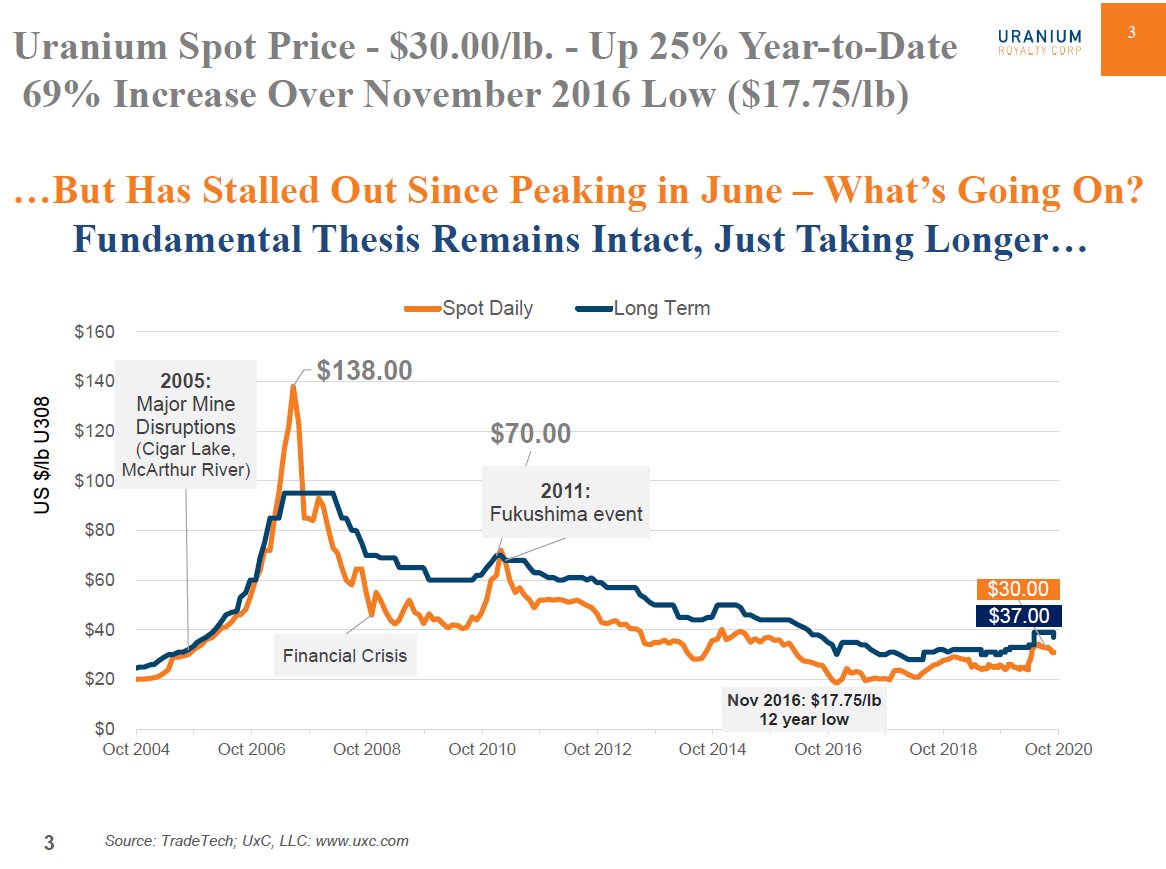

#Uranium Market Update in a nutshell https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥜" title="Erdnüsse" aria-label="Emoji: Erdnüsse"> #U3O8 continues to be a best performing commodity of 2020, up 25% YTD, up 69% from its bottom in November 2016.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥜" title="Erdnüsse" aria-label="Emoji: Erdnüsse"> #U3O8 continues to be a best performing commodity of 2020, up 25% YTD, up 69% from its bottom in November 2016. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">

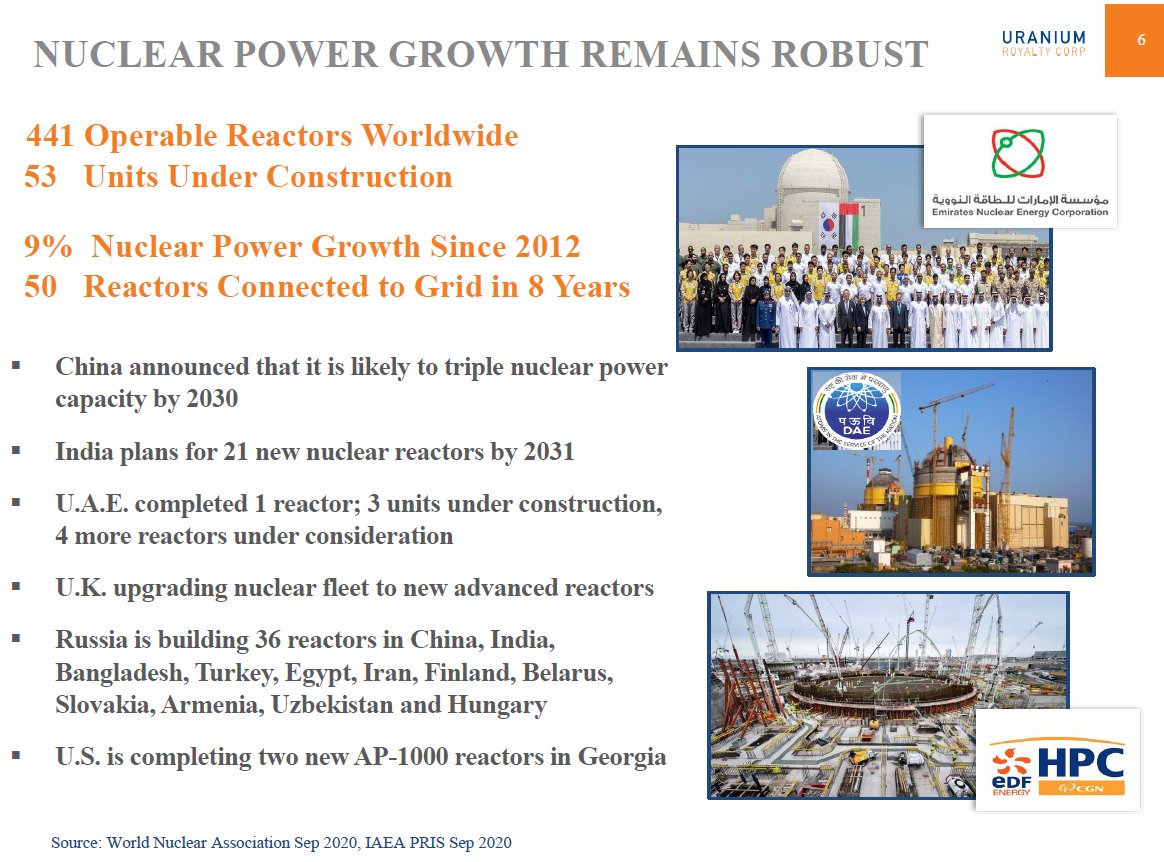

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> #Nuclear power growth remains robust

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> #Nuclear power growth remains robust  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">

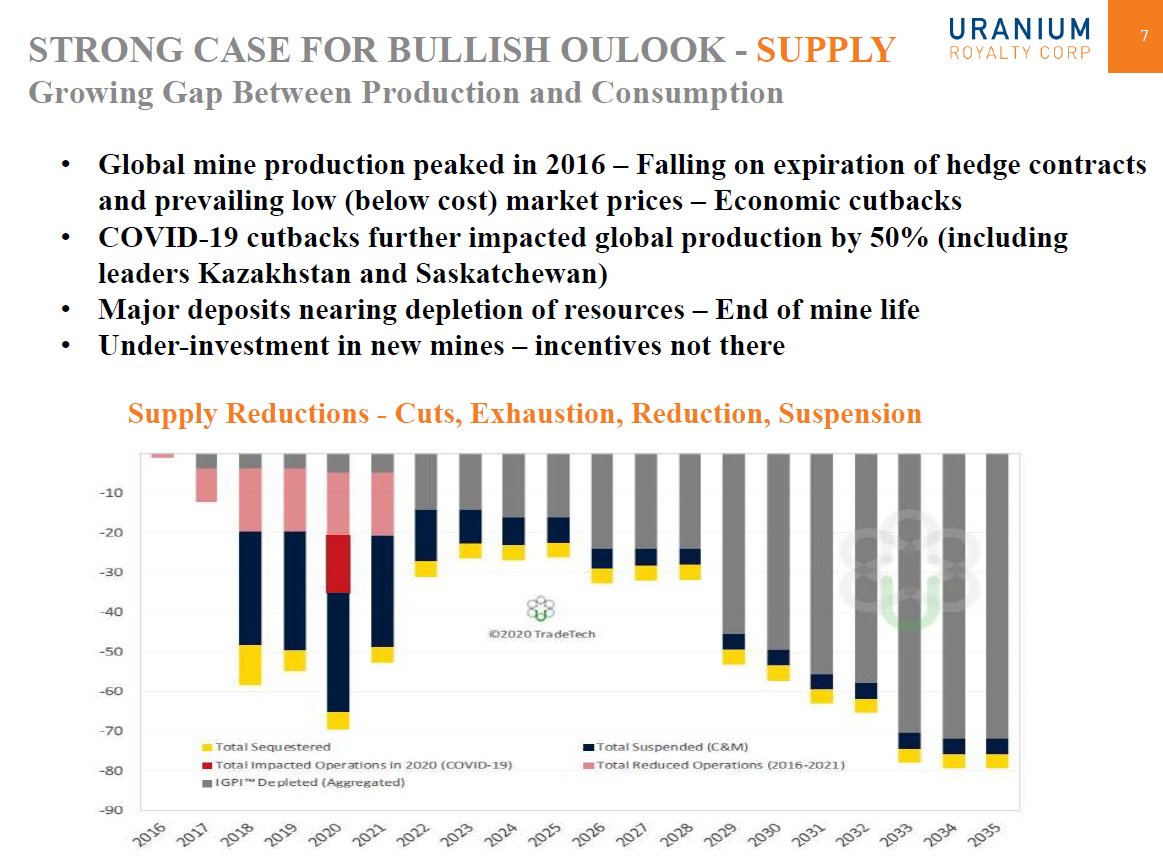

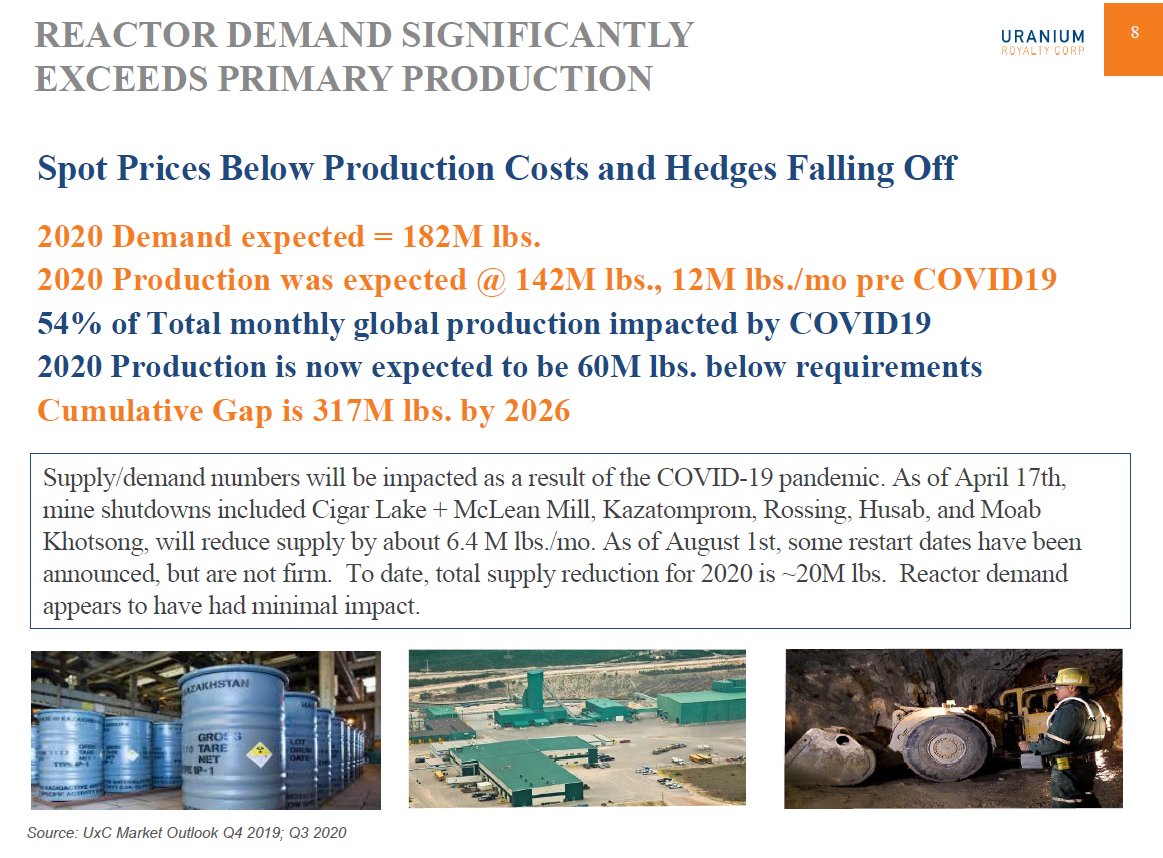

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil"> Demand at 182M lbs/yr & rising, Supply deficit ~60M lbs, -317M lbs by 2026

https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil"> Demand at 182M lbs/yr & rising, Supply deficit ~60M lbs, -317M lbs by 2026 https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏬" title="Nach unten zeigendes doppeltes Dreieck" aria-label="Emoji: Nach unten zeigendes doppeltes Dreieck">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏬" title="Nach unten zeigendes doppeltes Dreieck" aria-label="Emoji: Nach unten zeigendes doppeltes Dreieck"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Komprimierung" aria-label="Emoji: Komprimierung">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Komprimierung" aria-label="Emoji: Komprimierung">

#Uranium has strong #bullish outlook  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">

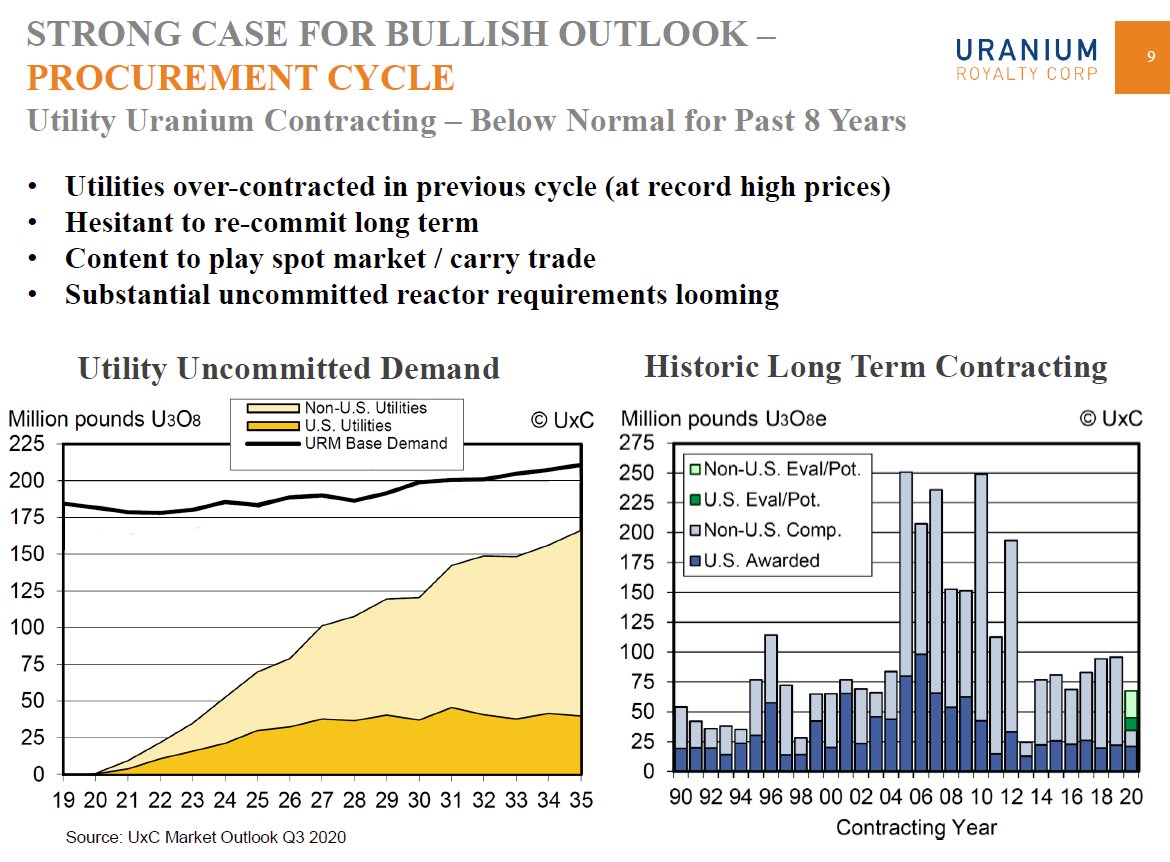

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔮" title="Kristallkugel" aria-label="Emoji: Kristallkugel"> #Nuclear utility contracting has been below normal for past 8 yrs. Re-stocking cycle overdue with growing uncovered demand & delayed Long-term contracting since 2012.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔮" title="Kristallkugel" aria-label="Emoji: Kristallkugel"> #Nuclear utility contracting has been below normal for past 8 yrs. Re-stocking cycle overdue with growing uncovered demand & delayed Long-term contracting since 2012. https://abs.twimg.com/emoji/v2/... draggable="false" alt="⌛️" title="Sanduhr" aria-label="Emoji: Sanduhr">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⌛️" title="Sanduhr" aria-label="Emoji: Sanduhr">

With such strong #Uranium supply/demand fundamentals, why is #U3O8 market rebalance taking so long?  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht"> Trade Issues, Russian Suspension Agreement, #COVID19 have sidelined #nuclear utilities BUT trade issues nearing resolution, utilities getting back to work, #China going all-in

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht"> Trade Issues, Russian Suspension Agreement, #COVID19 have sidelined #nuclear utilities BUT trade issues nearing resolution, utilities getting back to work, #China going all-in https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">

Secondary Supplies have been holding back #Uranium price response. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌧️" title="Wolke mit Regen" aria-label="Emoji: Wolke mit Regen"> But inventory drawdown has accelerated, #Japan restarts coming, Kazatomprom has abandoned Spot #U3O8 market sales, Carry trades harder to execute.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌧️" title="Wolke mit Regen" aria-label="Emoji: Wolke mit Regen"> But inventory drawdown has accelerated, #Japan restarts coming, Kazatomprom has abandoned Spot #U3O8 market sales, Carry trades harder to execute. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse"> #Nuclear getting #CarbonFree #GreenEnergy & #SMR boost.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse"> #Nuclear getting #CarbonFree #GreenEnergy & #SMR boost. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sonne mit Gesicht" aria-label="Emoji: Sonne mit Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sonne mit Gesicht" aria-label="Emoji: Sonne mit Gesicht"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil">

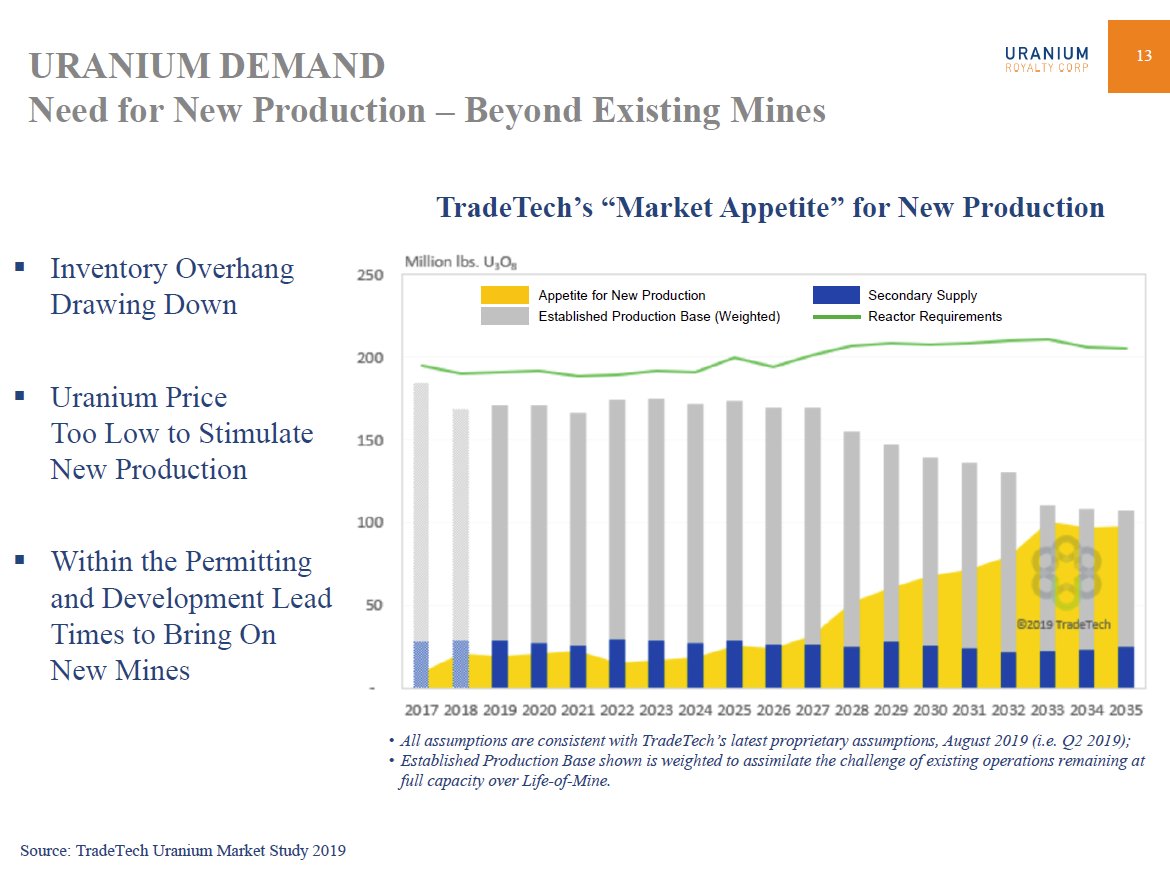

With #Uranium mines shutting down in #Niger & #Australia next year, while #Nuclear fuel demand rises  https://abs.twimg.com/emoji/v2/... draggable="false" alt="↕️" title="Auf-und Abwärtspfeil" aria-label="Emoji: Auf-und Abwärtspfeil"> there is a growing "Market Appetite" for new #U3O8 mines to fill supply gap.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="↕️" title="Auf-und Abwärtspfeil" aria-label="Emoji: Auf-und Abwärtspfeil"> there is a growing "Market Appetite" for new #U3O8 mines to fill supply gap. https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke"> But, U price too low to stimulate new production... needs to double to bring new mines online

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke"> But, U price too low to stimulate new production... needs to double to bring new mines online https://abs.twimg.com/emoji/v2/... draggable="false" alt="💲" title="Fettes Dollarzeichen" aria-label="Emoji: Fettes Dollarzeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💲" title="Fettes Dollarzeichen" aria-label="Emoji: Fettes Dollarzeichen"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck">

Read on Twitter

Read on Twitter #U3O8 continues to be a best performing commodity of 2020, up 25% YTD, up 69% from its bottom in November 2016.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> #Nuclear power growth remains robust https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil"> Demand at 182M lbs/yr & rising, Supply deficit ~60M lbs, -317M lbs by 2026https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏬" title="Nach unten zeigendes doppeltes Dreieck" aria-label="Emoji: Nach unten zeigendes doppeltes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Komprimierung" aria-label="Emoji: Komprimierung">" title=" #Uranium Market Update in a nutshellhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🥜" title="Erdnüsse" aria-label="Emoji: Erdnüsse"> #U3O8 continues to be a best performing commodity of 2020, up 25% YTD, up 69% from its bottom in November 2016.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> #Nuclear power growth remains robust https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil"> Demand at 182M lbs/yr & rising, Supply deficit ~60M lbs, -317M lbs by 2026https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏬" title="Nach unten zeigendes doppeltes Dreieck" aria-label="Emoji: Nach unten zeigendes doppeltes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Komprimierung" aria-label="Emoji: Komprimierung">">

#U3O8 continues to be a best performing commodity of 2020, up 25% YTD, up 69% from its bottom in November 2016.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> #Nuclear power growth remains robust https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil"> Demand at 182M lbs/yr & rising, Supply deficit ~60M lbs, -317M lbs by 2026https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏬" title="Nach unten zeigendes doppeltes Dreieck" aria-label="Emoji: Nach unten zeigendes doppeltes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Komprimierung" aria-label="Emoji: Komprimierung">" title=" #Uranium Market Update in a nutshellhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🥜" title="Erdnüsse" aria-label="Emoji: Erdnüsse"> #U3O8 continues to be a best performing commodity of 2020, up 25% YTD, up 69% from its bottom in November 2016.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> #Nuclear power growth remains robust https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil"> Demand at 182M lbs/yr & rising, Supply deficit ~60M lbs, -317M lbs by 2026https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏬" title="Nach unten zeigendes doppeltes Dreieck" aria-label="Emoji: Nach unten zeigendes doppeltes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Komprimierung" aria-label="Emoji: Komprimierung">">

#U3O8 continues to be a best performing commodity of 2020, up 25% YTD, up 69% from its bottom in November 2016.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> #Nuclear power growth remains robust https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil"> Demand at 182M lbs/yr & rising, Supply deficit ~60M lbs, -317M lbs by 2026https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏬" title="Nach unten zeigendes doppeltes Dreieck" aria-label="Emoji: Nach unten zeigendes doppeltes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Komprimierung" aria-label="Emoji: Komprimierung">" title=" #Uranium Market Update in a nutshellhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🥜" title="Erdnüsse" aria-label="Emoji: Erdnüsse"> #U3O8 continues to be a best performing commodity of 2020, up 25% YTD, up 69% from its bottom in November 2016.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> #Nuclear power growth remains robust https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil"> Demand at 182M lbs/yr & rising, Supply deficit ~60M lbs, -317M lbs by 2026https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏬" title="Nach unten zeigendes doppeltes Dreieck" aria-label="Emoji: Nach unten zeigendes doppeltes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Komprimierung" aria-label="Emoji: Komprimierung">">

#U3O8 continues to be a best performing commodity of 2020, up 25% YTD, up 69% from its bottom in November 2016.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> #Nuclear power growth remains robust https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil"> Demand at 182M lbs/yr & rising, Supply deficit ~60M lbs, -317M lbs by 2026https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏬" title="Nach unten zeigendes doppeltes Dreieck" aria-label="Emoji: Nach unten zeigendes doppeltes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Komprimierung" aria-label="Emoji: Komprimierung">" title=" #Uranium Market Update in a nutshellhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🥜" title="Erdnüsse" aria-label="Emoji: Erdnüsse"> #U3O8 continues to be a best performing commodity of 2020, up 25% YTD, up 69% from its bottom in November 2016.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> #Nuclear power growth remains robust https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil"> Demand at 182M lbs/yr & rising, Supply deficit ~60M lbs, -317M lbs by 2026https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏬" title="Nach unten zeigendes doppeltes Dreieck" aria-label="Emoji: Nach unten zeigendes doppeltes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Komprimierung" aria-label="Emoji: Komprimierung">">

#U3O8 continues to be a best performing commodity of 2020, up 25% YTD, up 69% from its bottom in November 2016.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> #Nuclear power growth remains robust https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil"> Demand at 182M lbs/yr & rising, Supply deficit ~60M lbs, -317M lbs by 2026https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏬" title="Nach unten zeigendes doppeltes Dreieck" aria-label="Emoji: Nach unten zeigendes doppeltes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Komprimierung" aria-label="Emoji: Komprimierung">" title=" #Uranium Market Update in a nutshellhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🥜" title="Erdnüsse" aria-label="Emoji: Erdnüsse"> #U3O8 continues to be a best performing commodity of 2020, up 25% YTD, up 69% from its bottom in November 2016.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> #Nuclear power growth remains robust https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil"> Demand at 182M lbs/yr & rising, Supply deficit ~60M lbs, -317M lbs by 2026https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏬" title="Nach unten zeigendes doppeltes Dreieck" aria-label="Emoji: Nach unten zeigendes doppeltes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Komprimierung" aria-label="Emoji: Komprimierung">">

#U3O8 continues to be a best performing commodity of 2020, up 25% YTD, up 69% from its bottom in November 2016.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> #Nuclear power growth remains robust https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil"> Demand at 182M lbs/yr & rising, Supply deficit ~60M lbs, -317M lbs by 2026https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏬" title="Nach unten zeigendes doppeltes Dreieck" aria-label="Emoji: Nach unten zeigendes doppeltes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Komprimierung" aria-label="Emoji: Komprimierung">" title=" #Uranium Market Update in a nutshellhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🥜" title="Erdnüsse" aria-label="Emoji: Erdnüsse"> #U3O8 continues to be a best performing commodity of 2020, up 25% YTD, up 69% from its bottom in November 2016.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> #Nuclear power growth remains robust https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil"> Demand at 182M lbs/yr & rising, Supply deficit ~60M lbs, -317M lbs by 2026https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏬" title="Nach unten zeigendes doppeltes Dreieck" aria-label="Emoji: Nach unten zeigendes doppeltes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Komprimierung" aria-label="Emoji: Komprimierung">">

#U3O8 continues to be a best performing commodity of 2020, up 25% YTD, up 69% from its bottom in November 2016.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> #Nuclear power growth remains robust https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil"> Demand at 182M lbs/yr & rising, Supply deficit ~60M lbs, -317M lbs by 2026https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏬" title="Nach unten zeigendes doppeltes Dreieck" aria-label="Emoji: Nach unten zeigendes doppeltes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Komprimierung" aria-label="Emoji: Komprimierung">" title=" #Uranium Market Update in a nutshellhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🥜" title="Erdnüsse" aria-label="Emoji: Erdnüsse"> #U3O8 continues to be a best performing commodity of 2020, up 25% YTD, up 69% from its bottom in November 2016.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> #Nuclear power growth remains robust https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil"> Demand at 182M lbs/yr & rising, Supply deficit ~60M lbs, -317M lbs by 2026https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏬" title="Nach unten zeigendes doppeltes Dreieck" aria-label="Emoji: Nach unten zeigendes doppeltes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Komprimierung" aria-label="Emoji: Komprimierung">">

#U3O8 continues to be a best performing commodity of 2020, up 25% YTD, up 69% from its bottom in November 2016.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> #Nuclear power growth remains robust https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil"> Demand at 182M lbs/yr & rising, Supply deficit ~60M lbs, -317M lbs by 2026https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏬" title="Nach unten zeigendes doppeltes Dreieck" aria-label="Emoji: Nach unten zeigendes doppeltes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Komprimierung" aria-label="Emoji: Komprimierung">" title=" #Uranium Market Update in a nutshellhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🥜" title="Erdnüsse" aria-label="Emoji: Erdnüsse"> #U3O8 continues to be a best performing commodity of 2020, up 25% YTD, up 69% from its bottom in November 2016.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> #Nuclear power growth remains robust https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil"> Demand at 182M lbs/yr & rising, Supply deficit ~60M lbs, -317M lbs by 2026https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏬" title="Nach unten zeigendes doppeltes Dreieck" aria-label="Emoji: Nach unten zeigendes doppeltes Dreieck">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗜️" title="Komprimierung" aria-label="Emoji: Komprimierung">">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔮" title="Kristallkugel" aria-label="Emoji: Kristallkugel"> #Nuclear utility contracting has been below normal for past 8 yrs. Re-stocking cycle overdue with growing uncovered demand & delayed Long-term contracting since 2012.https://abs.twimg.com/emoji/v2/... draggable="false" alt="⌛️" title="Sanduhr" aria-label="Emoji: Sanduhr">" title=" #Uranium has strong #bullish outlook https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔮" title="Kristallkugel" aria-label="Emoji: Kristallkugel"> #Nuclear utility contracting has been below normal for past 8 yrs. Re-stocking cycle overdue with growing uncovered demand & delayed Long-term contracting since 2012.https://abs.twimg.com/emoji/v2/... draggable="false" alt="⌛️" title="Sanduhr" aria-label="Emoji: Sanduhr">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔮" title="Kristallkugel" aria-label="Emoji: Kristallkugel"> #Nuclear utility contracting has been below normal for past 8 yrs. Re-stocking cycle overdue with growing uncovered demand & delayed Long-term contracting since 2012.https://abs.twimg.com/emoji/v2/... draggable="false" alt="⌛️" title="Sanduhr" aria-label="Emoji: Sanduhr">" title=" #Uranium has strong #bullish outlook https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔮" title="Kristallkugel" aria-label="Emoji: Kristallkugel"> #Nuclear utility contracting has been below normal for past 8 yrs. Re-stocking cycle overdue with growing uncovered demand & delayed Long-term contracting since 2012.https://abs.twimg.com/emoji/v2/... draggable="false" alt="⌛️" title="Sanduhr" aria-label="Emoji: Sanduhr">" class="img-responsive" style="max-width:100%;"/>

Trade Issues, Russian Suspension Agreement, #COVID19 have sidelined #nuclear utilities BUT trade issues nearing resolution, utilities getting back to work, #China going all-inhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">" title="With such strong #Uranium supply/demand fundamentals, why is #U3O8 market rebalance taking so long? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht"> Trade Issues, Russian Suspension Agreement, #COVID19 have sidelined #nuclear utilities BUT trade issues nearing resolution, utilities getting back to work, #China going all-inhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">" class="img-responsive" style="max-width:100%;"/>

Trade Issues, Russian Suspension Agreement, #COVID19 have sidelined #nuclear utilities BUT trade issues nearing resolution, utilities getting back to work, #China going all-inhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">" title="With such strong #Uranium supply/demand fundamentals, why is #U3O8 market rebalance taking so long? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht"> Trade Issues, Russian Suspension Agreement, #COVID19 have sidelined #nuclear utilities BUT trade issues nearing resolution, utilities getting back to work, #China going all-inhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🏗️" title="Gebäude im Bau" aria-label="Emoji: Gebäude im Bau">" class="img-responsive" style="max-width:100%;"/>

But inventory drawdown has accelerated, #Japan restarts coming, Kazatomprom has abandoned Spot #U3O8 market sales, Carry trades harder to execute.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse"> #Nuclear getting #CarbonFree #GreenEnergy & #SMR boost.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sonne mit Gesicht" aria-label="Emoji: Sonne mit Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil">" title="Secondary Supplies have been holding back #Uranium price response.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌧️" title="Wolke mit Regen" aria-label="Emoji: Wolke mit Regen"> But inventory drawdown has accelerated, #Japan restarts coming, Kazatomprom has abandoned Spot #U3O8 market sales, Carry trades harder to execute.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse"> #Nuclear getting #CarbonFree #GreenEnergy & #SMR boost.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sonne mit Gesicht" aria-label="Emoji: Sonne mit Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil">">

But inventory drawdown has accelerated, #Japan restarts coming, Kazatomprom has abandoned Spot #U3O8 market sales, Carry trades harder to execute.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse"> #Nuclear getting #CarbonFree #GreenEnergy & #SMR boost.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sonne mit Gesicht" aria-label="Emoji: Sonne mit Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil">" title="Secondary Supplies have been holding back #Uranium price response.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌧️" title="Wolke mit Regen" aria-label="Emoji: Wolke mit Regen"> But inventory drawdown has accelerated, #Japan restarts coming, Kazatomprom has abandoned Spot #U3O8 market sales, Carry trades harder to execute.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse"> #Nuclear getting #CarbonFree #GreenEnergy & #SMR boost.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sonne mit Gesicht" aria-label="Emoji: Sonne mit Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil">">

But inventory drawdown has accelerated, #Japan restarts coming, Kazatomprom has abandoned Spot #U3O8 market sales, Carry trades harder to execute.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse"> #Nuclear getting #CarbonFree #GreenEnergy & #SMR boost.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sonne mit Gesicht" aria-label="Emoji: Sonne mit Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil">" title="Secondary Supplies have been holding back #Uranium price response.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌧️" title="Wolke mit Regen" aria-label="Emoji: Wolke mit Regen"> But inventory drawdown has accelerated, #Japan restarts coming, Kazatomprom has abandoned Spot #U3O8 market sales, Carry trades harder to execute.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse"> #Nuclear getting #CarbonFree #GreenEnergy & #SMR boost.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sonne mit Gesicht" aria-label="Emoji: Sonne mit Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil">">

But inventory drawdown has accelerated, #Japan restarts coming, Kazatomprom has abandoned Spot #U3O8 market sales, Carry trades harder to execute.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse"> #Nuclear getting #CarbonFree #GreenEnergy & #SMR boost.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sonne mit Gesicht" aria-label="Emoji: Sonne mit Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil">" title="Secondary Supplies have been holding back #Uranium price response.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌧️" title="Wolke mit Regen" aria-label="Emoji: Wolke mit Regen"> But inventory drawdown has accelerated, #Japan restarts coming, Kazatomprom has abandoned Spot #U3O8 market sales, Carry trades harder to execute.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse"> #Nuclear getting #CarbonFree #GreenEnergy & #SMR boost.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌞" title="Sonne mit Gesicht" aria-label="Emoji: Sonne mit Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚛️" title="Atom-Symbol" aria-label="Emoji: Atom-Symbol">https://abs.twimg.com/emoji/v2/... draggable="false" alt="↗️" title="Nordost gerichteter Pfeil" aria-label="Emoji: Nordost gerichteter Pfeil">">

there is a growing "Market Appetite" for new #U3O8 mines to fill supply gap.https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke"> But, U price too low to stimulate new production... needs to double to bring new mines onlinehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💲" title="Fettes Dollarzeichen" aria-label="Emoji: Fettes Dollarzeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck">" title="With #Uranium mines shutting down in #Niger & #Australia next year, while #Nuclear fuel demand rises https://abs.twimg.com/emoji/v2/... draggable="false" alt="↕️" title="Auf-und Abwärtspfeil" aria-label="Emoji: Auf-und Abwärtspfeil"> there is a growing "Market Appetite" for new #U3O8 mines to fill supply gap.https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke"> But, U price too low to stimulate new production... needs to double to bring new mines onlinehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💲" title="Fettes Dollarzeichen" aria-label="Emoji: Fettes Dollarzeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck">" class="img-responsive" style="max-width:100%;"/>

there is a growing "Market Appetite" for new #U3O8 mines to fill supply gap.https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke"> But, U price too low to stimulate new production... needs to double to bring new mines onlinehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💲" title="Fettes Dollarzeichen" aria-label="Emoji: Fettes Dollarzeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck">" title="With #Uranium mines shutting down in #Niger & #Australia next year, while #Nuclear fuel demand rises https://abs.twimg.com/emoji/v2/... draggable="false" alt="↕️" title="Auf-und Abwärtspfeil" aria-label="Emoji: Auf-und Abwärtspfeil"> there is a growing "Market Appetite" for new #U3O8 mines to fill supply gap.https://abs.twimg.com/emoji/v2/... draggable="false" alt="⛏️" title="Spitzhacke" aria-label="Emoji: Spitzhacke"> But, U price too low to stimulate new production... needs to double to bring new mines onlinehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💲" title="Fettes Dollarzeichen" aria-label="Emoji: Fettes Dollarzeichen">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck">" class="img-responsive" style="max-width:100%;"/>