1/ Hims & Hers the latest to show how explosive the revenue growth can be in consumer healthcare.

2018: $27M

2019: $83M

2020E: $138M

While improving GMs from 29% to 71%.

2018: $27M

2019: $83M

2020E: $138M

While improving GMs from 29% to 71%.

2/ Going forward, the company forecasts modest growth, despite describing multiple large new markets of entry and tailwinds.

2020E: $138M (67% YoY)

2021E: $178M (30%)

2022E: $233 (30%)

2020E: $138M (67% YoY)

2021E: $178M (30%)

2022E: $233 (30%)

3/ COVID hasn& #39;t provided a huge tailwind to the volume of quarterly orders.

Q1 2019: 585,000

Q2 2019: 672,000

Q3 2019: 671,000

Q4 2019: 571,000

Q1 2020: 546,000

Q2 2020: 572,000

Q1 2019: 585,000

Q2 2019: 672,000

Q3 2019: 671,000

Q4 2019: 571,000

Q1 2020: 546,000

Q2 2020: 572,000

4/ A lot of discussion of subscription revenue, but unclear what the actual churn/retention figures look like. "250k+ customer subscriptions" while the company does more than 500k quarterly orders. They make case CAC:LTV works in the business: 3x, 3 years.

5/ Unclear how the opex breaks down but I would estimate annual run rate spend of $80M on product and G&A (this is in addition to marketing spend), with company forecasting slightly increased losses next year.

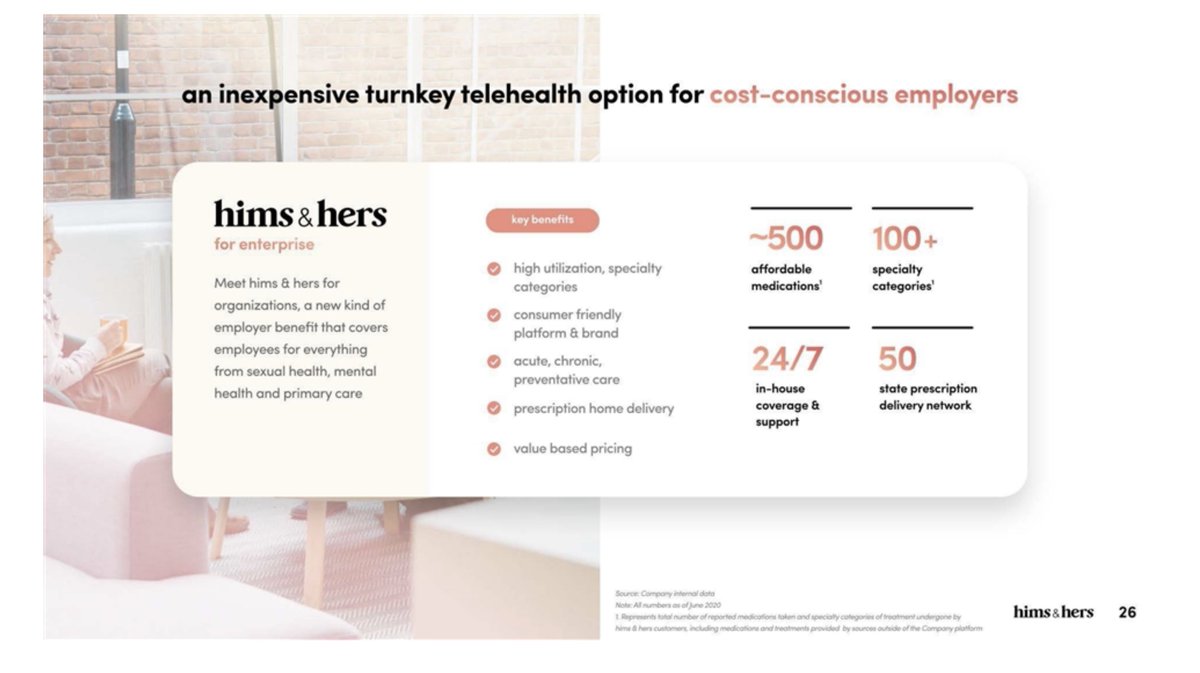

6/ With the Sinai and Ochsner deals, the company is also marketing directly into the enterprise market as well.

7/ What an incredible story since launch just a couple years ago. Kudos to the team! Excited that the founder and CEO, Andrew Dudum retains 90% voting control following the reverse merger that is expected to close this quarter.

8/ The deck is here in case you want to read: https://www.sec.gov/Archives/edgar/data/1773751/000119312520260568/d74354dex992.htm">https://www.sec.gov/Archives/...

Read on Twitter

Read on Twitter