Terrascend has made very smart investments in PA/NJ/CA that will begin to payoff into next year.

$MSOS $CRLBF $CURLF $GTBIF $TCNNF

Exciting thread.

1/

New CEO has a strong track record and has been executing with financial discipline.

#1 wholesale supplier in PA and set to be largest grower in NJ upon expansion completion in Q4.

#1 wholesale supplier in PA and set to be largest grower in NJ upon expansion completion in Q4.

CEO Jason Ackerman took over the role a year ago. Previously built FreshDirect online grocery over 10 years into a $700M business with 4k employees competing directly with Amazon. Experience translates nicely to cannabis -worked with farms/manufacturing. Direct to consumer brand

Terrascend was founded in 2017 in Canada. Initial investment from JW Asset Mgmt and Canopy Growth. Quickly pivoted to US market in 2018. Awarded NJ vert. license, acquired Apothecarium in CA and acquired Ilera in PA by Sep 2019 and appointed Jason Ackerman CEO in Nov 2019.

VERY UNDER THE RADAR - Jason& #39;s first public conference call was April/May this year - the story is just beginning.

Focus on customer loyalty and experience while going deep in limited license states. Emphasis on hiring TALENT.

Focus on customer loyalty and experience while going deep in limited license states. Emphasis on hiring TALENT.

Jason came from a low margin business and is laser focused on operation efficiency and financial discipline.

Terrascend understands importance of an online component and need to leverage big data to improve customer experience. Tech is a big focus.

Terrascend understands importance of an online component and need to leverage big data to improve customer experience. Tech is a big focus.

Overview of PA:

Ilera Brand - in 100% of PA med dispensaries

#1 supplier in PA wholesale market (>20% mkt share)

Cultivation - increased 3x in Q2 to 144k sqft, > 170 strains

Retail - 3 open dispensaries

1 of 5 vertical integrated entities

Ilera Brand - in 100% of PA med dispensaries

#1 supplier in PA wholesale market (>20% mkt share)

Cultivation - increased 3x in Q2 to 144k sqft, > 170 strains

Retail - 3 open dispensaries

1 of 5 vertical integrated entities

PA has 88 open dispensaries with 186 total licenses - already $1bln+ mkt.

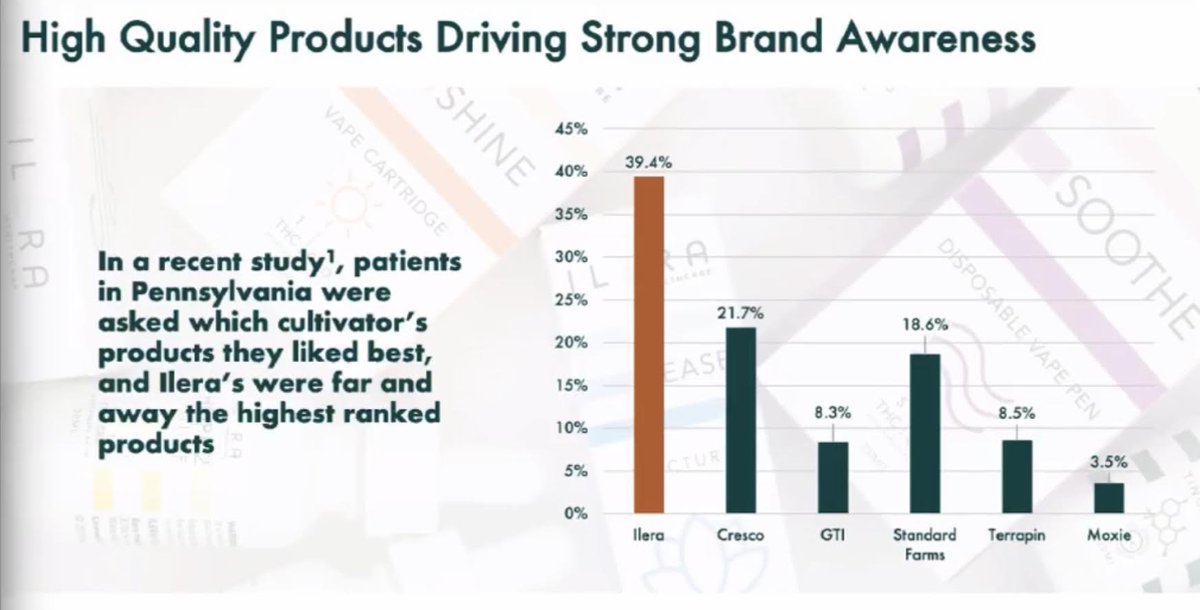

Recent poll showed Ilera most preferred brand by PA med patients (see graph)

Recent poll showed Ilera most preferred brand by PA med patients (see graph)

Overview of NJ:

1 of 4 MSO& #39;s in NJ, 1 of 12 in state.

Cultivation - 16 acre site w/ 240k sqft capacity (plan is 3 phases)

Phase 1 = 40ksqft completed July 20& #39; and harvested this week

Phase 2 = 80ksqft to be completed Nov 20& #39;

Phase 3 = TBD a will could be contingent on adult use

1 of 4 MSO& #39;s in NJ, 1 of 12 in state.

Cultivation - 16 acre site w/ 240k sqft capacity (plan is 3 phases)

Phase 1 = 40ksqft completed July 20& #39; and harvested this week

Phase 2 = 80ksqft to be completed Nov 20& #39;

Phase 3 = TBD a will could be contingent on adult use

After phase 2, will be largest grower in NJ market with 120k sqft

3 retail licenses hit Q4, Q1, Q2

Leveraging PA team to build and run east coast operations as NJ/PA similar med markets

ALL NJ investment through Phase 2 will be made by Q4202.

3 retail licenses hit Q4, Q1, Q2

Leveraging PA team to build and run east coast operations as NJ/PA similar med markets

ALL NJ investment through Phase 2 will be made by Q4202.

Overview of CA:

Northern California - Apothecarium 4 stores opened, 1 more to open

Working to scale brand - wholesale market is a bit tougher

Vertically integrated and sell on own shelves

Valhalla edible and StateFlower flower

Northern California - Apothecarium 4 stores opened, 1 more to open

Working to scale brand - wholesale market is a bit tougher

Vertically integrated and sell on own shelves

Valhalla edible and StateFlower flower

Nationwide CBD brands Funky Farms and Original Hemp

in 10k+ stores

Still has legacy Canada business - DOES NOT GROW IN CANADA just manufactures at 64k sqft plant. < 10% of rev from Canada.

in 10k+ stores

Still has legacy Canada business - DOES NOT GROW IN CANADA just manufactures at 64k sqft plant. < 10% of rev from Canada.

Financial Highlights (CAD$):

Q2 Rev $47.2 up 36% QoQ, 169% YoY

Q2 Gross Margin=56%,

EBITDA=$11M versus $5M Q1, EBITDA%=24%,

Opex as %Sales fell to 33% from 42%

^ALL WHILE ABSORBING SIGNIFICANT INVESTMENTS IN PA/NJ

Q2 Rev $47.2 up 36% QoQ, 169% YoY

Q2 Gross Margin=56%,

EBITDA=$11M versus $5M Q1, EBITDA%=24%,

Opex as %Sales fell to 33% from 42%

^ALL WHILE ABSORBING SIGNIFICANT INVESTMENTS IN PA/NJ

*98% of total capital plan will be spent by Q42020 (then only 2 small store capex)

Now we will see significant operating leverage into 1H2020. Capex will be $40M+ in 2020! and will be significantly lower going forward.

Now we will see significant operating leverage into 1H2020. Capex will be $40M+ in 2020! and will be significantly lower going forward.

Almost all capex in rearview for current owned assets, expanded cultivation in PA/NJ starts to hit market = EBITDA up, capex down = sustainability with CASH FLOW

Big scale coming...

Current Cash = $75M - Great cap position, recent CGC financing Mar 2020

Big scale coming...

Current Cash = $75M - Great cap position, recent CGC financing Mar 2020

Guidance (CAD$):

Rev = $192M EBIDTA = $45M

YTD EBITDA = $16M, so $30M+ expected in 2H2020 and starts to show early signs of scale that is coming.

Rev = $192M EBIDTA = $45M

YTD EBITDA = $16M, so $30M+ expected in 2H2020 and starts to show early signs of scale that is coming.

Quick review of rapid growth:

Q12020 - PA 3x expansion harvest

Q22020 - 3x harvest hits PA market for full quarter, 1 new dispensary opened

Q32020 - NJ 40k sqft planted in July 2020 - harvested this week, PA 25% cultivation expansion, 2 new dispensaries CA/PA

......

Q12020 - PA 3x expansion harvest

Q22020 - 3x harvest hits PA market for full quarter, 1 new dispensary opened

Q32020 - NJ 40k sqft planted in July 2020 - harvested this week, PA 25% cultivation expansion, 2 new dispensaries CA/PA

......

Q42020 - PA 25% expansion hits market, CA StateFlower brand 4x expansion, 2 new dispensaries CA/NJ, First NJ wholesale hits market

1H2021 - NJ cultivation and production goes to market (+potential adult use)

1H2021 - NJ cultivation and production goes to market (+potential adult use)

Terrascend has shown the ability to execute on their strategy of quickly building quality large scale vertical operations and becoming a top player in their core markets.

The last 9-12 months were heavy in NJ/PA capex and big scale is coming as we head into early next year.

The last 9-12 months were heavy in NJ/PA capex and big scale is coming as we head into early next year.

They spent smartly but also profitably and set themselves up to dominate in the region.

With adult use almost guaranteed to pass in NJ, the timing is perfect for a significant investment in the stock - under $5 is a gift.

With adult use almost guaranteed to pass in NJ, the timing is perfect for a significant investment in the stock - under $5 is a gift.

A position size equal to the Big 4 MSO& #39;s is not unreasonable  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps"> earlier growth stage = higher ROI.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps"> earlier growth stage = higher ROI.

My #2 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦍" title="Gorilla" aria-label="Emoji: Gorilla"> behind $CRLBF

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦍" title="Gorilla" aria-label="Emoji: Gorilla"> behind $CRLBF

Disclosure: I am irresponsibly long Terrascend and have no affiliation with the company.

My #2

Disclosure: I am irresponsibly long Terrascend and have no affiliation with the company.

Read on Twitter

Read on Twitter