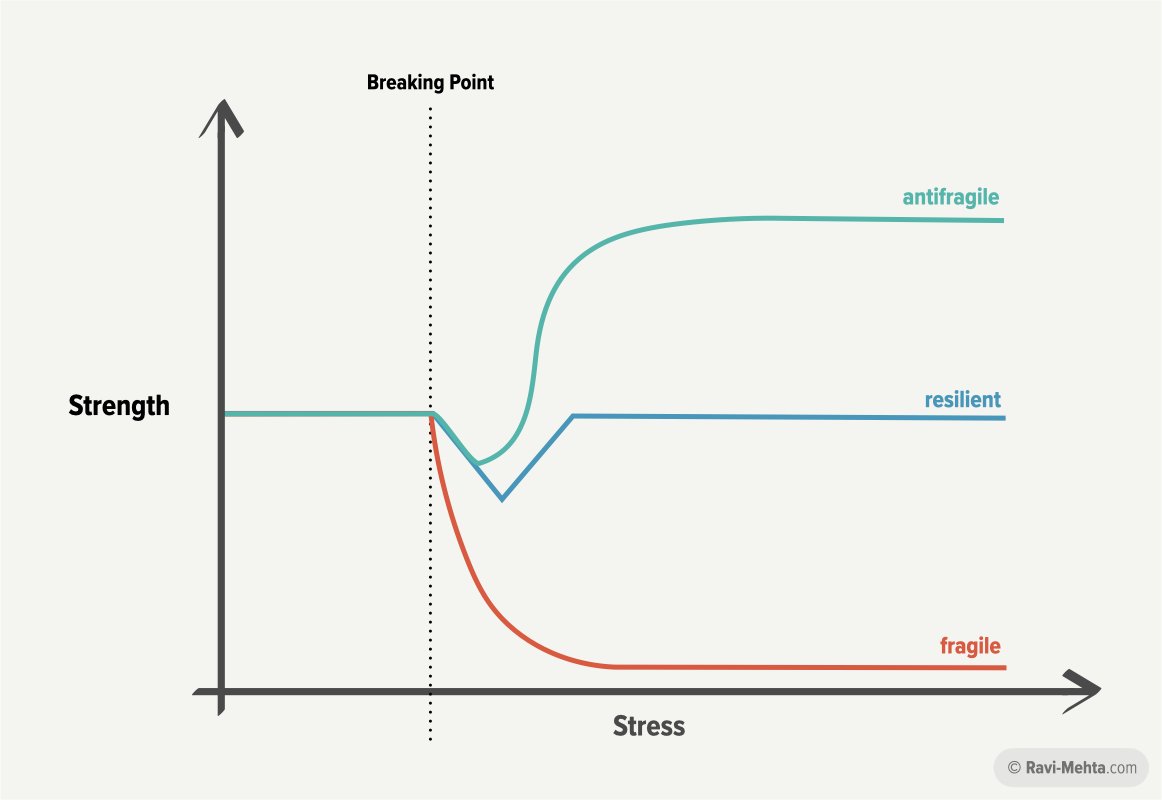

2/ Bitcoin has become more anti-fragile.

Anti-fragility as termed by @nntaleb makes something stronger after undergoing stress.

Anti-fragility as termed by @nntaleb makes something stronger after undergoing stress.

3/ In March bitcoin survived a liquidity crisis.

In September it shrugged off the third biggest hack in history.

In October it flinched at a DOJ indictment against one of the biggest bitcoin futures exchanges.

We& #39;re still above $10k after all of this https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">

In September it shrugged off the third biggest hack in history.

In October it flinched at a DOJ indictment against one of the biggest bitcoin futures exchanges.

We& #39;re still above $10k after all of this

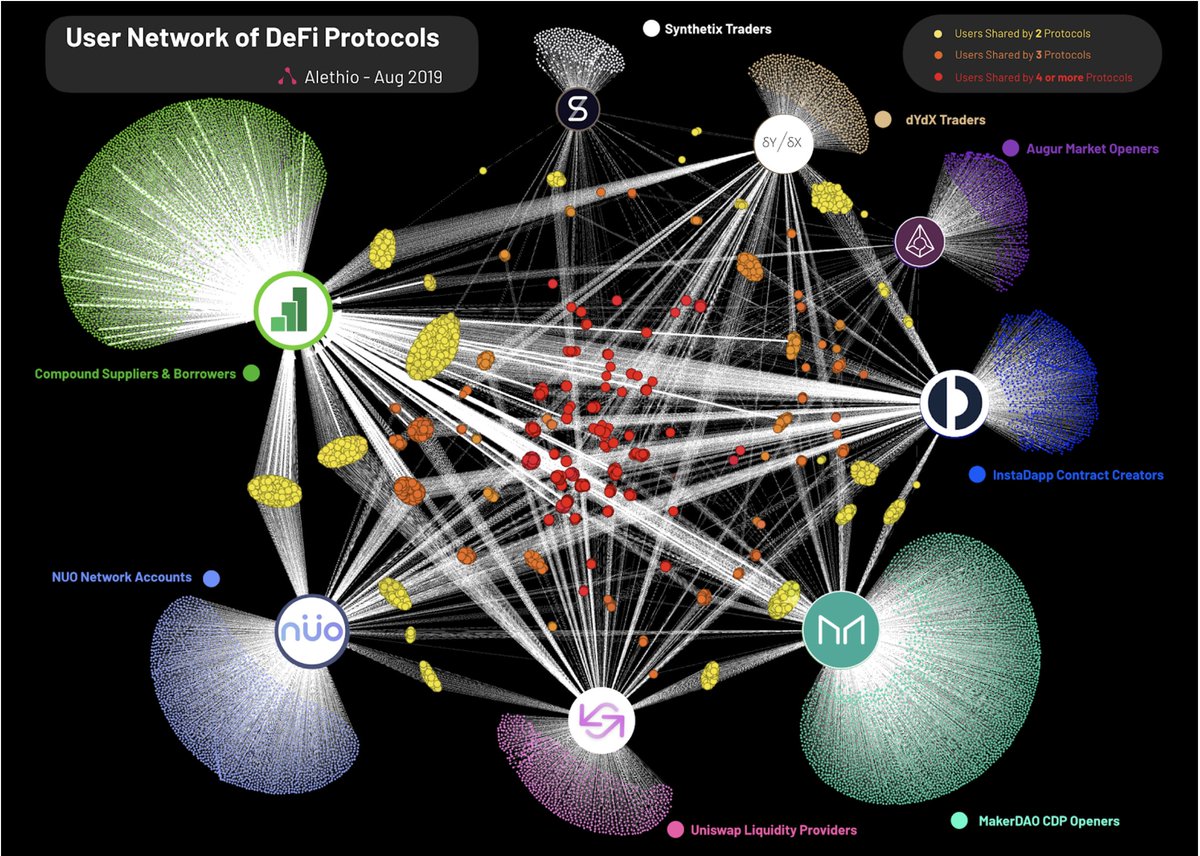

4/ We also experienced a Cambrian explosion in DeFi

What came first? The chicken or the egg? The user or the liquidity?

As we fixed liquidity via an insane experiment of incentives called yield farming, all the sudden the puzzle pieces started going together.

What came first? The chicken or the egg? The user or the liquidity?

As we fixed liquidity via an insane experiment of incentives called yield farming, all the sudden the puzzle pieces started going together.

5/ Instead of startup silos, we are seeing a lot of collaboration and interoperability. Every DeFi protocol is connected with perhaps a half dozen others, from @chainlink oracles, to @AragonProject DAOs, to @KyberNetwork/ @uniswapunicorn exchange capabilities.

6/ And the recent rally in DeFi has helped tons of projects replenish their treasuries and ensure several years of continued development.

And the interest in the space has attracted top talent to once again choose crazy crypto network over traditional meatspace startups.

And the interest in the space has attracted top talent to once again choose crazy crypto network over traditional meatspace startups.

7/ Institutional money is here:

The biggest hedge funds, venture funds, endowment funds, and even some public companies and pension funds have placed their bets on digital assets.

Nobody wants to be first, but nobody wants to be last either.

The first have made their move.

The biggest hedge funds, venture funds, endowment funds, and even some public companies and pension funds have placed their bets on digital assets.

Nobody wants to be first, but nobody wants to be last either.

The first have made their move.

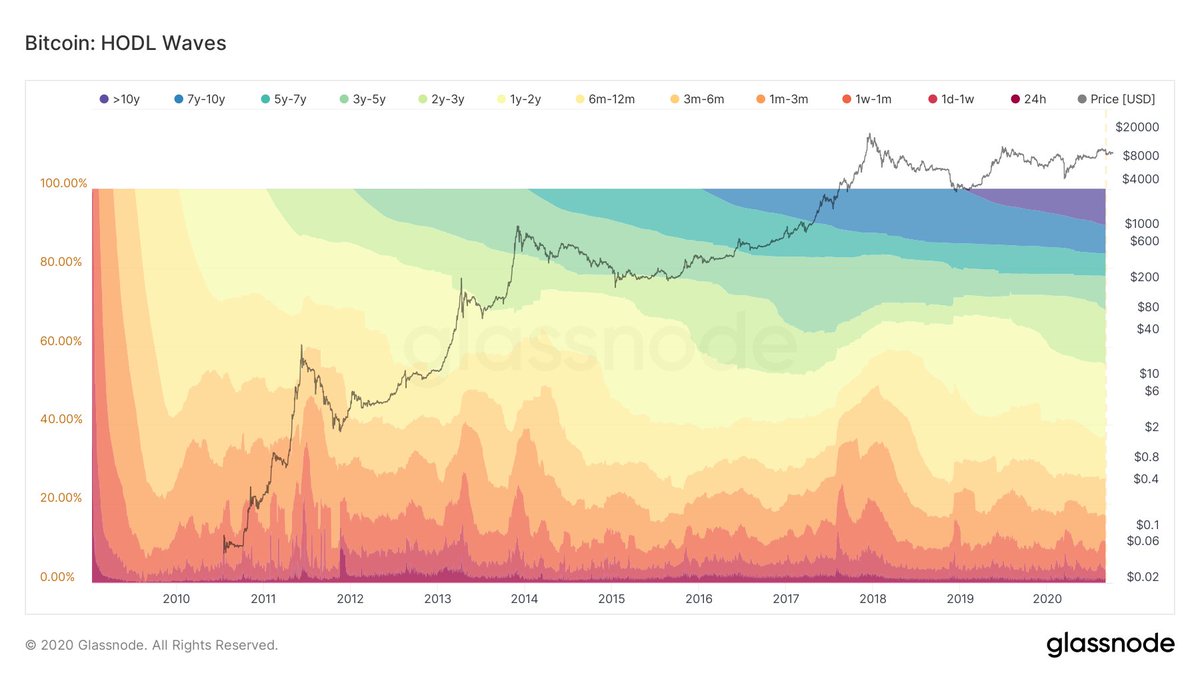

8/ And HODLers aren& #39;t selling any:

UTXO analysis shows that vast amounts of bitcoin are aging without being moved, suggesting the same holding patterns that we saw in the & #39;13 and & #39;16 accumulation before the parabolic runs.

UTXO analysis shows that vast amounts of bitcoin are aging without being moved, suggesting the same holding patterns that we saw in the & #39;13 and & #39;16 accumulation before the parabolic runs.

9/ The best performers are all volatile. The key is to pay attention to the holy trinity of asymmetric plays - position size, time horizon, and product delivery. One will keep you solvent, one will keep you patient, and one will filter the doers from the dreamers.

If you enjoyed this summary, give it a retweet and check out the full market update here: https://hartmanncapital.substack.com/p/taming-the-bull">https://hartmanncapital.substack.com/p/taming-...

Read on Twitter

Read on Twitter