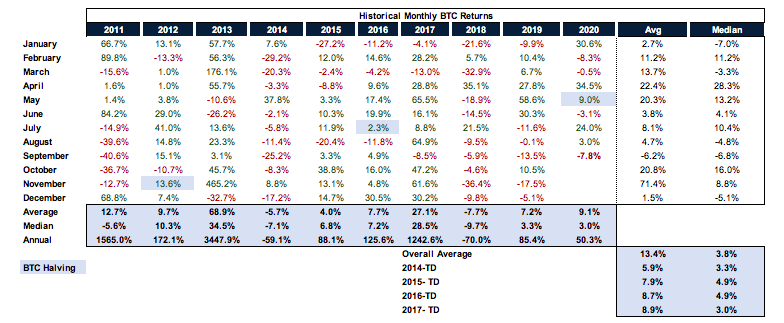

0/ $BTC finished September (-7.8%) its first down month since June. On the year it& #39;s +50.3%. October has historically been a strong month with an average / median performance of +20.8% / 16.0% with 55.5% positivity.

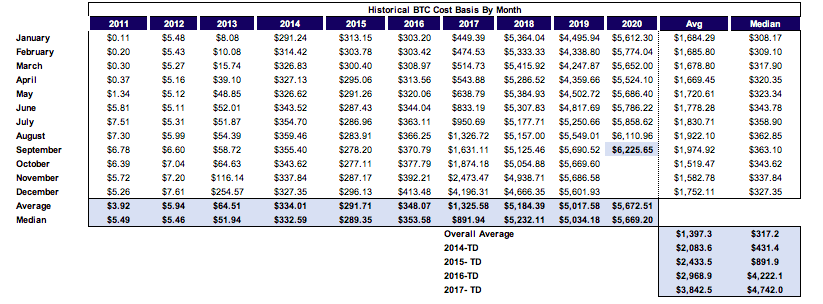

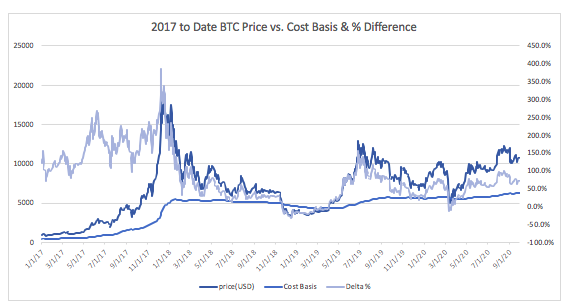

1/ The "theoretical cost basis" of $BTC has never been higher reaching an ATH of $6263 & "averaging" $6225 on the month.

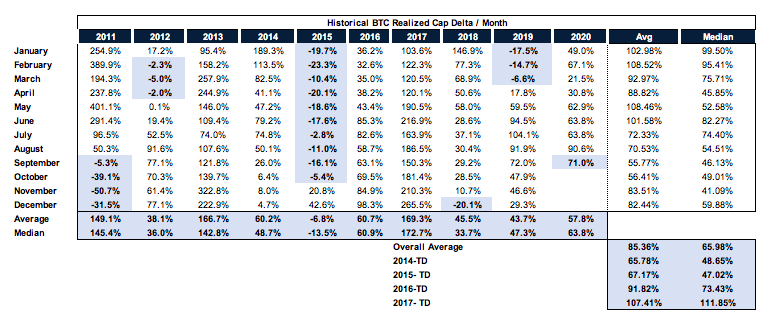

2/ If we look at the delta between the "Realized Cap" (per @coinmetrics) and the USD market cap $BTC is trading at a ~74% premium last which is in the top 40% of observed periods but down from August& #39;s 90% level.

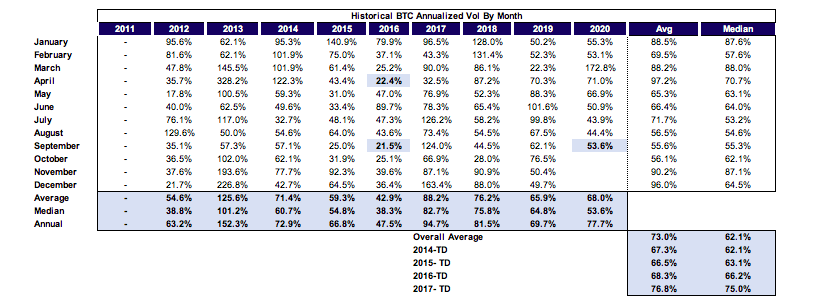

3/ Even with the down month $BTC realized vol has been relatively muted at ~53.5% annualized during the month and sitting at ~77.7% on the year.

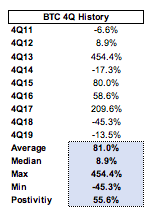

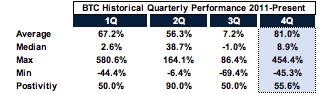

4/ As we enter into 4Q looking at history $BTC 4Q performance it& #39;s had two of the best quarters ever in 4Q13 (+454.4%) and of course 4Q17 (+209.6%); there is wide dispersion with the avg / median performance of 81% / 8.9% and 55.6% positivity.

5/ Comparing that to all other quarters it has the best performance with the exception of 2Q which has an average / median performance of 56.3% / 38.7% but more impressively ~90% positivity.

6/ In the below chart you can see the increasing base of the theoretical cost basis and note that the "premium" of spot to realized value is at the tightest its been with $BTC > $10K

7/ Notably in 3Q BTC "closed" above $10K for 66 of the 92 possible trading days or 71.7% of the time. $BTC has only ever "closed" above $10K for 233 days (167 excluding this Q) or 6% of the time.

Read on Twitter

Read on Twitter