1/ The last four months have seen *dozens* of protocols launch liquidity mining programs.

I& #39;ve written a piece explaining what liquidity mining is, what has worked well, and what could be improved: https://medium.com/bollinger-investment-group/liquidity-mining-a-user-centric-token-distribution-strategy-1d05c5174641">https://medium.com/bollinger...

I& #39;ve written a piece explaining what liquidity mining is, what has worked well, and what could be improved: https://medium.com/bollinger-investment-group/liquidity-mining-a-user-centric-token-distribution-strategy-1d05c5174641">https://medium.com/bollinger...

2/ Liquidity mining (LM) is a network participation strategy in which a user provides capital to a protocol in return for that protocol& #39;s native token.

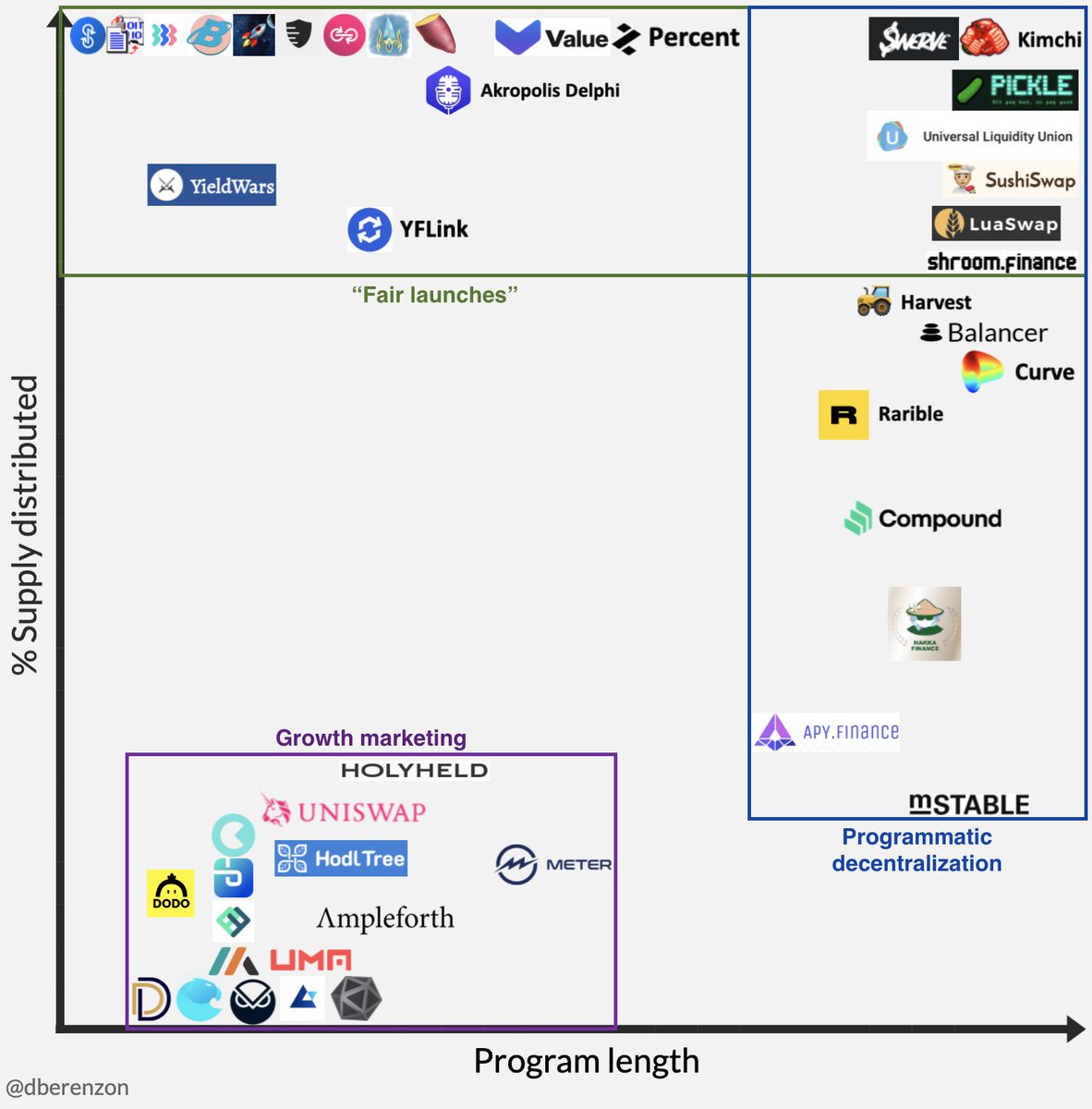

3/ LM programs come in 3 flavors:

- Growth marketing: <20% of tokens distributed to incentivize specific actions

- Programmatic decentralization: 20-80% of tokens gradually distributed to the community

- Fair launches: >80% of tokens quickly distributed via specific actions

- Growth marketing: <20% of tokens distributed to incentivize specific actions

- Programmatic decentralization: 20-80% of tokens gradually distributed to the community

- Fair launches: >80% of tokens quickly distributed via specific actions

4/ Liquidity mining results in:

- Broader distribution vs. private sales

- Closer alignment between users and token holders

- More inclusive governance via community ownership

- Faster experimentation via lower barriers to entry

- Broader distribution vs. private sales

- Closer alignment between users and token holders

- More inclusive governance via community ownership

- Faster experimentation via lower barriers to entry

5/ Things that worked:

- Rewarding long-term liquidity ( @AmpleforthOrg)

- Community engagement ( @YamFinance)

- Product innovation ( @BasedProtocol)

- Tuning parameters ( @BalancerLabs)

- Shorter programs ( @iearnfinance)

- Longer vesting ( @BreederDodo)

- Metrics/KPIs ( @UMAprotocol)

- Rewarding long-term liquidity ( @AmpleforthOrg)

- Community engagement ( @YamFinance)

- Product innovation ( @BasedProtocol)

- Tuning parameters ( @BalancerLabs)

- Shorter programs ( @iearnfinance)

- Longer vesting ( @BreederDodo)

- Metrics/KPIs ( @UMAprotocol)

6/ Issues that remain:

- Loopholes / gameable incentives

- "Rug-pulling" / malicious actors

- Technical risk / lack of audits

- Information asymmetry

- High gas costs

- Loopholes / gameable incentives

- "Rug-pulling" / malicious actors

- Technical risk / lack of audits

- Information asymmetry

- High gas costs

7/ It& #39;s still very early days in the design of liquidity mining programs, but it& #39;s a step in the right direction for cryptonetworks.

Many thanks to @delitzer, @HeyoChristopher, and @im_manderson for their feedback on this piece.

Many thanks to @delitzer, @HeyoChristopher, and @im_manderson for their feedback on this piece.

Read on Twitter

Read on Twitter