In the latest edition of our weekly insights, the topic explored is how to support #privatesector recovery in the #UAE, with a specific focus on SME finance @Nasser_Saidi (Thread)

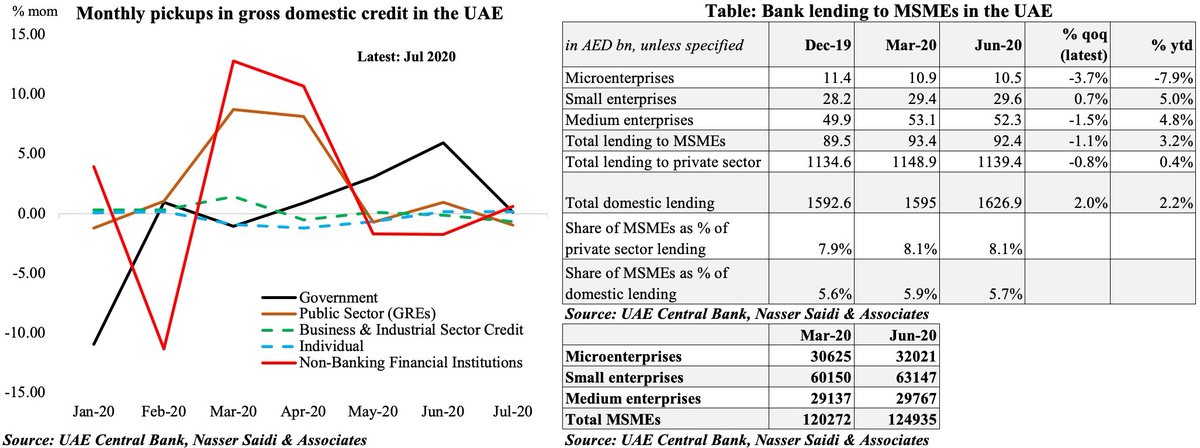

It is critical to understand the recent central bank data (till Jul 2020): 1. Pace of lending to the public sector/ GREs (+16.6% ytd) outruns lending to businesses (0.9% ytd) & individuals (-2.1% ytd)

2. An uptick was noted for non-banking financial institutions (+11.8% ytd): given lack of publicly available data, it is not clear if the SME customer segment, important for recovery, was catered to by the #NBFIs

3. Lending to MSMEs (a) SME lending share in total domestic lending 5.7% in Q2 (vs 5.9% at end-Q1) (b) largest share of loans disbursed to medium-sized firms in Q2 (56.6%) (c) amount disbursed per medium enterprise was AED 1.76mn (Q2): >3.7 times amount disbursed per small firm!

If targeted #policy stimulus measures are not extended: (a) likely to be spillovers into the financial sector via rising NPLs; (b) as companies wind down operations in the near- to medium-term, nascent #insolvency & #bankruptcy frameworks in the #UAE are likely to be tested.

How does #UAE perform in terms of resolving #insolvency vis-a-vis regional and global counterparts? @Nasser_Saidi Read more: https://nassersaidi.com/2020/09/29/weekly-insights-29-sep-2020-supporting-the-recovery-of-uaes-private-sector/">https://nassersaidi.com/2020/09/2... (End thread)

Read on Twitter

Read on Twitter